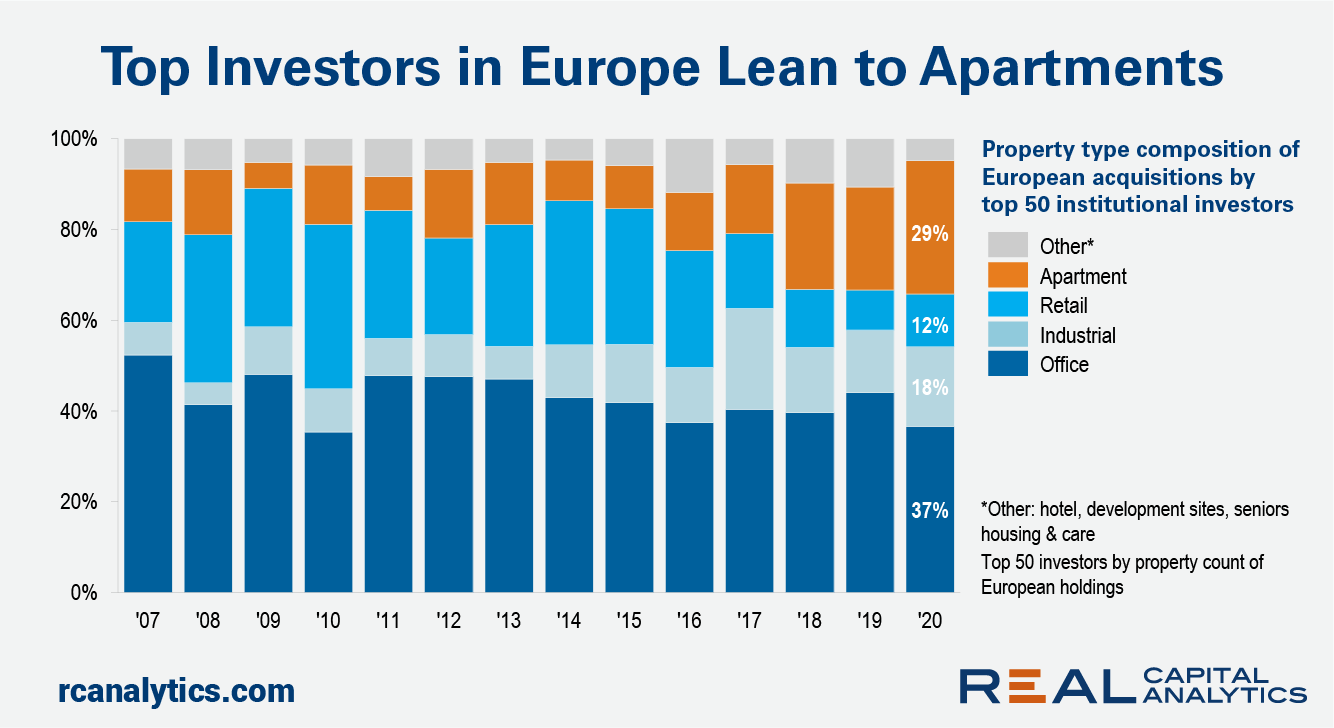

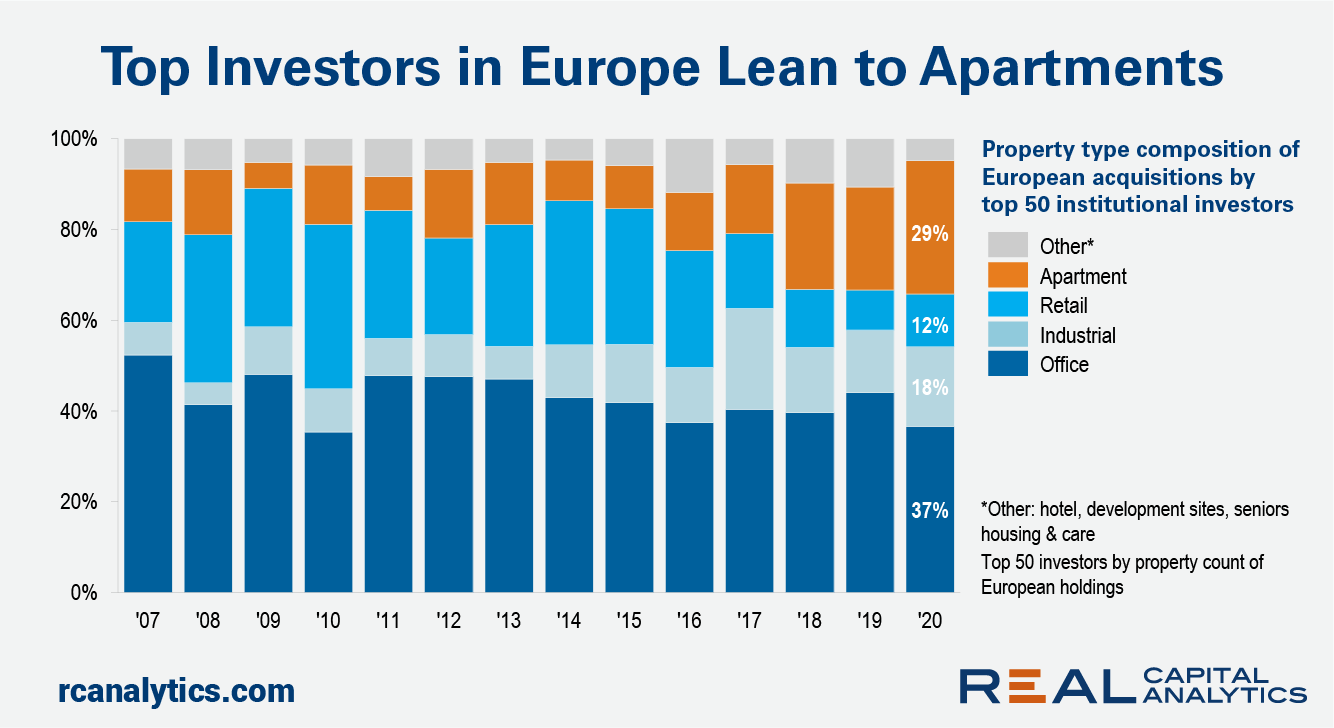

The biggest institutional investors into Europe’s commercial property market set a new record for apartment investment in 2020. Nearly 30% of total acquisition activity was focused on the residential for rent and student housing sector last year, according to Real Capital Analytics data.

It is already a cliché, but the Covid-19 crisis has accelerated shifts in commercial real estate markets that were underway pre-pandemic. Five years ago, apartments accounted for just 10% of all European acquisition activity by the biggest institutional investors and the proportion has steadily increased since.

In part, this was due to Blackstone’s acquisition of the multibillion pound iQ student housing portfolio in London and Manchester. But every year has its big deals and this simply underlines the depth and breadth of demand for a sector that has proved extremely resilient in the face of the challenges wrought by the Covid-19 pandemic.

Another shift put into greater focus by the pandemic is that towards the industrial and, more specifically, the distribution sector. Industrial property accounted for 18% of all acquisitions by these top 50 players in 2020, the second highest figure on record after 2017, when the Logicor megadeal took place. Meanwhile, office investment has taken its smallest piece of the pie in a decade: worries over how companies will use office space in the future and the record high pricing in most of Europe’s core markets put a brake on acquisition activity in 2020.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.