It’s prime time for online shopping. Earlier this year, Amazon announced that it would shift its annual Prime Day from mid-July to mid-October in response to the COVID-19 pandemic. New sales data shows that Amazon Prime Day 2020, which took place on October 13 and 14, outperformed previous Prime Days while also ushering in an increase in online sales at other major retailers.

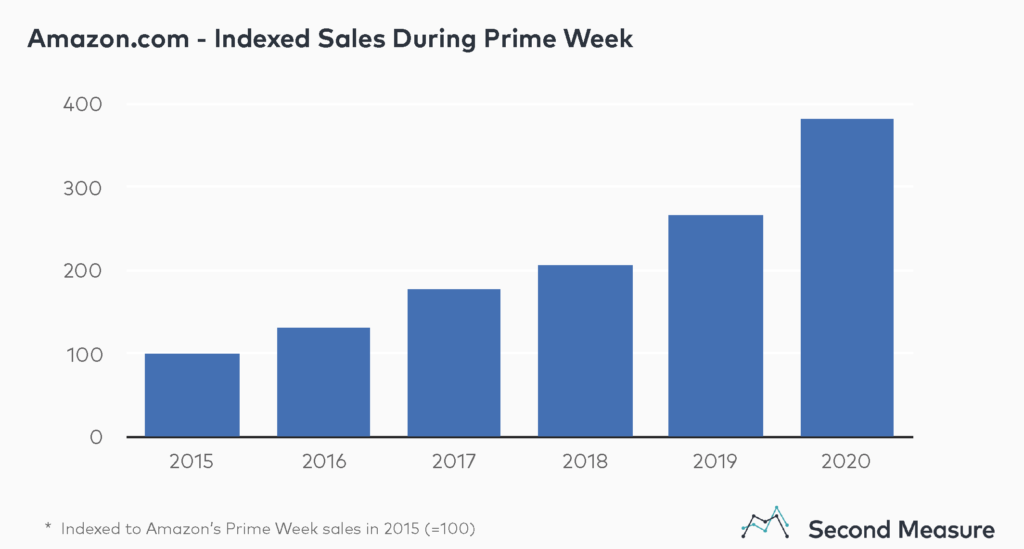

Prime Day sales have quadrupled since 2015

The first Amazon Prime Day—a 24-hour sales event—occurred on July 15, 2015 to celebrate the ecommerce giant’s 20th anniversary. Since then, it has become an annual event that has gradually expanded to two full days of discounts and deals.

Despite being rescheduled to October, Prime Day 2020 had the best sales performance of all Prime Days to date. Amazon’s sales the week of Prime Day in 2020 were almost four times the sales from the first event in 2015. This continues the trend of consistent year-over-year growth.

Other large retailers also saw a sales boost during Prime Week

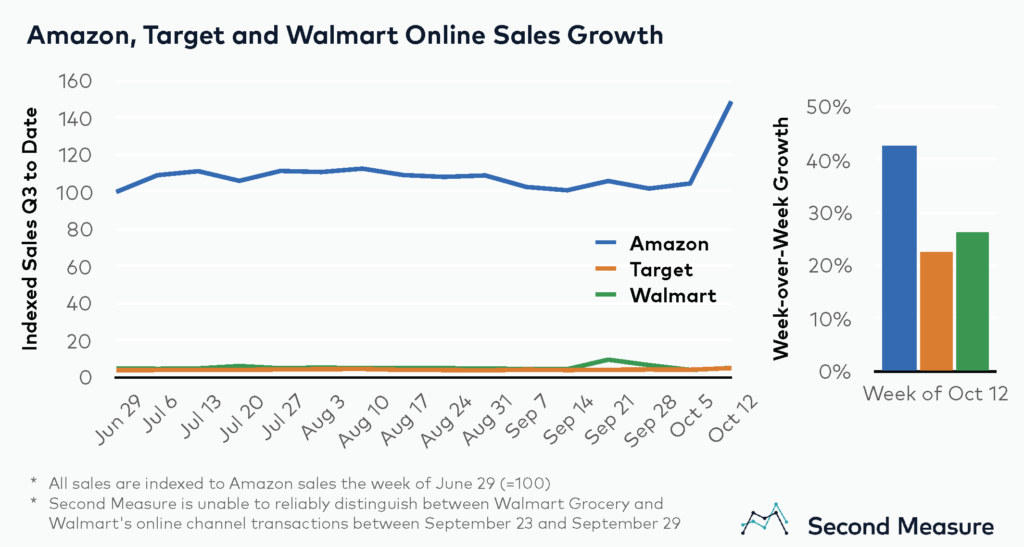

Superstores such as Walmart and Target hosted competing promotional events during Prime Week. While Amazon experienced 43 percent week-over-week growth, online sales grew 26 percent at Walmart and 22 percent at Target. However, the spike in sales did not extend to brick-and-mortar stores. During Prime Week, retail sales held flat at Walmart and increased only 3 percent at Target.

Zooming out, Amazon’s sales during Prime Week were about 1.5 times the sales at the beginning of Q3. Relative to Amazon, online sales at Target and Walmart have been relatively stable during this time frame, but both companies experienced a noticeable uptick in their online sales during the week of October 12.

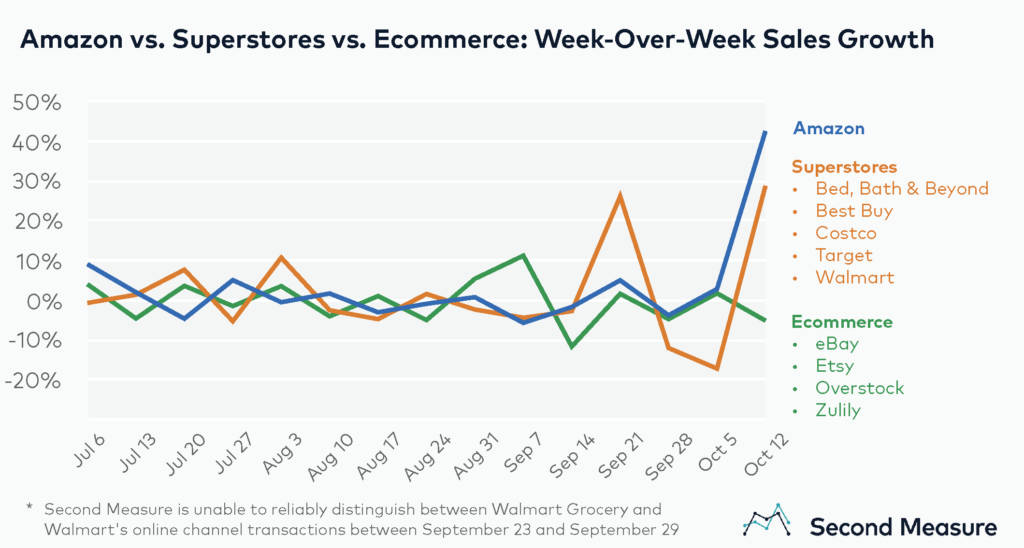

Not all ecommerce companies experienced a halo effect from Prime Day

As superstores including Target, Walmart, Costco, Best Buy, and Bed Bath & Beyond experienced a sharp increase in week-over-week sales during the week of Prime Day, ecommerce platforms—such as Overstock, eBay, and Etsy—collectively experienced a decrease in sales that week.

Compared to Amazon’s 43 percent week-over-week growth during Prime Week, online sales at the superstores grew an average of 29 percent while sales at the other ecommerce platforms saw an average decline of 5 percent. Interestingly, the superstores were more likely than the other ecommerce platforms to run competing sales during Prime Week. A notable exception is Overstock.com, which launched its Customer Day sale the week before Prime Day, thereby increasing its observed sales that week before decreasing during Prime Week.

Prime Day’s shift to October may represent the unofficial kickoff for holiday shopping. The retail and ecommerce industries, in general, are expected to ramp up even more over the next few weeks in anticipation of Black Friday and the holiday season. COVID-19 might further impact spending in the retail and ecommerce categories since other industries that typically perform well during the holidays, such as travel, transportation, and amusement parks, have been taking a hit in 2020.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.