In this Placer Bytes, we dive into Best Buy, one of the true kings of offline retail, and two of our 2020 winners – BJ’s and Dick’s Sporting Goods.

Best Buy’s Best Position

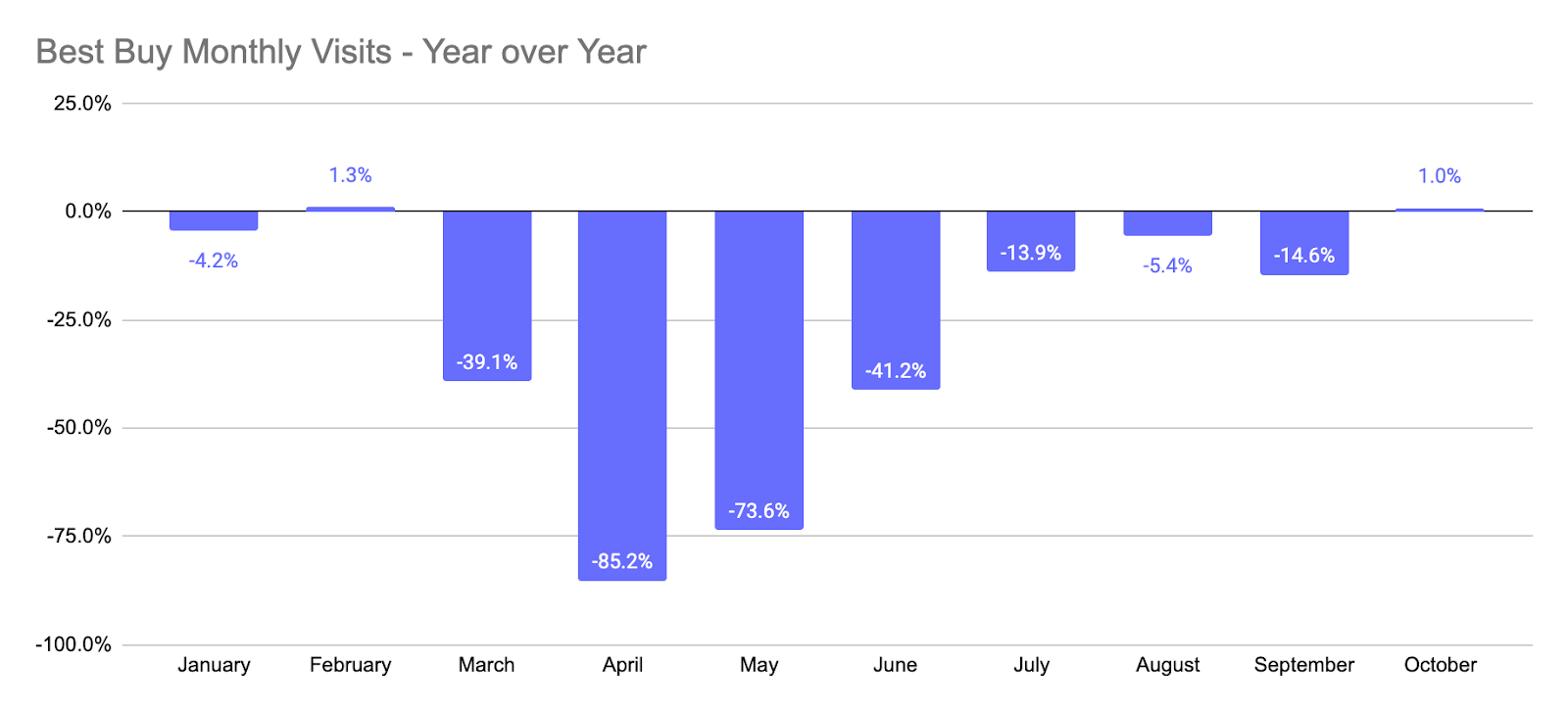

After proving just how substantial Amazon Prime Day’s offline impact could be, Best Buy looks well-established for an exceptional holiday season. Not only is the brand performing well in the context of the pandemic, but within any context. October visits were up 1.0% year over year following six months where visit rates were down year over year.

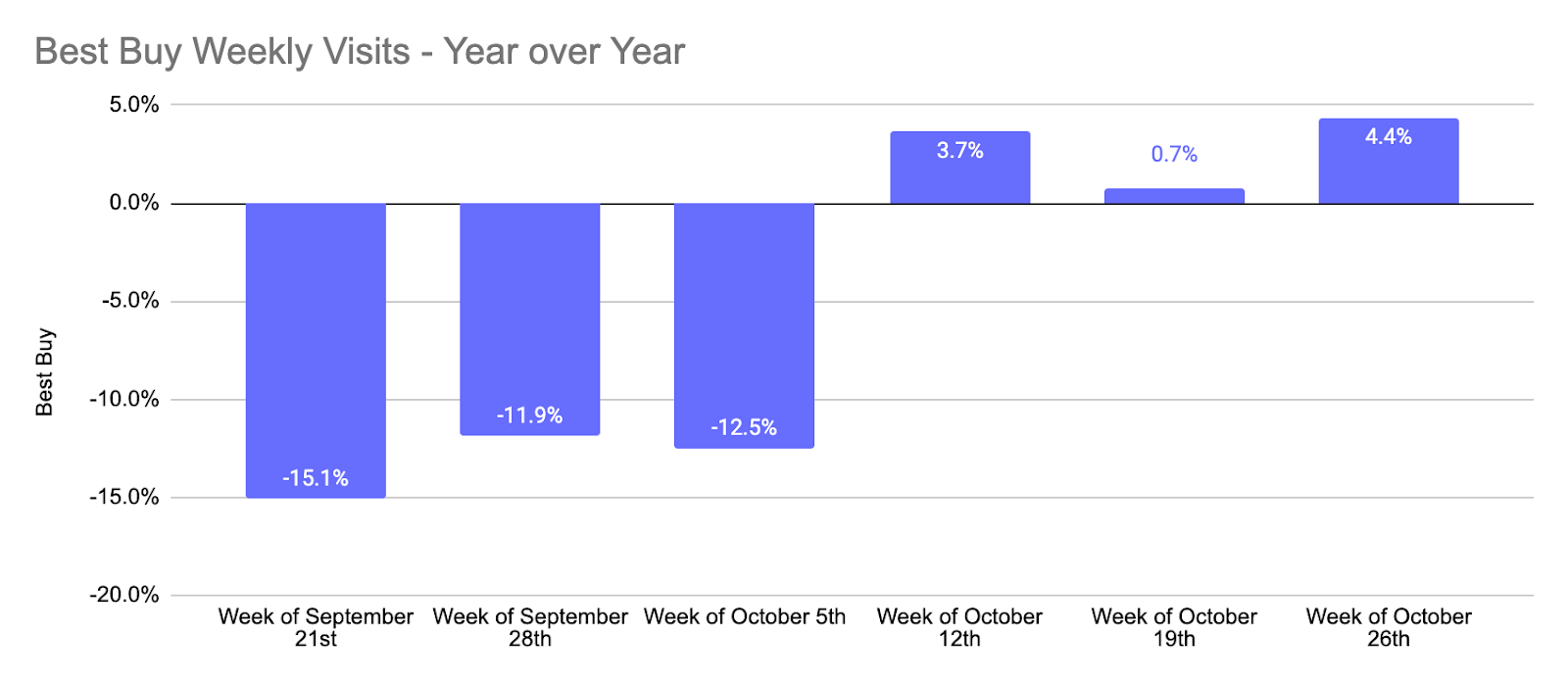

And if trending strength into the holiday season wasn’t enough, it does appear that the pace of recovery is strengthening. Visits the weeks beginning October 12th, 19th and 26th were up 2.9% year over year on average, while the three weeks prior to that were down 13.2%. This bodes exceptionally well for the brand, not just because of its offline strength, but because it has proven to be uniquely capable of leveraging its footprint. Whether it be high-converting appointment visits or using locations to improve distribution, Best Buy looks to be among the best-positioned brands ahead of a critical 2020 holiday season.

BJ’s Wholesale Rising Into the Holidays

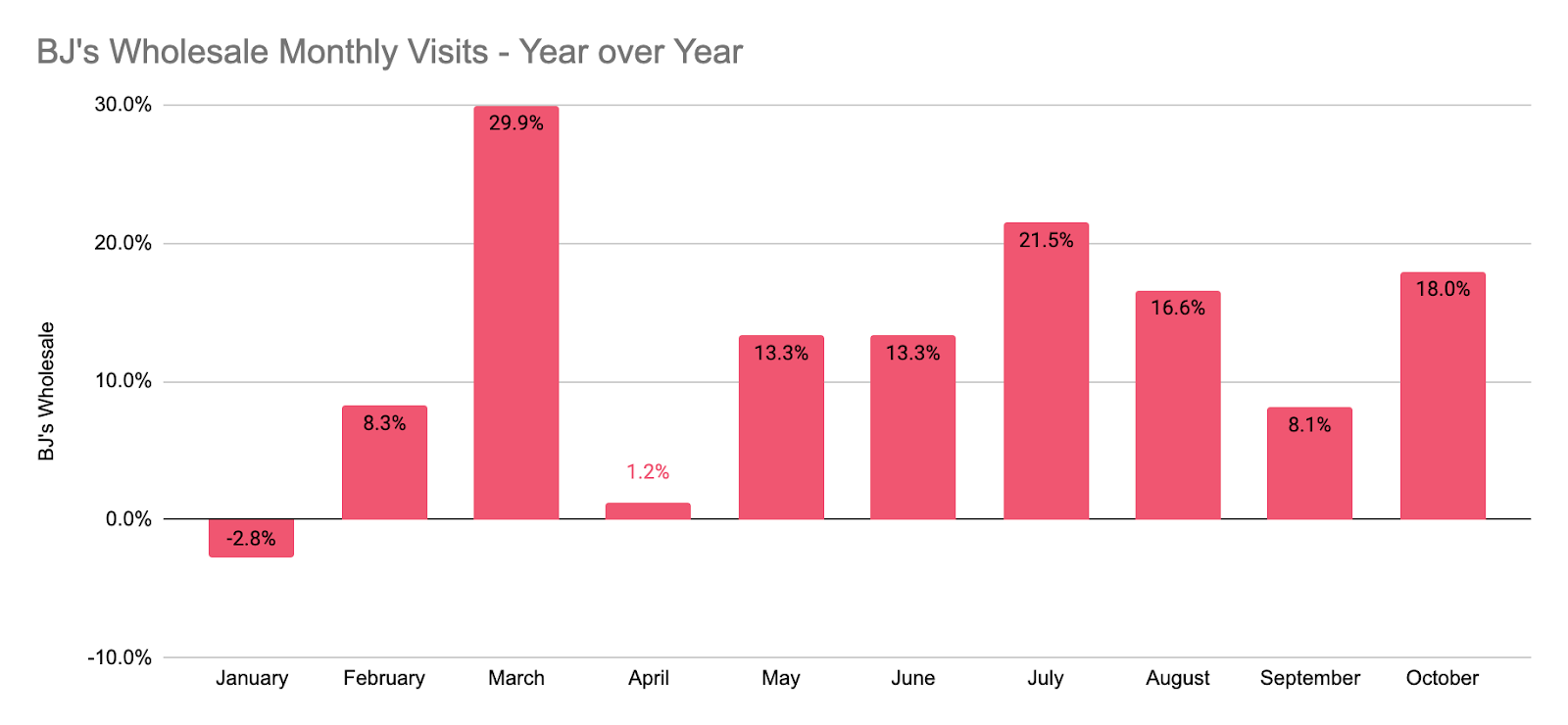

October marked the 9th straight month of year-over-year visit growth for BJ’s Wholesale with visits up 18.0% in October. This was the third-best mark of the year and well-timed coming after a September that had “just” 8.1% growth. And even September showed signs of the brand’s progress. In September 2020, BJ’s Wholesale had 9.0% of the overall visit share with industry leaders Costco and Sam’s Club, a significant step forward on 2019, when that number was 8.2%.

BJ’s could also enjoy a very strong holiday season. The period holds two critical days for grocery brands, with Turkey Wednesday and the days before Christmas causing peaks across the sector. And because of the wide spectrum of items it has on offer, BJ’s could also ride the mission-driven shopping trend to even greater heights in 2020.

Dick’s

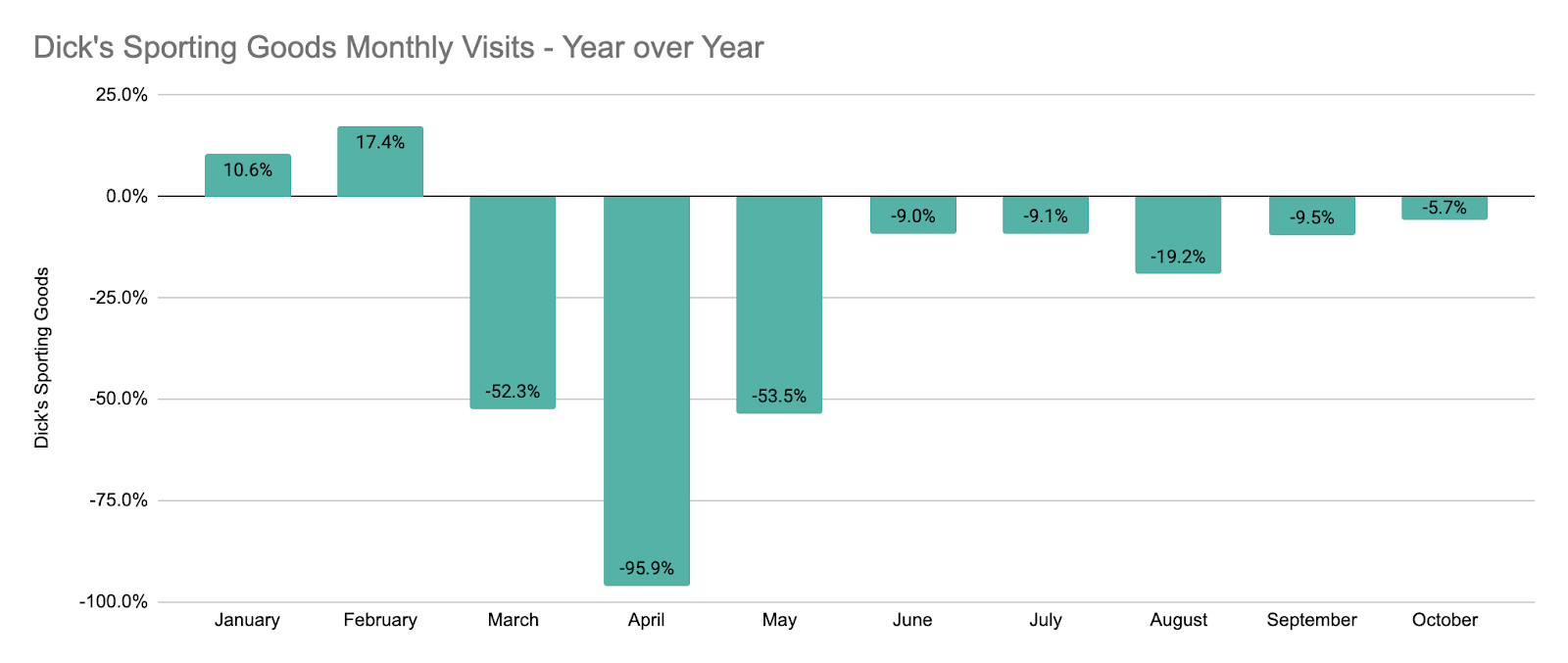

October was the best month for visits for Dick’s Sporting Goods since the start of the pandemic. After a seemingly endless period of months with year over year growth, Dick’s saw offline visits hit hard by the pandemic. But as if the brand timed it themselves, the rebound is picking up pace at just the right time. Visits for Dick’s were down just 5.7% year over year in October, a major step forward on a previous “best” of down 9.0% in June.

Should Dick’s prove capable of maintaining its larger basket sizes amid this visit improvement, the impact could be huge.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.