Over the past six years there has been an explosion of institutional investment into student accommodation around the world on the premise that demand for housing is robust. That premise has been thrown into doubt as Covid-19 forces universities to reduce or cancel in-person teaching and thwarts travel by international college students.

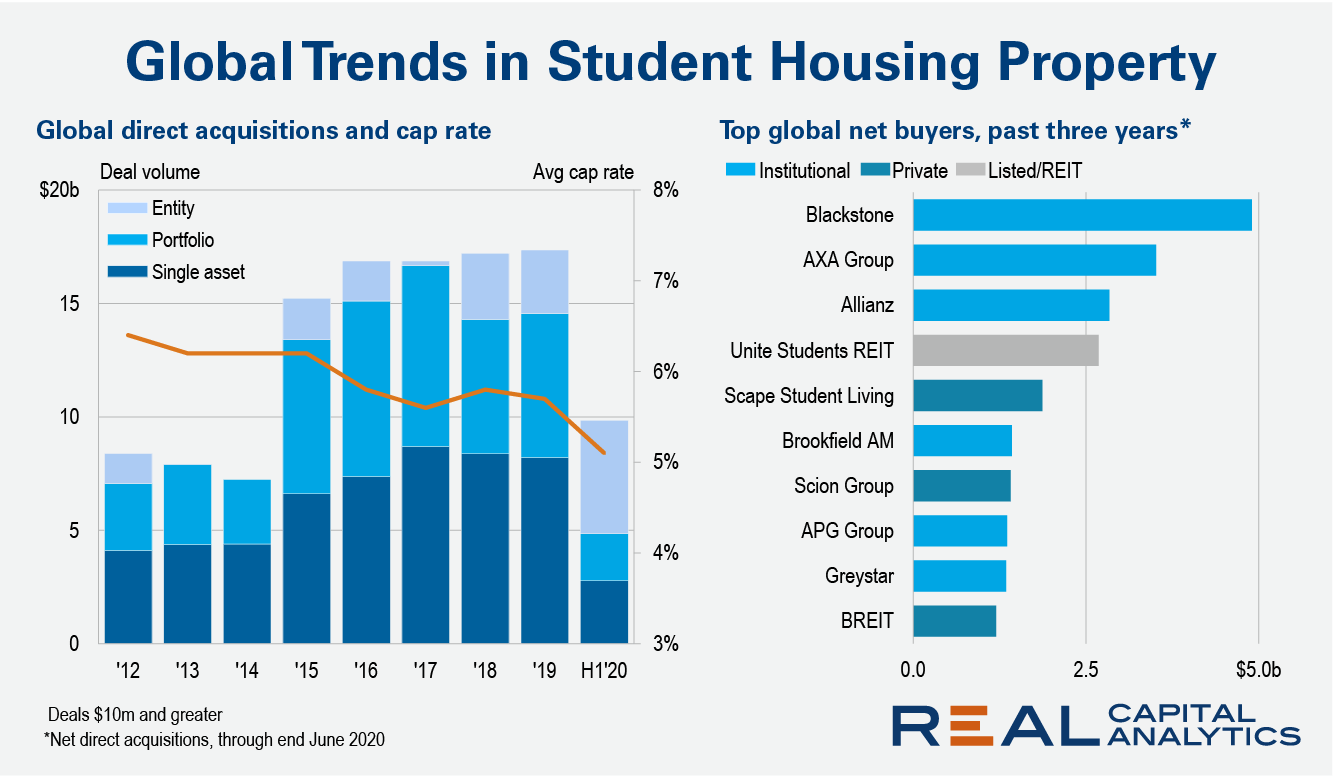

Investment in student housing took off in 2015 and since then investors have spent on average of $16.7 billion per year on direct acquisitions. In 2020, nearly $10 billion was spent in the first six months of the year alone, with close to a half of the total related to one mammoth U.K. deal.

Reflecting investor demand for this asset type, cap rates have fallen in recent years, down to an average of 5.1% in the first half of 2020, from 6.2% in 2015.

The list of top buyers of student housing assets includes some of the world’s best-known institutions as well as specialist operators. At the top of the pile is Blackstone, which purchased iQ Student Accommodation from the Wellcome Trust and Goldman Sachs. This deal, which is the biggest student housing transaction globally to date, was agreed in February 2020 and closed in May after regulatory approval.

In Australia, Scape Student Living, AXA Group, APG Group and Allianz partnered in an AU$2.1 billion ($1.4 billion) deal to buy the Urbanest student dormitories in the second quarter of 2020. The transaction was the second largest of any property type in the Asia Pacific region during the first half of this year.

As for the pipeline of deals, two transactions — both rumored to be priced in the hundreds of millions of dollars — are on the table. Germany’s Allianz is continuing its push into the Asia Pacific region with the purchase of a two-property portfolio in Melbourne, Australia, and in the U.S., TPG is reported to be buying an eight-property portfolio from Preferred Apartment Communities.

The wider rental accommodation sector, including apartment buildings, has been one of the more resilient sectors in year-to-date 2020. Student housing represented a 10% share of the overall sector, the highest level Real Capital Analytics has recorded since 2007. The long-term structural trends of rental accommodation will likely remain favorable, even if in the short-term there may be some headwinds for getting students back to school.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.