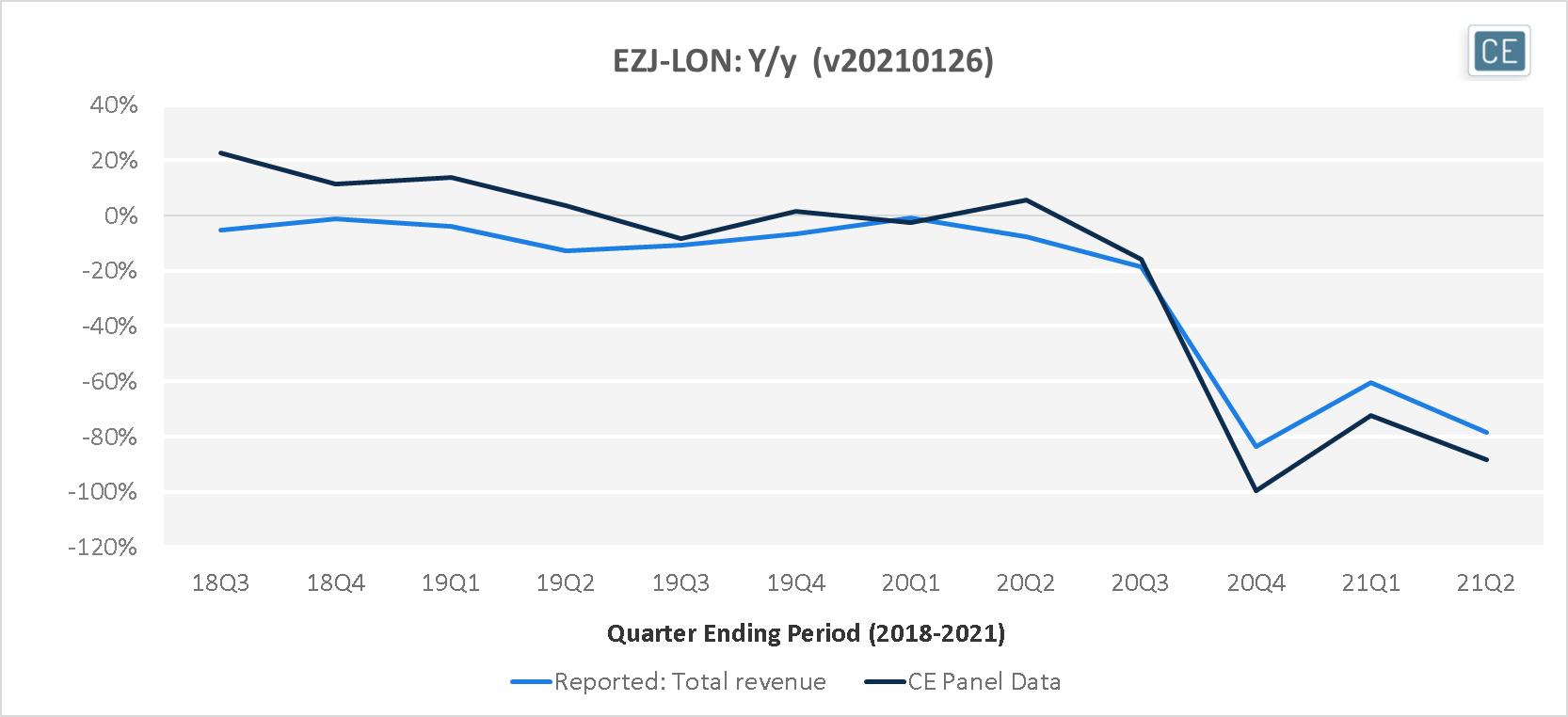

Consumer Edge’s recently launched UK dataset has already proven to be very predictive for several company earnings reports. One such company is easyJet, where a strong correlation provides confidence in Consumer Edge airline data overall. In today’s Insight Flash, we take a deep dive into UK travel trends, digging into how low-cost players like easyJet are holding up.

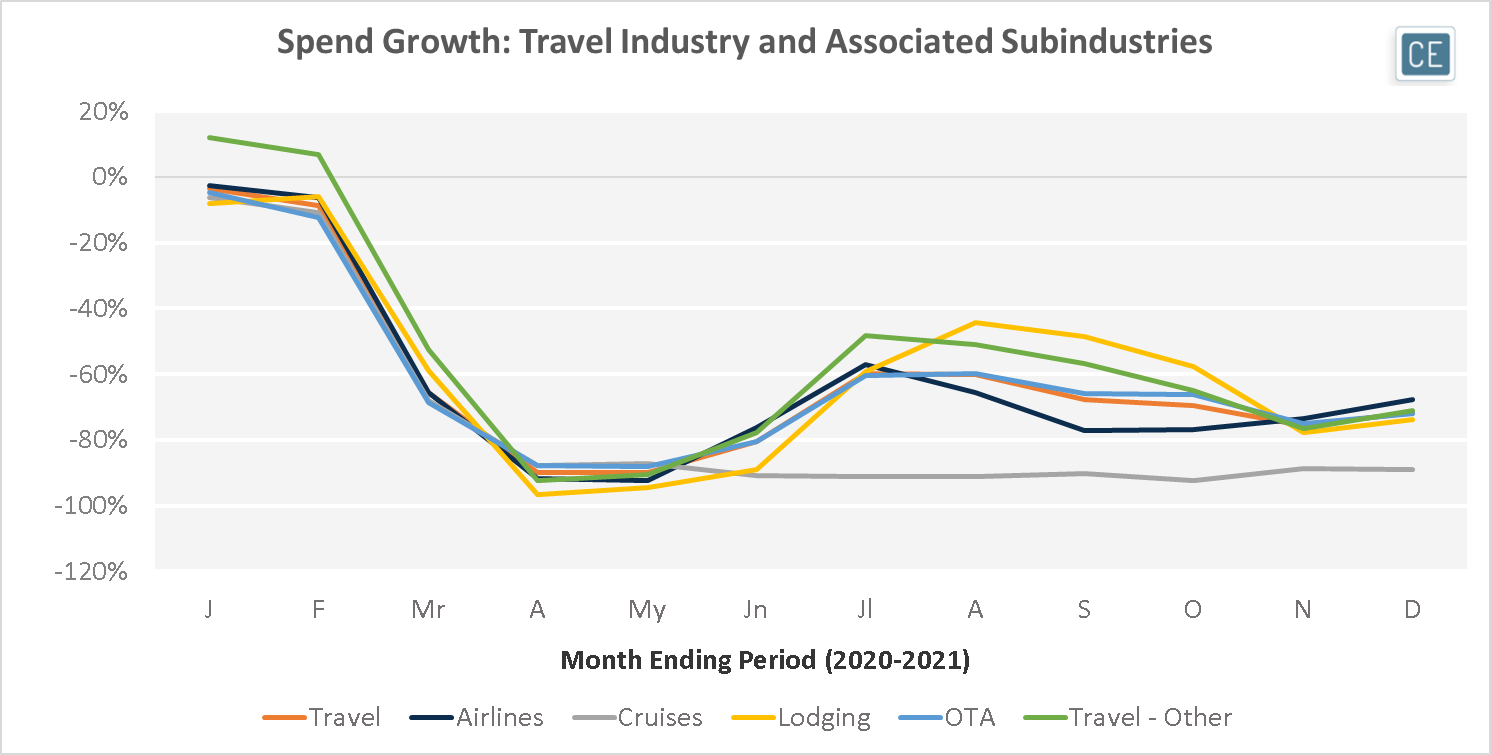

The UK Travel industry lost almost all of its sales in April and May 2020, with sales down -90% y/y. As trends recovered into the fall, Lodging was a standout for outperformance with spend down by only about half of the year before rate. Cruises have been the worst performer, remaining depressed at a -90% y/y decline in spend through December. Airlines have fared somewhere in between, with sales down by about three-quarters y/y in the fall, and a slight uptick to declines of only about two-thirds during holiday travel in December.

UK Travel Industry

Note: Credit card spend does not take into account rebooked travel

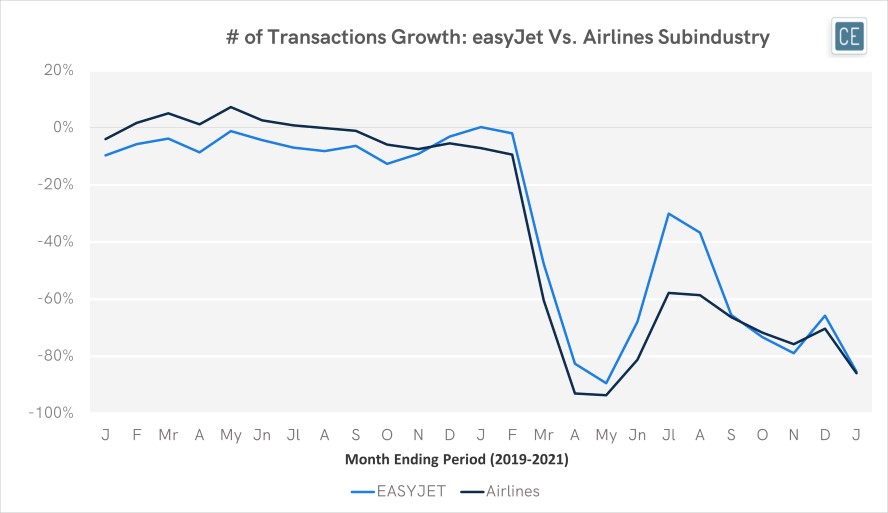

easyJet has been less susceptible to COVID-19 woes than the rest of the Airlines subindustry. Its declines in y/y transaction volume weren’t as sharp as the industry overall in April and May. And, during the summer travel season, transactions were only down -30% in July (half the decline of the industry overall) and -37% in August (two-thirds the rate of the industry overall).

easyJet Transaction Growth

Note: Credit card spend does not take into account rebooked travel

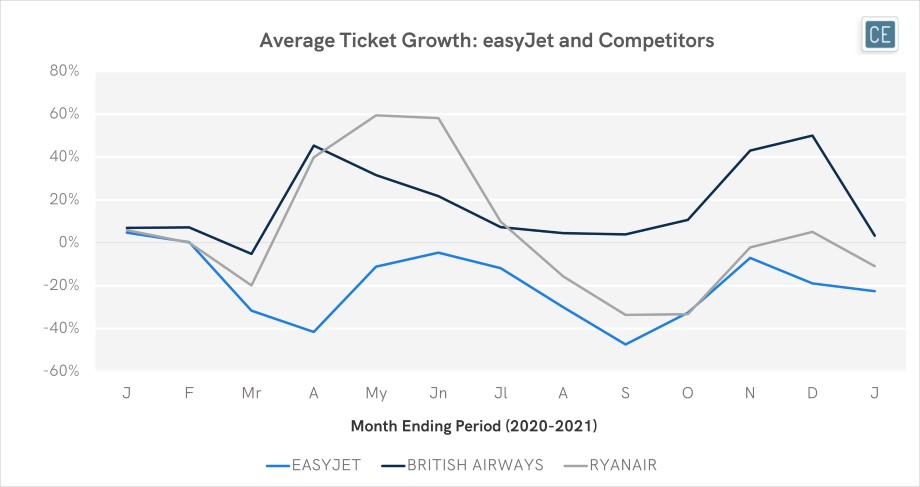

Pricing strategy may have been a tailwind for the airline. Both British Airways and Ryanair had soaring average spend per transaction at the beginning of the pandemic in April – up 45% for British Airways and 40% for Ryanair. Meanwhile, eayJet’s average spend per transaction was down -42%. These lowered rates remained consistent in the subsequent months, although Ryanair did eventually change course to match the cuts.

Average Spend per Transaction

Note: Credit card spend does not take into account rebooked travel

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.