First-Time Home Buyers Account for Greater Share of Mortgage Applicants in 2020

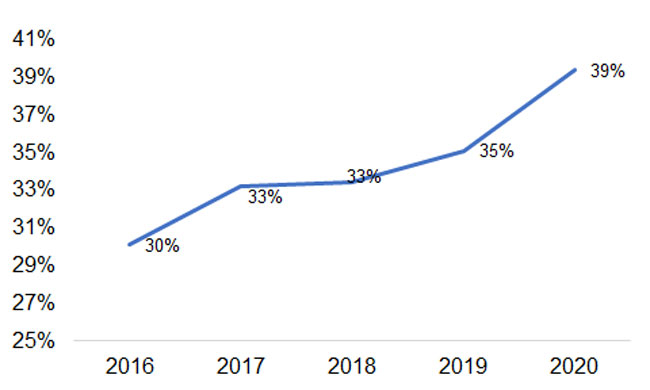

First-time home buyers have been a growing share of the home buying population, a trend that accelerated in 2020. According to CoreLogic Fraud Consortium Loan Application data, the share of first-time buyers surged to 39% in 2020, up from 30% in 2016 (Figure 1).[1]

Figure 1 The share of first-time home buyers among purchase-loan applicants jumped in 2020

While it may seem that first-time homebuyers have been highly encouraged by the onset of the pandemic and ensuing drop in mortgage interest rates, , our previous analysis suggests that the wave of first-time buyers was imminent irrespective of the pandemic as the largest cohort of millennials were settling down and approaching the median first-time home buying age of 32.[2]

Still, homeowners, and by extension real estate agents, are facing incredible acceleration in finding the dream home. Coupled with rising home prices across the United States and a newly virtualized homebuying experience, prospective homeowners and their agents are grappling with new challenges.

The following analysis explores the representation of first-time home buyer applications by geography to shed a light on where first-time buyers are finding opportunities to purchase a home, and where the share of first-time buyers in 2020 may have increased.[3]

Top 20 Counties with Highest Share of First Time Buyers

While the overall share of first-time buyers reached 39% in 2020, the presence of first-time buyers relative to repeat buyers is higher in some geographies. Out of the 500 counties with most mortgage applications in 2020, Figure 2 lists the top 20 counties with the highest share of first-time buyers.

Interestingly, 10 out of the 20 counties with the highest share of first-time buyers are in the New York Metropolitan area. In fact, the top 4 counties are in New York metro area and each has at least two-thirds of mortgage applicants being first time buyers.

Note, however, that many of the top 20 counties with the highest share of first-time buyers in 2020 also ranked among the top in 2019, especially the counties surrounding New York City. Only Suffolk, Massachusetts; Milwaukee, Wisconsin; Monroe, Pennsylvania; and Saint Louis City, Missouri were not ranked among the top 20 in 2019. Figure 2 also enumerates changes in the share of first-time buyers from 2019, and while Suffolk, Massachusetts, showed the most significant increase, Bronx and Kings, New York, both had a jump of more than 6 percent points.

Further, counties’ home prices can explain the large share of first-time buyers. For example, in the top 4 New York metro counties, first time buyers paid an average price which is about half or less of what the average price paid was in New York, New York (Manhattan) – at over $1.3 million. Among other metro areas, Clayton County in Atlanta is the metro’s most affordable county. At the state level, it is then no surprise that New York state ranks on top with 54% being first-time buyers, followed by Washington DC (51%), West Virginia (51%), Rhode Island (50%), Massachusetts and New Jersey (at 49%). The states with the lowest shares of first-time buyers are Idaho (28%), and Nevada, Arizona and North Carolina (each at 34%).

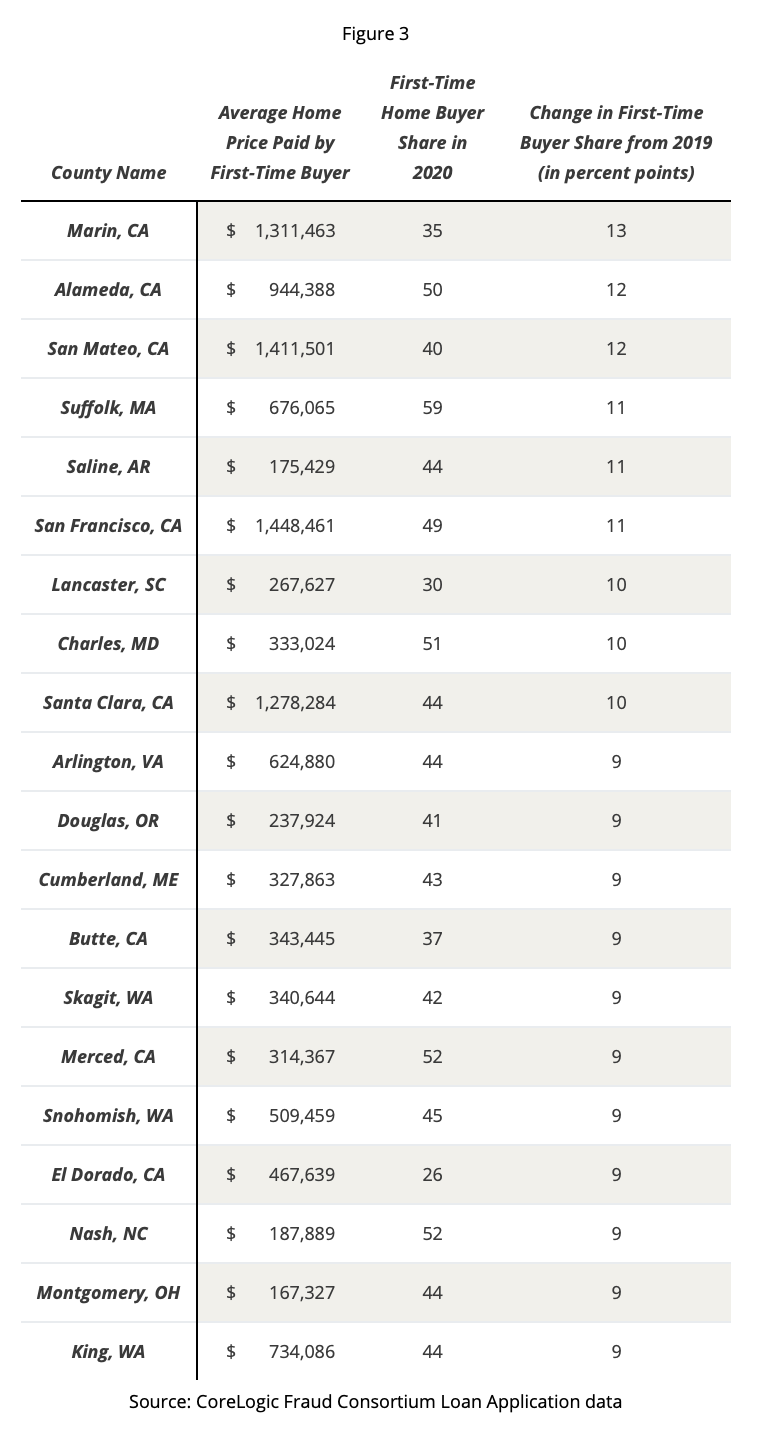

Top 20 Counties with Greatest Uptick in First Time Buyers

Nevertheless, while the presence of first-time buyers has been persistent in the Northeast over the last few years, affordability gains due to record low mortgage rates coupled with a pandemic-induced desire for more space, had led to a jump in first-time homebuyer applicant share in other areas.

Figure 3 ranks the top 20 counties by the increase in first-time buyers share between 2019 and 2020. In contrast to Figure 2, Figure 3 shows disproportional impact on first-time buyer share in San Francisco Bay Area counties. Marin, Alameda and San Mateo – which encircle San Francisco to the north, east and south – all saw a 12 to 13 percentage point increase in first-time home buyer share. It is notable to see the jumps in more expensive counties such as Marin and San Mateo as more affordable Alameda has generally absorbed a larger share of the new buyer population in previous years. San Francisco has also seen a solid jump in first-time buyer share.

In addition to the Bay Area counties, the other California counties that also saw a jump in first-time applicants are also located close to an urban/employment center, such as Merced’s proximity to San Jose and El Dorado’s proximity to Sacramento. These locations are also close to other outdoor attractions, such as Lake Tahoe and Yosemite National Park. Taken together, while some first-time buyers may be seeking to purchase a home outside the traditional urban centers, they are remaining strategically close to employment and urban amenities.

© 2021 CoreLogic, Inc., All rights reserved.

[1] First-time buyer share is likely to be higher than shown in other sources as the data excludes all-cash buyers which are generally repeat buyers.

[2] 2020 Profile of Home Buyers and Sellers, National Association of Realtors

[3] The analysis is based on the number of applicants who applied for home-purchase mortgage loans in 2019 and 2020. The analysis includes all home-purchase mortgage applications, accepted or not, from January 2019 through December 2020. Investors and second-home buyers were excluded in the analysis.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.