When we put together our expectations for who would dominate the coming holiday season one group that stood out were wholesale clubs. It seems that the unique nature of the current retail environment was well-suited to these brands.

And while we felt like a surface-level analysis was good, a deeper drive was required to emphasize the point and provide a better lay of the land.

Wholesale Club Leaders on the Rise

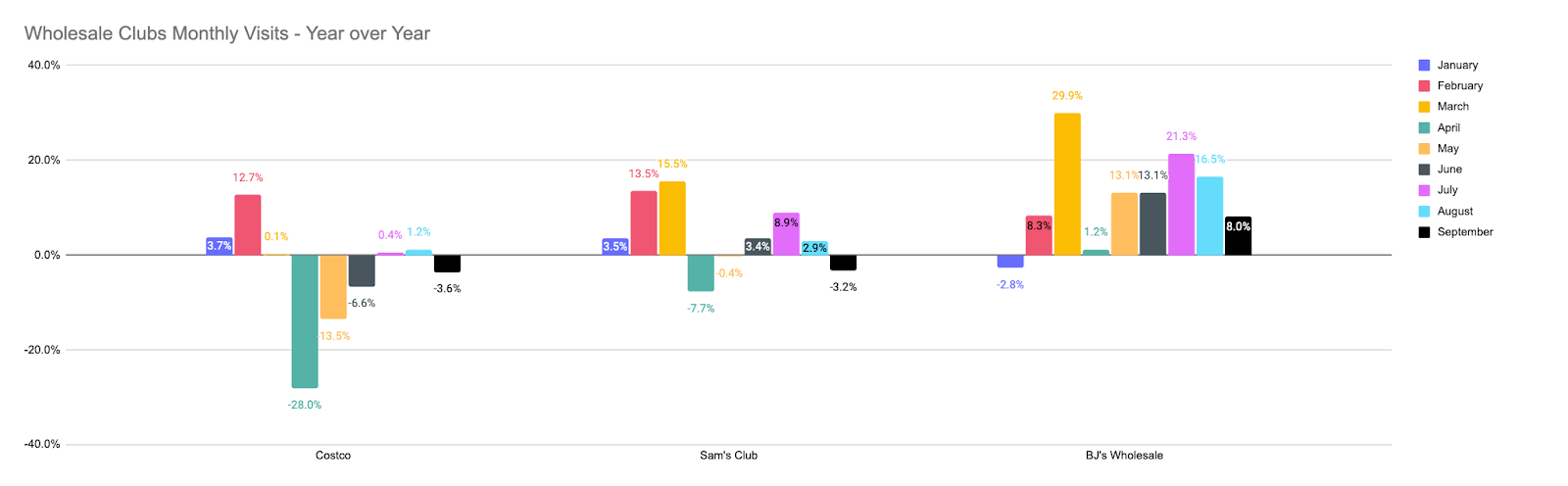

Heading into 2020, the wholesale club market was dominated by Costco with Sam’s Club filling the role as a capable second player. Both brands were riding consistent growth into 2020 and the first two months of the year continued the trend with Costco seeing visits up 3.7% and 12.7% in January and February respectively, while Sam’s Club saw increases of 3.5% and 13.5% those same months year over year. And this was after 2019 when annual visits were up 6.8% and 4.7% year over year for Costco and Sam’s Club, respectively.

BJ’s Wholesale, on the other hand, was not riding the same wave. After seeing visits drop 2.6% between 2018 and 2019, the brand kicked off 2020 with visits down 2.8% in January. But everything turned around with the onset of the pandemic. From the late month surge in February through September, BJ’s has seen nothing but huge year-over-year growth except for seeing just a small increase of 1.2% at the height of the pandemic in April.

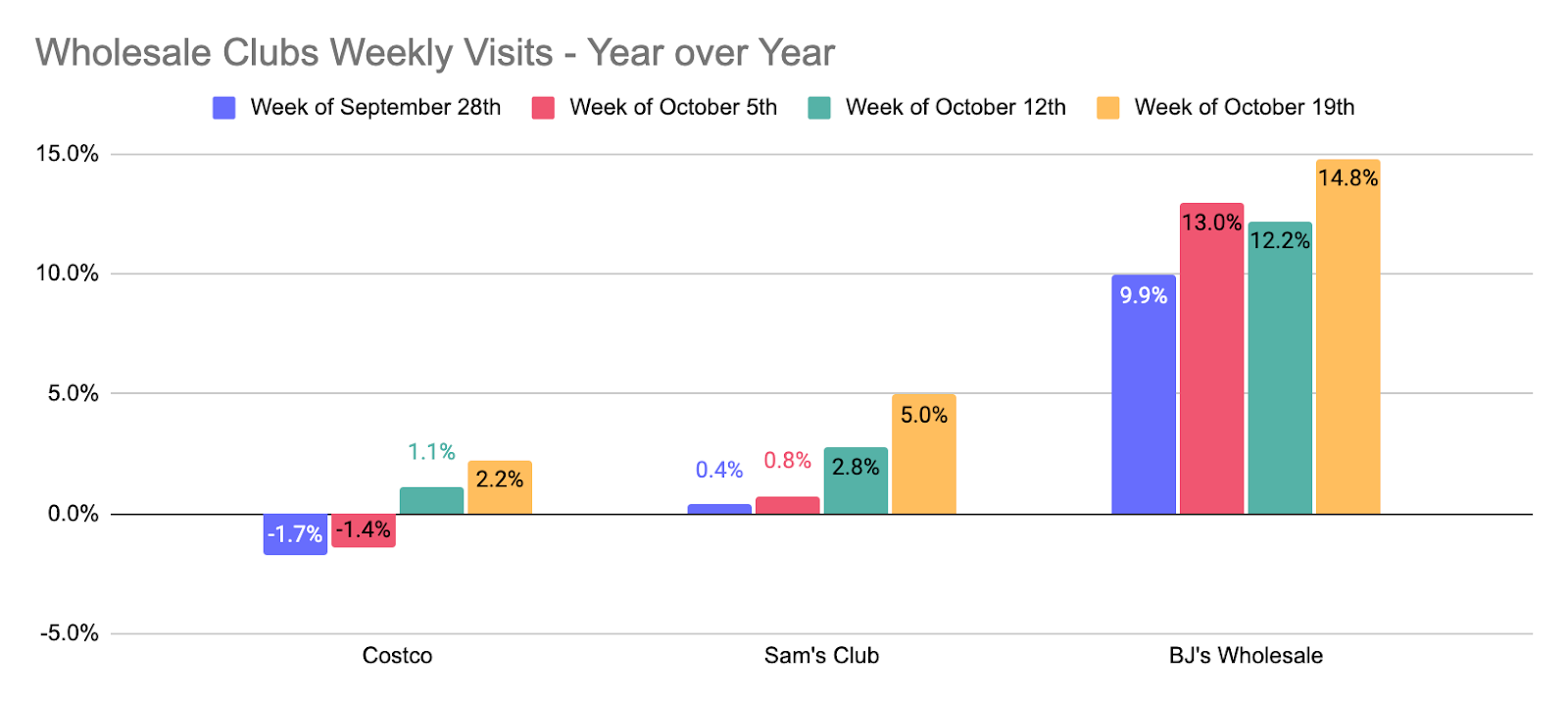

And apart from a minor dip in September, all three brands are seeing visits rising in October with the week of October 19th marking a high point for all three since early September.

Rising Tide Lifts All Boats

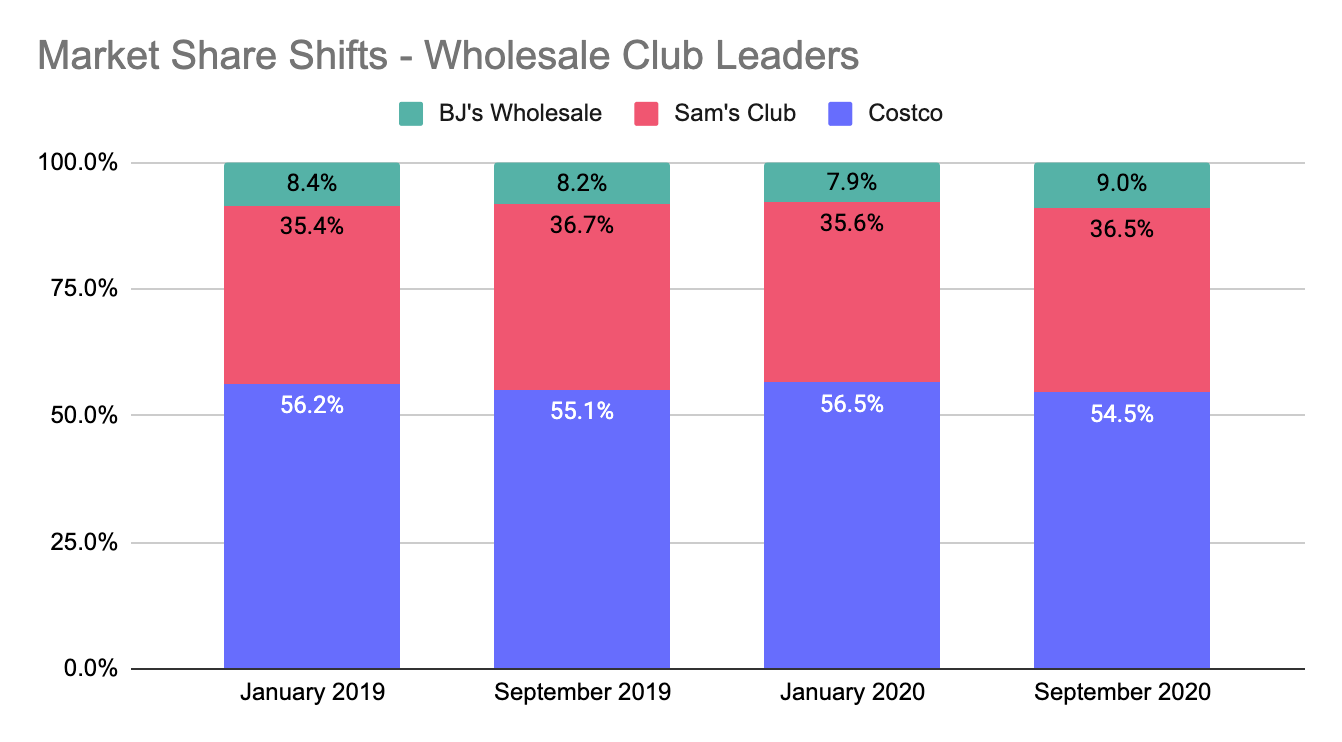

Interestingly, it does appear that the wider trend the brands are seeing is tide lifting all boats. While BJ’s is seeing a huge jump in visits, it has not made an overly dramatic impact on visit share. Costco held 54.5% of the overall visits for the group in September 2020, a decline of just 0.6% year over year, while BJ’s jumped 0.8% over that same period. The result is a clear indication that this sector is among those being buoyed overall by changes in consumer behavior.

Perfectly Aligned

But, visits only tell part of the story as this sector may be positioned for a uniquely strong holiday season. Not only are these brands seeing visits rise, but they are also seeing incredibly high-quality visits. While Sam’s Club visit durations have stayed flat, a feat in and of itself, Costco visit duration rose 4.7% from August through October 20th in 2020 compared to the same period in 2019, and BJ’s Wholesale saw durations rise 4.5% during that same period. And they all have a unique value proposition to help customers save money. This positions them exceptionally well along with two of the most critical trends in retail, mission-driven shopping where visitors look to accomplish more with each visit and a higher predisposition to value offerings in a period of extended economic uncertainty.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.