According to ATTOM Data Solutions’ newly released Q4 2020 Special Coronavirus Report spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the virus pandemic, pockets of the Northeast and other parts of the East Coast remained most at risk in Q4 2020, while the West continued to be less vulnerable.

ATTOM’s most recent Coronavirus housing impact analysis reported that New Jersey, Illinois, California, Louisiana, New York, Florida and Maryland had 40 of the 50 counties most vulnerable to the economic impact of the pandemic in Q4 2020. Those markets included eight suburban counties in the New York City metro area, four around Philadelphia, PA, and two near Washington, D.C., while six were in the Chicago, IL, suburbs and two were in the St. Louis, MO area.

The analysis noted the fourth-quarter trends generally continued those found in Q3 2020, but with different concentrations around several major metro areas. The number of counties among the top 50 most at-risk was up from five to eight in the New York, NY, area and from three to six in the Chicago, IL, area, but down from four to two in the Washington, D.C., region and from four to one in the Baltimore, MD area.

ATTOM’s Q4 2020 special report also noted that five of the seven western counties in the top 50 were in northern California, while Illinois had eight of the nine midwestern counties among those most vulnerable. Outside of Florida and Maryland, the only southern state with more than two counties in the top 50 was Louisiana.

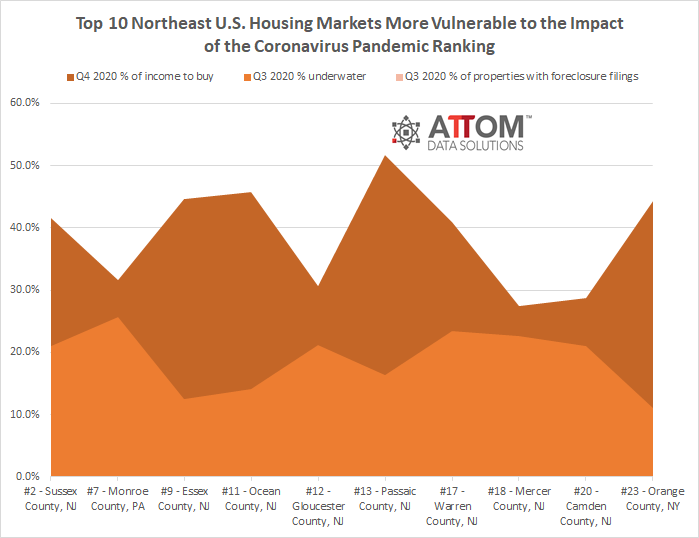

In this post, we take a closer look at those regions both more and less vulnerable to the impact of the Coronavirus pandemic in Q4 2020, to reveal where the top 10 counties in each category ranked and why. The top 10 markets in the Northeast that were more vulnerable to the impact of the Coronavirus pandemic in the fourth quarter included:

#2 – Sussex County, NJ

#7 – Monroe County, PA

#9 – Essex County, NJ

#11 – Ocean County, NJ

#12 – Gloucester County, NJ

#13 – Passaic County, NJ

#17 – Warren County, NJ

#18 – Mercer County, NJ

#20 – Camden County, NJ

#23 – Orange County, NY

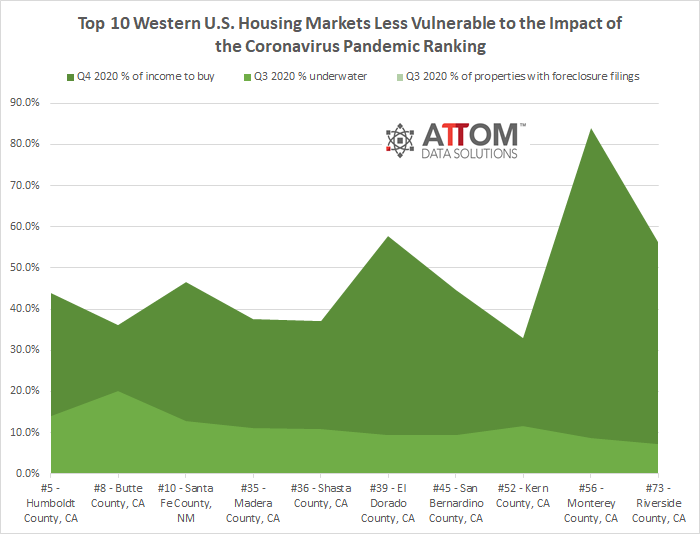

On the other end of the spectrum, the top 10 markets in the West that were less vulnerable to the impact of the Coronavirus pandemic in the fourth quarter included:

#5 – Humboldt County, CA

#8 – Butte County, CA

#10 – Santa Fe County, NM

#35 – Madera County, CA

#36 – Shasta County, CA

#39 – El Dorado County, CA

#45 – San Bernardino County, CA

#52 – Kern County, CA

#56 – Monterey County, CA

#73 – Riverside County, CA

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.