Whether mortgage investors expand or reduce appraisal waivers after the pandemic remains an open question

In the wake of the COVID-19 pandemic, purchase-loan appraisals took a blow from disruptions inflicted upon homebuying and selling activities under nationwide lock-down and social distancing restrictions. After all, there is less demand for appraisal services by lenders when home sales are down. Now, with much of the country re-opening, the good news is that home sales have rebounded quickly. July marks the second month of rapidly rising home sales. In fact, according to the National Association of Realtors (NAR), the latest rebound in home sales has put the housing market back on a course beyond the recovery phase.

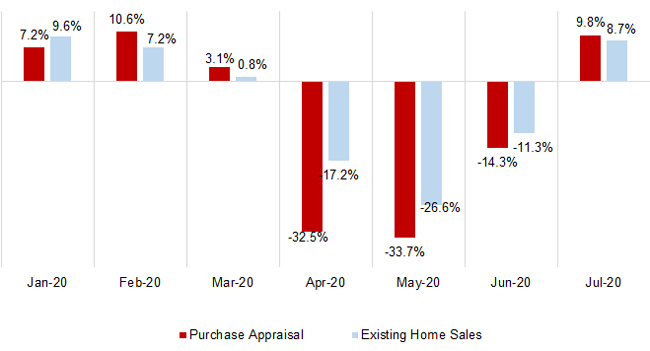

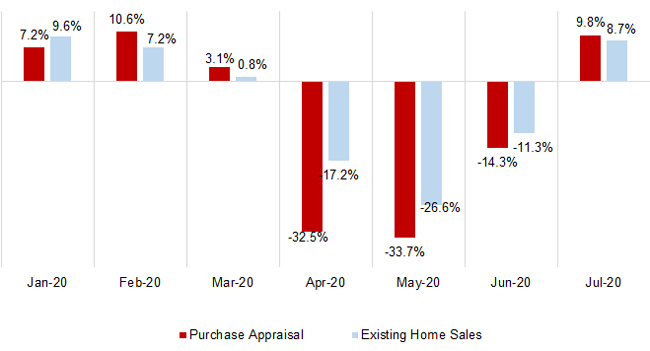

Year-Over-Year Change in Home Sales and Home Appraisals

July data shows that recovery of home appraisal activity has kept up pace with home sales. Figure 1 plots the year-over-year change in purchase-loan appraisals, inclusive of regular, interior-inspection as well as desktop and exterior-only inspection appraisals ─ the latter options became permissible in March 2020 under the new COVID-19 appraisal guidelines.[1]

Figure 1

The year-over-year changes of appraisal volume are based on “same-store” comparisons.

April was the first full month under the impact of the pandemic, and despite the new policy initiatives to substitute regular appraisals with exterior-only or desktop inspection, appraisal volume dropped 32.5% ──nearly twice the rate of decline in existing home sales. At its worst month during the pandemic, home appraisals plunged 33.7% in May when existing home sales tanked 26.6%. By July, however, following a strong recovery in existing home sales, home appraisals have also rebounded quickly in a pace on par with home sales, up 9.8% compared to the 8.6% reported by NAR.

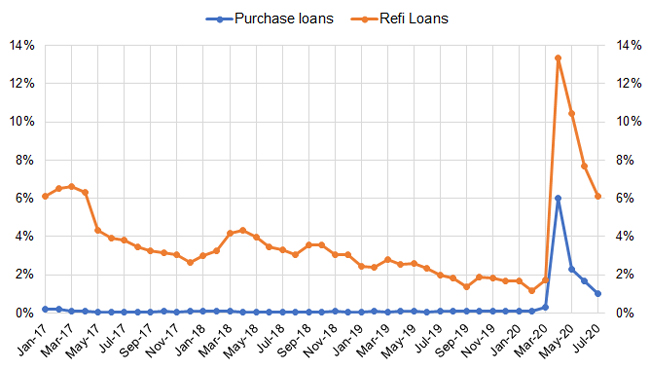

Share of Exterior-Only or Desktop Inspection Appraisals by Loan Purpose

Surprisingly, the pandemic to had more of an impact on appraisal services than home sales. However, the new COVID-19 appraisal policy means that appraisers have the flexibility of completing appraisal via a drive-by or desktop inspection of the property without having to break lock-down or social distancing restrictions – often assisted by innovative appraisal workflow tools which allow homeowners to supplement property information such as interior and exteriors photos.[2] In addition, appraisal services are deemed essential business so that even onsite interior-inspection appraisals could be arranged if warranted.[3]

In fact, there was a strong surge in April and May of appraisals completed via exterior-only or desktop inspection (Figure 2). But even with that, their combined volume seems to have contributed only marginally to preventing appraisal orders from plummeting in April and May. During its peak month in April, exterior-only and desktop inspection appraisals accounted for 6% of purchase-loan appraisal orders and 13% of refinance loans.

Figure 2

If COVID-19 had posed significant disruptions to appraisal services, one would expect appraisers to rely more heavily on exterior or desktop inspection to fulfill appraisal orders. But the data so far indicates the pandemic’s impact on appraisal method has been relatively small.

So the question remains, what caused the appraisal volume in April and May to drop significantly more than home sales, measured year-over-year?

There are two factors that may explain the pattern. One is that alternative collateral valuation tools, such as automated appraisal waivers, may have gained importance during the pandemic. According to the American Enterprise Institute (AEI) Housing Center, 8 to 9% of the home-purchase mortgages originated in May and purchased by Fannie Mae and Freddie Mac used appraisal waiver.[4] Automated appraisal waivers were first launched in 2017 by the GSEs for eligible refinance as well as purchase loans. Early results showed that the take-up rate by lenders was very low.[5] Now, more than three years later, lenders may have become more accustomed to the tools to increase their usage. The AEI Housing Center analysis further indicated that between December 2019 and May 2020 the use of appraisal waivers nearly doubled, likely related to both the pandemic and the refinance boom. Will lenders continue to expand appraisal waivers after the pandemic? Whether the increased use of waivers is temporary or permanent will certainly have long term implications on the appraisal industry.

A second causal factor may be that federal regulators have temporarily allowed banks to defer appraisals for up to 120 days during the pandemic.[6] If so, we may expect appraisal orders to outpace home sales in the latter part of this year.

© 2020 CoreLogic, Inc. , All rights reserve.

For more on CoreLogic’s perspective on the U.S. housing economy, check out our Insights blog.

[2] For example, CoreLogic’s PropertyAssistTM enables buyers and homeowners to send property information to assist in the appraisal process: https://www.alamode.com/propertyassist

[4] Source: Edward J. Pinto, “Prevalence of Appraisal Waivers at the GSEs, Including CLTV Statistics,” August 25, 2020 e-mail.

[5] Source: An Overview of Enterprise Appraisal Waivers, FHFA-OIG White Paper, September 2018.

[6] Under “Appraisal and Evaluations: Interim Final Rule and Interagency Statement for Real Estate-Related Financial Transactions Affected by the Coronavirus” by the OCC, FRB, and FDIC, federally regulated lenders could defer appraisals up to 120 days from the closing date of a transaction. It is not clear, however, to what extent lenders have made use of the deferral, for federally insured loans and loans sold to the GSEs are also subject to the agencies’ appraisal alternatives/flexibilities guidelines.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.