Source: https://www.corelogic.com/blog/2021/2/single-family-rent-growth-accelerated-at-the-end-of-2020.aspx

U.S. Single-Family Rents Up 3.8% Year Over Year in December

Overall Single-Family Rent Growth

U.S. single-family rent growth strengthened in December 2020, increasing 3.8% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.9% rate recorded for December 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

Single-Family Rent Growth by Price Tier

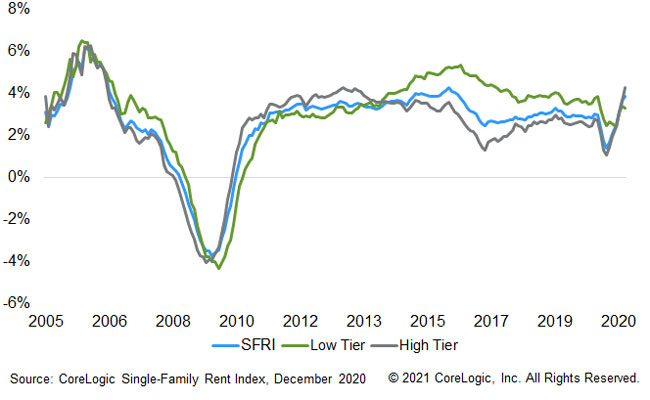

An uneven U.S. job recovery is reflected in price tier rent growth (Figure 1). Unlike the high-priced tier, rent growth in the low-priced tier remains below year-pre-pandemic levels as the recession has disproportionately affect lower-wage workers. Rent prices for the low-end tier, defined as properties with rent prices less than 75% of the regional median, increased 3.3% year over year in December 2020, down from 3.5% in December 2019. Meanwhile, higher-priced rentals, defined as properties with rent prices greater than 125% of a region’s median rent, increased 4.3% in December 2020, up from a gain of 2.4% in December 2019.

Figure 1: National Single Family Rent Index Year Over Year Percent Change By Price Tier

Metro-Level Results

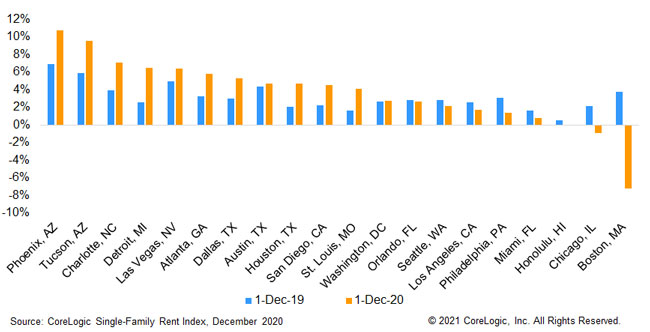

Figure 2 shows the year-over-year change in the rental index for 20 large metropolitan areas in December 2020. Among the 20 metro areas shown, Phoenix had the highest year-over-year rent growth in December as it has since late 2018, with an increase of 10.7%, followed by Tucson, Arizona (+9.5%), and Charlotte, North Carolina (+7.1%). Three metro areas experienced annual declines in rent prices: Boston (-7.2%), Chicago (-.9%) and Honolulu (-0.1%).

Figure 2: Single Family Rent Index Year Over Year Percent Change In 20 Markets

While 8 of the 20 metros shown in Figure 2 had lower rent growth than a year ago, Boston had the largest deceleration in rent growth, showing annual rent growth of 11 percentage points lower than in December 2019. The weakness might be attributed to a large number of students choosing to not return to Boston — a city that’s home to 35 colleges and universities — but instead opting to continue virtual learning in their hometowns.

U.S. unemployment rates fell after the initial increase in April, however, some areas of the country are continuing to experience higher rates of job loss — adversely impacting rental demand and slowing rent price growth. For example, unemployment in Austin, Texas, decreased to 5.3% in December 2020 while Honolulu’s unemployment decreased to 8.4%. And while year-over-year single-family rent in Austin grew by 4.7% in December, it decreased by 0.1% in Honolulu. As states begin managing the administration of vaccines as well as mitigating continued unemployment concerns, rent prices will likely continue to experience mixed growth rates in metros across the nation.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.