For what feels like the first time since 2020 began, there is good news on the horizon. Less than one year since the novel coronavirus changed our world, several vaccines boasting impressive efficacy are nearly ready to go to market, and even more are in the works.

Pharmaceutical giants Pfizer and Moderna have separately released preliminary data that suggest their respective vaccines are highly effective. Both vaccines utilize breakthrough messenger RNA (mRNA) technology that would be the first of its kind approved for humans. Most recently, AstraZeneca’s late-stage trials show its COVID-19 vaccine is also highly effective, and may have some advantages when it comes to cost and distribution.

Drugmakers are moving at record speed as they pursue emergency use authorization from the FDA. Barring any unexpected findings that would block regulatory clearance, initial doses of the vaccines could be available as early as December.

As each company edges closer to FDA approval, we took a closer look at the three front runners – Pfizer (NYSE:PFE), Moderna (NASDAQ:MRNA), and AstraZeneca (LSE:AZN.L) – to see whether recent developments are causing any significant impact to jobs numbers or stock prices.

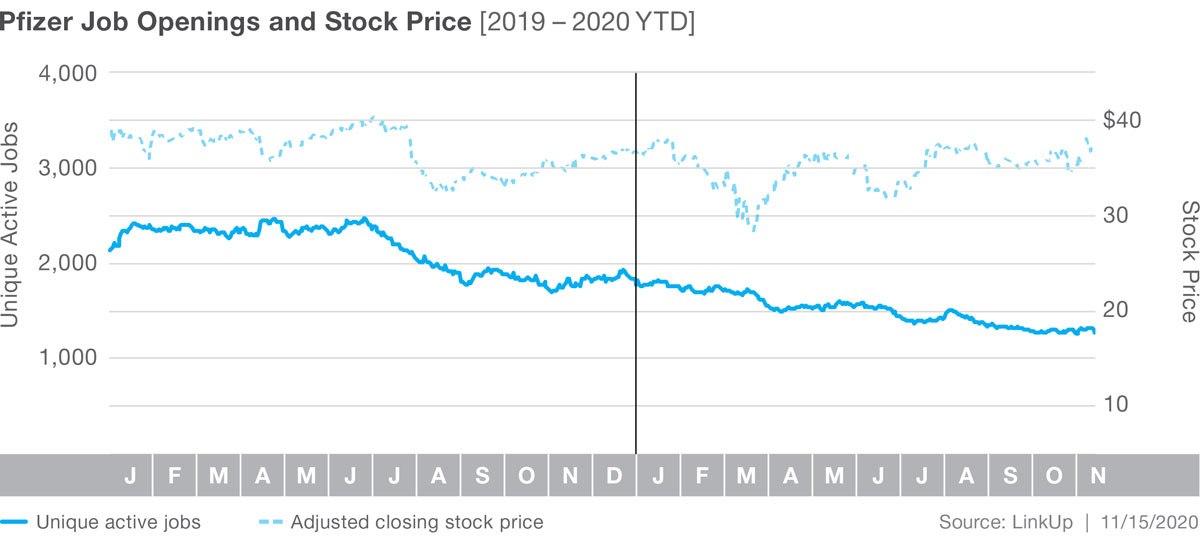

Pfizer

We turn first to Pfizer, who was one of the earliest companies to share promising results. Anticipating emergency government approval, Pfizer is expecting to begin limited distribution of their vaccine within weeks, with tens of millions of doses ready to go by the end of December. Their go-to-market plan encounters some complexity due to the specific storage needs for the vaccine; their mRNA-based shot must be stored at almost 100 degrees below zero Fahrenheit.

In addition to the vaccine itself, the company has been working on storage technology (they have designed suitcase-sized shipping containers that will keep doses at the required temperature for up to 10 days) as well as logistical planning with shipping carriers like FedEx, UPS and DHL.

Job listings at Pfizer have actually fallen steadily since the middle of 2019, with listings down 29% in 2020 YTD. While Pfizer’s stock did slip recently with the news of Moderna’s positive results, in the long run it has remained steady, up 2.7% in 2020 YTD.

Moderna

We then look at Moderna, who is on a similar track to emergency authorization. Developments around the company’s vaccine have dominated the news cycle as of late with its mRNA-1273 shot boasting a 94.5% effectiveness rate. Moderna also has an important advantage over the Pfizer vaccine in that standard refrigeration can be used to store it for up to 30 days, and it can be kept at room temperature for up to 24 hours.

These developments appear to have initiated a spike in stock price, which is up 365% YTD. Job listings have increased dramatically in 2020 as well, up 274% YTD.

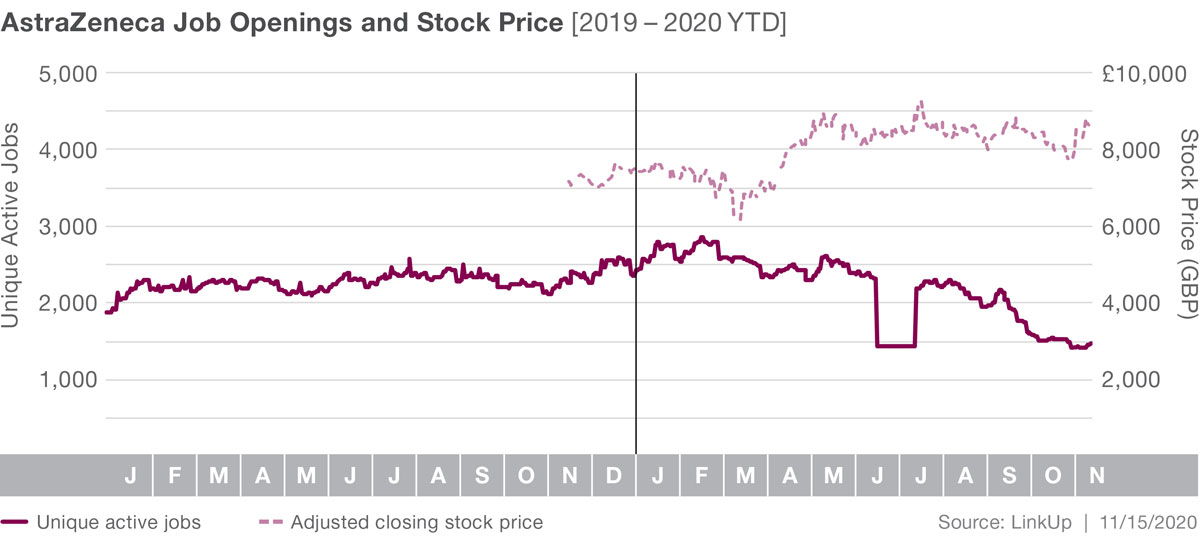

AstraZeneca

AstraZeneca has emerged as the third major drug company to report late-stage data for a potential COVID-19 vaccine. There are some notable differences between the company’s viral vector vaccine (created using a genetically engineered cold virus) and the mRNA versions made by Pfizer and Moderna. While its 90% effectiveness rate is similar to other companies’, the AstraZeneca vaccine is showing particularly promising results for older individuals, generating as strong an immune response in those over the age of 70 as it does in younger people.

Expected to seek FDA approval in late December, the AstraZeneca vaccine doesn’t require freezer temperatures for storage, potentially making it a better candidate for distribution among developing countries. There are significant cost differences at play as well, largely due to agreements the company has brokered with governments and international health organizations as well as their vow to not make a profit off of a vaccine during the pandemic. The cost for the AstraZeneca vaccine is about $2.50 a dose, compared to Pfizer’s $20 per dose and Moderna’s $15 to $25 range.

Looking at jobs data, we see AstraZeneca has significantly more job openings than Pfiizer and Moderna. Job listings had been fairly steady, but have actually declined since the outbreak, falling 38% YTD. Stock prices are up 16% YTD though, and that may continue to increase as specifics about their vaccine become more widely known.

And so we wait

Though we are in the midst of what appears to be a race to be the first drugmaker to release their vaccine, it’s important to note that this isn’t a winner-take-all proposition. Multiple companies succeeding in developing safe and effective vaccines serves the common goal of immunizing as many people as possible as quickly as possible. Current demand far exceeds what any one company would be able to meet on its own, and even with multiple solutions in the market there will likely be a tiered approach to distribution. We, along with everyone else hoping to glimpse the light at the end of the tunnel in 2021, will continue to monitor developments in vaccine news and how they impact the labor market.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.