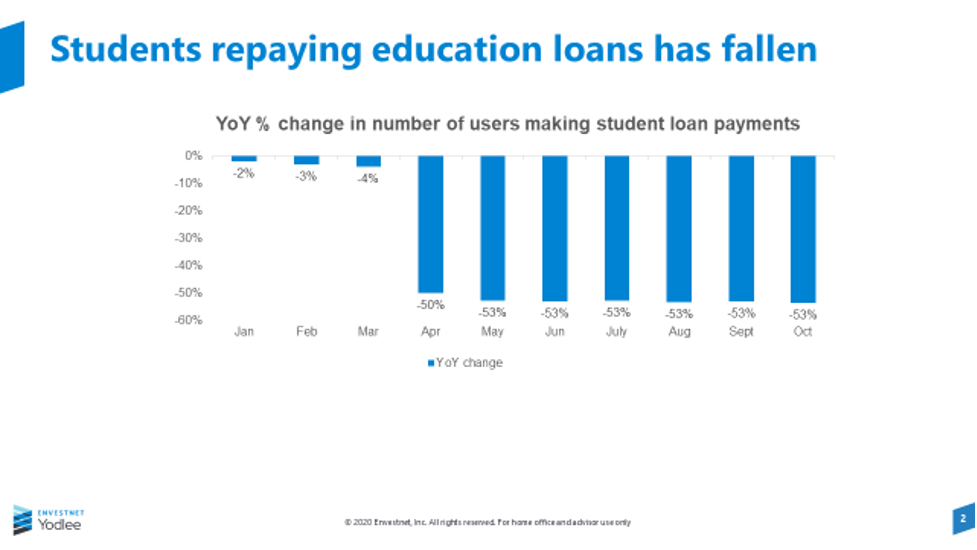

Many Americans who stopped paying student loan payments in April are still not paying. That can be seen in the Envestnet | Yodlee Income and Spending trends data through the month of October.

The number of users making student loan payments beginning in April dropped by 50 percent. In March, the Coronavirus Aid, Relief and Economic Security or (CARES) Act provided relief for payments on qualifying federally-held student loans (the September deadline was extended through December). The interest was waived on student loans during that time.

Many students have chosen this path. According to CNBC, the flexibility gave some students the funding they needed to meet other basic needs, given hardships such as job loss during the pandemic.

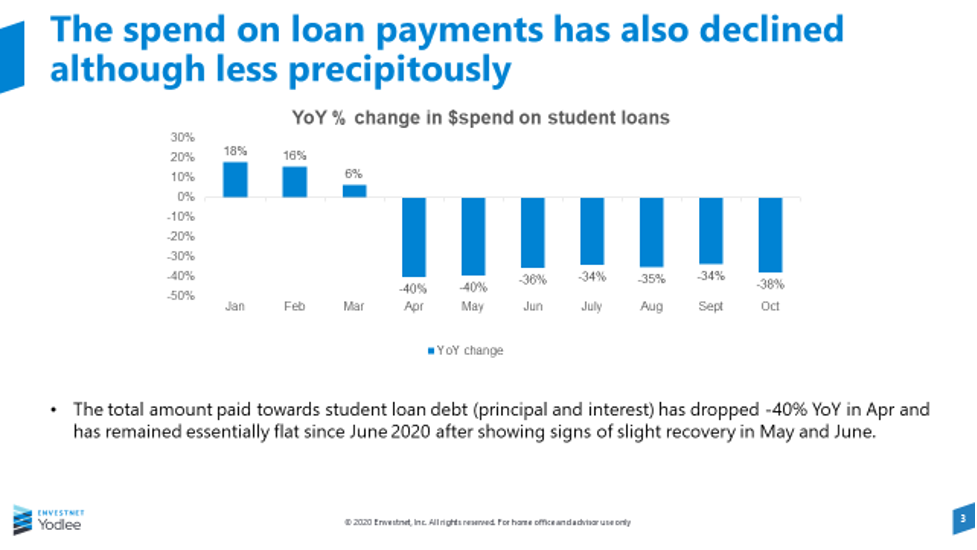

However, the silver lining for those continuing to pay down their federal loans was the ability to pay down debt interest free. Any payments made during the forbearance period helped a student pay off their debt faster. As a result, the drop in spend was not as precipitous as the decline in students paying down loans.

Those who are paying their loans seem to be paying more monthly. In addition, students borrowing from private loan lenders would not have their interest stop accruing. If payments on those loans were paused, the lender would continue charging interest, so the student would actually end up with a larger balance.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.