We’re in the middle of a significant COVID surge, with a 54% growth in the new case rate over the last 14 days. Nearly every state is trending the wrong way and hospitalizations are up dramatically. In response, many states have issued new restrictions and guidance. So, how have consumers adjusted?

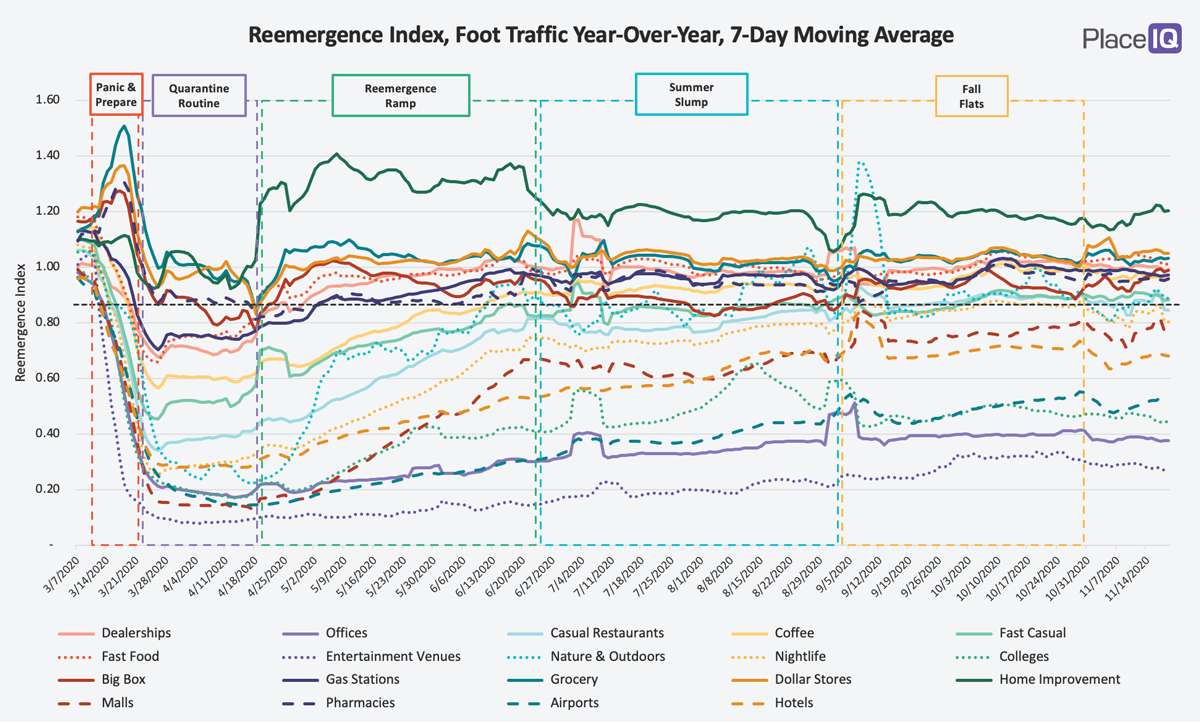

Overall, foot traffic has pulled back:

If we start looking at the individual categories, the story becomes more complex, albeit in a familiar way. People are changing their behaviors in response to an increase in cases, but they aren’t treating all categories similarly.

And, holiday shopping is very much happening.

Join us below as we break down what we’re seeing. Thanks as always for reading and have a safe and relaxing holiday.

We are gratified to see our analyses being included in various reports, since it is our goal to contribute to the #dataforgood effort. If you choose to re-use one of our analysis, all we ask is that you attribute the analysis or content to PlaceIQ. Thank you!

Holiday Shopping is in Swing

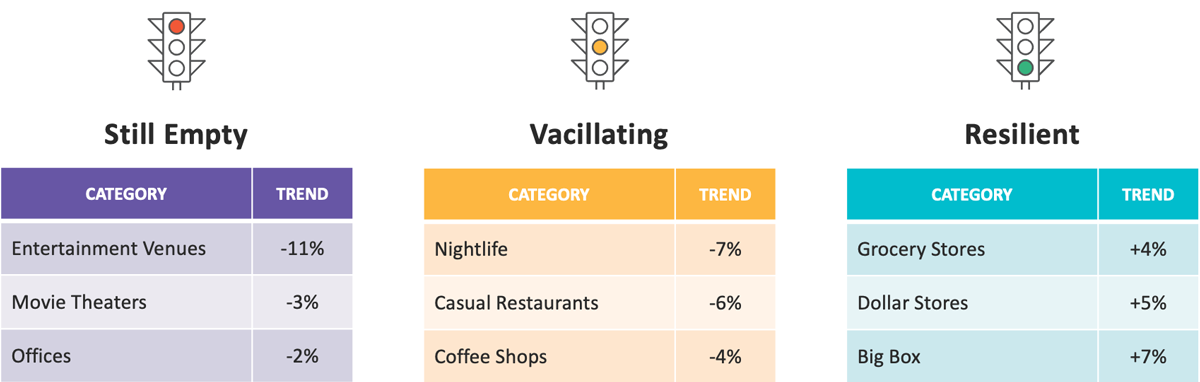

Take a look at the chart above and notice who’s gaining and losing in November. You might find a familiar pattern. Entertainment venues, bars, restaurants, cafes, and offices are all down significantly. But grocery stores, dollar stores, home improvement, and big box brands continue to post stable numbers.

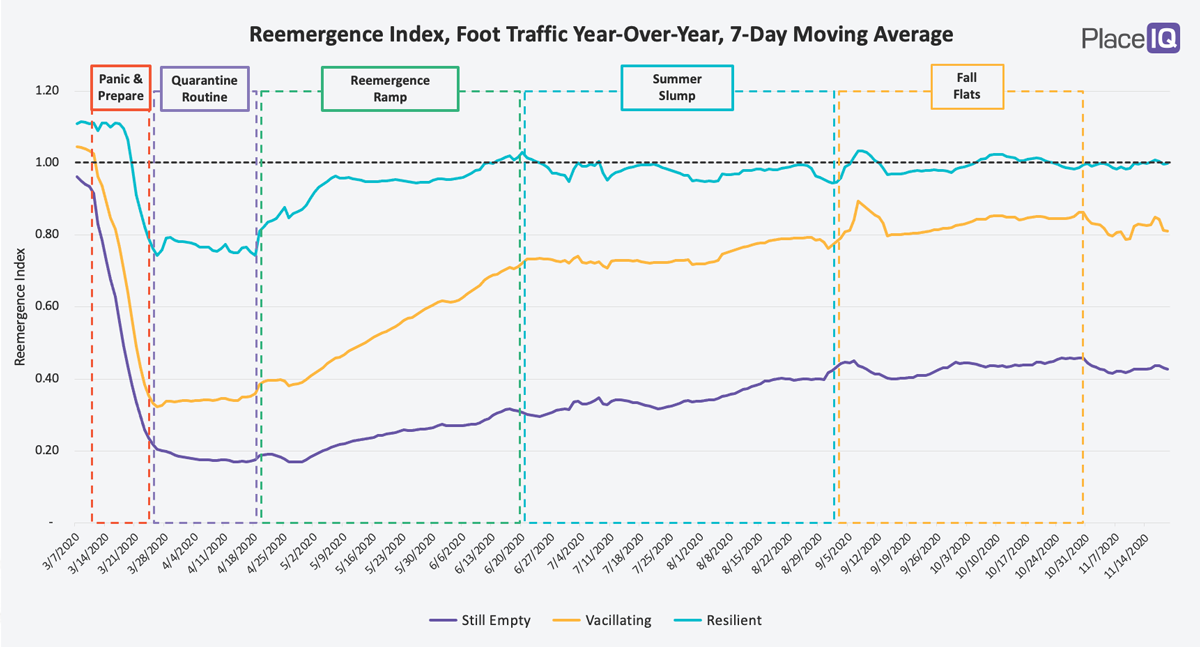

If these clusters of strongly and poorly performing venues sound familiar, it’s because they’re the same clusters, following the same patterns, which we identified back in June. Shortly after that post we renamed the clusters but their descriptions hold:

These categories have been handy for us and our clients because they help us predict the future. We don’t know what the virus is going to do, but the clusters predictably respond to surges and remissions. Our rule of thumb is as follows:

This is what we’re seeing today:

Zooming in on the visitation trends of individual categories illustrates this even better:

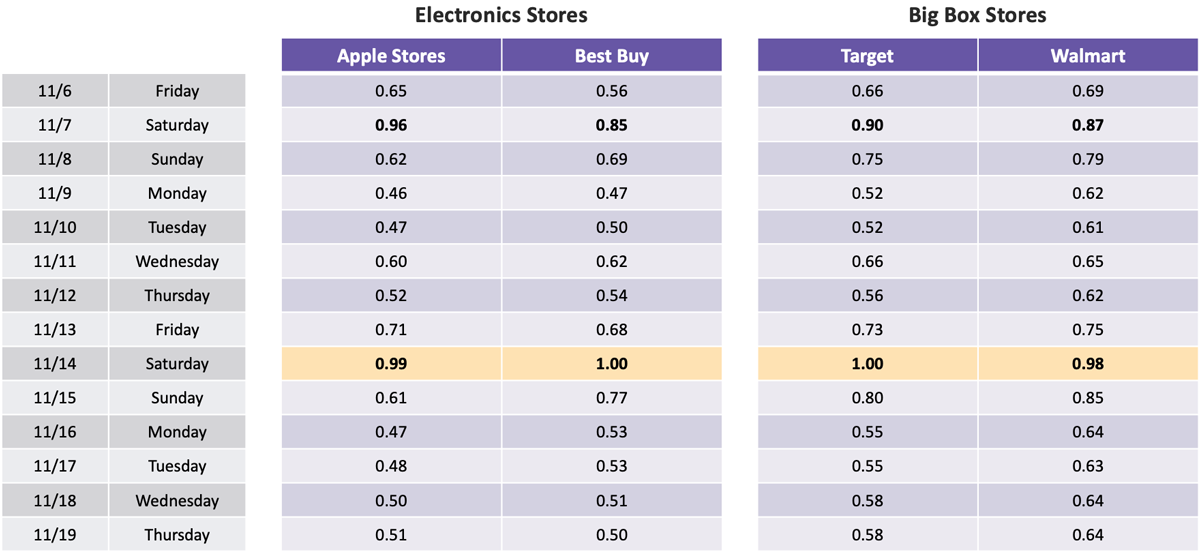

Still, even that view undersells the figures retail has been putting up. We calculate ‘visitation trends’ by comparing the average traffic over the previous 7 days to the average traffic 7 days prior. This lens provides us a stable view, but can sometimes mute spikes. If we look at daily visitation indexes for individual brands over the last two weeks, we can see that big box and electronics stores put up some of their highest traffic figures in 6 months:

Visit Index is calculated separately for each brand. A score of 1.00 is the highest traffic for the time period, April 1st to present.

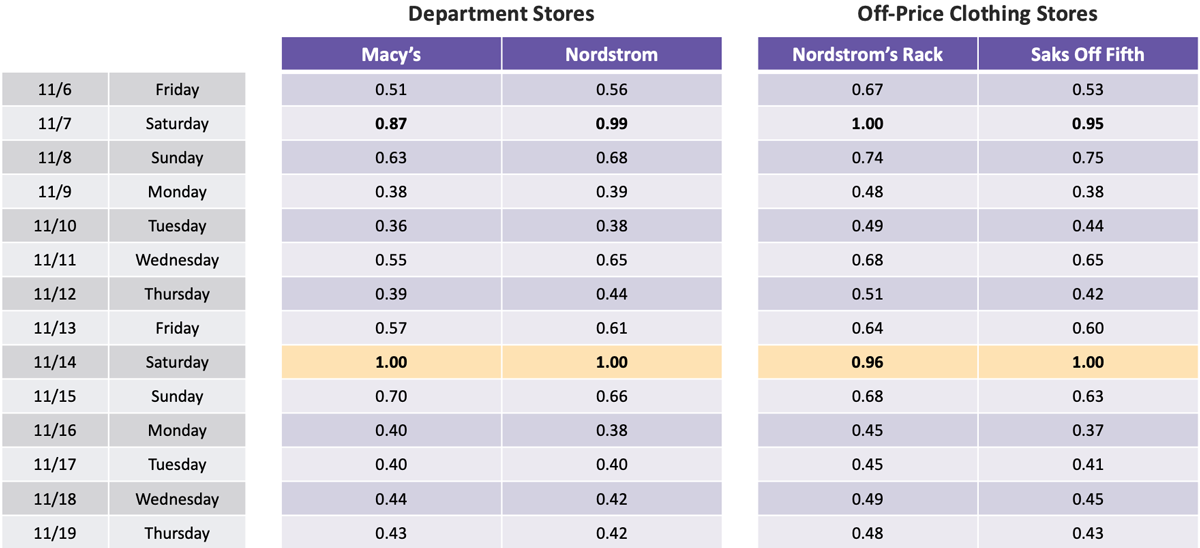

Even department stores and off-price retailers are hitting new highs:

Visit Index is calculated separately for each brand. A score of 1.00 is the highest traffic for the time period, April 1st to present.

All of this is occurring as people are leaving their houses less and staying closer to home.

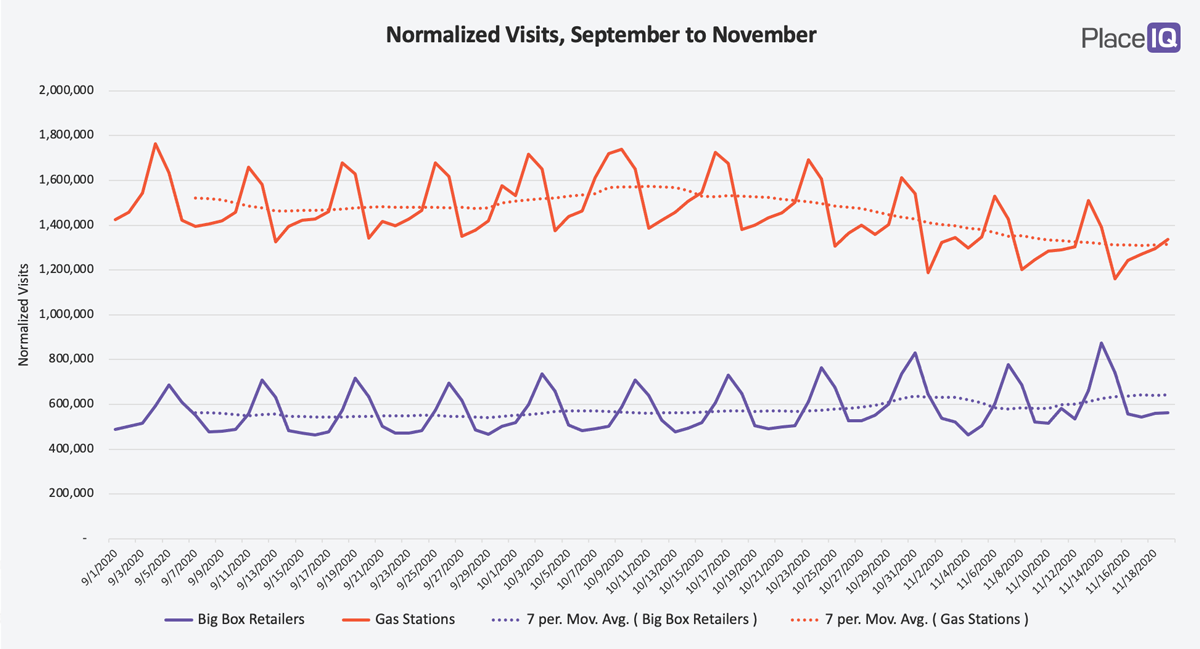

To get a general traffic index for context, we can look at visitation to gas stations. The regular and near-universal usage of gas stations allows them to function nicely as an index. And better yet: the more places you drive, the more you visit them. So, it’s quite shocking to see visits to gas stations in decline while big box visits are heading up:

This split is hugely important to businesses this holiday season. Surges in COVID cases are driving consumers to dial back riskier behaviors, but holiday shopping is still occurring. Big box retailers (Walmart, Target, Costco, Sam’s Club, and others) are especially thriving, likely because they allow caution and holiday shopping to coexist: consumers continue to consolidate trips to reduce risk and stores that sell necessities and gifts will crush it this season.

As always, let us know if you have any comments, questions, or topics you’d like us to explore. Cheesy as it may sound, we’re especially thankful for you all this season. An engaged audience we’re able to inform and assist in challenging times is continually rewarding.

Stay safe and Happy Thanksgiving.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.