Credit Benchmark have released the September Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The September CCIs show prolonged credit deterioration for UK, EU and US Industrial companies.

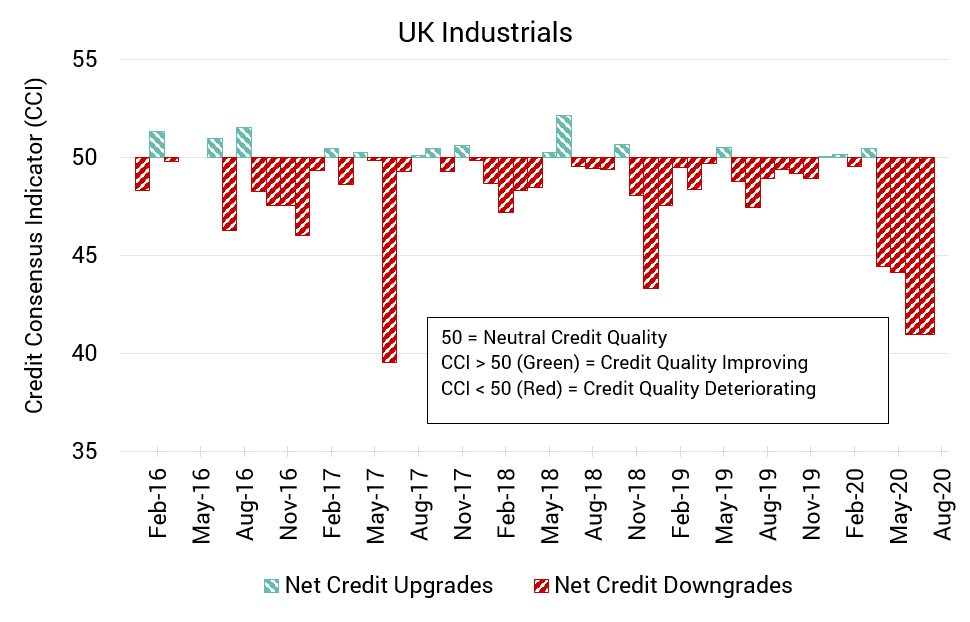

UK Industrials: No Improvement Seen in CCI

UK Industrial companies have seen no improvement in their credit quality since last month – but nor have they worsened, after three prior months of progressive deterioration.

This month, the CCI is 40.9; unchanged from last month.

A CEBR report warns that in the event of another coronavirus wave and lockdown, UK GDP could be 3% to 5% lower in the fourth quarter compared to Q3.

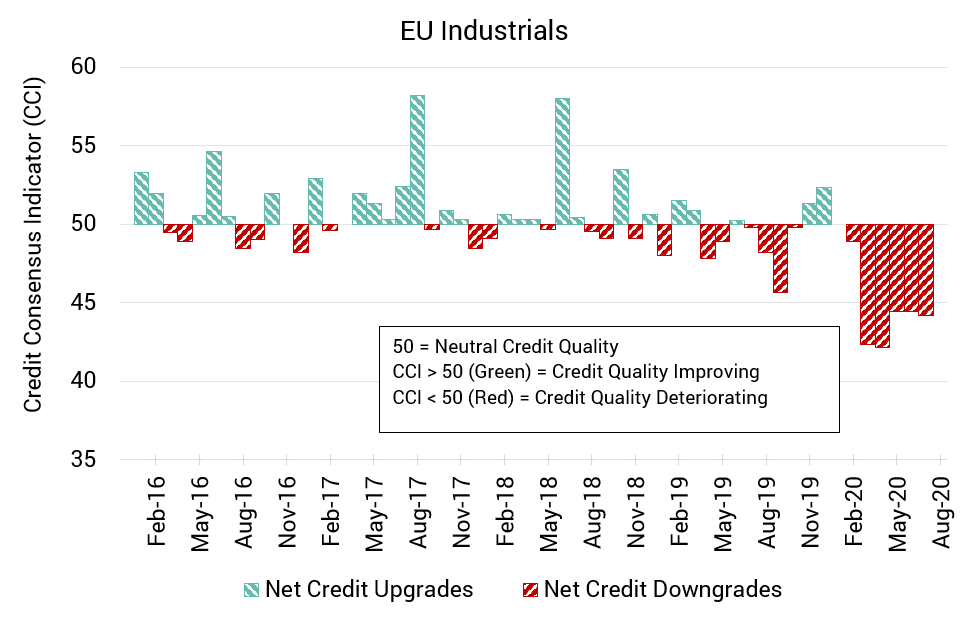

EU Industrials: Credit Deterioration is Prolonged but Steady

EU Industrial companies have shown a steady pattern of credit deterioration for several months, with little month-to-month fluctuation in the CCI.

This month, the CCI for EU firms is 44.2, a slight worsening from last month’s CCI of 44.4.

Though Eurozone manufacturing showed some signs of bouncing back from earlier COVID-induced crashes, confidence has taken a hit and any sustained return to growth is some way off.

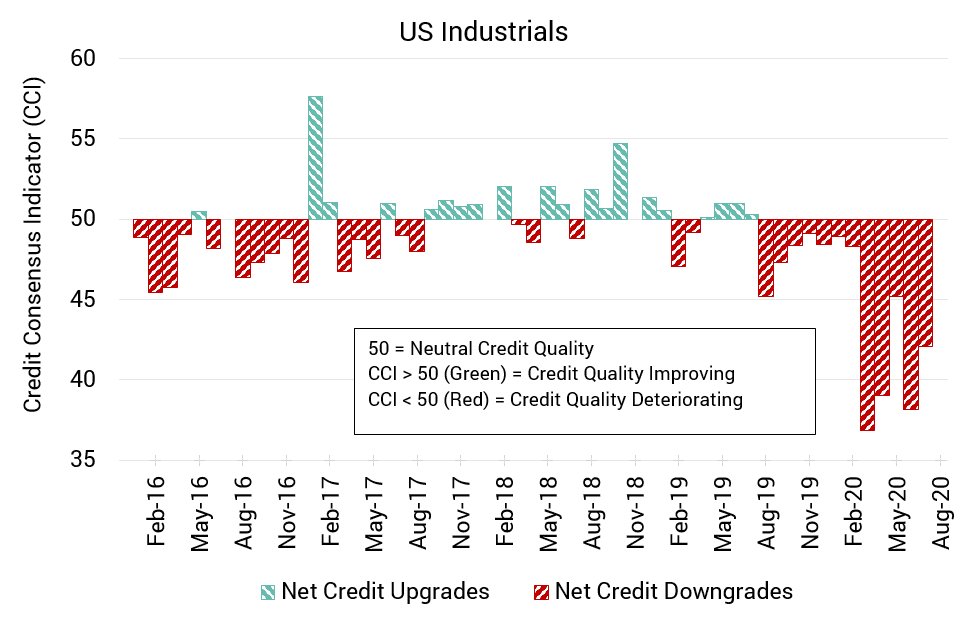

US Industrials: CCI Stays Negative After a Year of Deteriorations

Credit quality for US Industrial companies remains negative, with only a slight reduction in the severity of this month’s CCI.

The CCI is currently 42.1, a mild improvement from 38.2 last month.

The latest update completes a 12th month of continuous net deterioration, with trade tensions already having affected industrial output ahead of the unanticipated COVID impact in early 2020. While manufacturing activity has recently improved, employment figures are still contracting, supporting economists’ views that the US labor market faces future trouble.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.