One of the trademarks of some hip new brands, including Away Travel and Everlane, has been an avoidance of the entrenched practice of marking items up just to mark them down, with many older brands known for having “sales” almost every other week. Yet, in the face of depressed shopping activity due to the COVID-19 pandemic, both brands launched uncharacteristic fixed price sales this past summer. We use CE Vision’s newly launched Promotional Intelligence dashboard suite to evaluate the effectiveness of these sales, digging deep into which groups were most attracted to the discounts. Additionally, when a retailer launches a sale there are usually two key worries – one is that it will attract one-time customers who are cherrypicking the sale and will never buy anything full price; the other is that existing customers will hold off purchasing awaiting a sale and the brand will capture less margin from them. In this flash, we also evaluate whether or not Away Travel and Everlane sale shoppers were simply cherrypicking low prices or would become more lucrative long-term customers.

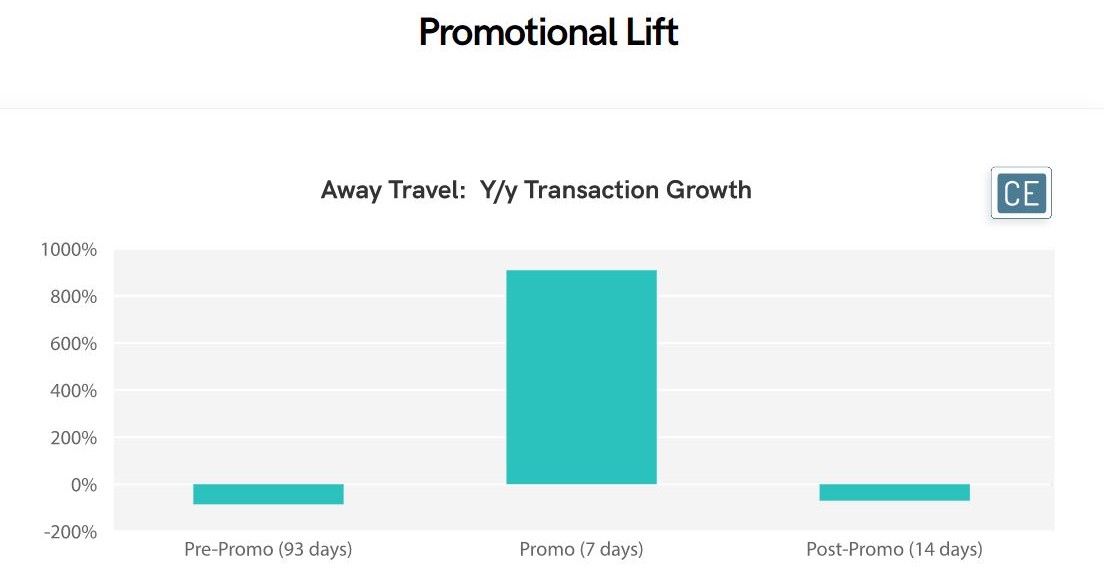

Away Travel’s seven-day promotion in September led to 900% growth y/y, versus an 85% decline in the three months prior to the promotion and a 70% decline in the two weeks after. For Away, although the highest growth was among those aged 45-54, all age groups in the 35-64 range saw over 1,000% growth in transactions during the promotion. There was an even more dramatic differentiation in growth by income bucket, where transaction growth was up over 3,000% for those making $80,000 – 100,000 per year – perhaps a sweet spot of those with enough money to travel but conscious of spend while doing so.

Everlane’s promotion in July was unique in its deviation from the brand’s usual “Choose What You Pay” discount events. The already existing promotional cadence may be part of the reason why the reaction to the sale was more subdued than the reaction to Away’s, although still quite substantial at over 100% y/y transaction growth during the promo week versus under 2% in the three months before. Interestingly, it seems like the sale did drive some follow-on business, with an almost 20% y/y transaction lift in the two months after the sale.

Though some of that follow-on may be from the promotional value of the sale, it is more likely due to new customers liking their merchandise and deciding to buy more – sale shoppers who had never shopped Everlane in our data history prior to the July promotion represented a substantial percentage of transactions in the post-promo weeks. They represented a quarter of transactions in the promotional week and for each of the two weeks after. This engagement ramped up as the weeks went on and new products became available, with the Everlane shoppers who first shopped the brand during the July promotion representing just under half of transactions in the week ending 10/4/2020. This would imply that the sale was a very positive event for Everlane, as it introduced new customers to the brand who liked their discounted purchases and continued to buy even more items outside of the promotion in the following weeks.

The Everlane sale appears to be a success in capturing new, valuable customers and avoiding the cherrypicking problem. Whether this is the case with Away Travel remains to be seen as a much shorter time has lapsed and luggage is a much less frequent purchase than apparel. But, the data allows us to analyze for both companies whether their existing customers took advantage of the sale and diverted full-price purchases. In this case, it seems clear that neither company was cannibalizing itself, and that instead the sales led the brands’ most loyal existing customers to buy even more.

Interestingly, a similar percentage of shoppers for both Away Travel and Everlane who had shopped the brands in the three months pre-promotion returned for the sales (14.4% for Away Travel and 12.6% for Everlane). But even more interestingly, in both cases it was each brand’s best customers who came back for the sale. Away Travel pre-promo customers who came back for the sale spent 14% more in the pre-sale period than those who did not come back. Everlane pre-promo customers who came back for the sale spent 115% more in the pre-sale period than those who did not come back. In both cases, the promotions appeared to be incentivizing customers who had already made substantial purchases to come back for incremental discounted items rather than attracting those who were just waiting for price cuts to buy more goods.

Promotional effectiveness can be very difficult to measure. It involves not only looking at the lift from a sale period versus the periods before an after, but also evaluating which demographics the sale attracted, the extent to which new customer brought into the sale were cherry-picking discounts and wouldn’t return for full-price items, and the extent to which the sale cannibalized potential full-price sales from existing customers. CE Vision Pro allows users to examine all of these factors and more, generating a complete analysis of promotional effectiveness with a wholistic customer viewpoint. For companies that are already able to run this analysis on their own customers and promotions, CE Vision’s unique behavioral cohort filters allow them to do the same analysis for competitor promotions and see how their own most loyal shoppers are reacting to competitor sales.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.