If you live in the United States and spend any time in front of a screen during election season, you’ve seen them: political ads.

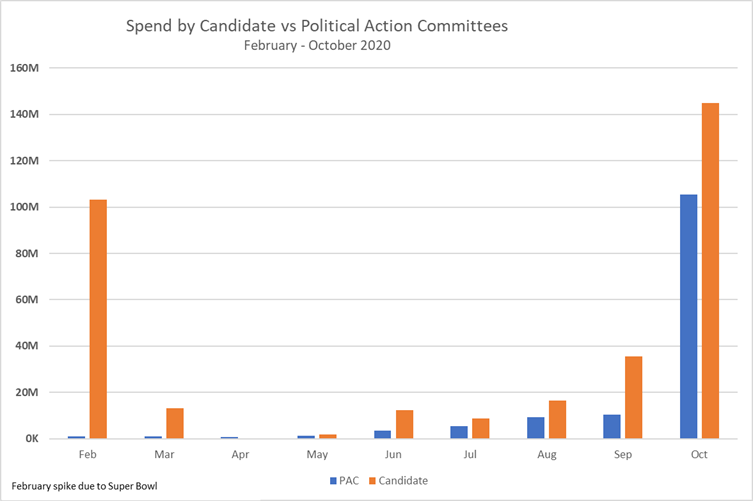

Ads sponsored by PACs and the political candidates themselves are a dime a dozen—but only to viewers. The ads themselves represent billions of dollars of ad spend thrown into digital, print, and tv ads supporting specific parties and candidates.

But how does this spend break down in the grand scheme of things? What types of ads is the money going towards, and who’s paying for it? Keep reading to learn more.

TV Ads Maintain a Longstanding Importance

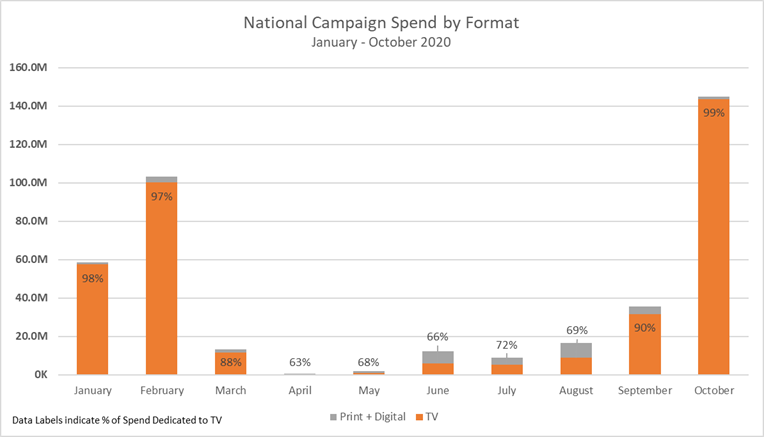

Even as the marketing world as a whole becomes more and more enamored with OTT programmatic and other forms of digital advertising, political ads maintain a heavy tv presence based on decades of tradition.

As early as the 1920s, presidents began looking to professional showmen for ticks and trips on getting and keeping positive public attention. By the 1950s, the modern, short version of political ads was made a reality by Dwight Eisenhower.

These 30-second clips saw great success in turning unhappy voters into supporters, but also brought in viewers who had previously not been inclined to vote at all. From then on, in various ways, candidates have fought to use the same medium to the same end.

Now, while both major parties and many third parties continue to broadcast ads nationally, they place special attention on battleground states that aren’t a sure victory for either side.

Both major candidates spent over $200 million each between Labor Day and election day. The Trump campaign spent much of that in just five states: Wisconsin, North Carolina, Florida, Georgia, and Minnesota.

While the campaigns use different algorithms to determine where to target their ads, experts often look for the locations that seem to draw the attention of both sides.

“If they’re both somewhere, you know, you know their data both matches up, that’s the hot place,” explains Michael Beach, CEO of Cross Streams Media.

After 2016 elections, social platforms are not as viable for political advertising

Digital ads have made a place for themselves in the political arena—though each platform has its own limiting policies.

Unfortunately for political advertisers, many digital platforms and social media sites—including Twitter and TikTok—ban political ads. This leaves PACs and candidates with fewer options.

Chief among these remaining options is Facebook, which attributed nearly 3% of their third-quarter revenue to political ads alone. “For better or worse — mostly worse — Facebook is the de facto place you go,” Nick Fitz, CEO of online donations company Momentum told CNBC. “It’s the cheapest and most effective way to get in front of the right people.”

Due to the misuse of Facebook, YouTube and Twitter during the 2016 elections, these platforms have taken steps to reduce misinformation, “coordinated inauthentic behavior,” and foreign interference. As part of this effort, Facebook rejected new political ads on October 20th and will suspend political ads after polls are closed.

MediaRadar Insights

Methodology

The following findings are based on our analysis of political campaign and fundraising spend from January through October across print, digital, and tv ad formats.

This data only examines national campaigns. Senate and house candidates, as well as regional ads from national candidates, are excluded.

Findings

From January through October of 2020, national political ad spend from candidates and PACs totaled $396 million. This amount takes into account print, digital, and tv spend.

Until March, the democratic presidential candidates heavily contributed to the spend. The biggest spender was Mike Bloomberg, who contributed 99%.

Friends of Bernie Sanders contributed larger buys in the first quarter as well, but spend fell drastically after Super Tuesday, and remained under $10,000 per month through August when he endorsed Joe Biden for President.

Spending by Format:

Print: The highest print spend, $2.1M, occurred in February.

Digital: The highest digital spend, at $7.5M, occurred in August.

Television: In October, the market saw the largest television ad spend at a whopping $143 million+.

Between Donald J. Trump for President and Biden for President campaigns, the top 10 digital sites by ad spend were:

Spend associated with Bloomberg’s campaign, though cut short in March, accounted for 61% of television spend between Bloomberg, Biden, and Trump’s campaigns—$121M. Much of this was spent on Fox, ABC, NBC, and Univision.

Between the Donald J. Trump for President and Biden for President campaigns, the top ten television networks by ad spend are:

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.