In this Placer Bytes we dove into the Q4 data surrounding the Yum! Brands’s portfolio, Chipotle and how 2021 has kicked off for these QSR leaders.

Yum! Brands

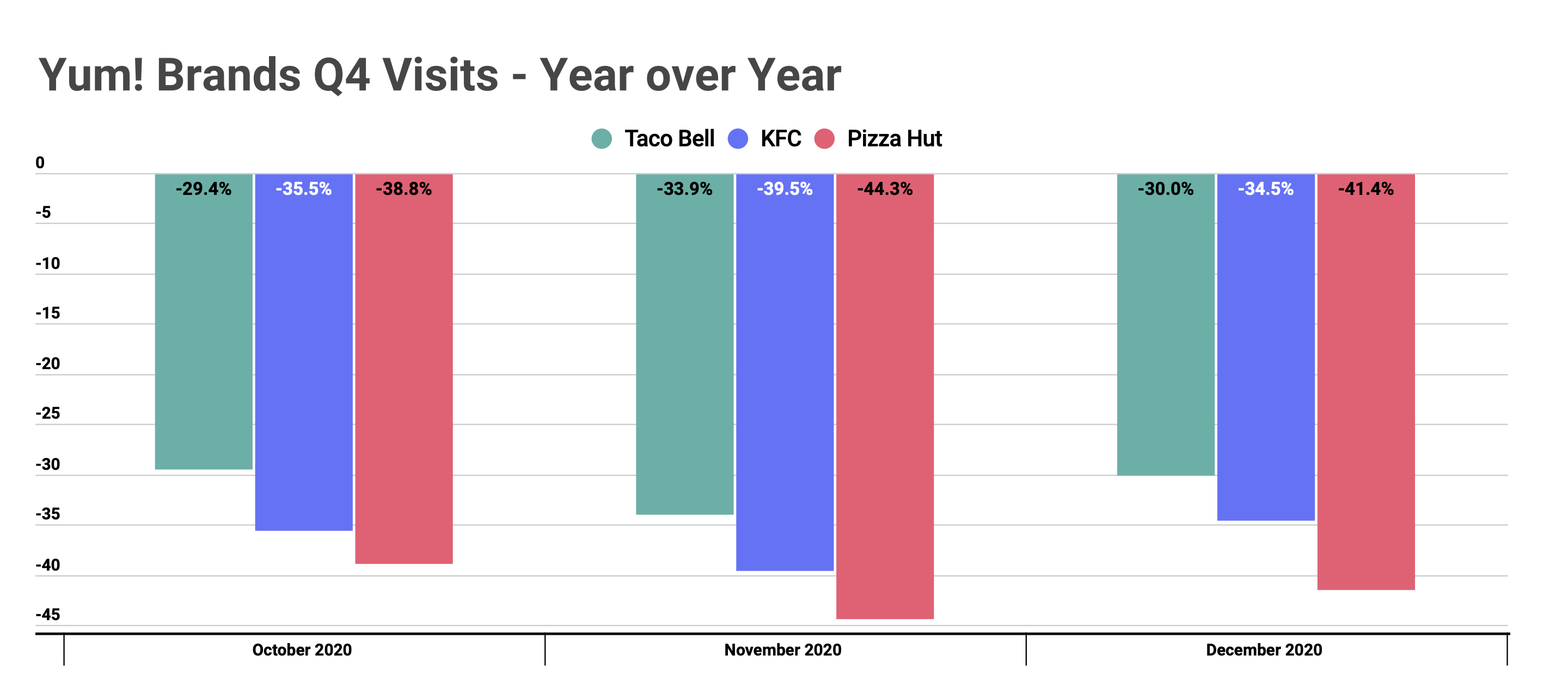

Back when we checked in on Yum! Brands’s most popular chains, Taco Bell, KFC and Pizza Hut, monthly visits were still significantly down for all three brands, with Taco Bell showing the most severe year-over-year declines in traffic. And while visits are still down, the Yum! Brands’s portfolio is showing strong signs of recovery, even after the resurgence of COVID cases drove an increase in the year-over-year visit gap across the retail and restaurant landscape.

Visits for KFC were down 34.5% in December, a 5.0% improvement in the visit gap compared to November. Taco Bell also showed positive momentum with the visit gap shrinking by 3.9% during the same timeframe with Pizza Hut showing 2.7% improvement. And this is without considering the strength all three brands have in drive thru, takeaway and delivery. In fact, Pizza Hut, the brand with the most significant year-over-year declines, may be the best positioned as its orientation to delivery and high value meals is perfectly suited for the current environment.

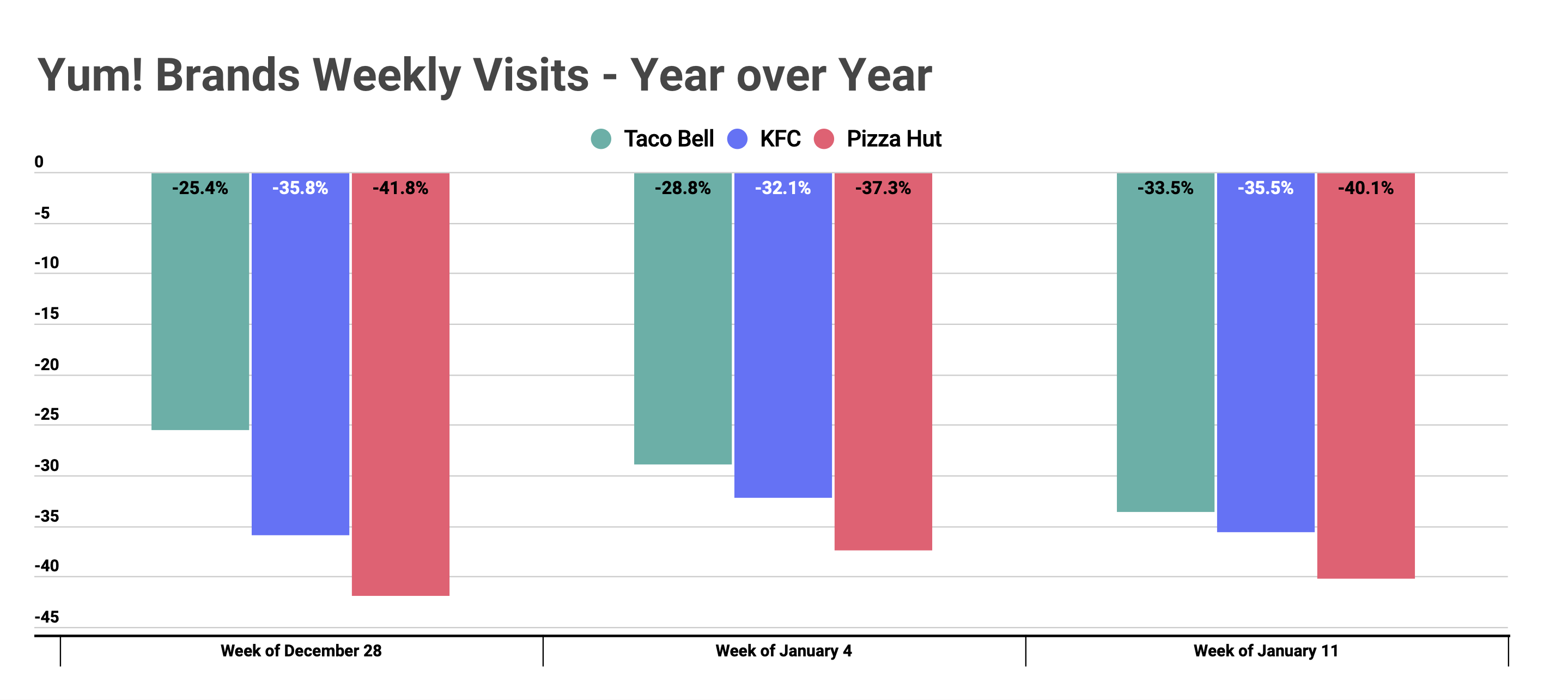

And when looking at weekly data from January 2021 we see visits continuing to move closer to normalcy. All three brands saw average weekly visits on par or ahead of the December visit gap with average weekly visits down just 29.2% for Taco Bell the weeks beginning December 28th, January 4th and January 11th. The in-store progress in this current environment alongside the obvious strength in other channels like delivery, should be seen as a tremendous step forward. And the fact that these brands are also so well aligned with key trends, like providing high value offerings during a period of extended economic uncertainty, could portend even bigger things in the coming year.

Chipotle

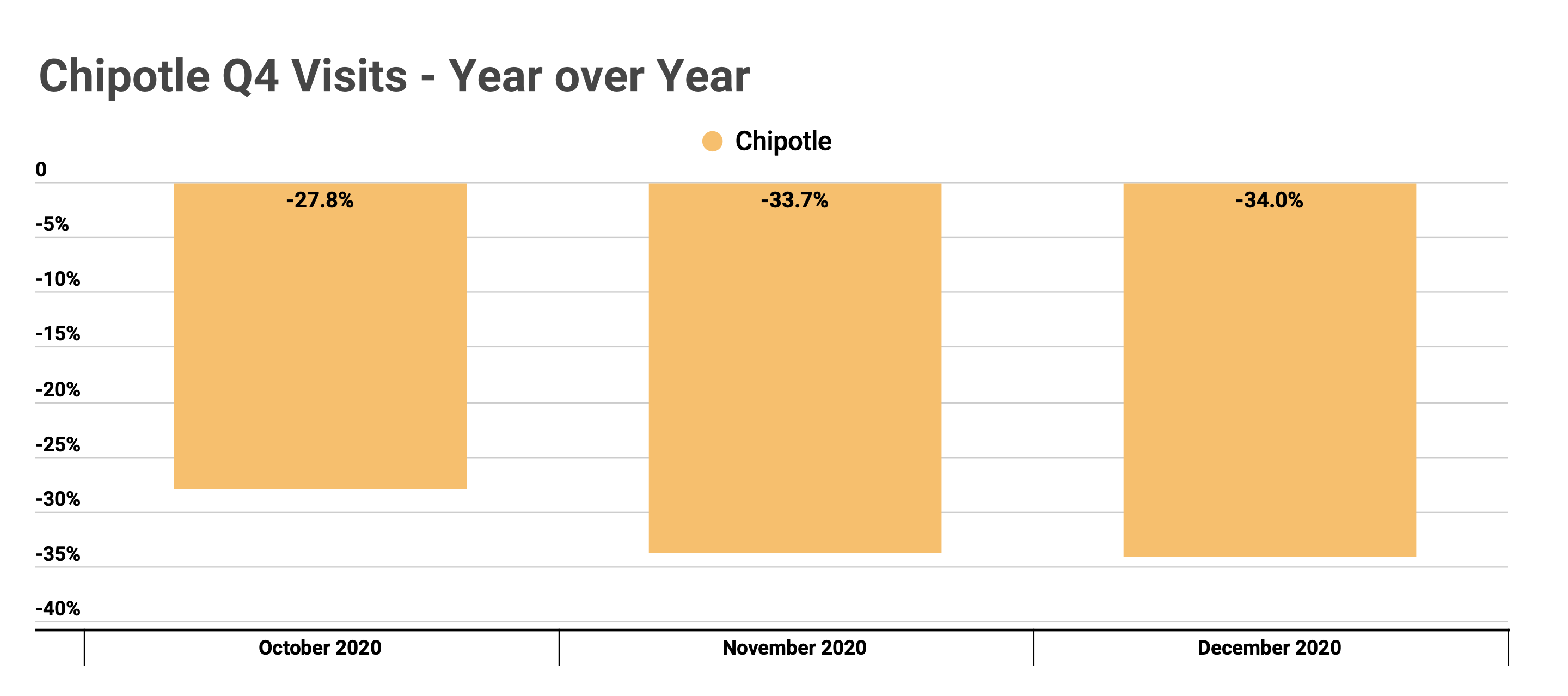

Chipotle started Q4 on a very strong note. Visits to the popular Mexican chain were down just 27.8% year over year in October, a near 4.0% jump closer to 2019 levels compared to the month prior. But, November and December didn’t prove to be as strong. Traffic in November was down 33.7% and fell even further off pace in December, when visits were 34.0% down year over year, marking the worst month the brand has seen since June 2020. However, this was clearly impacted by the resurgence of COVID cases potentially and may have potential indicated strength as the visit gap didn’t increase even more.

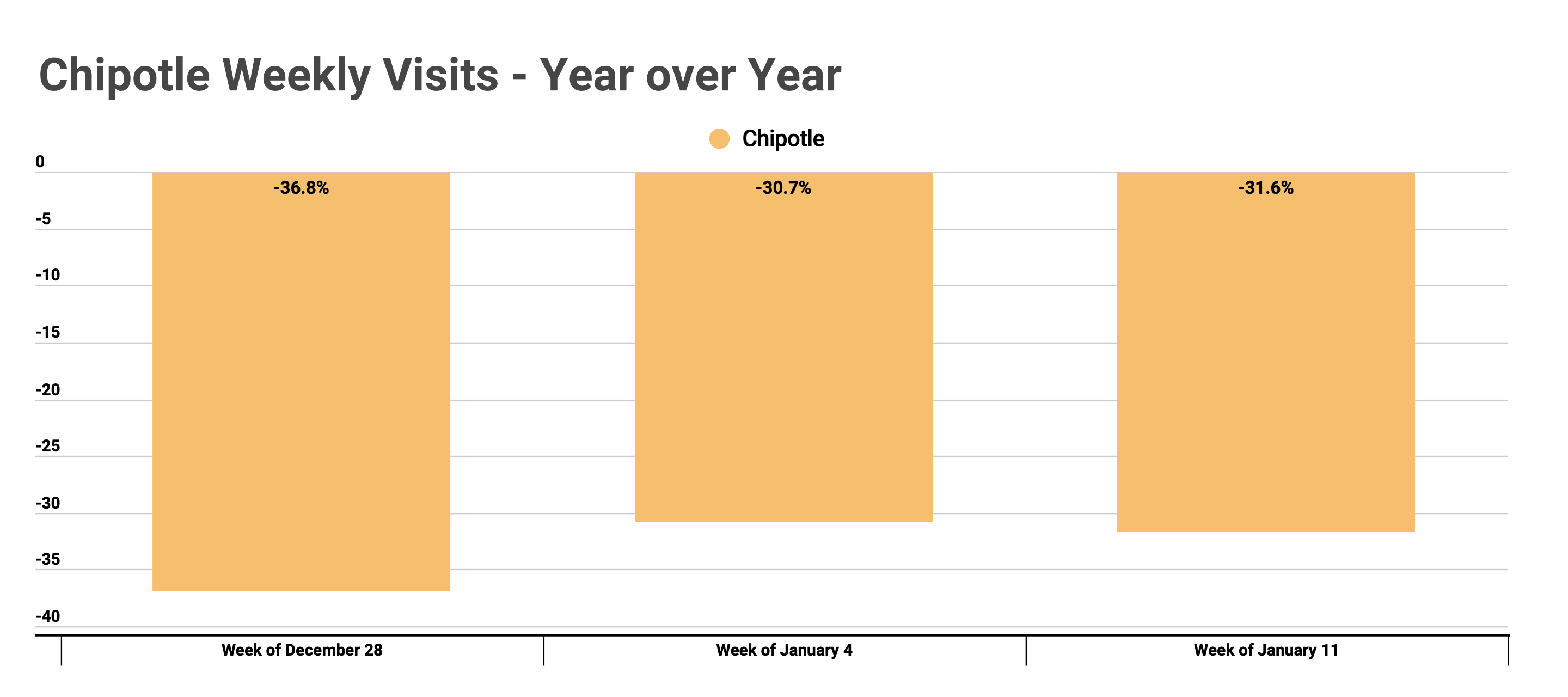

And this idea is further strengthened when looking at the kickoff to 2021. The weeks beginning December 28th, January 4th and January 11th all marked strong steps forward for the brand with the visit gap down to just 36.8%, 30.7% and 31.6% year over year, respectively for those weeks. Should this trend continue, Chipotle could be in store for a very rapid rebound.

Chipotle also seems to be committed to enhancing its user-experience to drive additional traffic with its addition of its “Chipotlanes,” its newly added drive-thru lanes. So, it will be interesting to watch this brand move through the new year with new opportunities and digital enhancements.

How will these brands perform throughout 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.