At this point, it should be unsurprising to hear that online sales grew faster than offline during Black Friday week, when customers in previous years have formed lines blocks long to catch early deals and it used to be that parking spaces at malls took hours to find. Yet, the specific drivers of this online outperformance are important for companies to understand so that they can benchmark themselves and understand the dynamics of targeting promotions better next holiday season. In this week’s Insight Flash, we dig into the drivers of online success, looking at growth in individuals vs. spend per individual, growth in various transaction size buckets, and growth by age group.

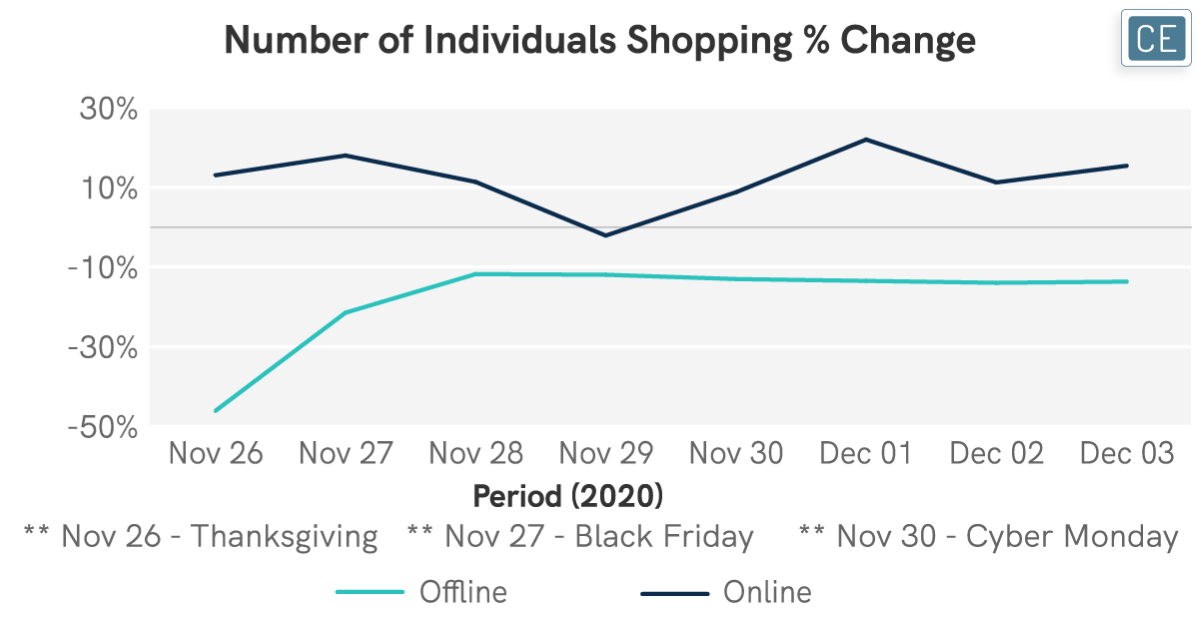

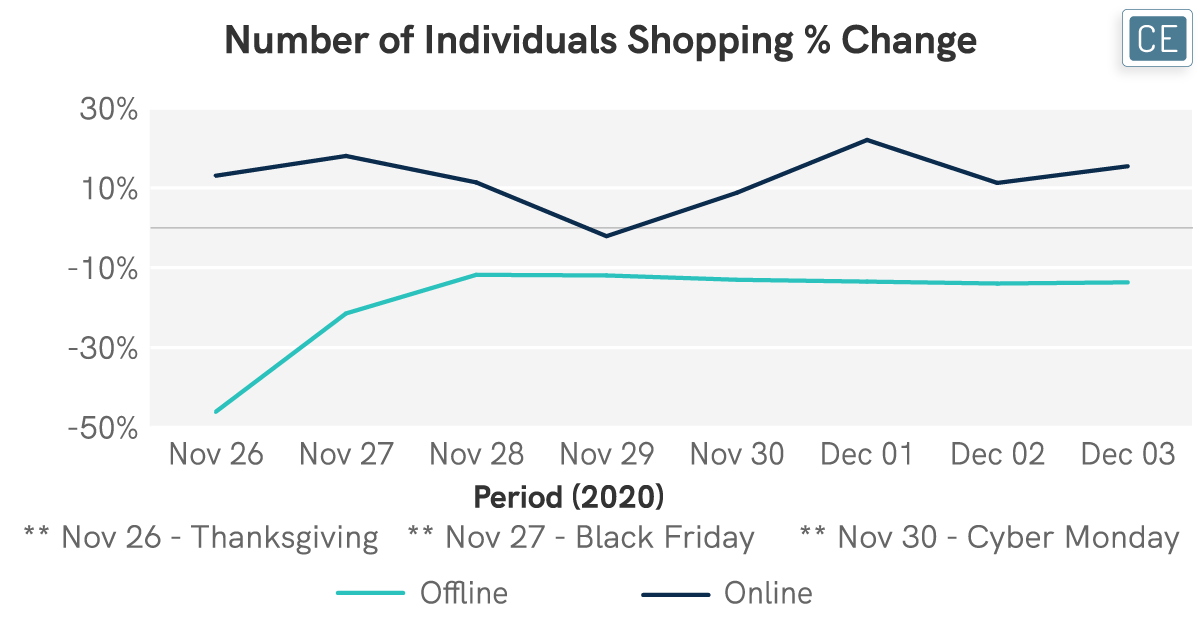

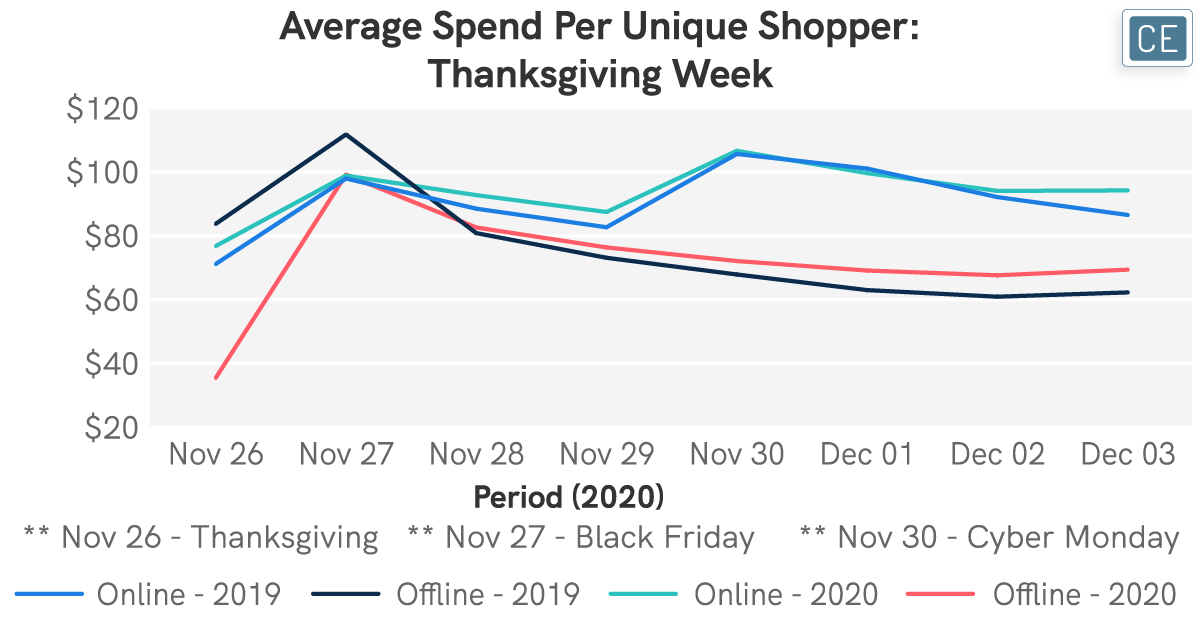

Looking specifically at the week of Thanksgiving and comparing y/y growth versus the same day of week last year, e-commerce showed double-digit growth in the number of individuals buying products online for almost every day of the week (negative sales trends on Sunday are likely reflective of the fact that cards are charged only when the item ships). The highest growth was the day after Cyber Monday at 22%, likely reflective of Cyber Monday orders being shipped. Meanwhile, offline trends were decidedly negative – almost half as many shoppers made a purchase offline on Thanksgiving, likely due to closed stores, with -21% fewer shopping in-store on Black Friday. Spend per person for e-commerce was more muted, actually decreasing for online purchases the Tuesday after Cyber Monday and never hitting double-digit rates. Yet, there was a jump in spend per person in stores the days following Cyber Monday: 9.7% on Tuesday, 11.0% on Wednesday, and 11.5% on Thursday. This may be due to shoppers not finding the products they were hoping for on the web and buying more in-store to compensate.

Online Trends for Individuals

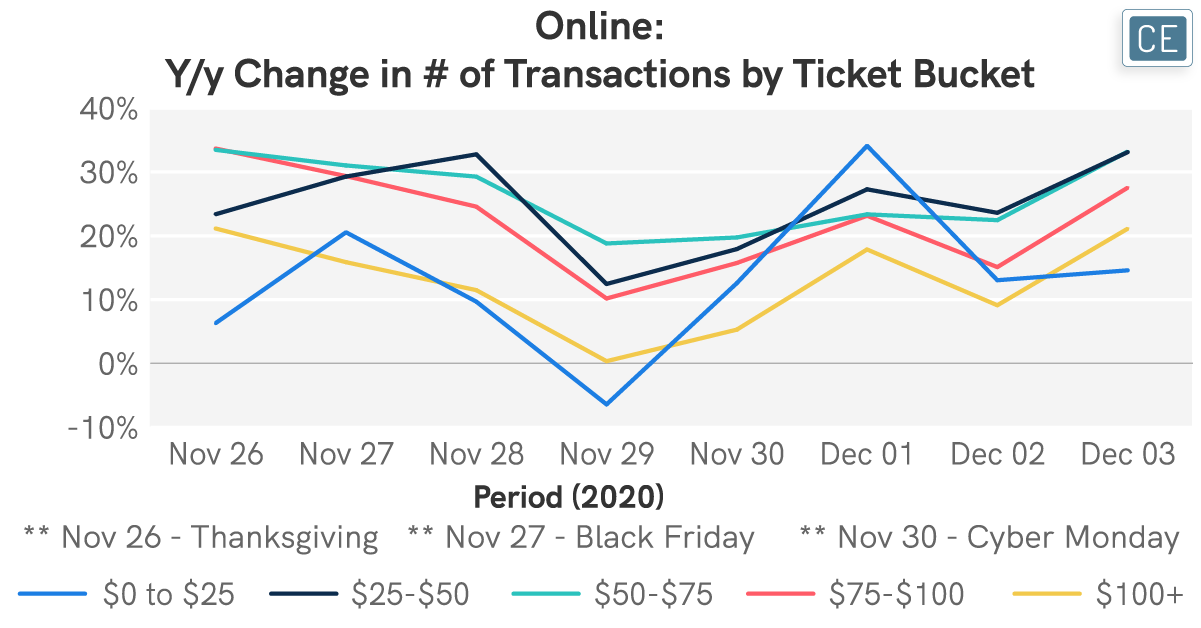

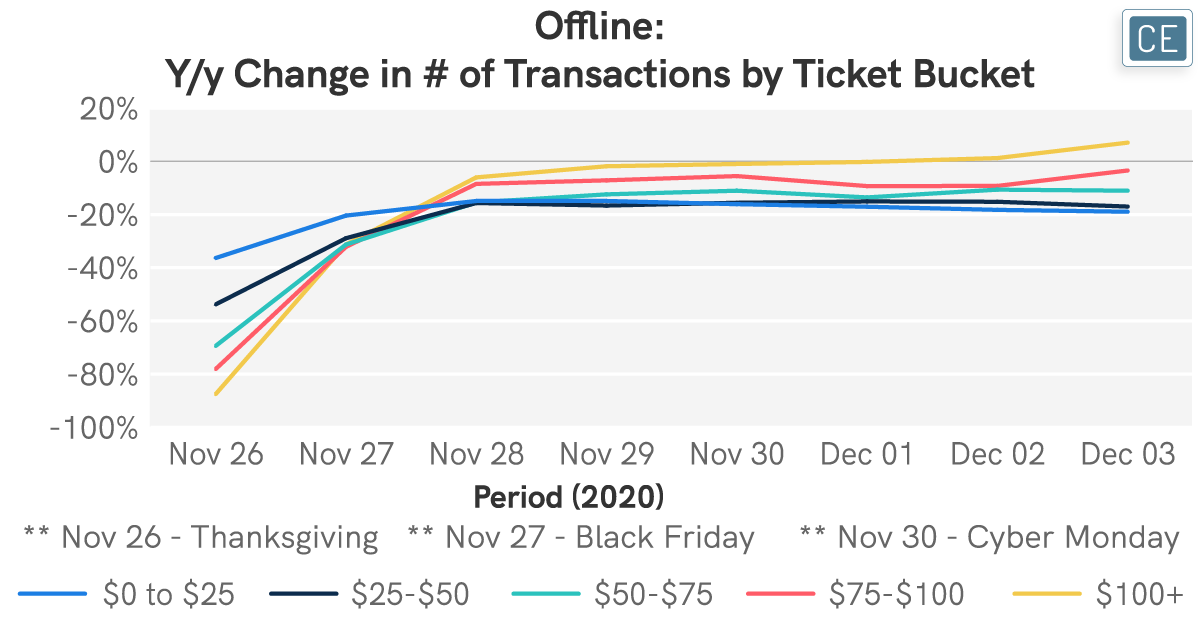

The size of transactions growing is important to look as well – many promotions, especially free shipping, are driven off order sizes. One interesting contrast between online and offline purchases this holiday season is that purchases over $100 generally saw the lowest growth online, but the highest growth (or for many days lowest decline) offline. This may mean that people braving stores were trying to get more out of each trip and avoid the risk of extra visits to crowded places.

Ticket Buckets

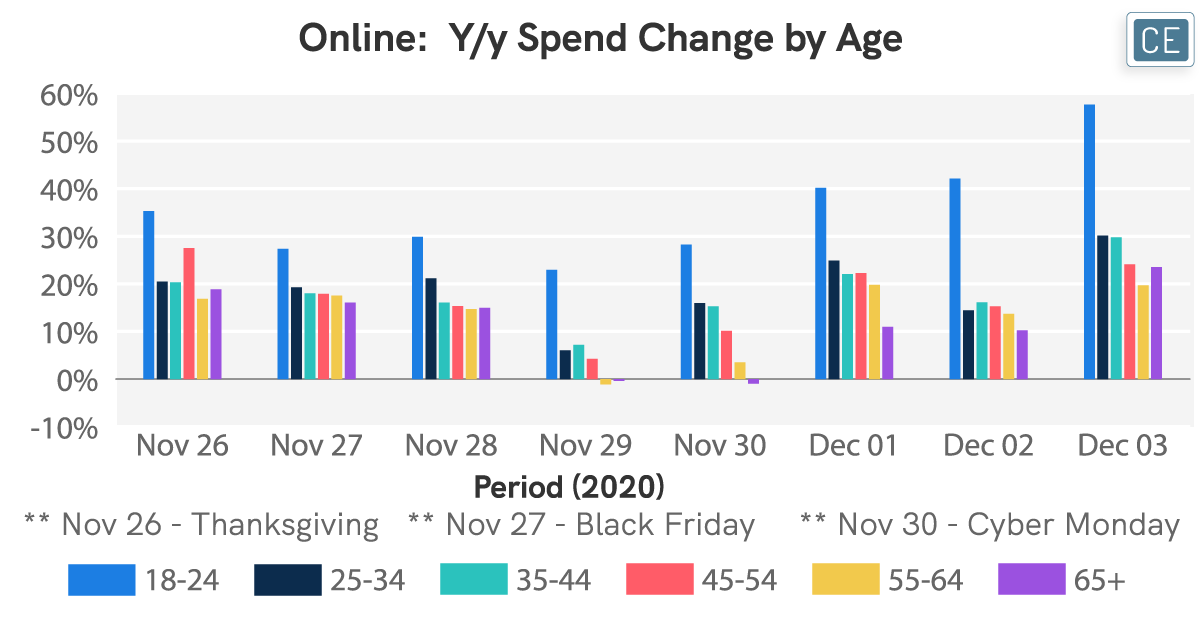

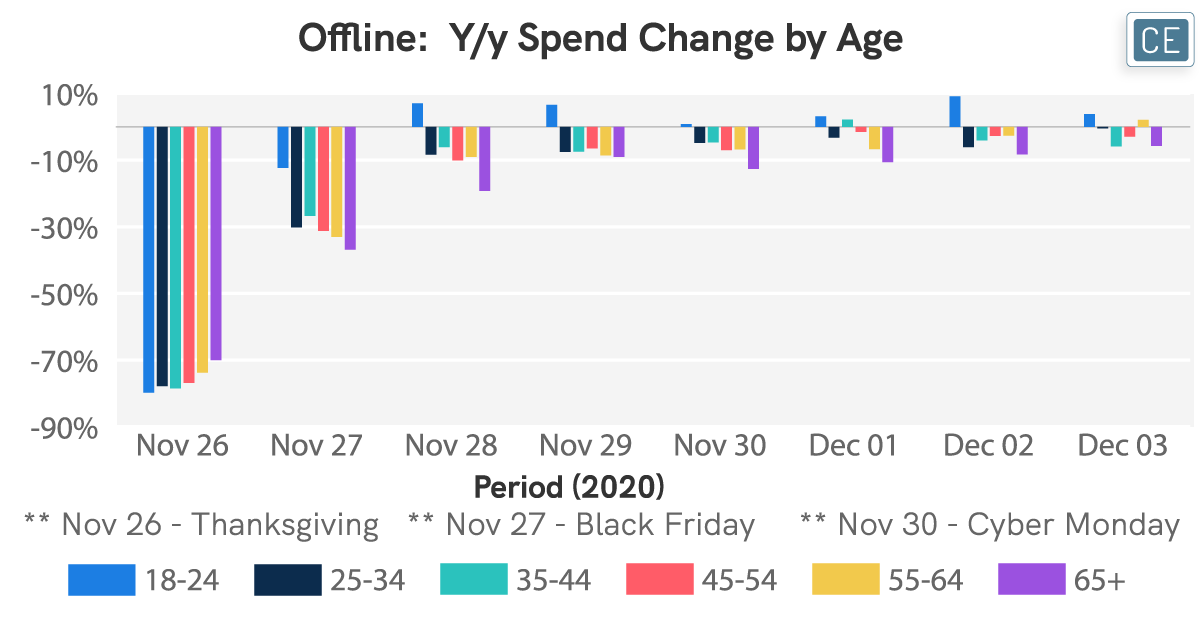

Although much has been made of the pandemic introducing older shoppers to e-commerce, it was still 18-24 year olds who drove the most online spending growth for every day of Thanksgiving week. Interestingly, it was also this demographic who was most willing to brave stores that week with positive y/y spend growth offline Thanksgiving weekend (Saturday and Sunday) as well as in the days following Cyber Monday, although this growth was much smaller than the growth in their online spend. In general, however, almost every age group showed positive online spend growth for the majority of Thanksgiving week.

Demographics

It’s easy to open up a newspaper and understand headline trends like higher online sales for the holiday. However, with a powerful tool like CE Vision, companies can dig deeper into the drivers of those trends. Understanding whether growth is coming from more shoppers or higher spend per shopper can help direct marketing efforts and capacity planning. Understanding growth by transaction size can help companies maximize returns on promotions like free shipping and tiered discounts based on spend. Finally, understanding which demographics are driving the trend can help with product planning and more targeted marketing efforts.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.