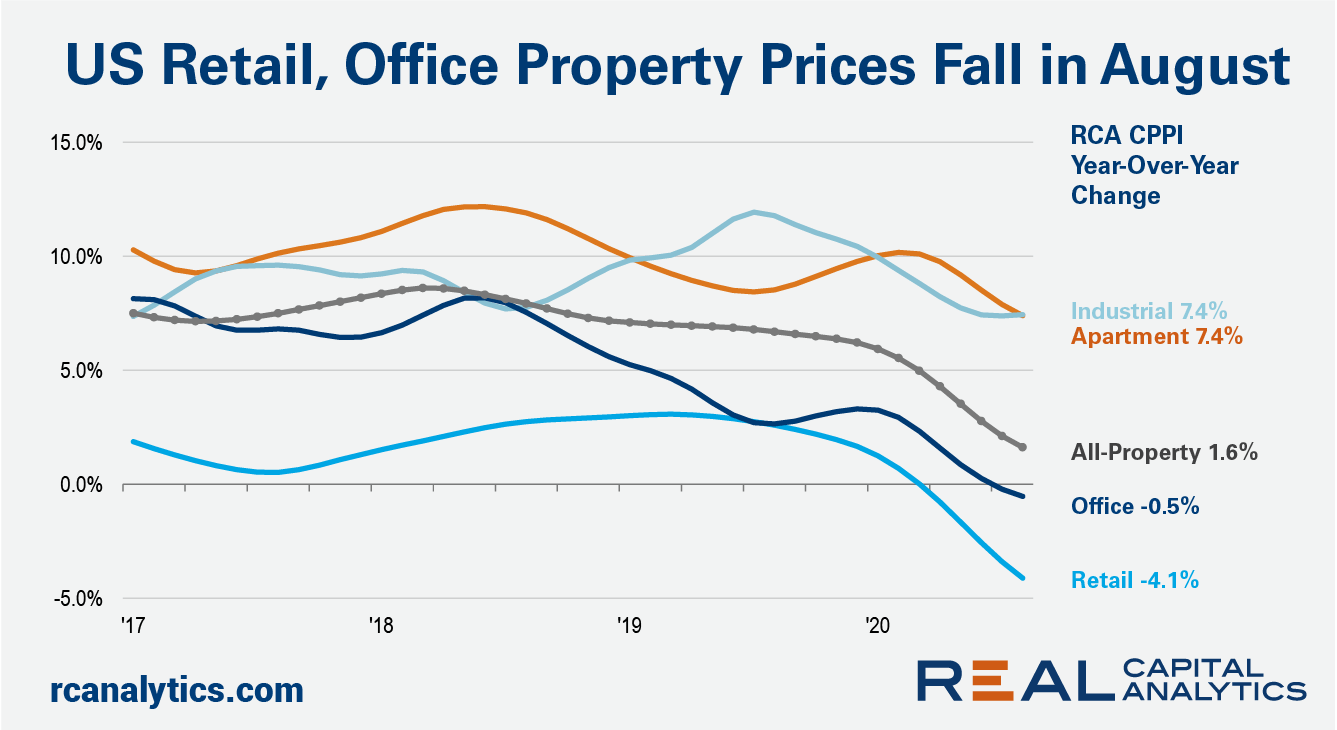

U.S. commercial property prices posted a 1.6% year-over-year gain in August as declines in retail and office pricing weighed against continued growth in industrial and apartment prices, the latest RCA CPPI summary report shows. The US National All-Property Index was rising at close to a 6% rate at the start of 2020, before the Covid-19 crisis hit the economy.

Retail prices sank in August, posting a 4.1% year-over-year drop. Prices for the beleaguered sector started declining in April and have accelerated each month since then. Overall office prices were dragged down by a 1.4% annual decline in suburban office prices.

Prices for the industrial sector — still seen as an investor favorite despite a continuing slump in transaction volume — rose 7.4% from a year prior. Apartments also posted a 7.4% year-over-year gain.

Debt markets are supporting commercial real estate pricing, as noted in the new edition of US Capital Trends, also released this week. More capital flowed into refinancing activity than acquisition activity in the first half of 2020. The ability of owners to refinance properties rather than sell has led to sticky prices.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.