Source: https://www.placer.ai/blog/placer-bytes-ascenas-assets-bed-bath-beyonds-future-and-dunkins-surge/

In this Placer Bytes, we dive into Ascena’s strengths as a means of looking forward, break down Bed Bath & Beyond’s latest and dive into Dunkin’s surge.

Ascena’s Assets

In 2019, and again this past June, we noted that one of the most interesting sectors in apparel was the plus-size segment. This perspective gave us more confidence in a struggling Ascena as it sits on some of the most exciting brands in the space including Lane Bryant and Catherines.

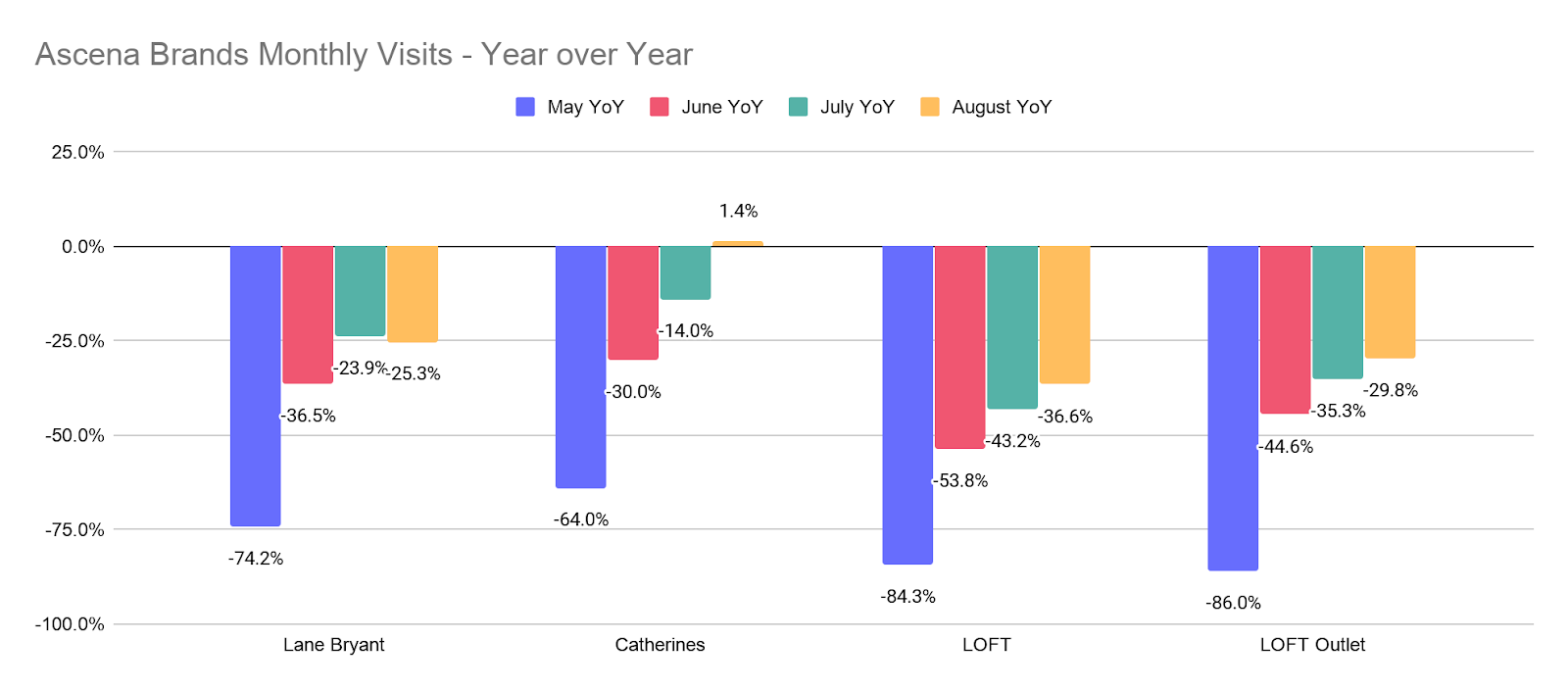

And looking at monthly visits rates for Ascena brands has only reinforced this confidence as Lane Bryant and Catherines have rebounded to 25.3% down year over year in Lane Bryant’s case and 1.4% up for Catherines by August 2020. These numbers were in line, if not ahead of the wider movement in the apparel sector during the retail recovery.

But interestingly, it isn’t just plus-size that caught our attention; Ascena could have a very interesting off-price play as it looks to redefine its future.

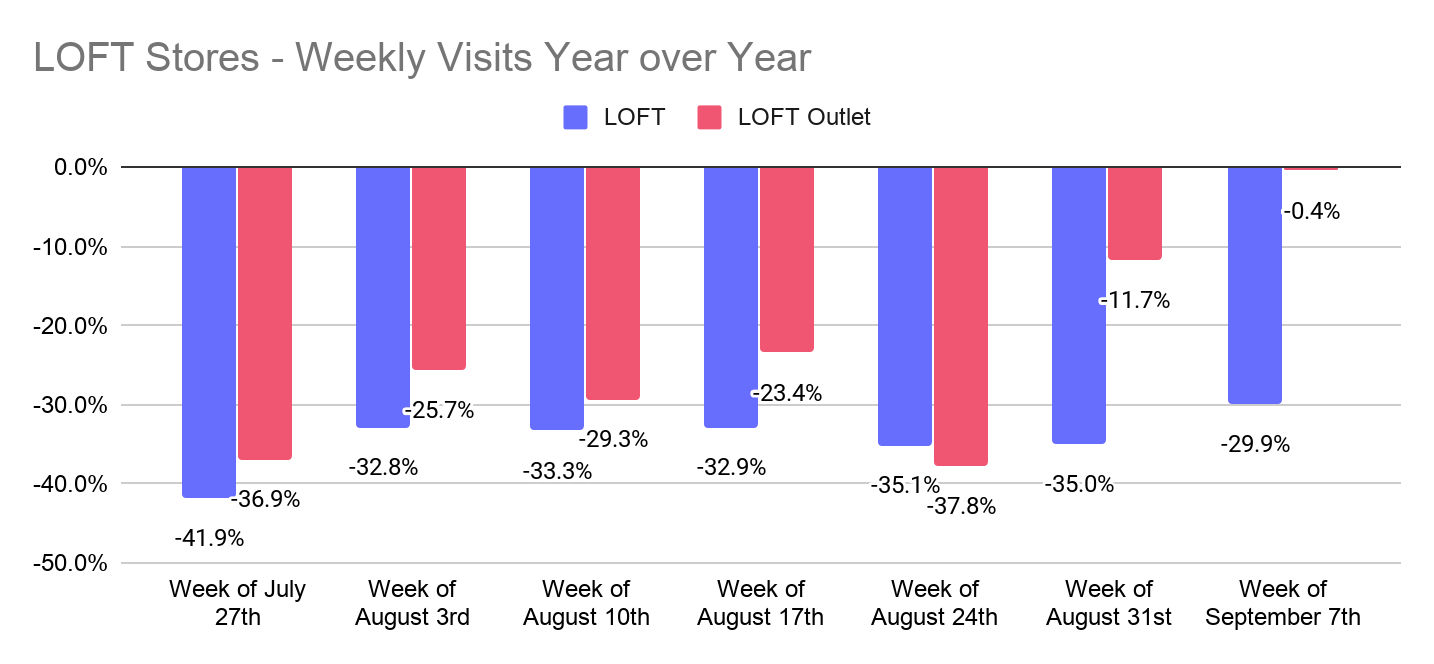

Analyzing visit rates to LOFT stores compared to LOFT Outlet locations show the latter recovering at a far faster rate. Now, this is clearly boosted by a shift toward price-conscious shopping in the current retail climate, but also speaks to the ability of this brand to operate effectively in a variety of settings. Should Ascena succeed in coming out of its current financial situation or find a new owner for its assets, there is hope for many of the brands under its umbrella. Whether it be focusing on high-growth segments like plus-size, looking to diversify its offline footprint with a greater mix of indoor and outdoor locations or leaning more into value shopping, there is a window for growth.

Bed Bath & Beyond’s Future

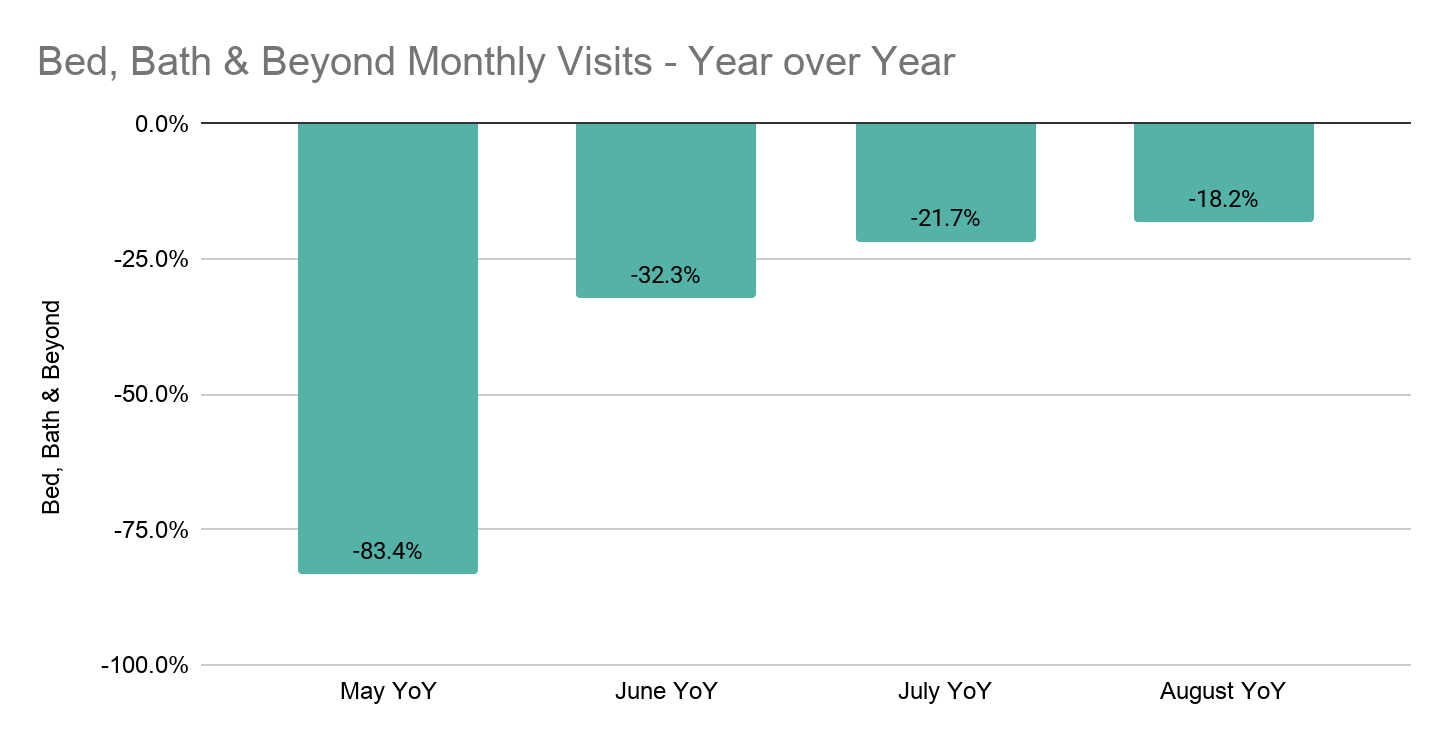

The Bed Bath & Beyond story is becoming increasingly complex and interesting. The brand recently announced that they would be going through a deep process to optimize its retail footprint, something Placer.ai data showed could be effective. Add to this a thinning competitive landscape where closures for brands like Pier 1 could create a vacuum Bed Bath & Beyond is well-positioned to fill. And the visit data does show a recovering brand with each month bringing the home goods leaders closer within range of 2019 numbers.

Yet, while this trend is encouraging, Bed Bath & Beyond is lagging behind players like At Home, HomeGoods and others that already returned to year-over-year visit growth by July. So what should we expect? The answer is muddled with much of the success likely depending on the effectiveness of location optimization plans and how effectively the brand can take advantage of the upcoming holiday season. But should either of these prove effective, the upside could be huge.

Dunkin’ on the Rise

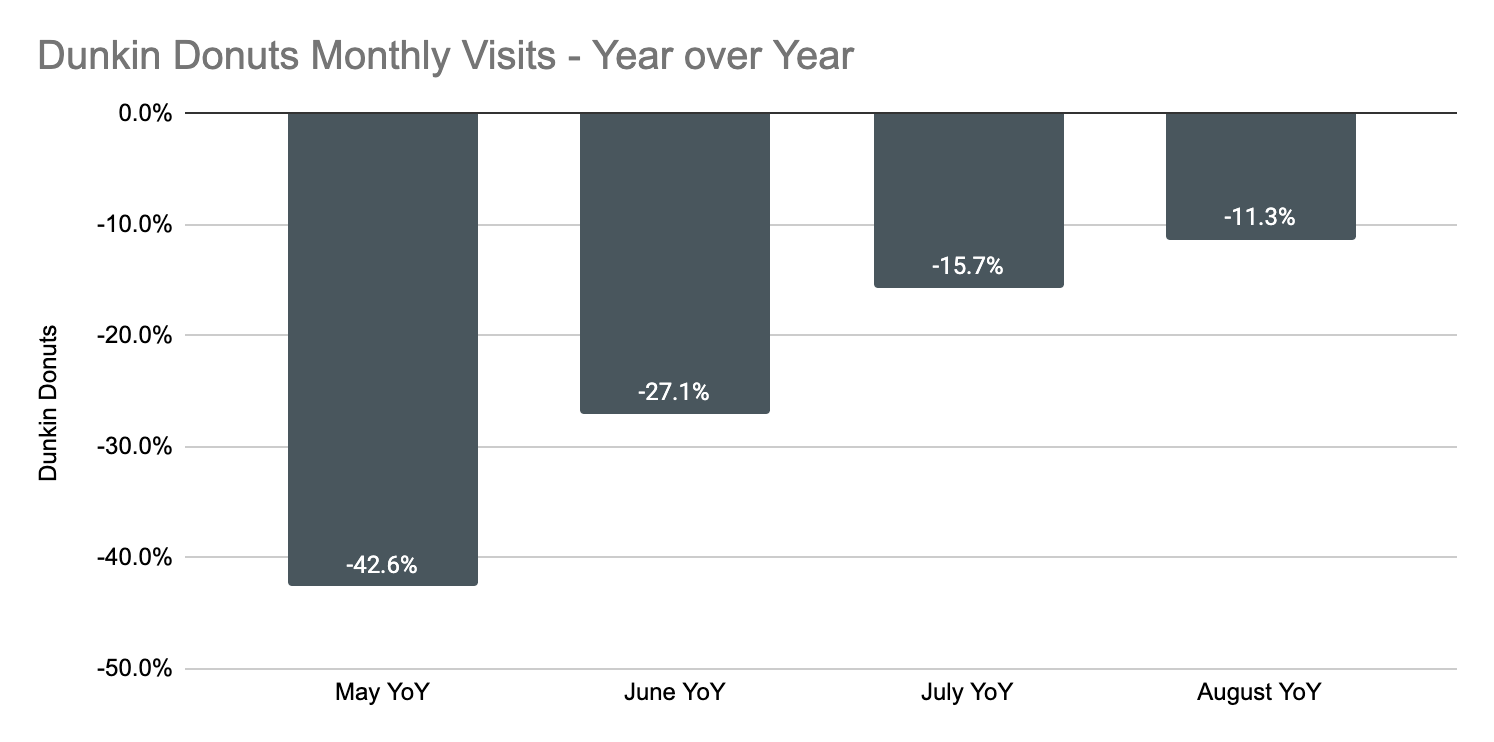

While it might not have the zeitgeist shifting power of Starbucks and its seasonal lattes, Dunkin’ looks to be rising back as well. The brand saw visits push closer to 2019 levels throughout the summer, culminating in August visits that were down just 11.3%. And early September saw a boost from a later Labor Day where year-over-year daily visits rose 1%, 11%, and 7% respectively for the Saturday, Sunday, and Monday of the holiday weekend.

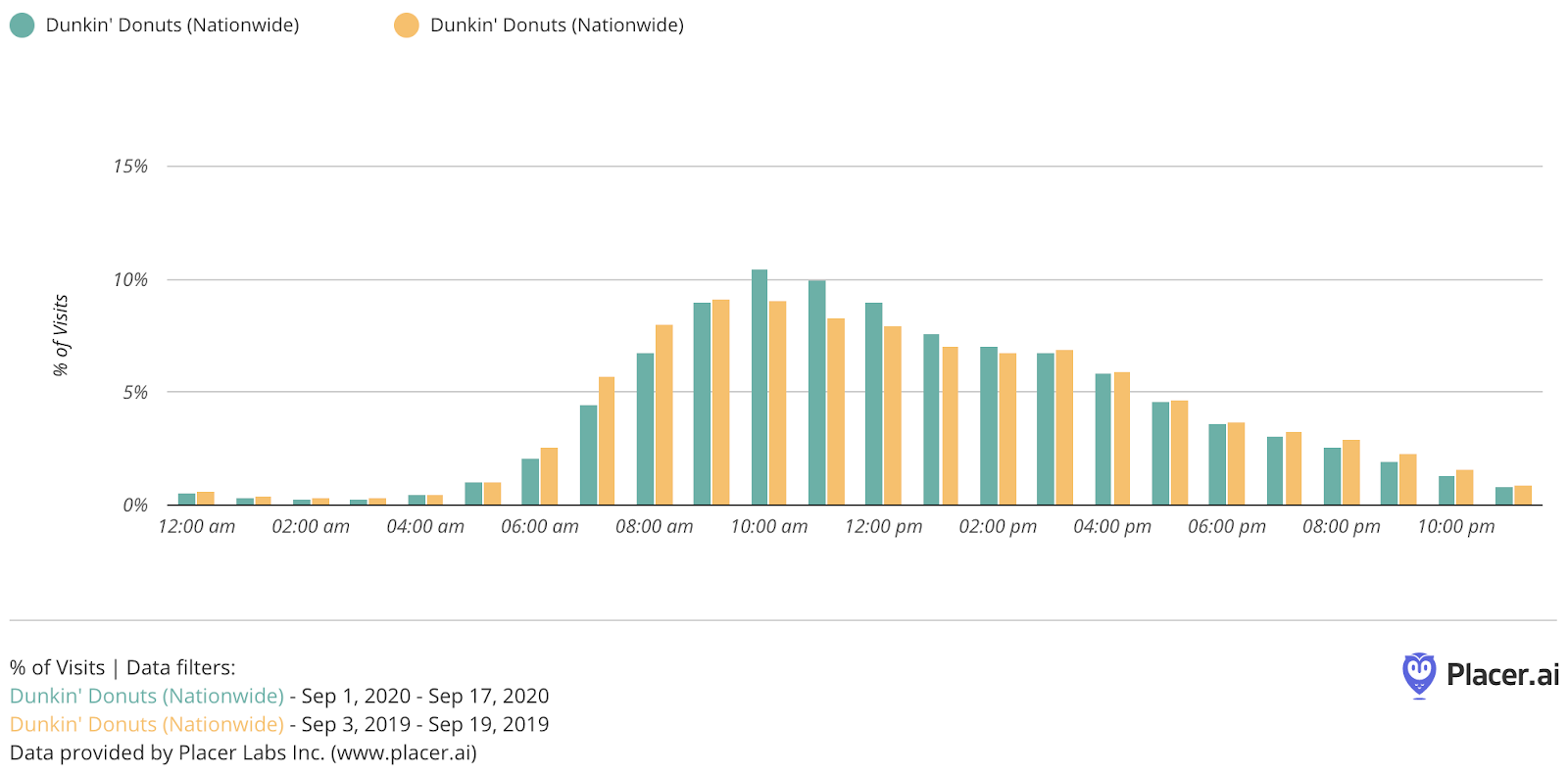

But, there is one key metric for a full recovery. It does still appear that the time of day that visits take place matters a lot. While July and August numbers pulled close to normal visit breakdowns between 2019 and 2020, the start of September and the return to work/school has exaggerated the difference again.The more “norma”’ the morning visits, the more likely that the routines that privilege a morning and coffee oriented brand like Dunkin’ have returned. Until that shifts, it will be difficult for Dunkin’ to drive a full in-store recovery. On the other hand, should the brand prove capable of sustaining its newfound late morning/early afternoon strength, the return of morning routine could drive a very powerful boost.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.