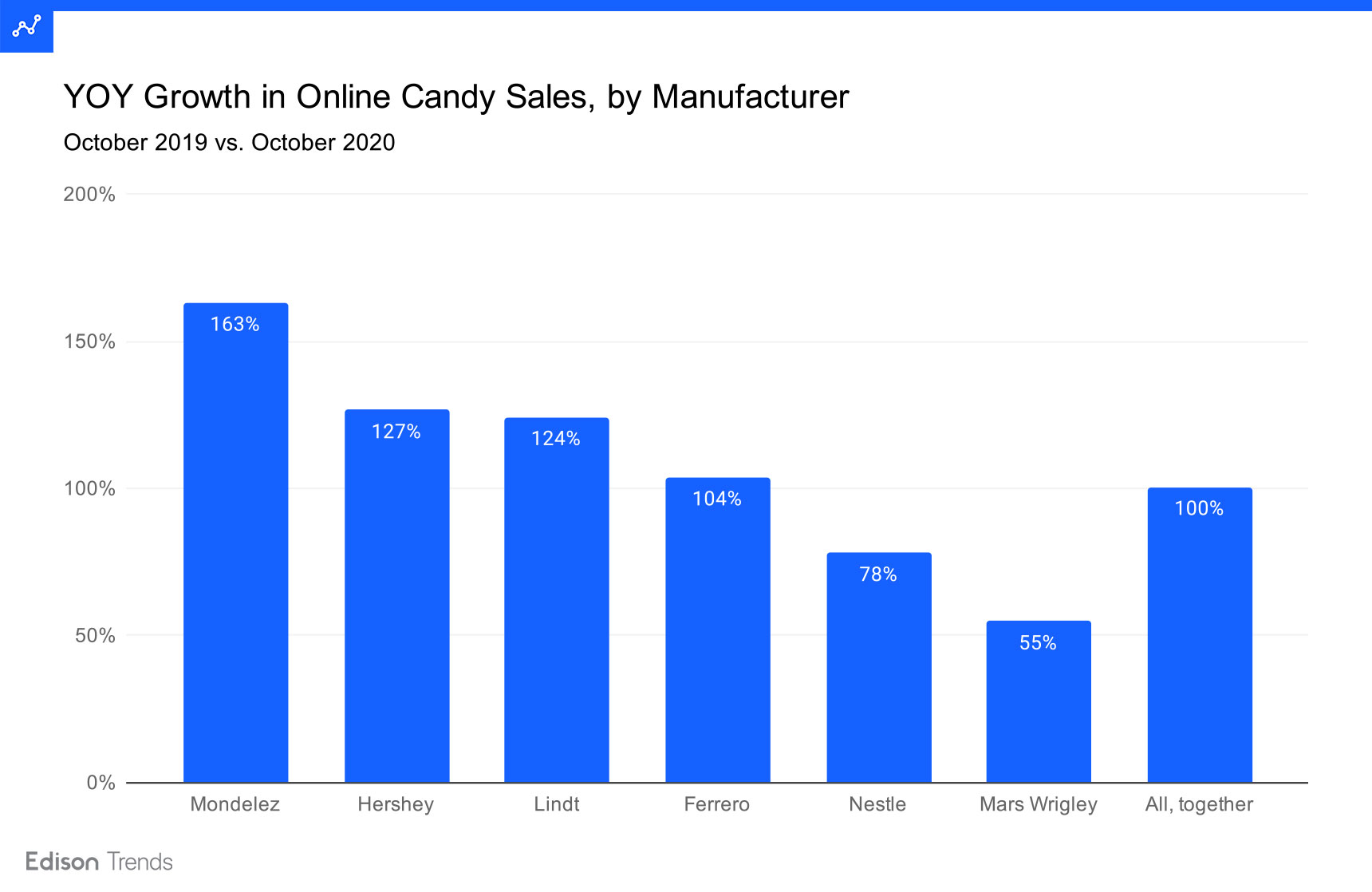

Mondelez chocolate sales grew the most, up 163% from last year

Key Takeaways:

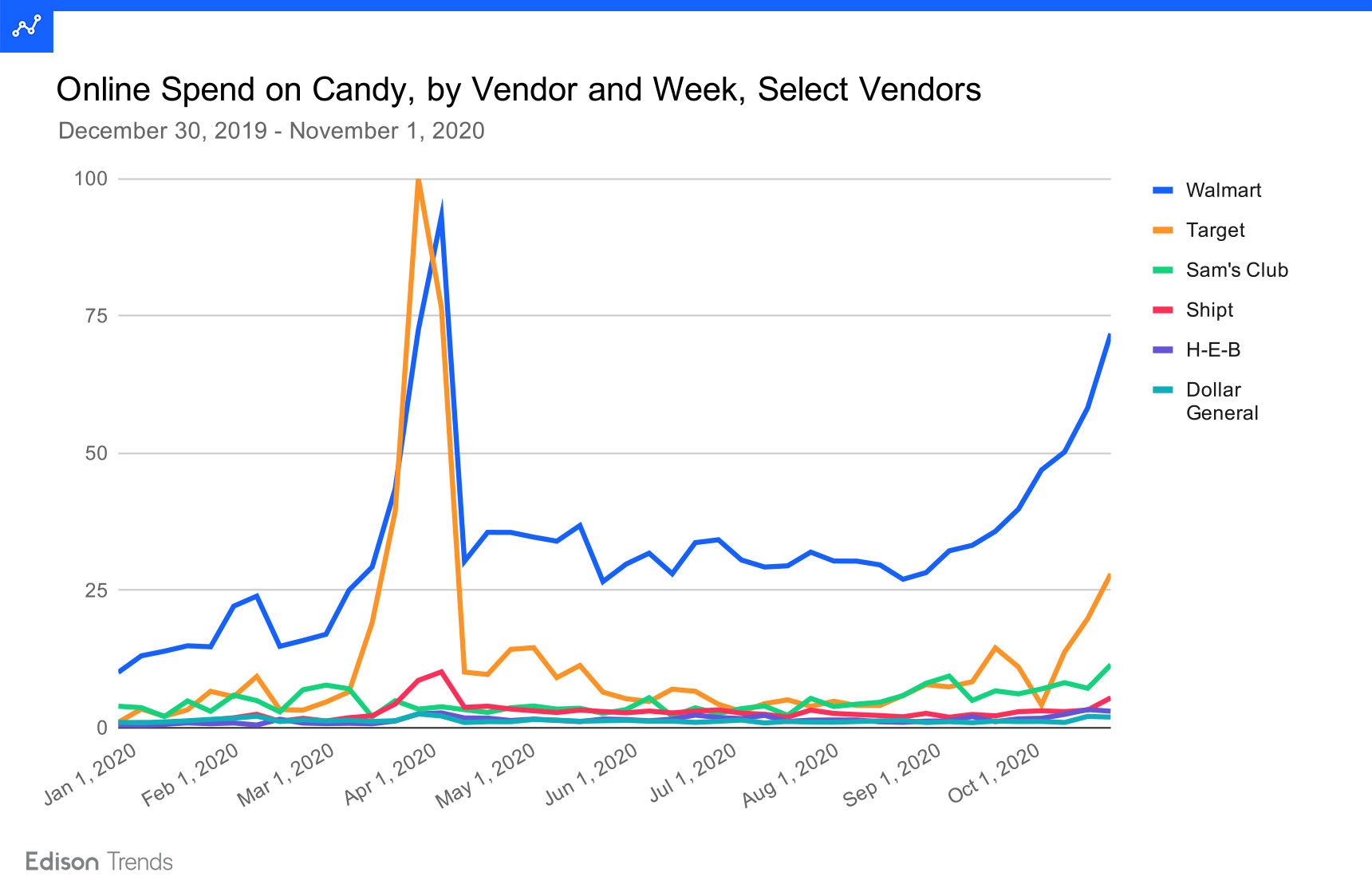

• Walmart was the clear winner when it came to online Halloween chocolate sales among merchants.

• Target (direct) had the highest peak for chocolate sales at merchants over Easter

• Comparing holiday sales in 2020 saw overall online chocolate sales 13% higher the week of Easter than the week of Halloween

Halloween 2020 likely looked a bit different this year than in previous years. With COVID-19 remaining a looming threat, many people found creative ways to still celebrate the holiday in a socially distanced manner. Some homeowners in places like Staten Island, for example, used “candy shoots” to send candy to trick-or-treaters or laid candy options out on a table, while some cities in states like Massachusetts decided that there would be a complete ban on trick-or-treating during 2020. Regardless of how Halloween was celebrated, as with other holidays this year chocolate was still consumed and cavities were certainly made. To see how online spend on chocolate has been affected by COVID-19 and the spooky holiday, Edison Trends took a deep dive into over 215,300 transactions in the USA.

How has online chocolate spend changed by manufacturer this year compared to last year?

Some chocolate manufacturers saw a large year-over-year increase in online spending on their products from October 2019 compared to October 2020 . Mondelez has grown the most, rising 163% YOY. Hershey and Lindt follow with 127% and 124%, then Ferrero at 104%. Nestle and Mars Wrigley round out the pack at 78% and 55%. Taken all together, these vendors grew their customers’ online spending by 100% YOY.

Comparing holiday sales in 2020 saw that overall online chocolate sales were 13% higher the week of Easter than the week of Halloween.

How has weekly online spend on chocolate changed in 2020?

While Target (direct) had the highest peak over Easter, Walmart was the clear winner when it came to online Halloween chocolate sales. In the week of October 26, they bested Target by 156%. Sam’s Club came in third that week, followed by Shipt, H-E-B, and Dollar General. This ordering is also a change from Easter, when Shipt–which receives a large portion of their business from Target orders–came in third.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.