Source: https://www.corelogic.com/blog/2020/11/pending-sales-provide-a-short-term-price-forecast.aspx

The CoreLogic Home Price index has reported quickening appreciation in home values since May, and in September annual price growth was more than two percentage points faster than one year earlier. The acceleration in price growth reflected a demand and supply imbalance. Record-low mortgage rates stimulated demand: Millennials and Gen Xers saw the opportunity to be either first-time or trade-up buyers. Concurrently, the pandemic contributed to an acute supply shortage: Warnings that older Americans were at greater health risk coupled with shelter-in-place restrictions prompted some older prospective sellers to defer their listing. But will summer’s increasing price growth continue in the autumn?

A partial answer is found looking at pending sales. The pending sales contract is typically made 30 to 45 days before closing of the transaction. The price information in the sales contract provides a window into what we should expect to eventually see in a traditional price index, which is based on closed sales.

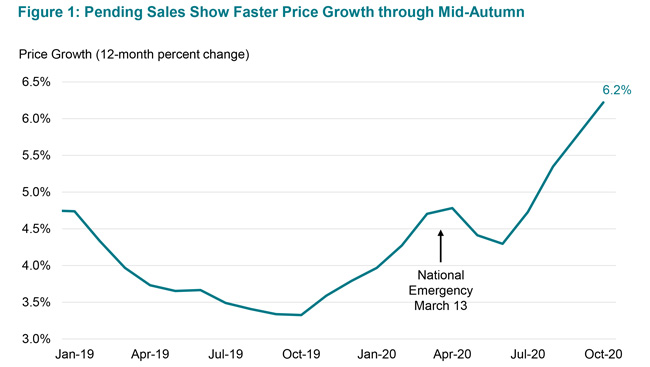

Using pending sales through September from the CoreLogic Multiple Listing Service, we can construct a home-price metric that provides a good prediction of home-price trends through mid-autumn. Our Pending Home Price Index finds that annual price growth will continue to quicken. (Figure 1) Based on a composite index covering 20 metros, we find annual price growth continuing to accelerate in October at the fastest pace in more than two years.

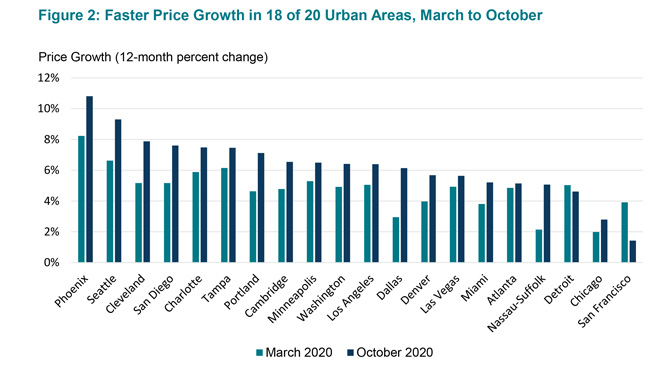

Across these 20 urban markets, annual price growth has increased since March in all but two cities. (Figure 2) Only Detroit and San Francisco had slower price growth, with annual price growth easing to about 1% in San Francisco. Dallas has had the biggest jump in annual price gain, doubling to 6% growth in October. In Phoenix and Seattle, which already had above average annual appreciation before the pandemic, annual price growth has accelerated to near 10%.

Our analysis of pending sales indicates that price growth will remain strong and increase in most markets though mid-autumn. But in 2021, as pandemic worries recede and more inventory is listed for sale, the CoreLogic forecast has a slowing in home-price growth.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.