In 2019 there were 4.54 billion scheduled passengers worldwide. Analysts expected 2020 to set a new record of over 4.72 billion passengers, but instead, the coronavirus pandemic spread its tentacles across the globe, practically bringing international travel to a standstill.

Airports Council International (ACI) estimates that around 50% of passenger traffic will be lost in 2020. As a direct relationship exists between passenger numbers and airport revenue, the ACI predicts that over the year, the airport retail market will also drop by over half in some regions. Dufry, the world’s biggest airport retailer, reported that April 2020’s sales had dropped by 94% compared to the previous April.

How can this situation be salvaged? Some experts suggest a heavier investment in e-commerce by airports and travel retail brands, others suggest looking at innovation and data to zero in on your target market.

“The pressure to make the right decision can be felt across the industry. Companies can’t afford to sit on their laurels, to wait it out. They need to look at facts to overcome fear. Re-think their strategies as the travel trends move from international to domestic and regional,” says Jerome Goldberg, Retail & Travel Retail Customer Success Manager at ForwardKeys.

New opportunities during a crisis

Coresight’s report says that shoppers have around 56 minutes of free time before boarding so spend around 25 minutes shopping at duty-free stores. Watches, jewellery, and fashion are the most popular as prices are duty-free and “typically lower than in regular retail stores”. Also, having a range of products that can be purchased, collected, and delivered could be more likely to boost spend per passenger.

With this in mind and the shift in shopper profile, some are now able to capitalize on new business opportunities, even during this crisis.

“The latest data we are seeing from China using our Chinese Shopper Tracker, paints a very promising picture,” adds Goldberg.

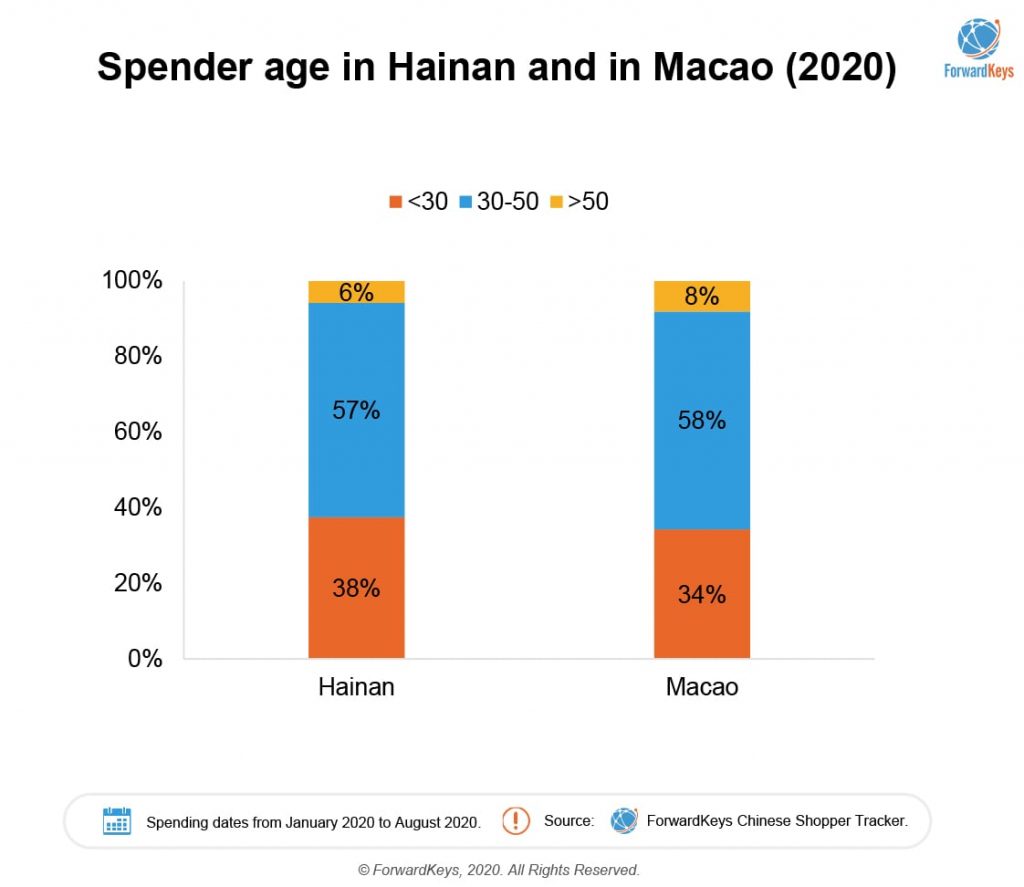

“When looking at who is currently shopping in Hainan, we’ve noticed key differences in the age brackets and key origin cities from mainland China compared to near-by destinations.” Indeed the data reflects the attraction of the tropical shores of Sanya, rising since the new duty-free allowances were introduced.

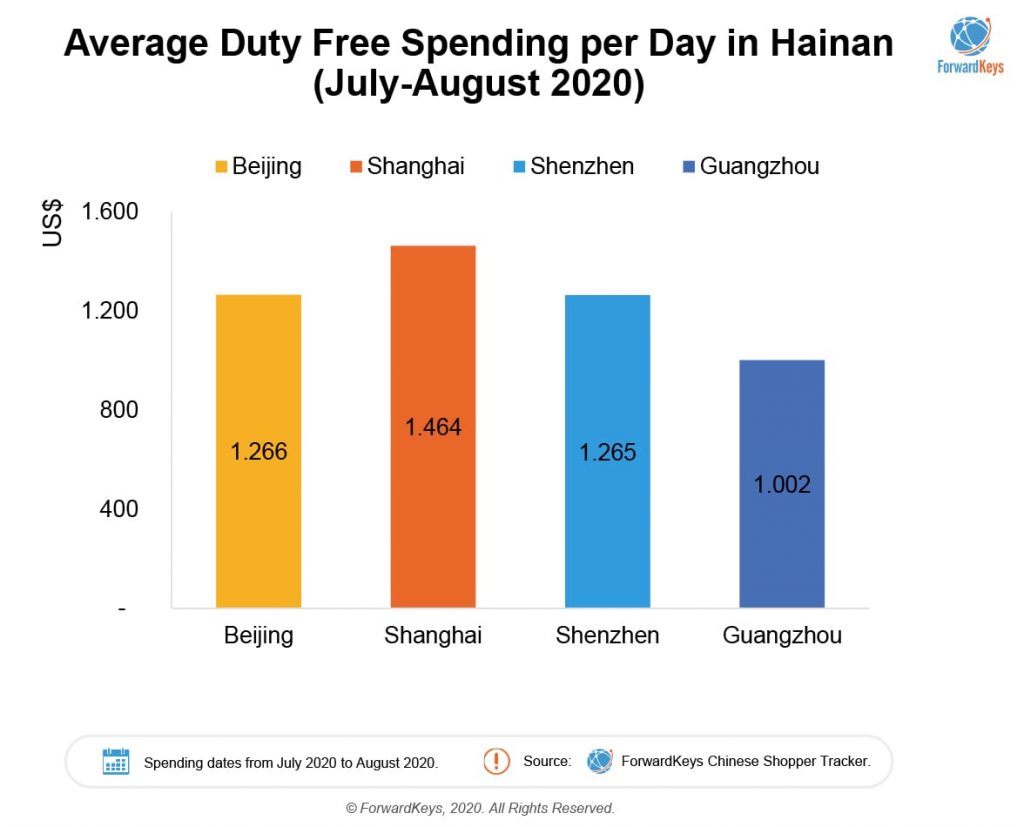

Not only is the average traveller leaning slowly more towards a much younger audience, but the biggest spenders and luxury brand lovers stem from Shanghai, long-known as the fashionistas of China. Previously the travel market hailed from the capital, Beijing. This presents an exciting opportunity for fashion and beauty segments in the travel retail industry.

All Eyes on China

When comparing year-on-year trends in China, the power of Shenzhen shopping might need to be recognized as an extra chance for travel retailers to widen their shopping cart.

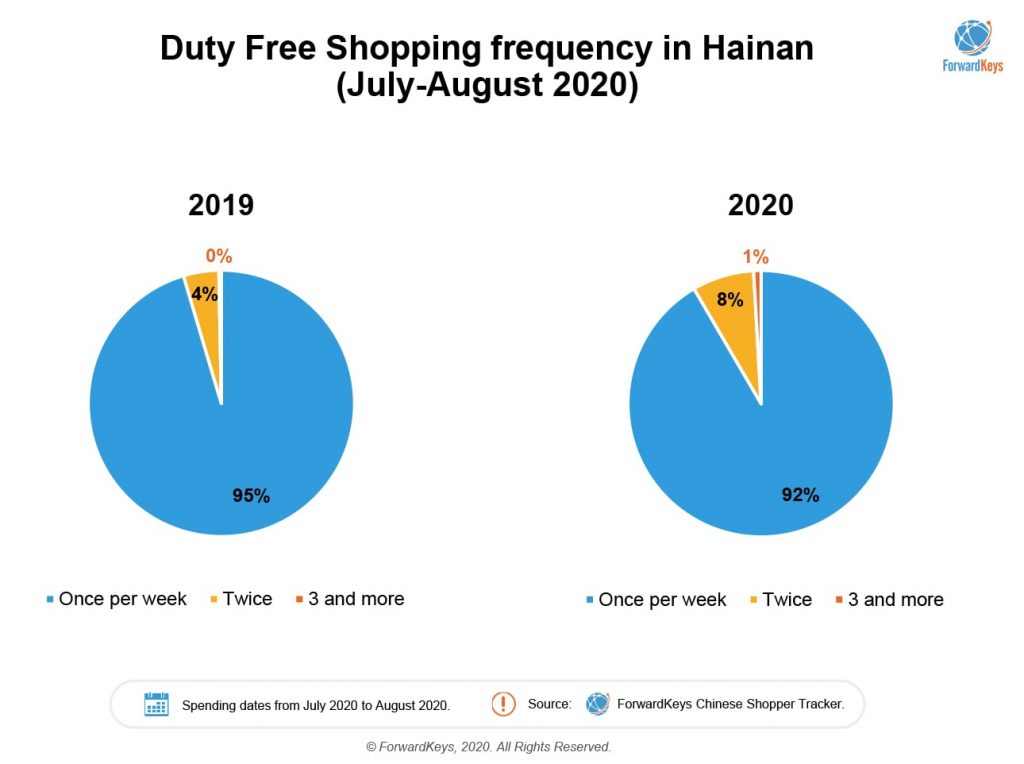

Not only is the data showing an increase in the cost per transaction, but there has been an increase in the number of transactions. Could that also be down to the fact that there is a growing number of consumers who are now also visiting duty-free stores more than once per week?

The shopping boom that has transpired in domestic China has had a helping hand from a few other things such as an increase in seat capacity, discounted airfares, and greater control of Covid-19 in China. Wise lessons that other nations should lobby for if they would like to re-start any movements in their travel retail sectors.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.