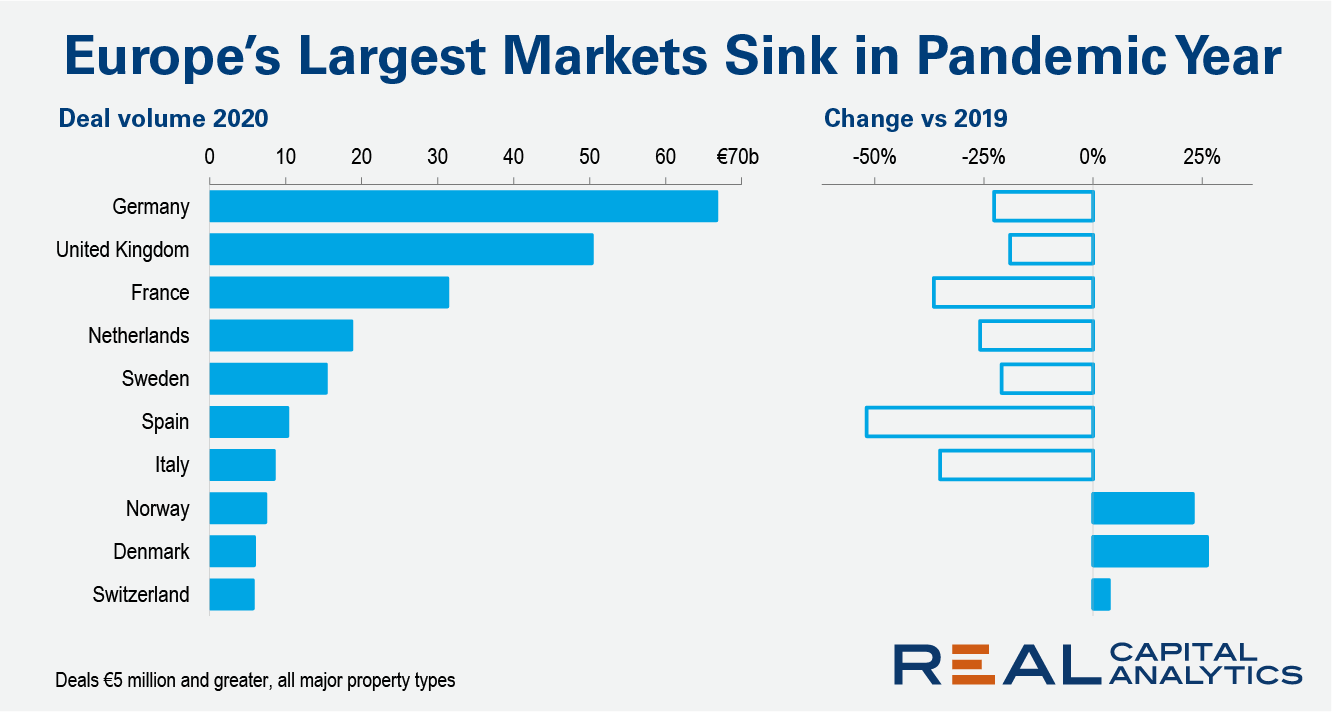

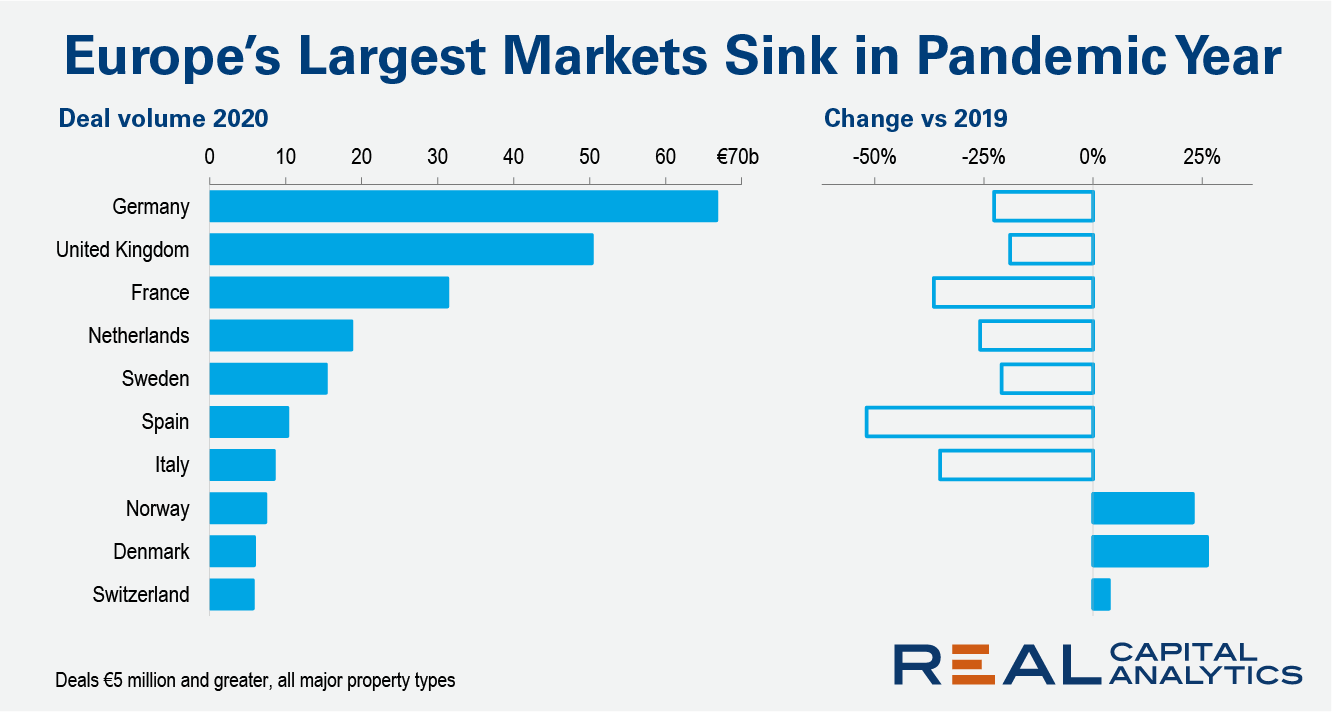

Commercial property sales activity in Europe tumbled by just over a quarter in 2020 in the face of challenges from the Covid-19 pandemic, with a steeper drop seen into the close of the year, the latest Europe Capital Trends report shows.

Investment volume across all property types dropped 27% versus 2019. In the fourth quarter, activity was 44% lower than the same period a year earlier, when a record total of commercial property deals closed.

The shift in investment to the apartment and industrial sectors, which was evident before the pandemic, escalated. Deal volume for these two sectors accounted for 37% of all European transaction activity in 2020, a new record share and greater than the amount spent on offices for the first time.

Sales activity in the apartment sector aided annual deal totals for Germany and the U.K., with deal volume in both countries falling less than the aggregate European decline. Transaction volume in France dropped more sharply, falling 37% versus 2019, though Paris just retained its status as the number one European market, ahead of London.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.