When stay-at-home orders closed gyms and fitness classes in many states in March, many Americans turned to baking as an alternate activity, leading to jokes about the COVID-driven 19 pounds of weight gain. However, not all consumers turned to banana bread for comfort. Many former gym members began purchasing at-home equipment and streaming classes, leading to success for companies like Peloton. In this week’s Insight Flash, we examine the extent to which former gym members were driving these sales and how many have returned to reopened facilities.

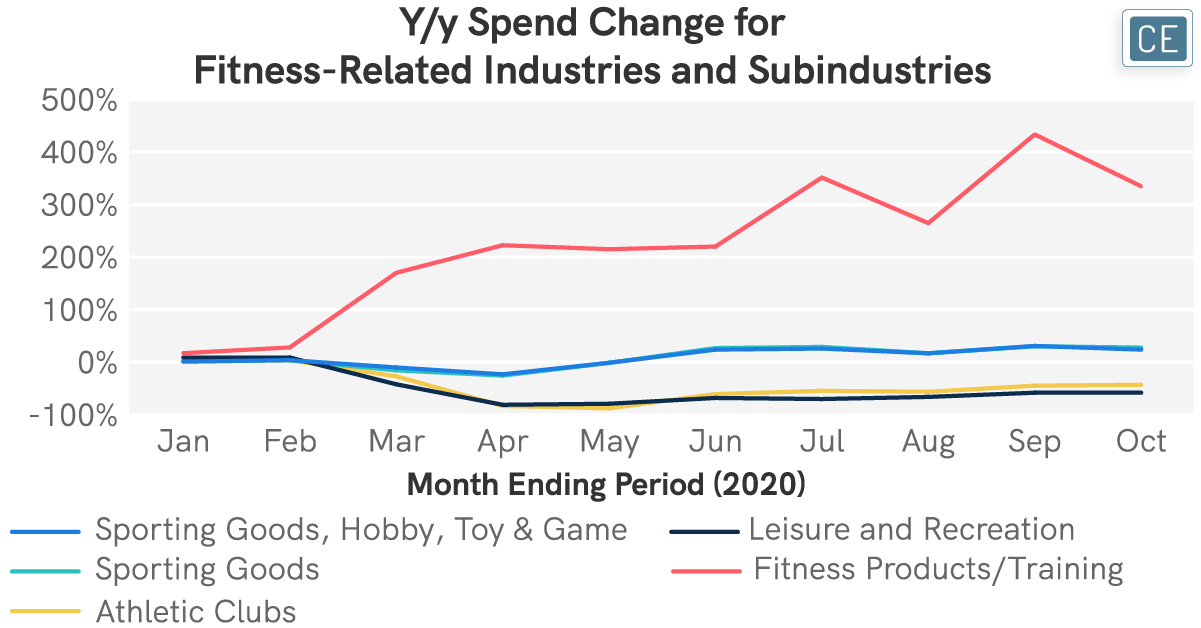

Athletic Clubs were a common target of shutdowns across states, due to fears heavy breathing in close quarters would accelerate the spread of coronavirus. Although monthly dues were charged to some subscribers in March, by April y/y spend was down -83%. Y/y spend dropped even more sharply in May to -88%. And while declines were less severe in later months as states allowed clubs to reopen, restrictions and mask requirements remained in place so that by October y/y spend growth for Athletic Clubs was still severely negative at -43%.

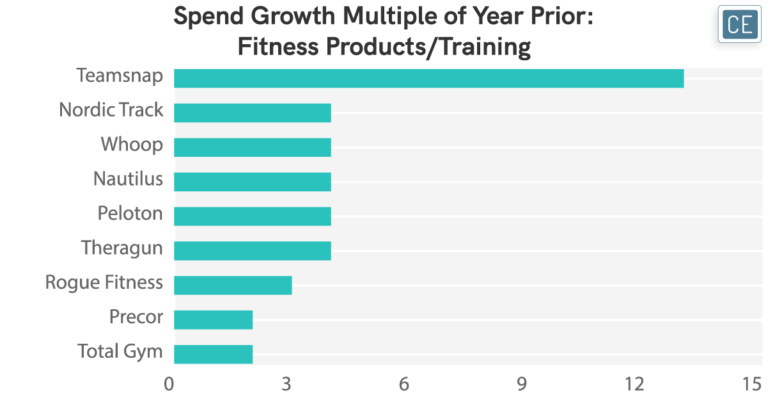

Meanwhile, the at-home workout industry boomed. Fitness Products/Training spend grew 223% y/y in April, with spend levels rocketing even higher even as traditional gyms reopened – growing 352% in July, 265% in August, peaking at 434% in September, and most recently growing 335% in October. Individual brands on already-strong trajectories saw results improve still further – TeamSnap growth was 13 times what it had been the prior year, while NordicTrack, Whoop, Nautilus, Peloton, and Theragun all saw their DTC growth rise by 4 times what it was a year ago.

Fitness Industry

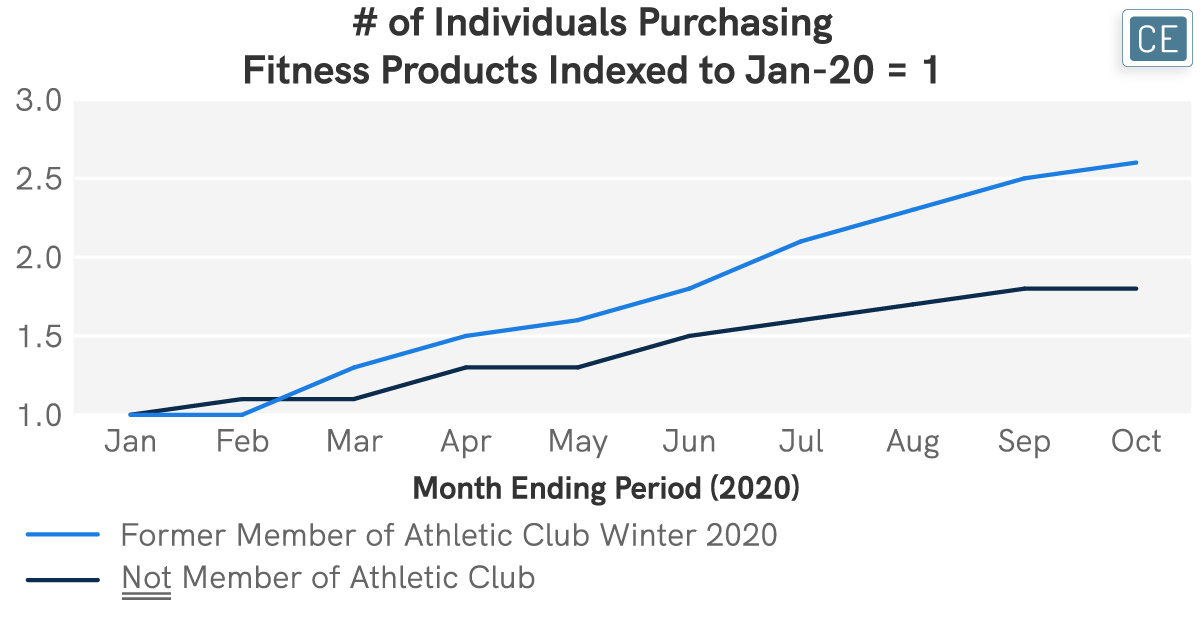

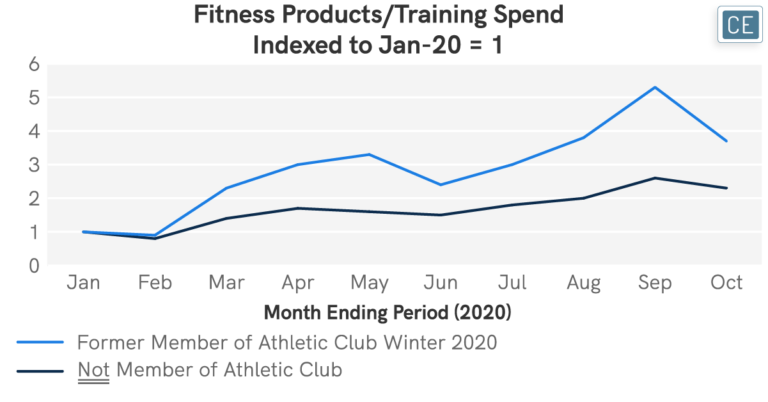

Whether this strong growth for fitness products can continue as studio and club workouts become an option again remains to be seen. CE Vision provides the unique capability to cut data by customer behavior characteristics, seeing how much of these companies’ growth was driven by gym rats who lost their gyms. Indeed, those who were gym members in the first three months of the year but didn’t have a gym charge on their credit card for the second three months showed much higher growth in Fitness Products/Training spend than those who were not gym members. The number of former gym members who made a purchase of a Fitness Product in September or October was about 2.5x what it had been in January at peak Fitness Resolution time. This compares to only 1.8x as many individuals who were not gym members buying Fitness Products in September and October. Similarly, former gym members spent 5.3x as much and 3.7x as much as they did in January on Fitness Products in September and October (respectively), vs. 2.6x and 2.3x for non-members.

Spend Growth by Behavior

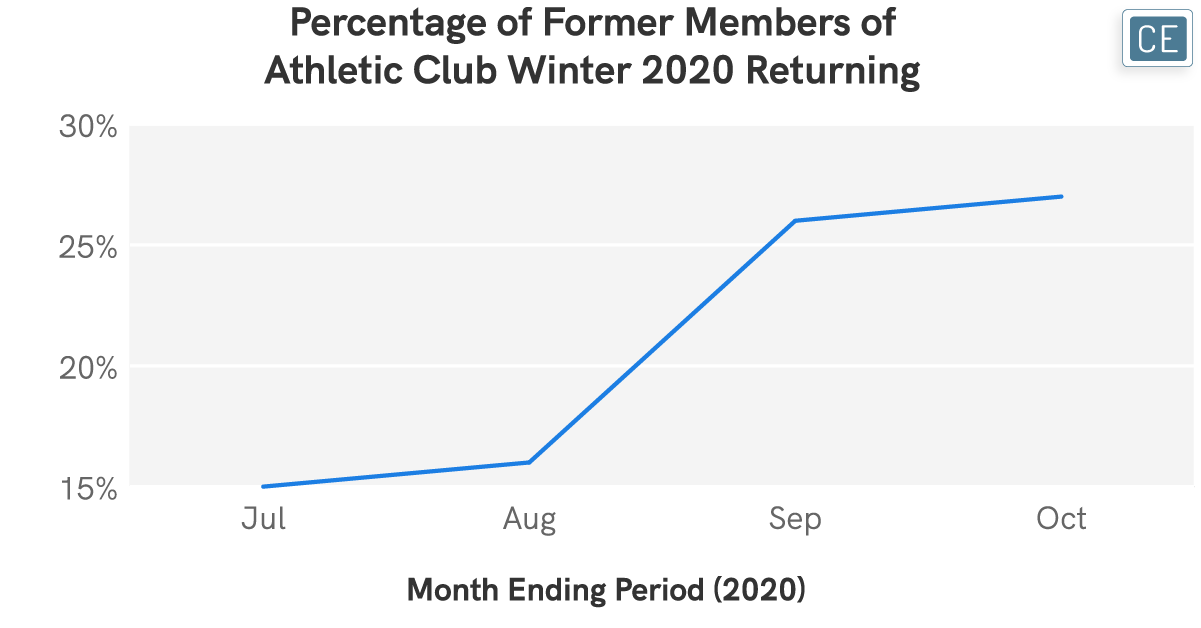

Yet, some of the strong growth in Fitness Products from former gym members may be due to the fact that they have not yet returned to the gym. In July, only 15% of those who had been gym members in the winter but couldn’t return in the spring were back at the gym, increasing slightly to 16% in August, 26% in September, and 27% in October. It may be that some of these shoppers have gotten comfortable with new fitness routines and will continue their at-home training. But others may be waiting for gyms to be safer and have fewer restrictions, in which case Fitness Products may see growth slow if recent promising news of vaccine success manifests in widespread vaccine distribution and population immunity.

Return Behavior

For all companies, it is important to pay attention to switching behavior and where new customers are coming from. CE Vision provides unique tools to analyze spending trends by customer behavior profiles to see how much of recent sales growth is coming from customers responding to a temporary change in circumstances versus an underlying shift in preferences. It also allows companies to track in close to real-time when those temporary circumstances might revert and plan for any potential changes.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.