In this Placer Bytes, we dive into Tractor Supply’s continued surge, analyze Chipotle’s Q3 and look into Albertsons impressive grocery performance.

Time to Take Notice of Tractor Supply?

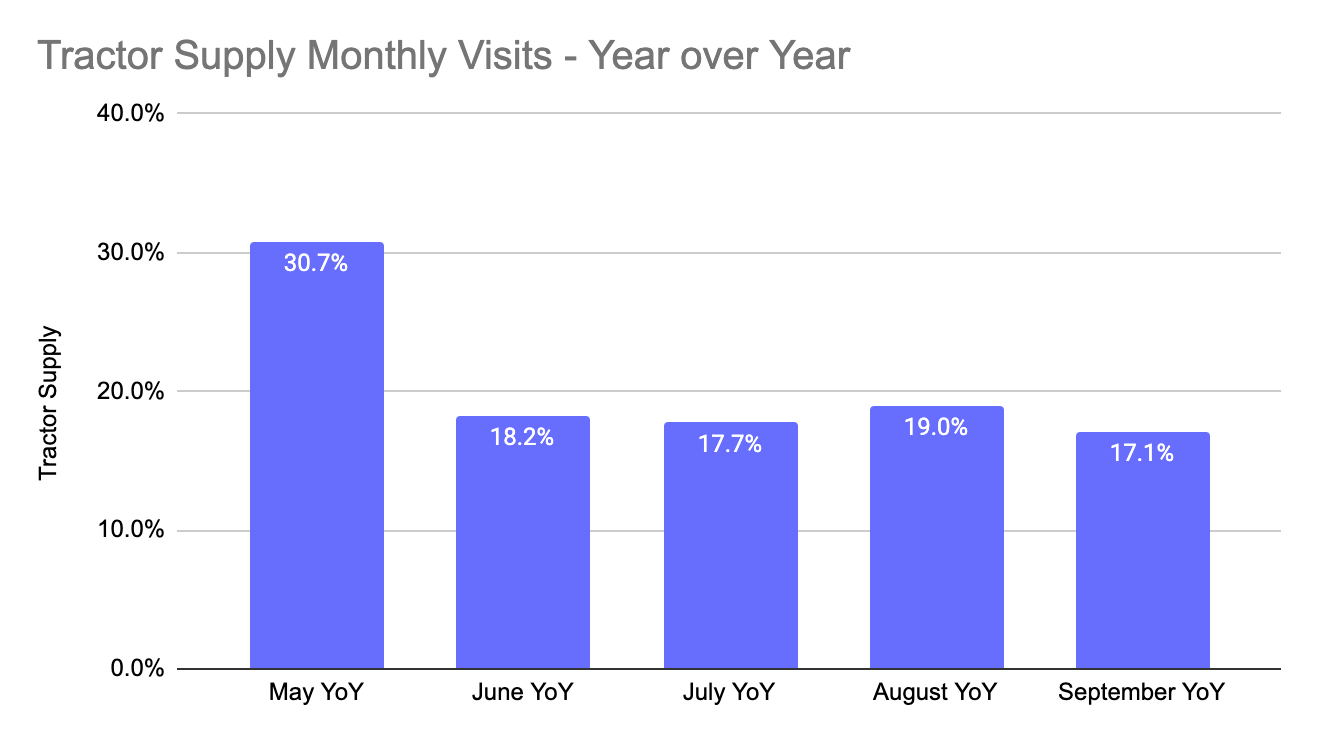

In a sector where giants like Home Depot and Lowe’s have dominated headlines, Tractor Supply has continued to perform well beyond expectations in its own right. The brand saw visits grow year over year in July, August, and September by 17.7%, 19.0%, and 17.1% respectively. And these impressive numbers follow an equally strong spring where May and June visits were up 30.2% and 18.2% respectively.

But, it’s possible that there is still more room for growth here. The brand is still highly focused on its core market, as opposed to pushing harder to take market share in the more mainstream home improvement space. Should that switch come into play, the long term potential could become even more exciting.

Chipotle’s Rebound Stalls?

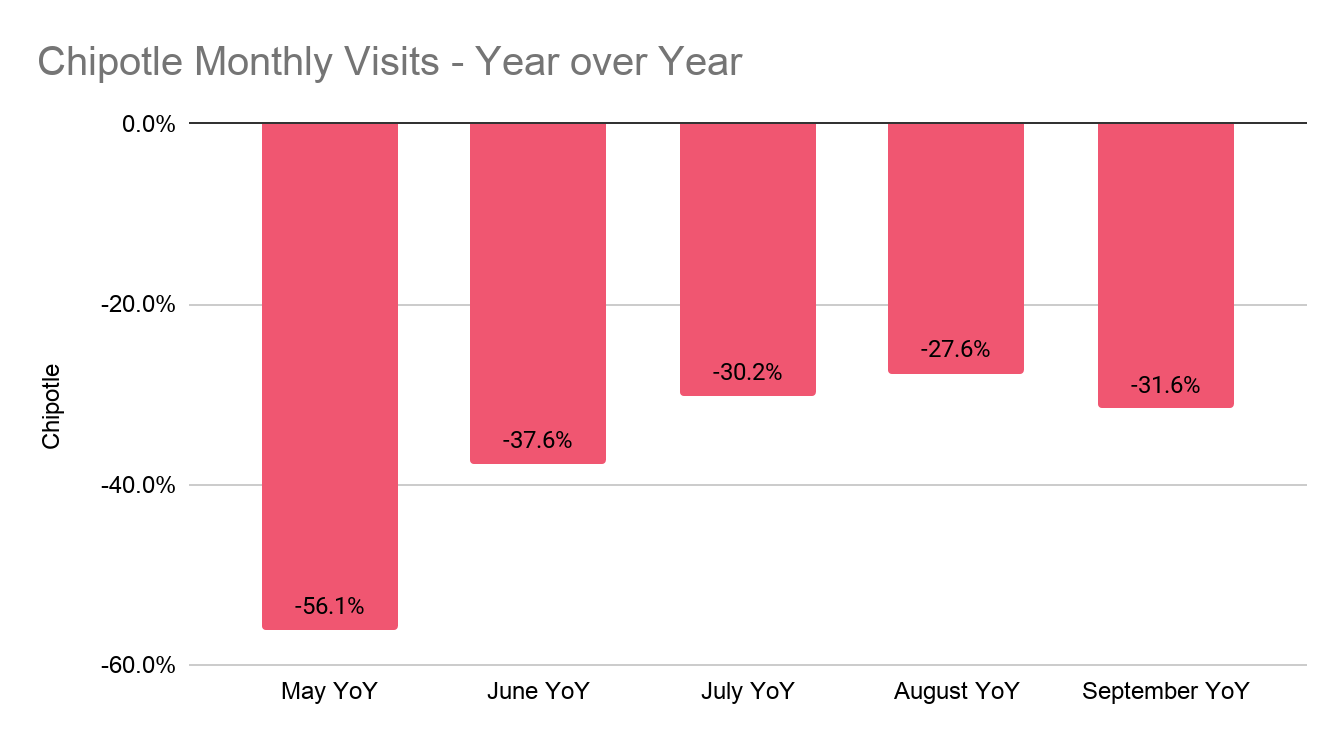

Following a huge traffic jump between May and June, Chipotle was enjoying a steady climb towards 2019 traffic levels before a September backslide. Visits in July and August were the best since the start of the pandemic, down just 30.2% and 27.6% year over year, respectively. Yet, visits in September were down 31.6%.

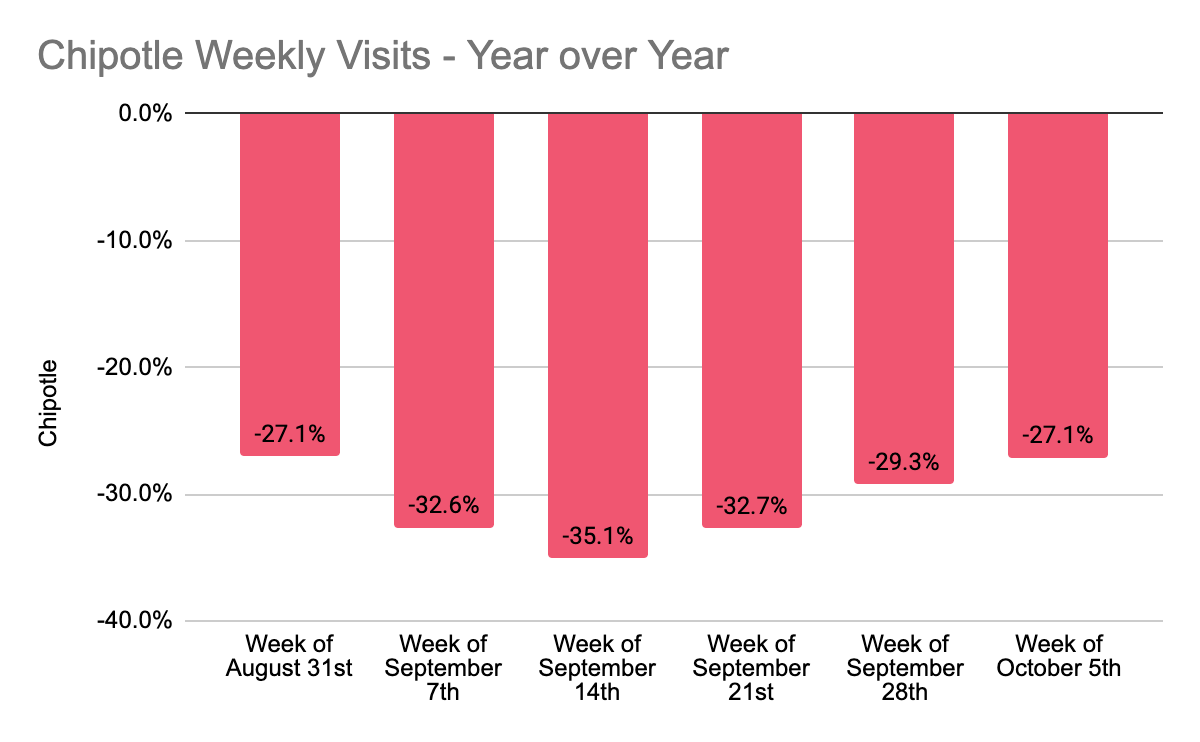

However, it does appear that this was just a temporary lull that aligned with a wider dip in the fast-food sector. Looking at weekly visits year over year, mid-September marked a shift where Chipotle began to see consistent growth again in nationwide numbers each week. And all this while California, the state with the largest number of locations is still behind heavily impacted by state-level restrictions. An overall picture that points to an especially bright outlook should the situation turn more effective.

Albertsons

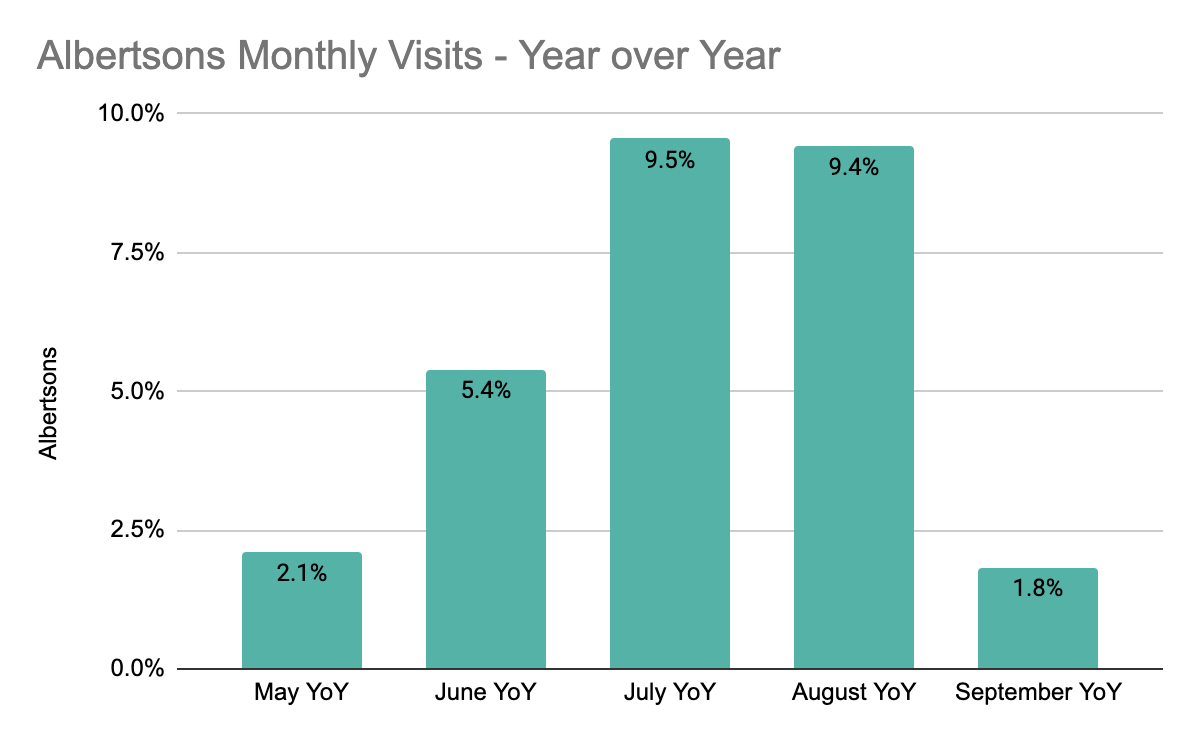

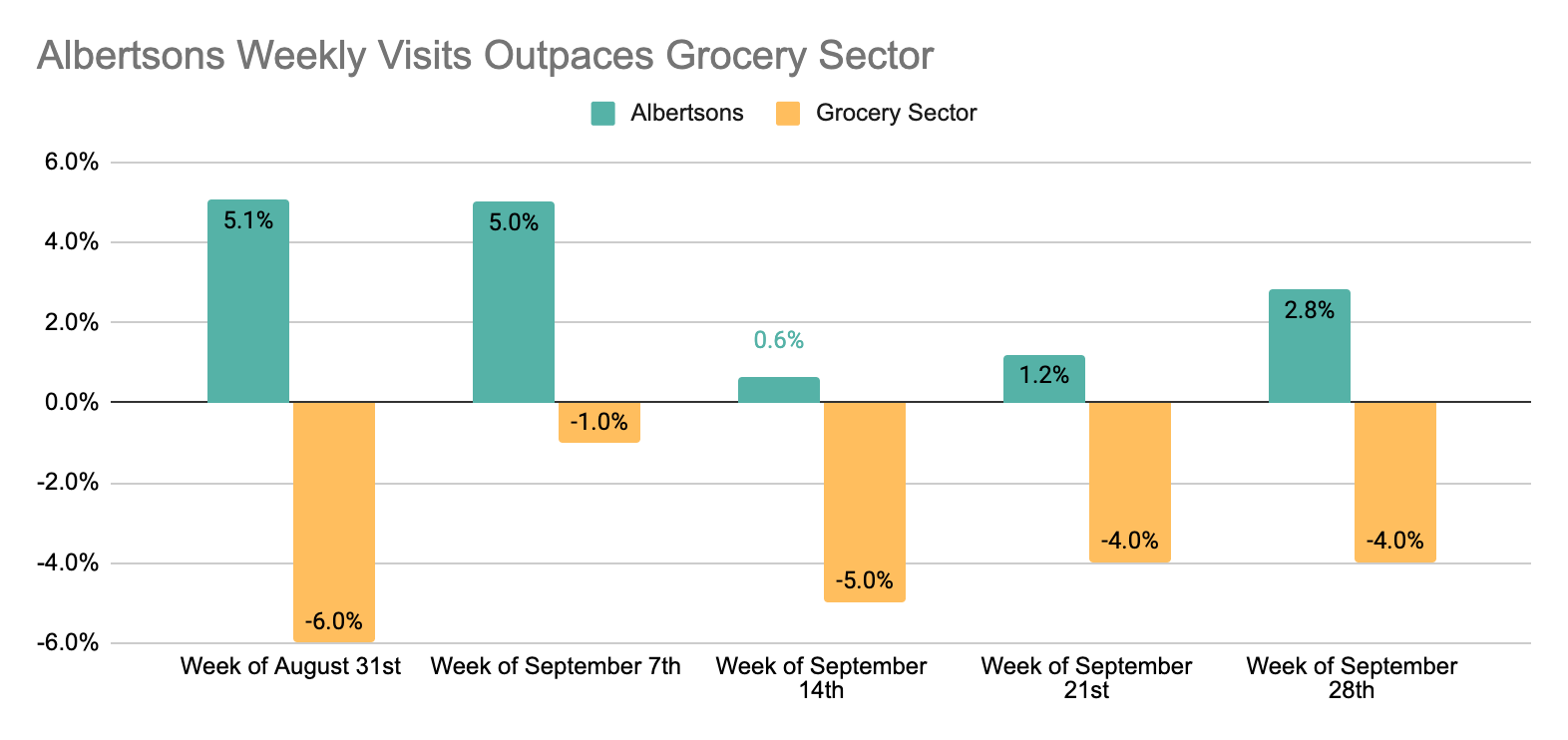

Albertsons, one of the most impressive performers of the pandemic period, is seeing its unique strength last deep into the recovery period. Following year-over-year growth of 2.1% and 5.4% respectively in May and June, July, August, and September rose 9.5%, 9.4%, and 1.8% respectively year over year. And it appears that Albertsons’s summer numbers are a far better indication of its current offline strength than September.

Visits in the first few weeks of September were up just over 5.0% before a relative lull hit the weeks of September 14th and 21st. Critically, this lull still amounted to year over year growth, a hugely impressive statement in the current environment, and was aligned with a wider trend the grocery sector saw overall. And even more, visits were again picking up pace with the week beginning September 28th up 2.8% year over year. And the first days of October continued this trend with visits the first seven days of the month up an average of 5.0% year over year.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.