In this Placer Bytes, we take a look at overall retail performance in 2020 and 2021 and dive into Southeastern’s Winn Dixie – even without their IPO.

Retail Category – Year over Year

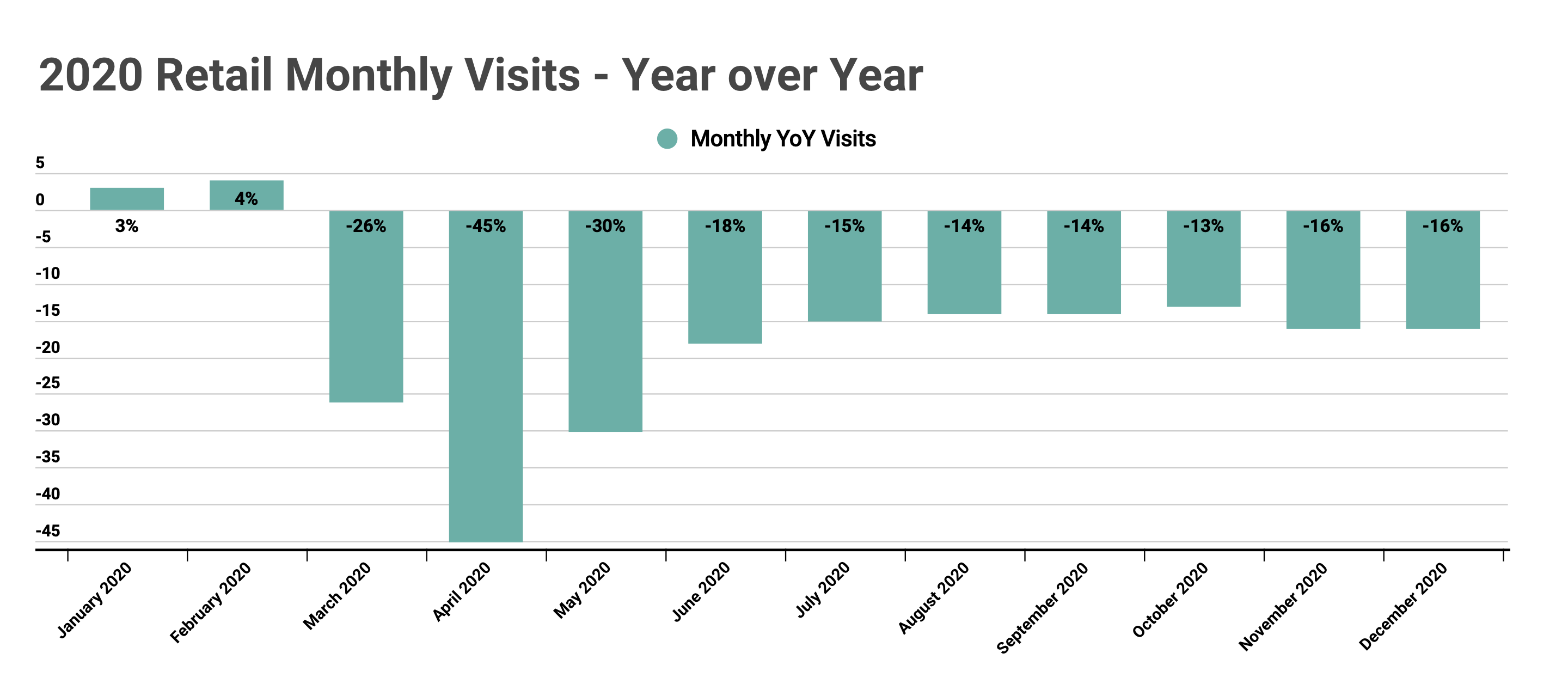

The wider retail sector had a memorable 2020 and while there were some categories that outperformed, it was certainly a challenging year for offline retail. While the wider retail segment saw visits up 3% and 4% respectively in January and February, the havoc of the pandemic made its presence felt in the spring. Visits in March, April, and May were down 26%, 45%, and 30% respectively nationwide.

But, just as significant as the decline, was the pace of the recovery. While clearly buoyed by stronger performing sectors, the overall retail space saw visits down just 13% year over year in October. But again, the resurgence of COVID cases ahead of the holiday season left a substantial mark. Visits in November and December were down 16% year over year, with the combination of rising COVID cases and the high mark the 2019 holidays set contributing to the gap.

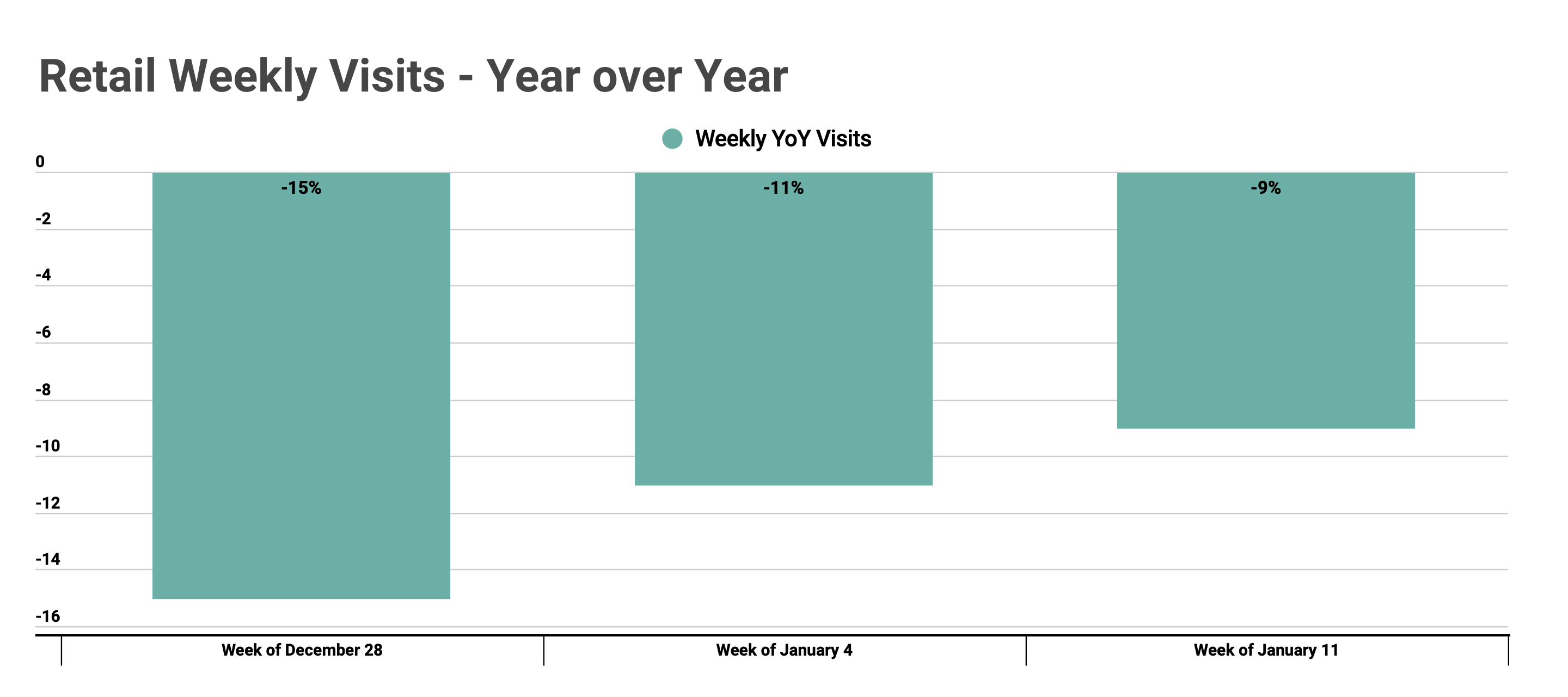

But early indications from 2021 are very positive. Visits the week beginning January 11th were down just 9%, a significant improvement on year-over-year visits gaps of 15% and 11% the weeks beginning December 28th and January 4th.

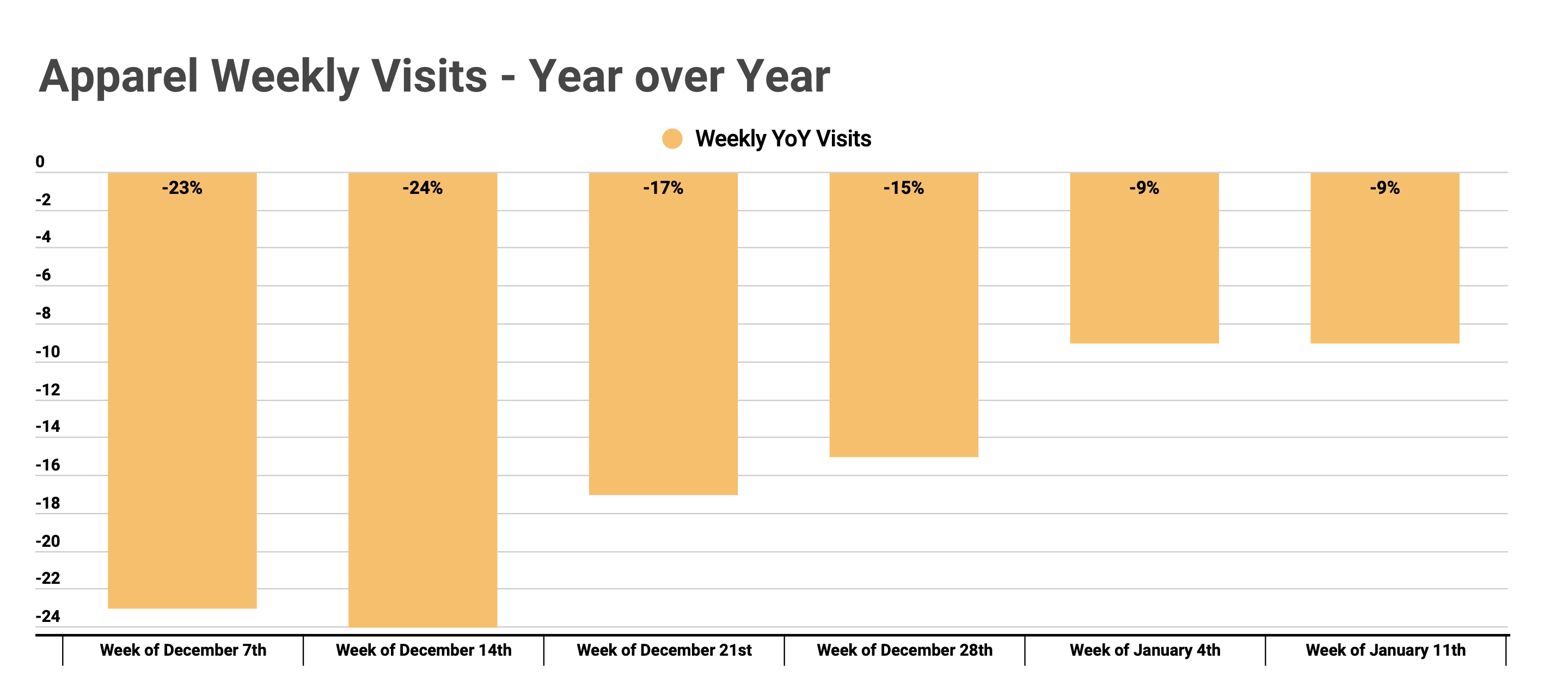

And the rebound is being seen even in one of the hardest-hit sectors – apparel. Visits to the apparel category were down just 9% the weeks beginning January 4th and 11th, a marked improvement on the four weeks prior when the average visit gap was 20%. Granted, it is far easier to shrink the visit gap in a less-trafficked month like January, the pace of recovery in the overall retail category is a very positive sign.

The Next Grocery IPO

Albertsons went public in 2020, and the timing couldn’t have been better for a brand we think could have an even stronger year to come. And what seemed like the next grocery IPO on the docket did have a similar feel to it. Southeastern Grocers, coming off bankruptcy in 2018, was heading to the public markets, and one big reason could be the strong success of Winn-Dixie, a key brand for the company.

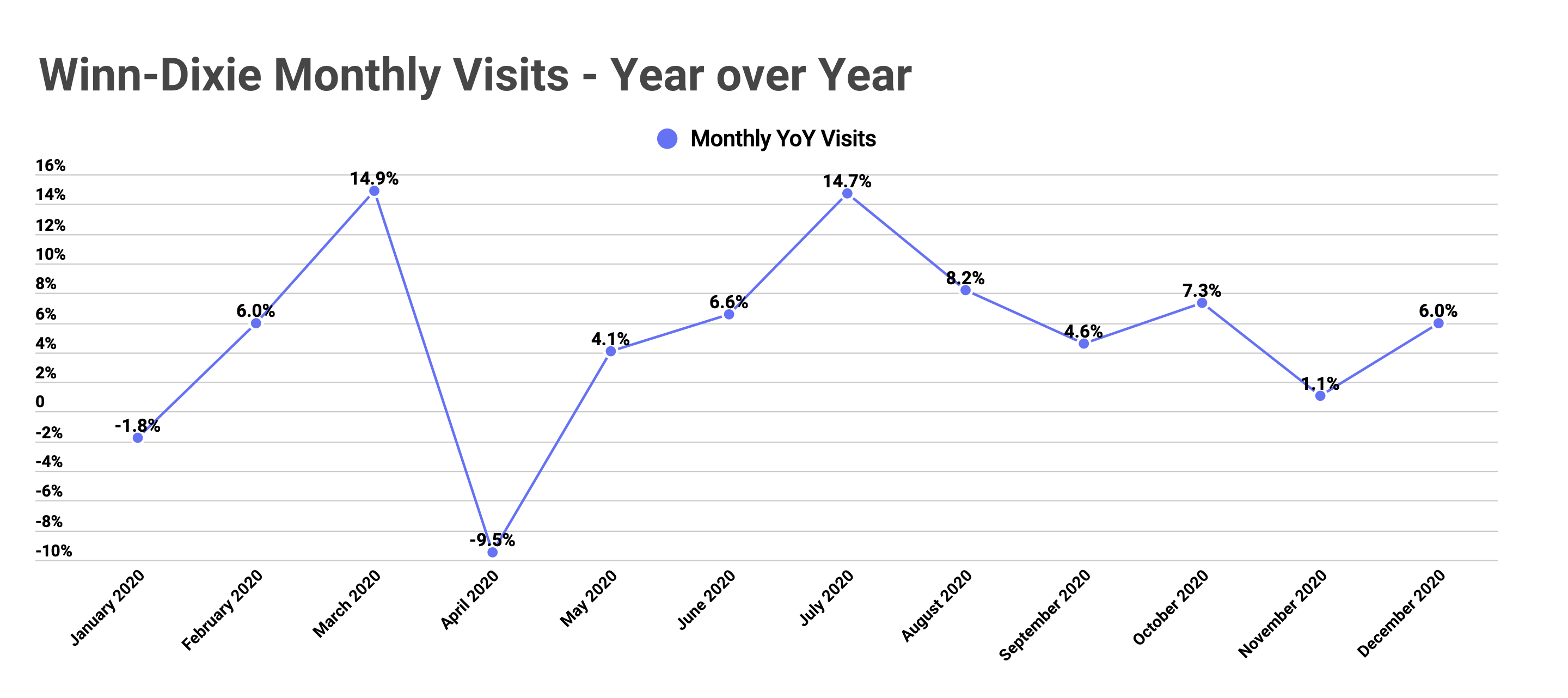

Following 2019 when the average month saw a visit gap of 6.3% year over year, Winn-Dixie saw that number skyrocket in 2020, with the average month seeing year-over-year growth of 5.2%. And while this spiked in March and July with visits up 14.9% and 14.7% respectively year over year, the growth was very consistent. Winn-Dixie benefited from a trend that boosted many traditional grocers, a rise in mission-driven shopping, and an economic scenario that privileged home-cooked meals.

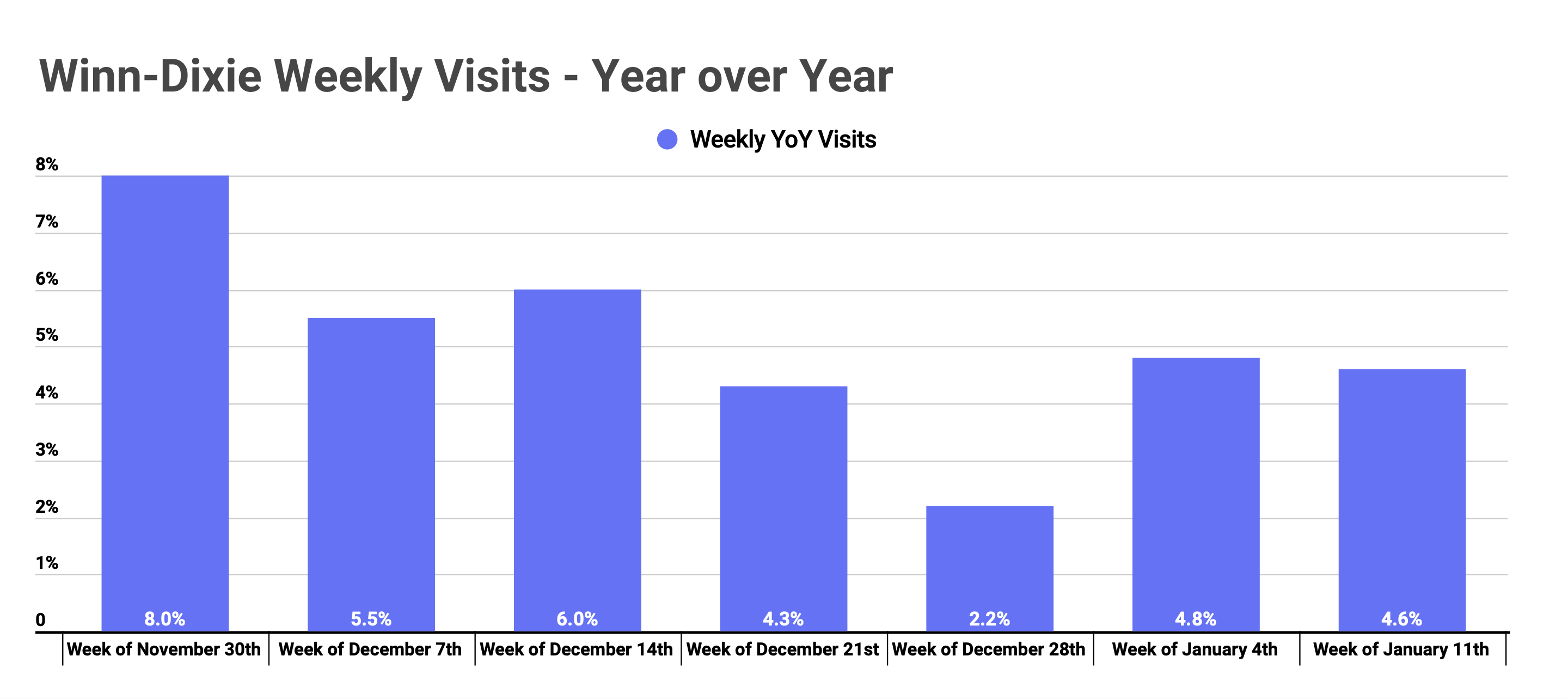

And this trend shows no signs of abating. Since the week beginning November 30th, weekly visits have been up an average of 5.0% year over year. Why? One, it’s clear that Winn-Dixie is doing something right in terms of keeping customers happy. Two, it is well aligned with the current environment. The focus on being a ‘one-stop-shop’ grocer in the current context is very valuable especially when the brand is also seen as a high-value option when compared with other food options. Should Winn-Dixie prove capable of building on this moment in time to drive a long-term turnaround, the potential could be massive.

Will the retail recovery continue in January? Can Winn-Dixie produce an even bigger 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.