In this Placer Bytes, we dive into the remarkable recovery of Planet Fitness, Hibbett’s positioning ahead of the holidays, and dive into why Gap might be moving out of malls.

Planet Fitness’s Remarkable Recovery

Planet Fitness has been leading a wave of top fitness chains that are enjoying a strong bounce back. And yet, the brand’s impressive performance may actually be even better than it appears at first glance.

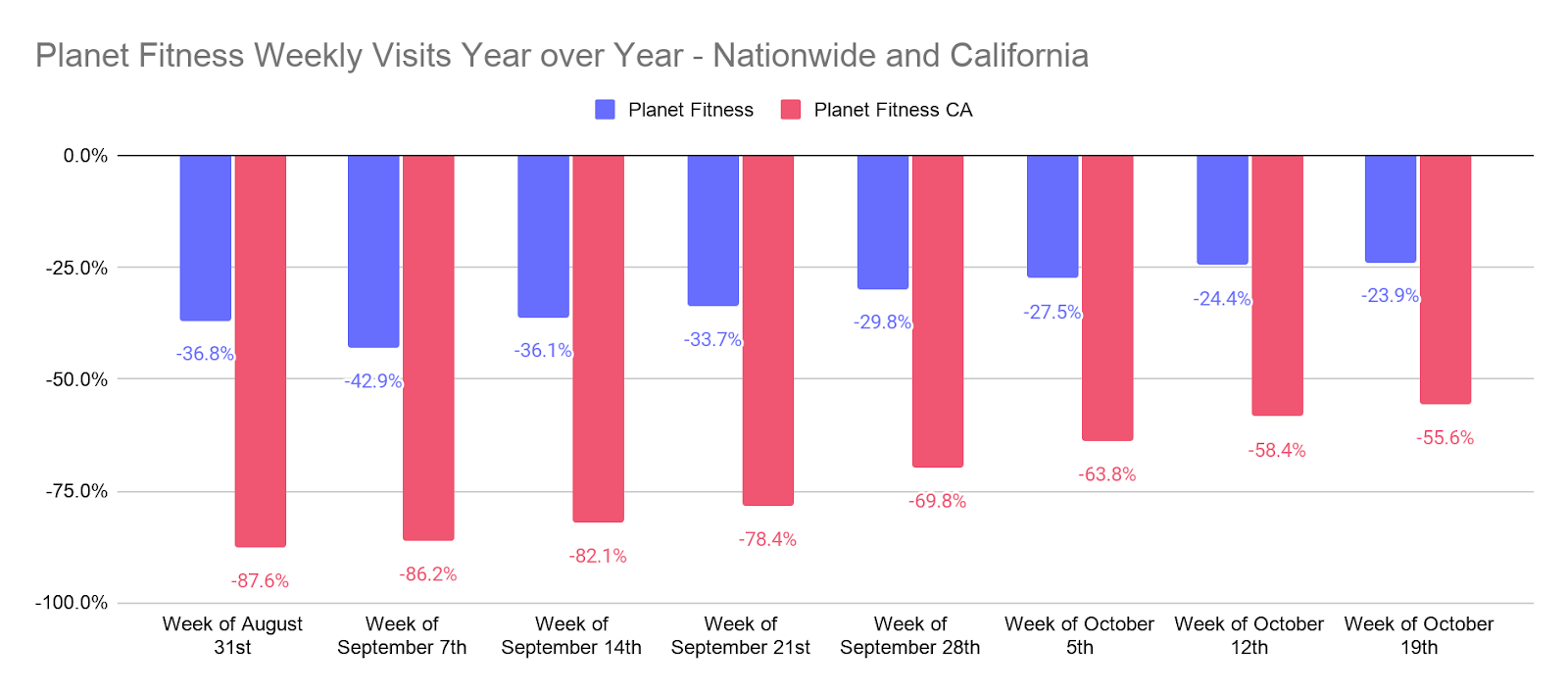

Planet Fitness saw visits pull within 24.2% of 2019 levels the week beginning October 12th, continuing a period of consistent improvements in the year-over-year visit gaps since reopenings began in the late spring. And the chain is doing so while the state with the most locations continues to cope with a variety of challenges. While visits for Planet Fitness locations nationwide were down an average of 27.1% for the weeks beginning September 28th, October 5th, and October 12th, California locations were down an average of 63.9%. This shows a huge potential resource for improving the visit gap in the very short term. And that phenomenon is already showing signs of life with nationwide visits and California visits rising at steady and impactful paces.

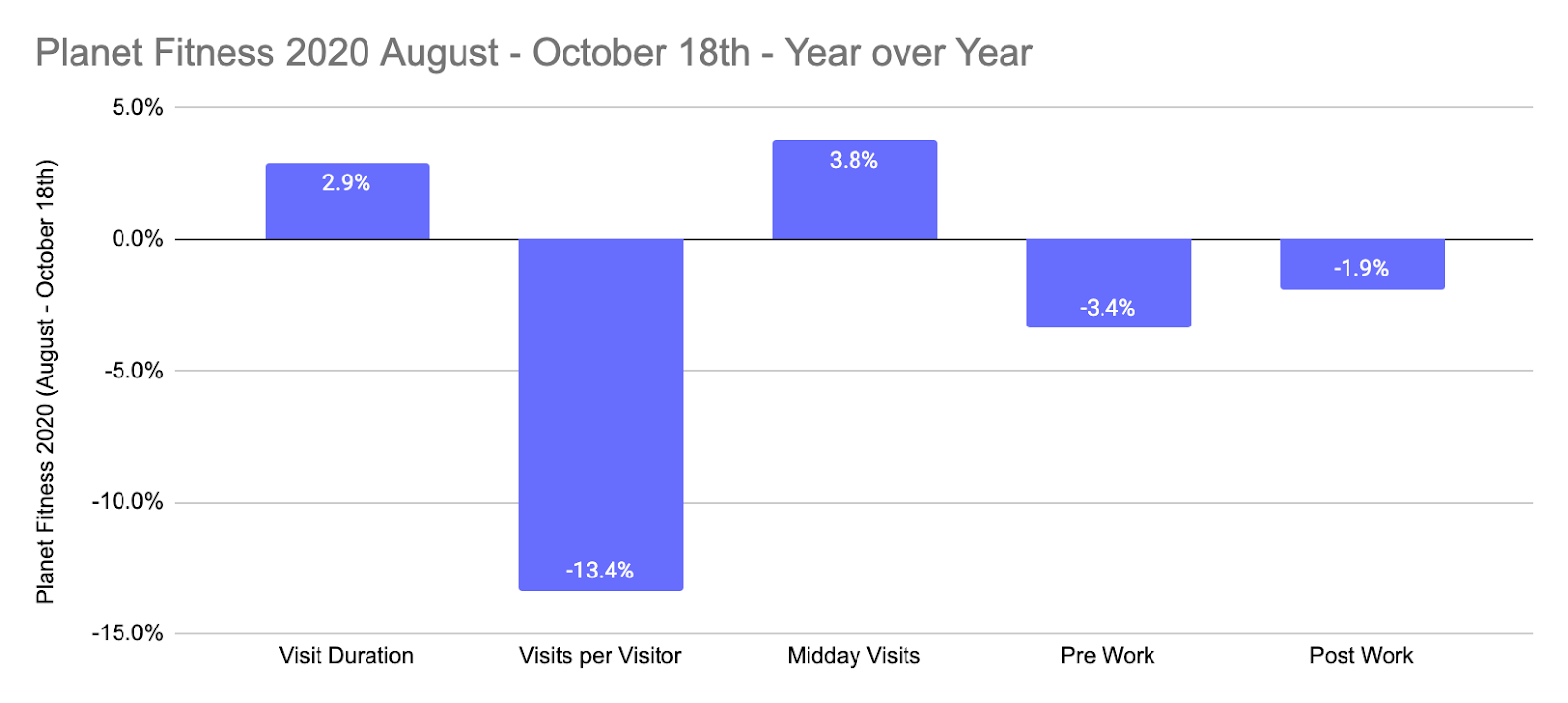

And diving even deeper into the quality of visits further emphasizes the brand’s unique potential heading into 2021. While visits are still down and visits per visitors are down, visit duration is up nearly 3% when comparing August through October 18th, 2020 to the equivalent period in 2019. Planet Fitness is also likely still feeling the decline of normal routines with the percentage of visitors that come before and after work down 3.4% and 1.9% respectively. This means that as normal commuting patterns return, the brand could be well-positioned to see visit gaps shrink even more.

Hibbett Riding Strength Into the Holidays

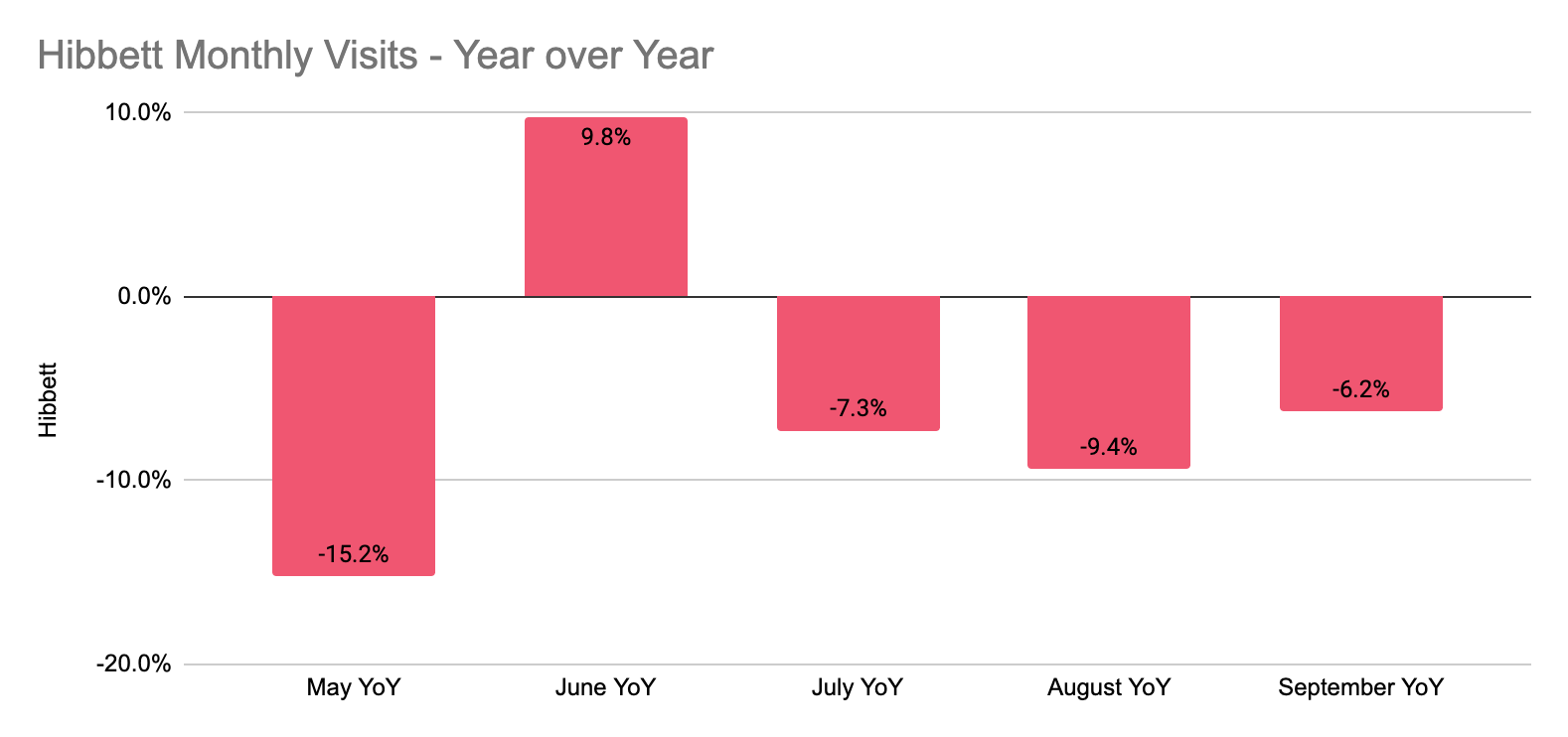

The athleisure and athletic retail categories are among the best positioned heading into the holiday season and Hibbett could be set up to enjoy a strong period. The brand has seen visits down just 7.6% on average year over year in July, August, and September. And all this while enjoying the mission-driven shopping trend that pushes consumers to accomplish more with each visit – a concept that benefits a retailer providing a wide range of goods like Hibbett.

And the brand has also proven capable of seeing and delivering upon visit surges like the near 10% year-over-year growth surge it enjoyed in June. With a holiday season coming that will likely privilege Hibbett’s business model and product spectrum, there could be very strong results from the sporting goods player.

Gap Coming Out

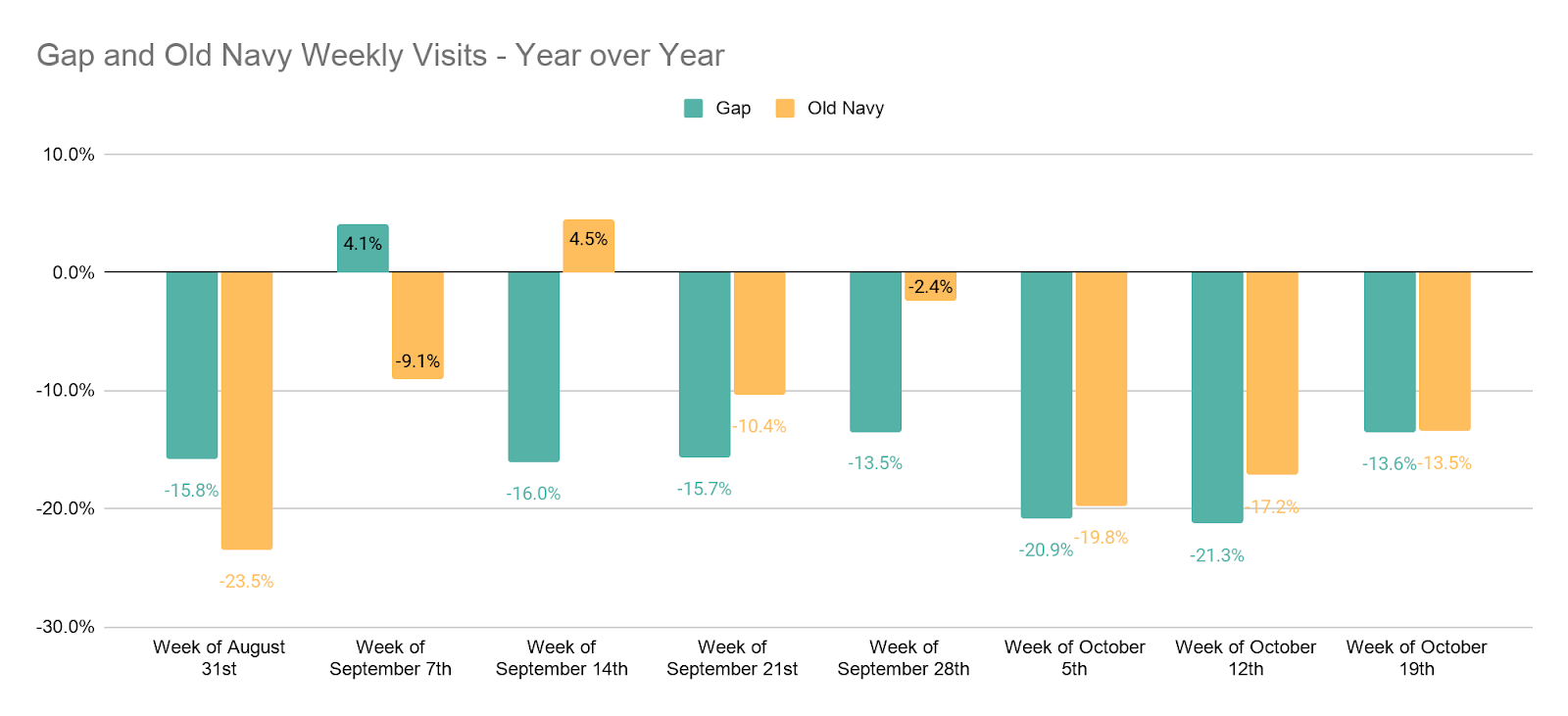

With Gap recently announcing a plan to close stores and shift more of its retail footprint outdoors, the decision may have been heavily influenced by another brand within the same umbrella – Old Navy. While Gap has seen weekly visits down an average of 29.5% year over year since the week beginning August 31st through the week beginning October 12th, Old Navy saw weekly visits down just 11.0% on average during that same period.

Much of this certainly centers around the brand’s outdoor orientation, but value also plays a role. Old Navy is able to provide value at a time when economic uncertainty puts a premium on such an offering. Which begs the question of how Gap will handle its shift. Outdoor formats are an excellent option, but they are not a cure-all especially with mall traffic back on the rise. The pivot will likely need to include more than just store closures and new locations to drive impact.

Yet, with visits for Gap down an Old Navy-esque 13.6% the week beginning October 19th, it is possible that Gap was geared up for a comeback as winter months make malls all the more attractive.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.