2020 has literally rocked the boat, grounded airplanes, and simultaneously altered how we travel. This week the team of analysts at ForwardKeys has taken the liberty to examine the performance of key international airport hubs using Actual Air Tickets data to monitor how travel retailers, advertising agencies and duty-free operators can seize new business opportunities when they quickly arise.

Airport Hubs and flying point to point

Since the arrival of Covid-19, safety has become a key concern for travellers and will remain to be so. This means the sector needs to be ready so that travel remains a safe experience, and that it is perceived as such.

Right now, it seems like the safety perception is influencing the way people travel and the itineraries they take.

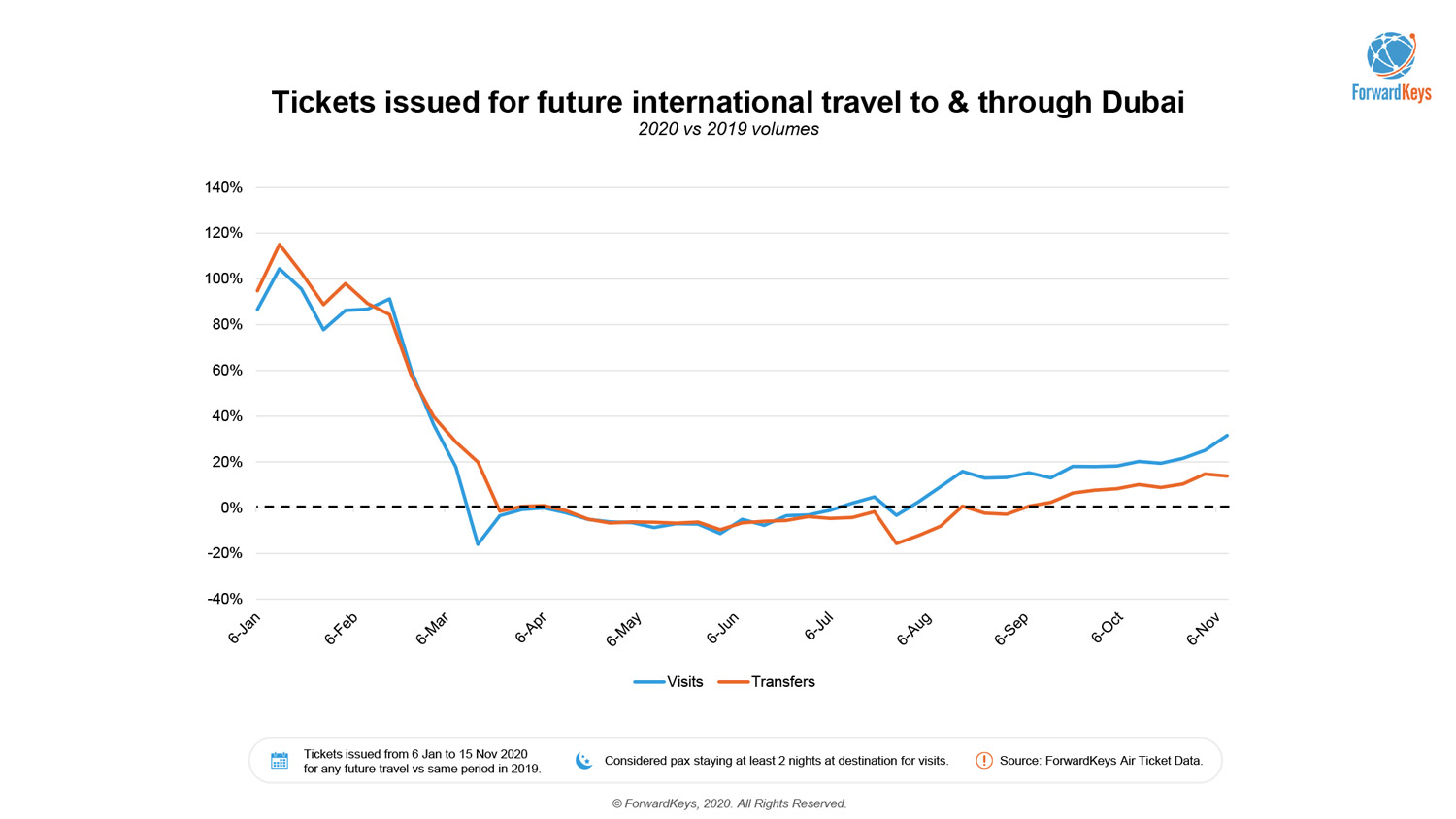

This becomes even more apparent when looking at the performance of hubs. Connecting flights at international hubs, as seen in Dubai, are suffering a slower reactivation than direct flights. Although both tickets for visits to Dubai and travel through Dubai are on the rise, the first is currently tracking below. This suggests that people are avoiding stopovers and prefer flying direct to their destinations, when possible.

“We need to understand that people think differently about international travel nowadays. For example, they are much more likely to fly directly to their destination rather than to use connecting flights. In Dubai (DXB), for instance, we can see that tickets for trips connecting – in orange – are recovering at a significantly slower pace than tickets for a trip ending in Dubai (in blue). In practical terms, this means that there are fewer people with time on their hands to shop at the airport”, says Olivier Ponti, VP of Insights at ForwardKeys.

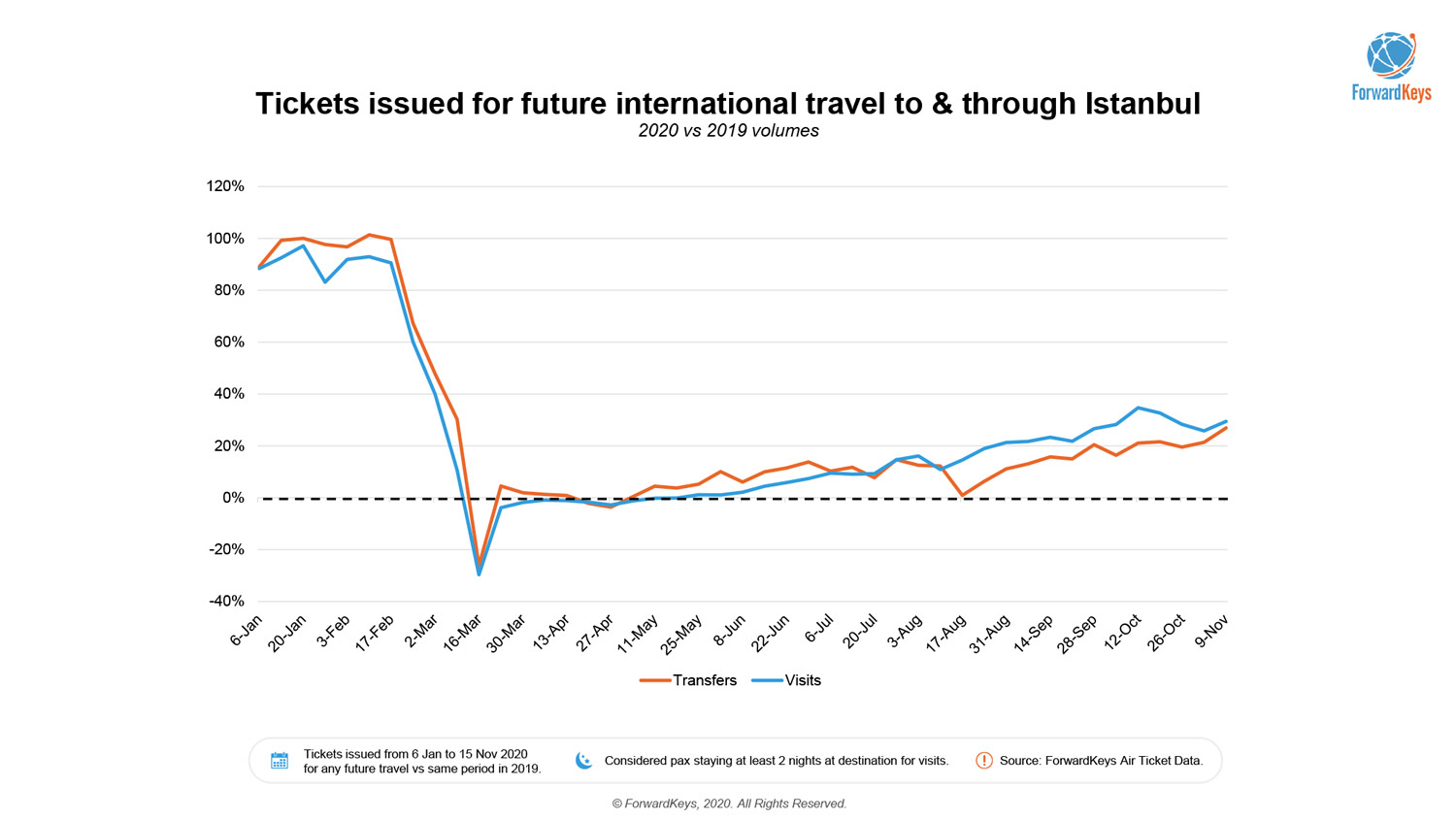

Another example showing the difficulties of international hubs in the times of Covid is Istanbul’s Ataturk airport, where tickets for connecting trips are also recovering slower than tickets for visits, albeit at a smaller difference than in the case of Dubai.

“The difficulty for duty-free and travel retail operators in international hubs is that they are used to doing business not only with people visiting their destinations but with those also connecting via these mega-hubs. These hubs are currently challenged by the fact that 1) business travel has not resumed and 2) leisure travellers are preferring point to point travel now due to COVID-19 and quick changing travel restrictions,” adds Ponti.

The future for airport travel retail and duty-free

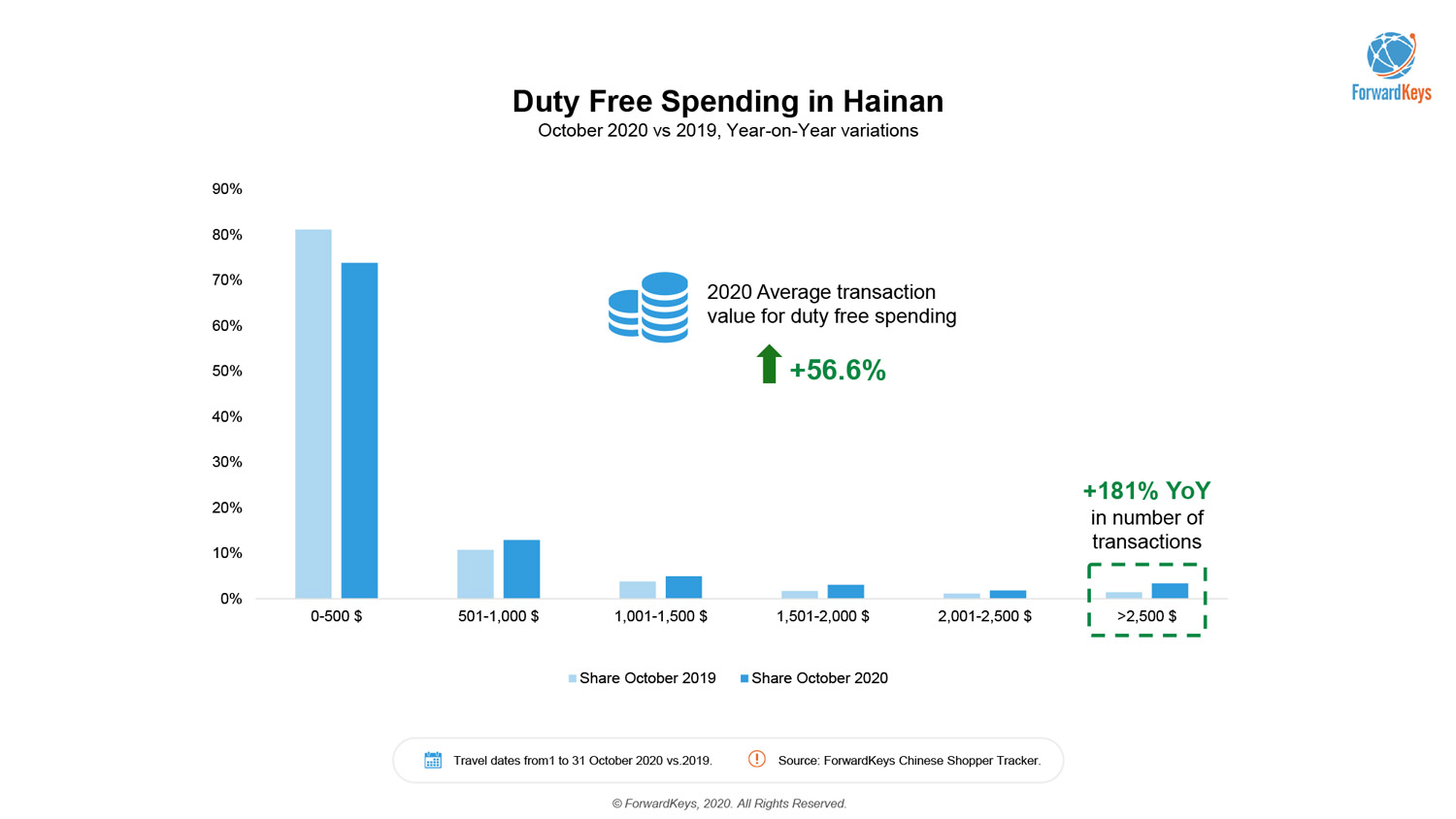

With long-haul travel recovery looking much further afield than expected, some luxury brands and duty-free chains are moving their business focus to Asian airports and domestic terminals as seen recently in China. As reported by Forbes recently, eight new luxury brands, including Gucci and Chanel have opened in Shenzhen and Shanghai Hongqiao airports as the domestic recovery in China presents a new business opportunity – previously untapped.

Hainan, the newest shoppers paradise, is a great example of how brands and duty-free operators can be more creative in this competitive landscape. With the spending power increasing and the destination being “cool” again to a wider demographic pool, interactive pop-up stores could be a great way to test the waters on a new business strategy.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.