Following the COVID-19 pandemic and ensuing economic downturn, rental markets across the country experienced an uncharacteristic decline in rent prices this summer. Nationally, rents dropped 1.3 percent from March to June, a time period when rent prices rose roughly 2 percent in each of the three previous years. Expensive coastal cities have been hit the hardest. Rental markets in San Francisco, New York, Boston, and others, have experienced double-digit year-over-year rent drops.

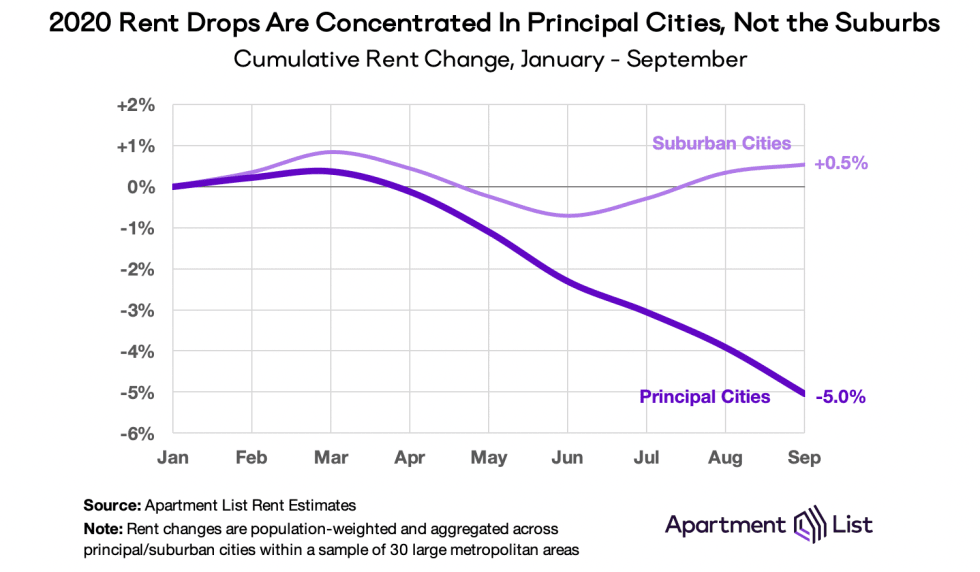

But within metropolitan areas we find that principal and suburban cities are on different trajectories. While rents have declined steadily in the larger, denser, principal cities at the core of each metropolitan region, rents in the outlying suburban areas have, on the whole, rebounded to pre-pandemic levels.1 The trend can be seen clearly in the chart below, which aggregates data for principal cities and suburbs of the nation’s 30 largest metros. We observe three distinct phases:

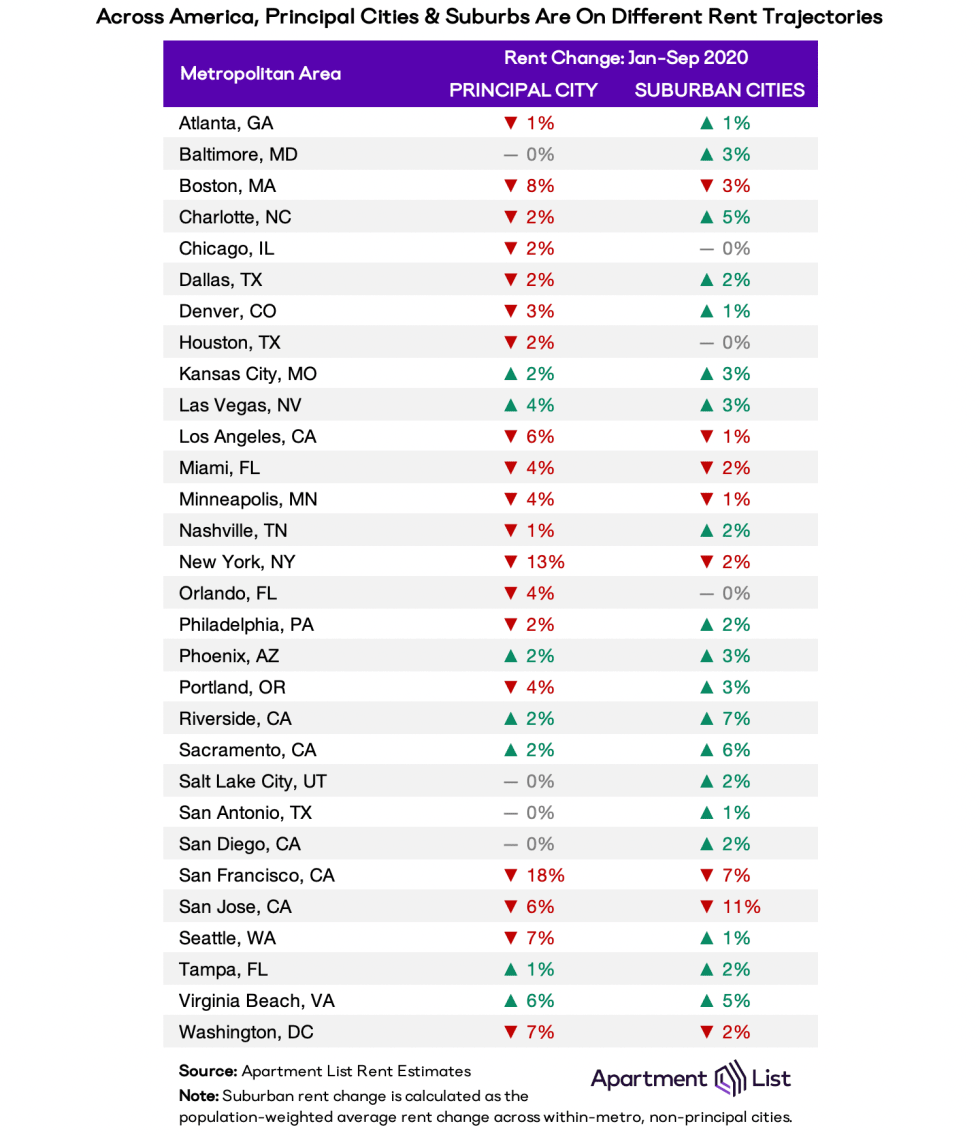

Breaking down the numbers by metropolitan area shows how widespread this trend is. In 27 of 30 large metros, principal cities are experiencing faster rent drops or slower rent growth than their surrounding suburbs. And in 11, including major economic centers like Atlanta, Dallas, and Philadelphia, apartments in the principal city are getting cheaper while at the same time apartments in the suburbs are getting more expensive.

Use the interactive chart below to examine local trends in each market. The bold line represents each metro’s principal city, while the thinner lines represent its nearby suburbs. Hovering over each line will highlight city-specific rent data. The raw data are available for download here.

Why Is This Happening?

There are a number of reasons why rent trends in the principal city do not mirror those of nearby suburbs. The pandemic’s effects on everyday life have certainly been more pronounced in cities than suburbs. Shelter-in-place requirements and business restrictions have ground to a halt many of the events and amenities that attract people to cities in the first place: live entertainment, bars and restaurants, public festivals, and the like. Many renters today are questioning whether it still makes sense to pay a premium for city living.

As a result, migration plays a big factor in the urban and suburban rent divide. While rents cool, the for-sale housing market remains hot, and the people who leave the rental market to become homeowners are often creating vacancies in dense, renter-friendly cities. Temporary moves have also been common this summer and are mostly affecting large cities where younger, more-mobile residents tend to cluster. Furthermore, whereas principal cities typically enjoy an annual influx of new residents each summer (especially college graduates and people pursuing career change), a shift towards remote work has stifled this inbound migration.

There are also differences in the types of apartments available in each type of city; dense urban centers are more likely to contain newer, more-expensive, more-luxurious apartments that are positioned to see more vacancies and steeper rent drops during an economic recession. Meanwhile, suburbs tend to have a greater share of cheaper, lower-density homes that remain in high demand even as renters look to cut costs.

In recent years, suburbs have offered cheaper housing options to those willing to sacrifice the benefits of living close to a job center. But in 2020, this affordability gap is shrinking in many metros that command the highest prices. After a decade in which proximity was at a premium, the pandemic has now sparked the flame of suburban rental demand. As a result, we should expect an uneven rental market recovery in the months to come.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.