In this Placer Bytes, we analyze IKEA’s surprising surge, the potential next steps for Levi’s, and the impressive performance of footwear retailers.

IKEA Demonstrating Dominance

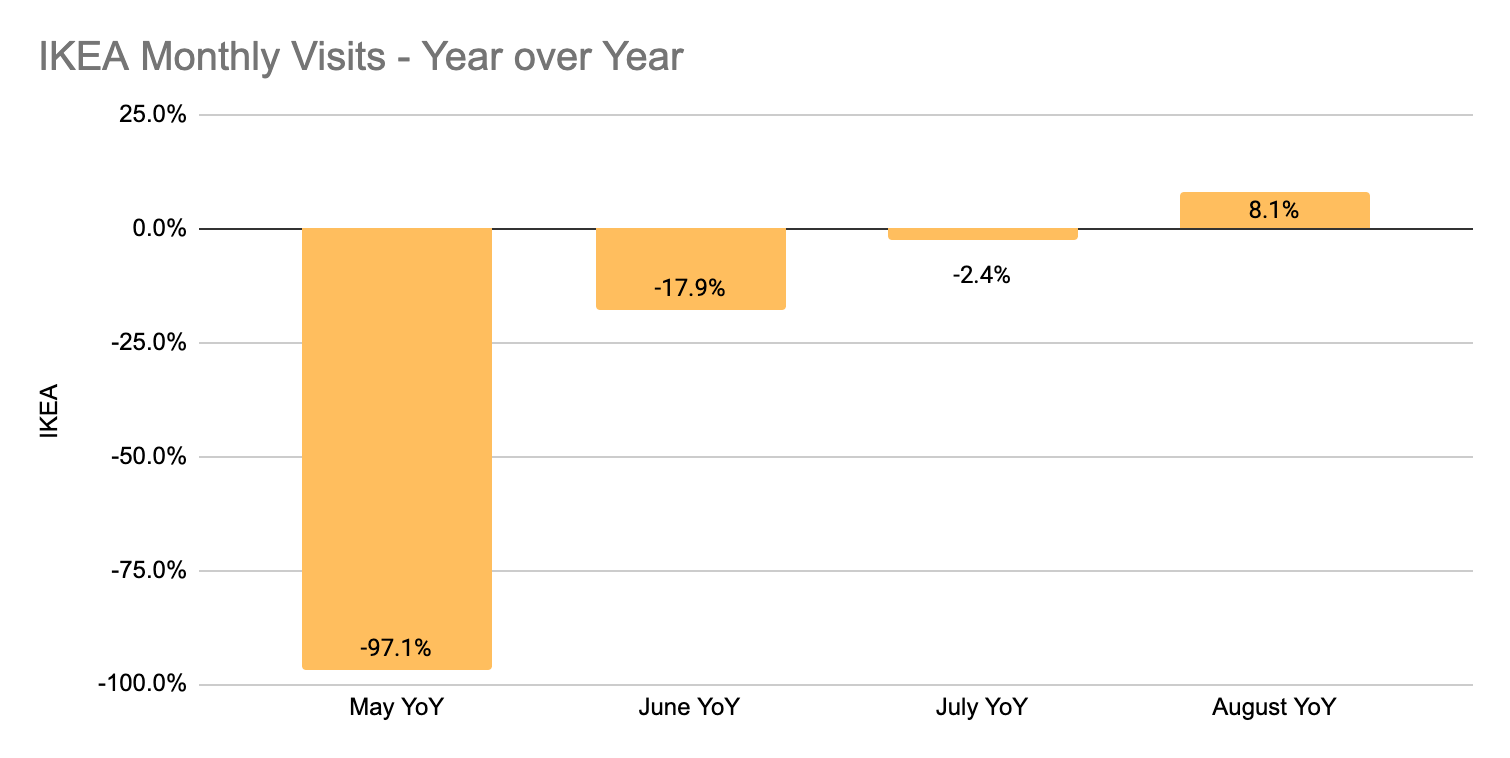

When we looked at the wider home improvement surge, we lauded everyone from Home Depot and Lowe’s to At Home and HomeGoods. But one brand we didn’t give credit to was IKEA, and we missed the boat. Since the shutdown brought visits to IKEA saw visits surge to down just 2.4% year over year in July and up 8.1% in August. And it looks like this is just the beginning for the brand.

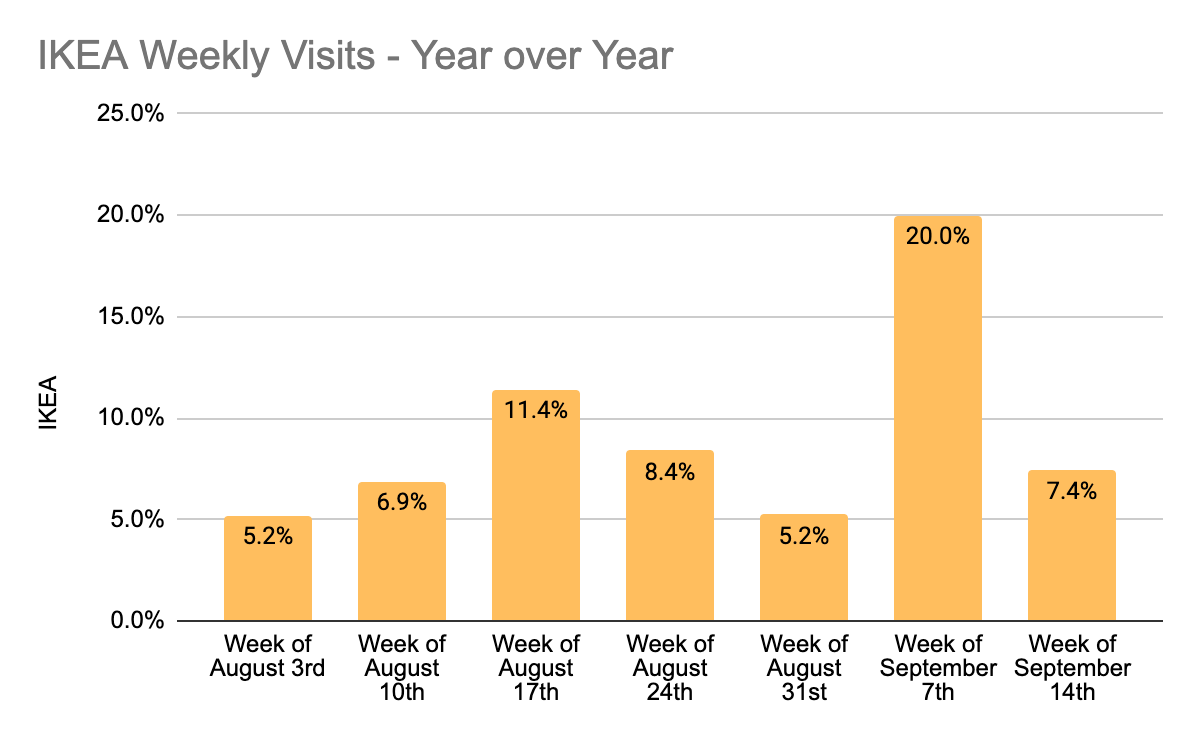

For the weeks beginning August 31st, September 7th, and September 14th, IKEA has averaged 10.9% year-over-year growth in weekly visits. So, while the brand may have entered the wider home improvement and home goods surge later than others, they seem to only be picking up pace heading into a critical fall and holiday season. And this is important, for while many other brands in the sector see their seasonal peak in the spring, IKEA enjoys its busiest offline periods during the winter.

Levi’s Next Move?

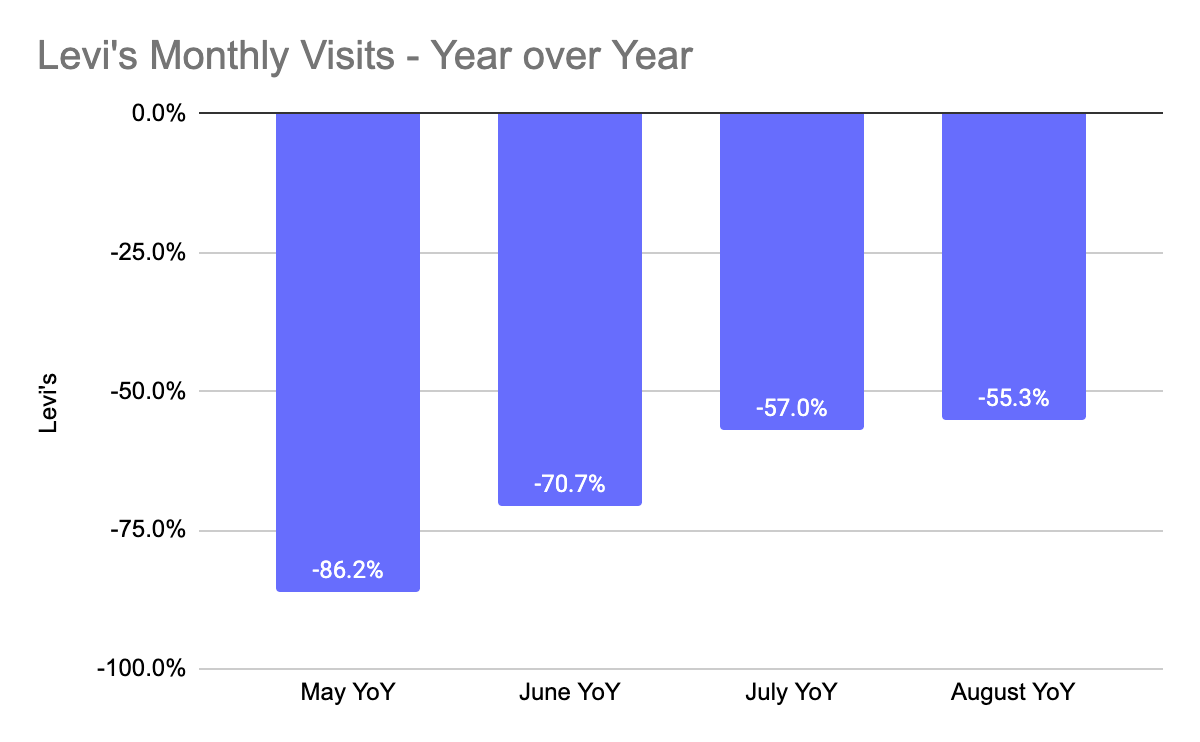

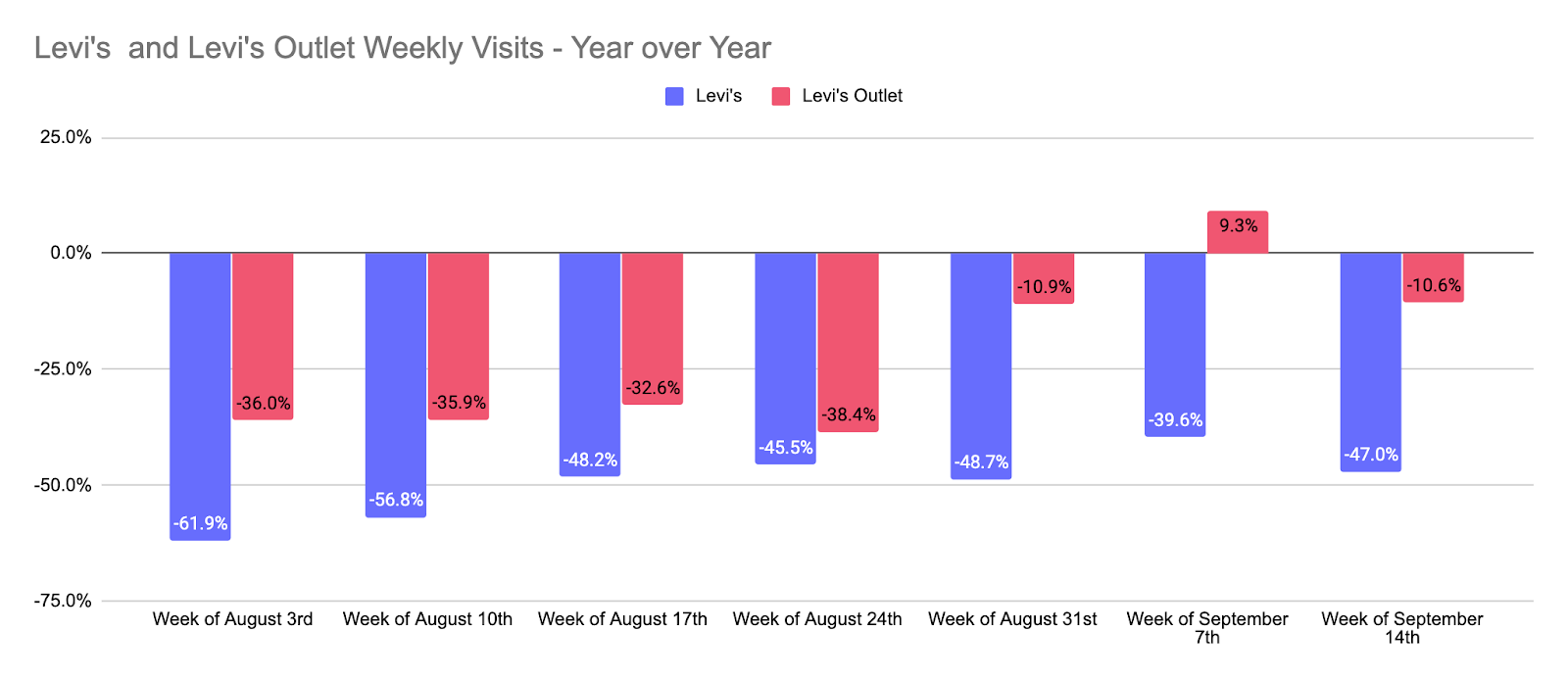

In 2019, Levi’s announced a planned expansion of 100 stores alongside drops in its wholesale business, something that happened in parallel to significant growth in visits to Levi’s owned locations. And while visits to Levi’s stores are returning at a solid pace, the recovery rate has been more in line with department stores than faster-moving sectors like off-price or athleisure. In August, visits were down 55.3% year over year, a slight step forward from July when visits were down 57.0%. Though this doesn’t account for the August heights normally reached during the back to school season, it does serve to highlight an aspect of Levi’s offline reach that could receive greater focus.

While Levi’s owned store recovery has been limited by the recoveries of malls and states where the largest number of locations are situated, there is another aspect to its offline reach recovering much faster. Levi’s Outlet locations have consistently outperformed other stores, and for good reason. Firstly, the outdoor orientation of many of these stores has helped them reopen faster and to larger crowds. Secondly, the off-price focus has a particular appeal in the current environment of economic uncertainty.

With Levi’s already serving as a trendsetter with the decision to shift more focus to owned retail, the push to more outlet locations and options could put the brand ahead of the curve again.

Footwear Retail Rising

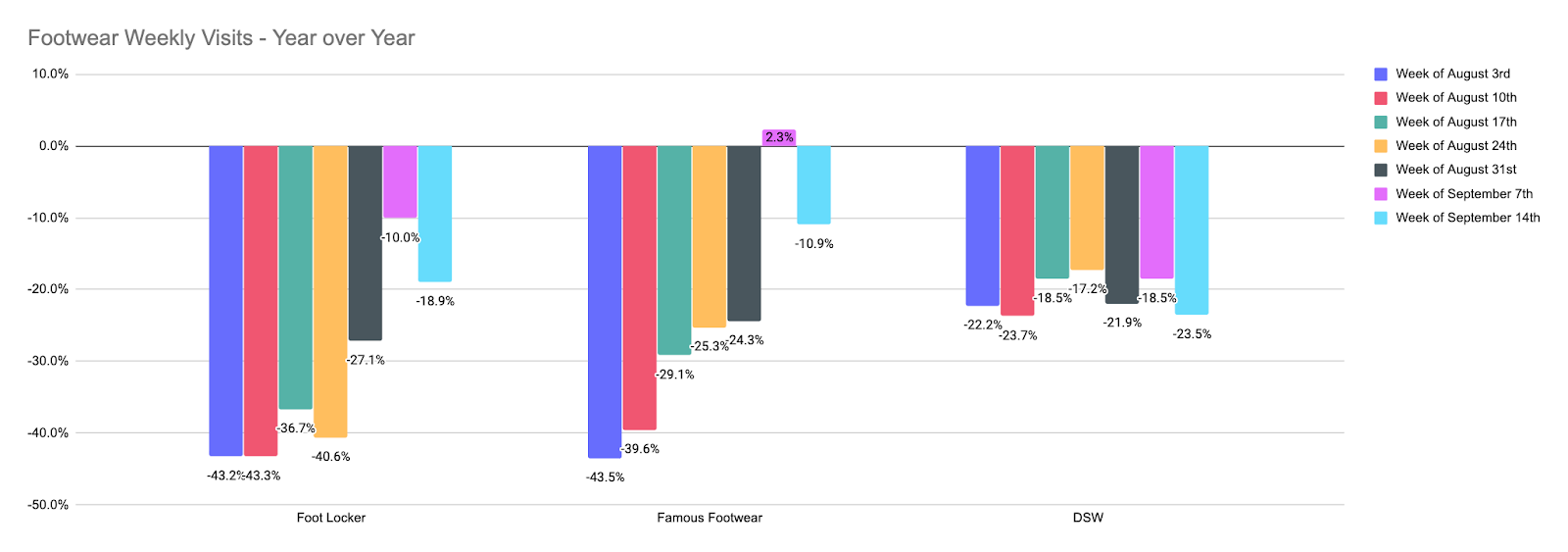

Apparel has struggled with a strong impact on department stores and other elements of the sector focused on reselling other brands. But the same doesn’t seem to be true with footwear. Looking at Foot Locker, Famous Footwear, and DSW, all three have shown very strong progress in their recoveries with Famous Footwear actually seeing year-over-year growth of 2.3% the week of September 7th.

With Foot Locker rising fast as well, it does appear that this segment of apparel could be well-positioned for the holiday season to come.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.