Back in July, LinkUp wrote an article testing the hypothesis that government stimulus was preventing workers from returning to work. The prevailing narrative was that some workers were receiving more compensation through the CARES Act than they would by returning to many low-paying jobs, so those workers were opting out and low-paying jobs were going unfilled. In our article, we concluded that LinkUp’s data did not support this claim at that time. We also offered an alternative take; that there simply were not enough open jobs for which the unemployed could apply. Our assertion was that the federal government should continue offering stimulus directly to citizens in some shape or form, as it would not serve as a disincentive to return to work.

The first and most comprehensive round of federal unemployment benefits ended at the end of July. Executive orders were passed that continued unemployment benefits, with the federal government paying $300, and states picking up an additional $100 of the tab. Each state has chosen to handle this a bit differently, but the majority will pay out the remaining federal aid they have at a rate of $300, with payments starting in September.

Even with executive orders, unemployed citizens will see their unemployment benefits decrease by $200 at minimum, with the majority seeing a decrease of $300. Depending upon what legislation follows, unemployed citizens will be left without support when these benefits lapse. In further testing the hypothesis of our last article, we would expect closed duration to decrease as a result of this loss of stimulus. Simply stated, if there are fewer employment benefits available, the unemployed will have more incentive to return to work.

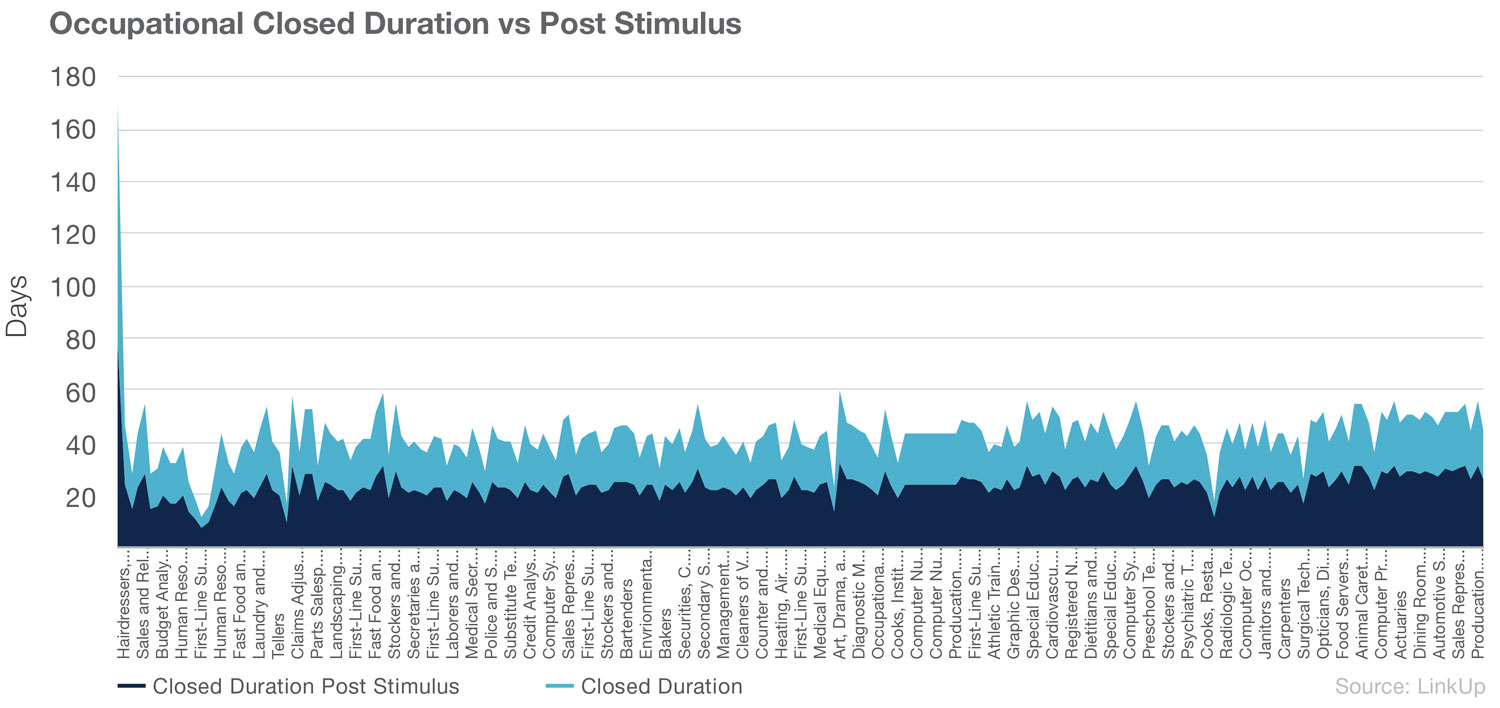

Examining the data using the same methodology that was used in the original O*Net post, we see that the data does not support this hypothesis. Since the stimulus has decreased, we have not seen closed duration decrease. Rather, we saw an increase in almost all occupations with the exception of hairdressers.

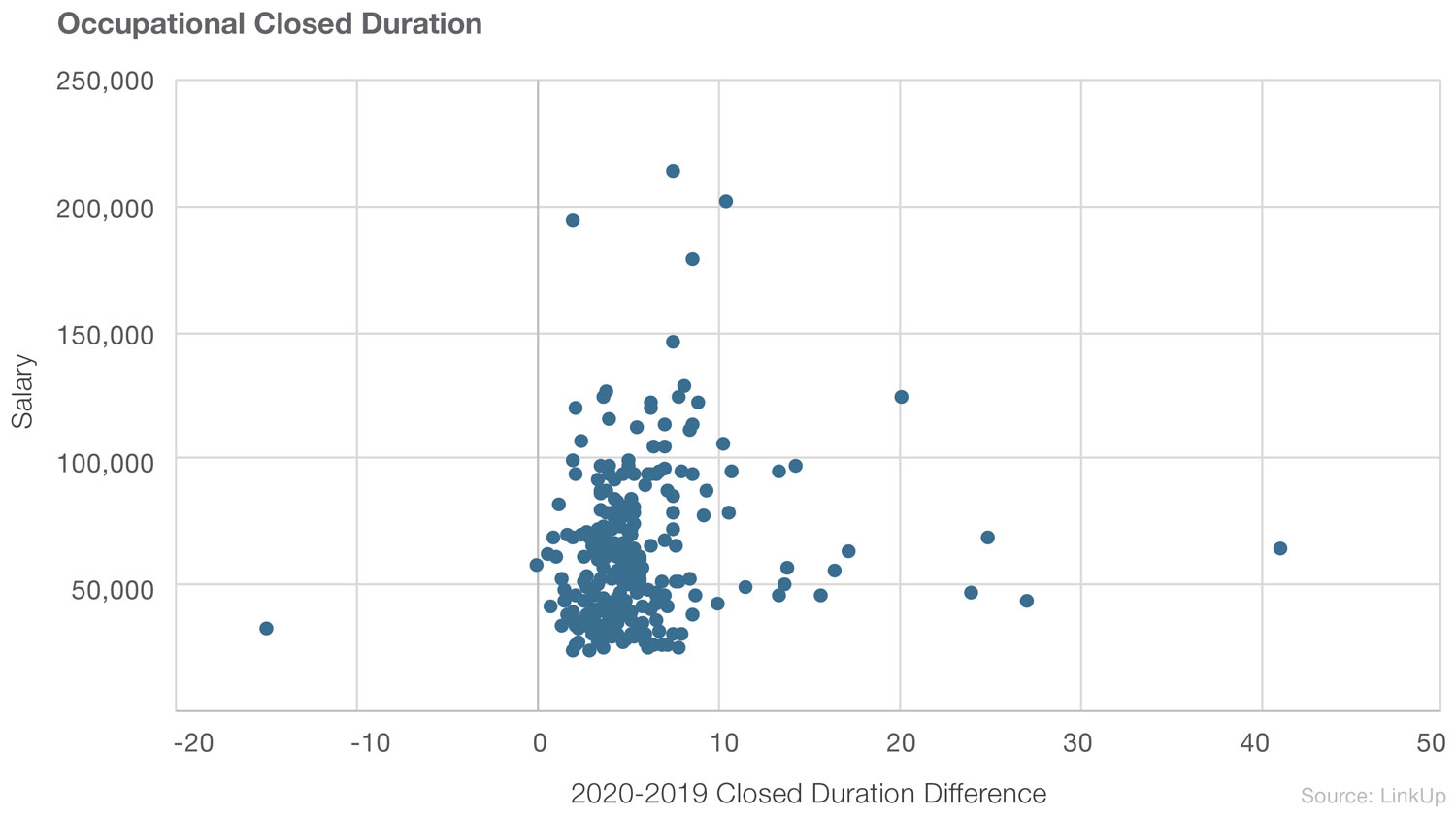

The average increase in closed duration was 5.6 days. Again we observed no noticeable correlation between the salary and the difference in closed duration. This is at odds with the expectation that those seeking lower paying positions would have returned to work now that the stimulus offered has decreased.

It is important to note that, at the time of this writing, stimulus has only been decreased for roughly 2 months. Given more time, it’s likely closed duration could decrease as more positions are filled. Additionally, there are other possibilities that could cause the increase in closed duration, like larger applicant pools that grant employers the ability to be more selective, or employers grappling with depleted resources for hiring as a result of COVID.

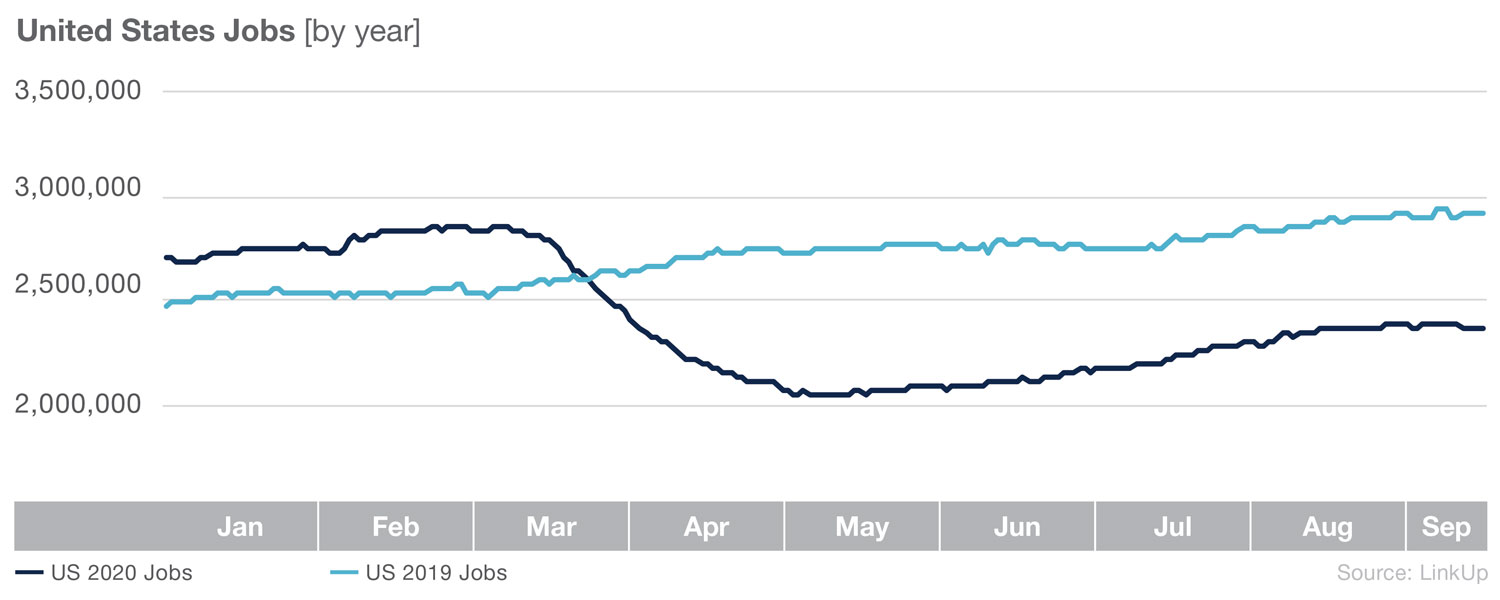

Ultimately, it does appear the US job market is in a much better position as a whole than it was earlier this year in April and May. However, job postings have a lot of ground to regain before they reach their pre-pandemic levels. So while the specific impact of a decrease in stimulus may be up for debate, halting the program altogether would potentially stunt the critical labor market growth we are currently observing.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.