While COVID-19 has changed many consumer behaviors and limited entertainment, team sports have played on. Specifically, football on Sundays, and the foods that go with it, has remained in place as a national pastime. As the playoffs progress heading into the Super Bowl, we take advantage of CE Vision’s unique ability to easily isolate transactions by day of week to examine how food delivery on Sundays during Football Season differs from during the rest of the year.

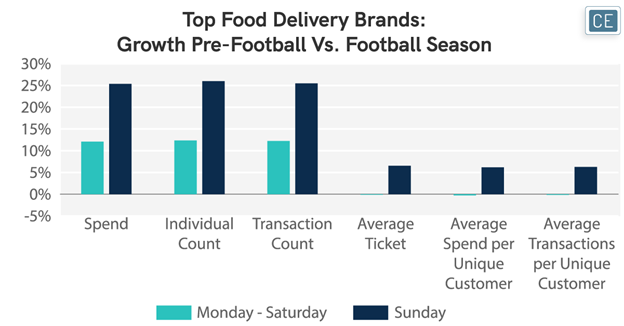

Events like football do appear to be driving substantial incremental growth for food delivery services even on top of pandemic-related drivers. Spend at the top food delivery services grew 25% on Sundays during Football Season from the prior weeks, but only 12% on the other days. The biggest differences for Sundays was more individuals ordering food, but growth outpaced on all six metrics tracked by CE Vision: Spend, Individual Count, Transaction Count, Average Ticket, Average Spend per Unique Customer, and Average Transactions per Unique Customer.

Food Delivery Growth

Note: Growth is for the specified day of week, 05/18/2020-09/06/2020 (Pre-Football) vs. 09/07/2020-12/27/2020 (Football Season); Top Food Delivery Brands defined as: DoorDash, Grubhub, Postmates, and Uber Eats

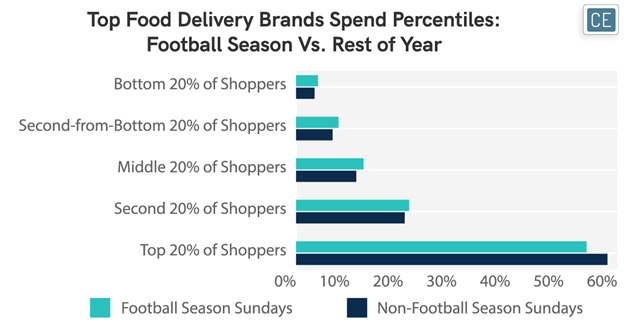

Following from this strong growth, it is interesting to note that Football Sunday delivery is also bringing in a broader base of ordering. Even though Football Season Sundays saw substantial growth versus Sundays earlier in the year, spend was less concentrated. The top 20% of spenders during Football Sundays made up only 54% of sales for the top delivery companies, versus 58% earlier in the year.

Concentration Percentiles

Note: 05/18/2020-09/06/2020 (Non-Football Season) vs. 09/07/2020-12/27/2020 (Football Season); Top Food Delivery Brands defined as: DoorDash, Grubhub, Postmates, and Uber Eats

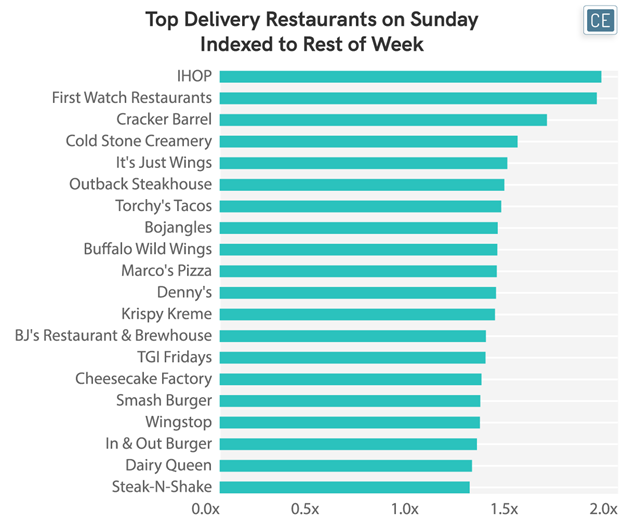

Where are Football fans ordering from though? CE Vision’s extensive capabilities include the ability to see both the delivery brand and the restaurant being delivered for food orders. By looking at the ratio of customers ordering from each restaurant on Sunday versus the rest of the week, it is possible to get a view on what foods are most popular for football fans. Of course, IHOP and First Watch’s Sunday popularity is unlikely related to football – the Sunday brunch favorites are almost twice as likely to be ordered on Sundays than any other day of the week, highest among our tracked restaurants. But, the popularity of It’s Just Wings (1.4x as likely to be ordered on Sundays),Buffalo Wild Wings (1.4x as likely to be ordered on Sundays), and BJ’s Restaurant and Brewhouse (1.3x as likely to be ordered on Sundays) may be more seasonal trends that could fade out as sports cycle to those played on all days of the week.

Brand Basket

Note: Based number of same-basket “trips” with DoorDash, Grubhub, and Postmates; 09/07/2020-12/27/2020

While most companies track seasonal trends in their businesses, day of week trends can be harder to capture. Variations in business based on seasonality in addition to day of week or due to big events can be even more elusive. CE Vision’s easy-to-use day of week filters allow companies to understand these dynamics, and to plan operational capacity and promotional cadence around them. They also provide more nuanced benchmarking of competitors and analysis of industry dynamics.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.