U.S. single-family rent growth strengthened in September, increasing 2.5% year over year, showing solid improvement from the low of 1.4% reported for June 2020, but a slowdown from the 3% rate recorded for September 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

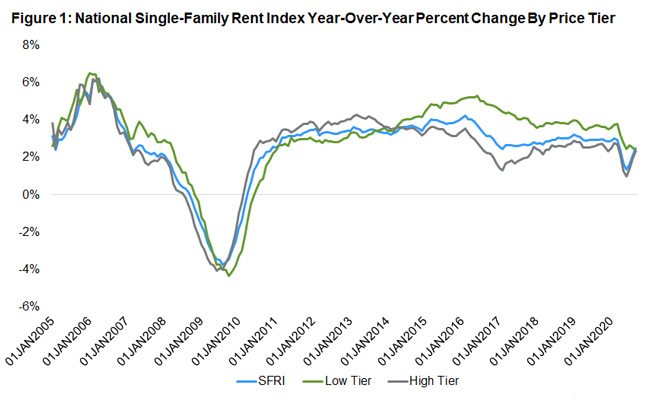

Low-priced and high-priced rentals grew at roughly the same rate in September, a departure from the six-year trend of low-priced rentals having significantly faster growth then high-pried rentals (Figure 1). Rent prices for the low-end tier, defined as properties with rent prices less than 75% of the regional median, increased 2.4% year over year in September 2020, down from 3.7% in September 2019. Meanwhile, higher-priced rentals, defined as properties with rent prices greater than 125% of a region’s median rent, increased 2.3% in September 2020, down from a gain of 2.7% in September 2019.

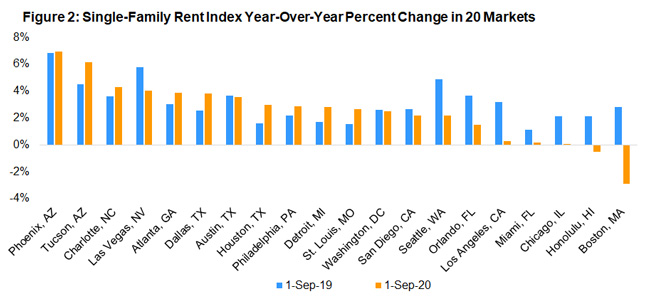

Figure 2 shows the year-over-year change in the rental index for 20 large metropolitan areas in September 2020. Among the 20 metro areas shown, Phoenix had the highest year-over-year rent growth this September as it has since late 2018, with an increase of 6.9%, followed by Tucson (+6.2%) and Charlotte (+4.3%). Two metro areas experienced annual declines in rent prices: Boston (-2.9%) and Honolulu (-0.5%).

Boston had the largest deceleration in rent growth in September, showing annual rent growth of 5.7 percentage points lower than in September 2019. The weakness might be attributed to a large number of students choosing to not return to Boston — a city that’s home to 35 colleges and universities — but instead opting to continue virtual learning in their hometowns. U.S. unemployment rates remain elevated and the nation had 6.4% fewer jobs in September 2020 than a year earlier. However, some areas of the country are continuing to experience higher rates of job loss — adversely impacting rental demand and slowing rent price growth. For example, Honolulu posted an employment decrease of 16.3% year over year in September and ongoing rent declines. Meanwhile, employment declines in Phoenix (-2.9%) and Tucson (-4%) were relatively small amongst the 20 metros covered in the report. With the continued resurgence of COVID-19 cases across the country, we may expect to see further disruption of local rental markets.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.