In this Placer Bytes, we dive into the impressive results from the TJX portfolio, and the Q4 performances from Dillards and Macy’s.

TJX’s Impressive Reach

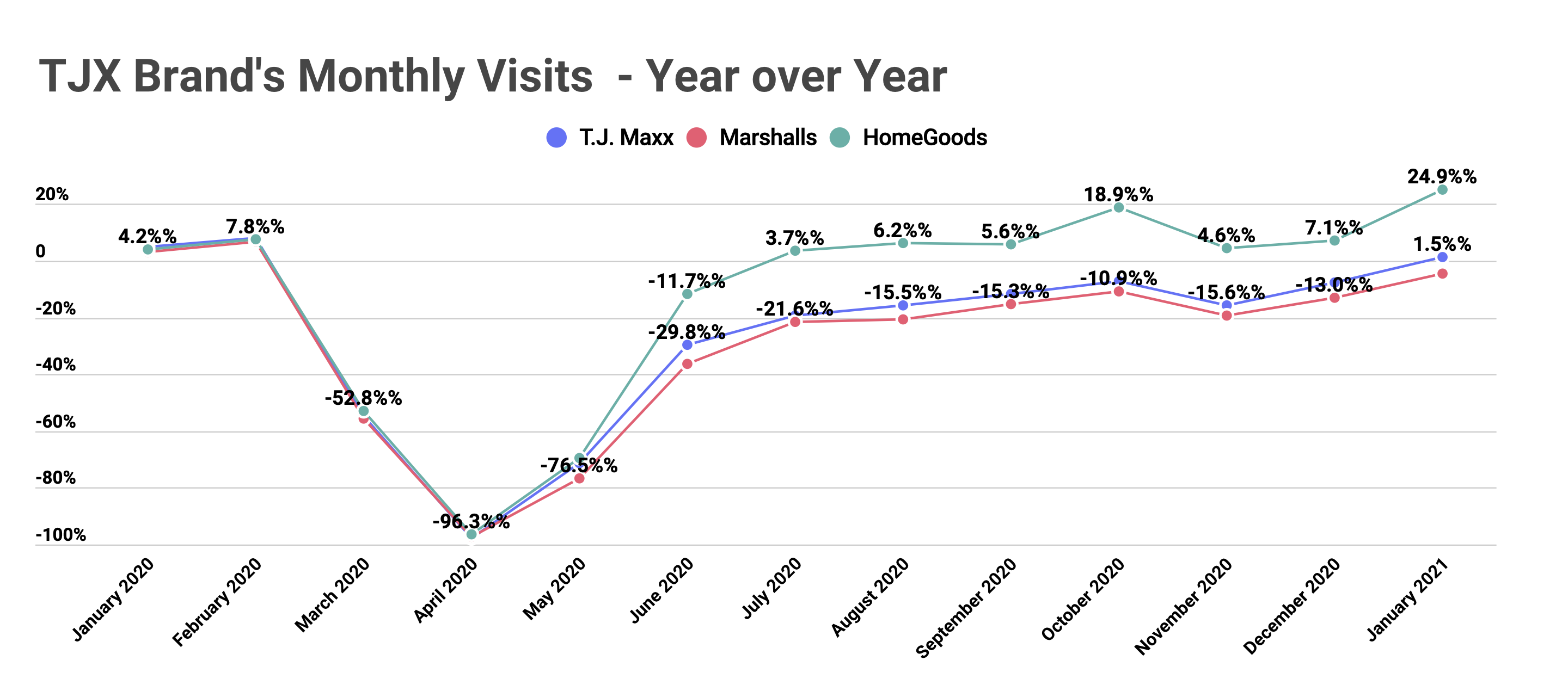

The wider TJX portfolio had an exceptional end to 2020 and a very strong start to 2021. Visits to T.J. Maxx, Marshalls, and HomeGoods locations quickly overcame a visit drop between October and November as COVID cases surged and then sustained the positive momentum into 2021.

T.J. Maxx saw visits down 15.6% in November before seeing the visit gap decrease to just 7.8% in December and actually reach 1.5% year-over-year growth in January. Marshalls saw a similarly impressive pace with the year over year visit gap declining to 13.0% in December and just 4.4% in January. HomeGoods continued to ride the home furnishings surge to visit growth of 4.6% in November, 7.1% in December, and a massive 24.9% year-over-year increase in January.

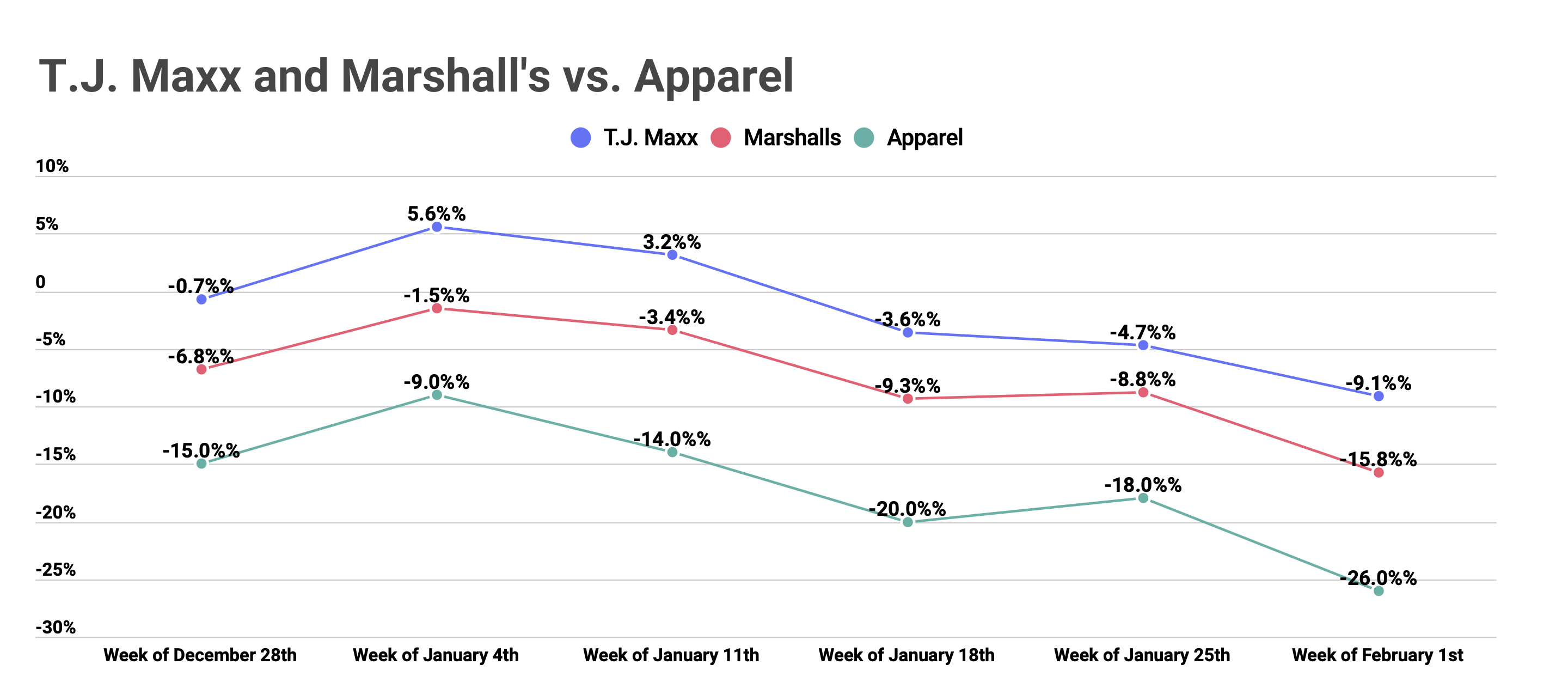

Even more impressive is that all three of these brands outpaced their respective sectors. Looking at weekly visits from the week beginning December 28th to the week beginning February 1st shows T.J. Maxx and Marshalls consistently outperforming the wider apparel sector by a large margin. The ability of both brands to provide significant value in an outdoor center seems to be propelling them ahead of the wider apparel space. And considering that the economic uncertainty driving much of this attention is unlikely to end anytime soon, there’s good reason to believe that these brands will continue to lead the way for many months, if not years, to come.

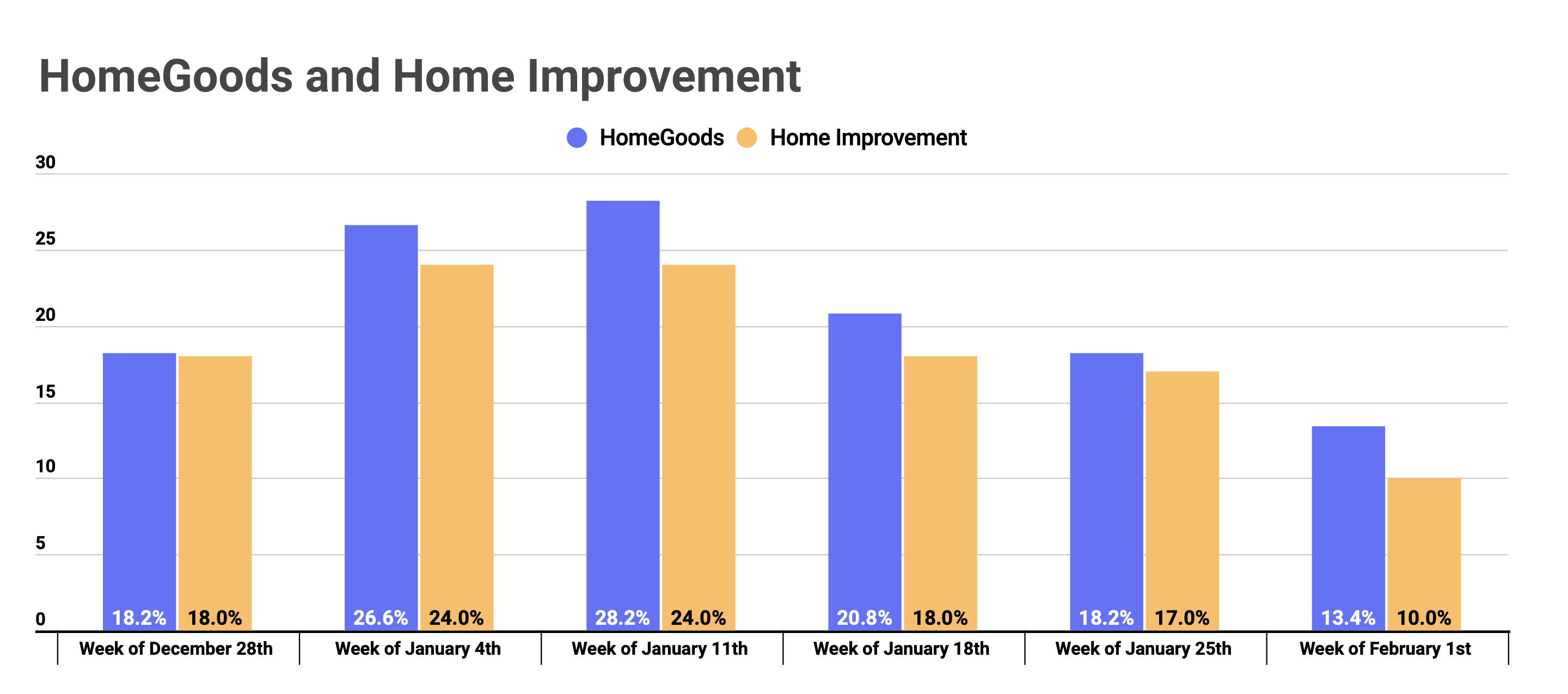

But perhaps the most impressive brand is actually HomeGoods. While T.J. Maxx and Marshalls outperformed in a struggling segment, HomeGoods outperformed in one of the strongest. Looking at the same period shows that HomeGoods’s visits consistently outpaced the exceptional performance of the overall home improvement category. And like its other TJX counterparts, the ability to provide high value in a high performing sector could mean strong results deep into the year.

Department Stores

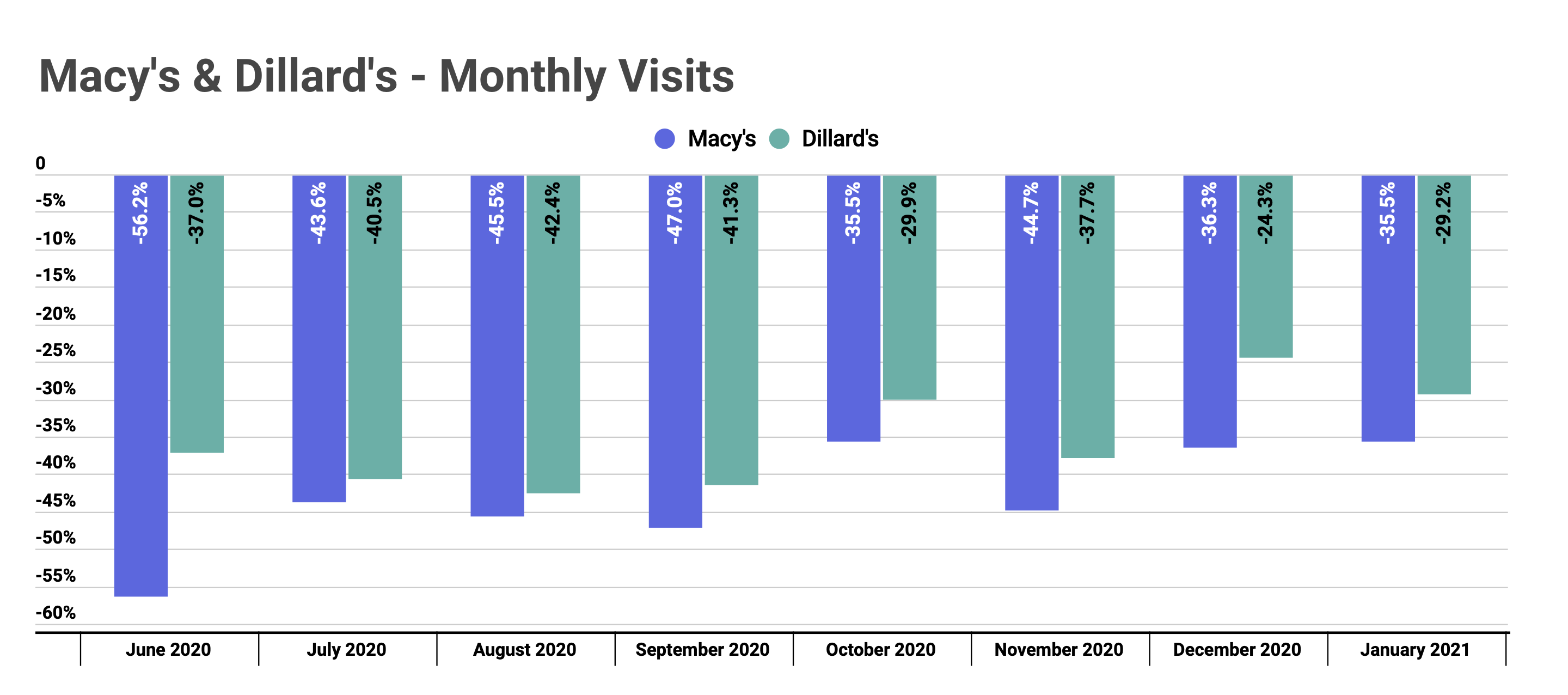

Department stores were clearly hit hard by the pandemic, and while newer and smaller formats may offer promise these brands are still relying on a rebound for their core assets. And there’s reason to believe that this recovery could happen faster than many expect. First, malls are recovering and this clearly provides a significant boost for the department store sector as a whole. Second, the data is clearly showing signs of recovery.

While visits saw a step back in November due to a resurgence of COVID cases and the comparison to 2019’s ‘normal’ holiday season, December and January were already showing significantly better results. Macy’s saw a 44.7% year-over-year visit gap in November shrink to 36.3% in December and 35.5% in January. Dillard’s saw a 37.7% year-over-year decline in November drop to just 24.3% and 29.2% in December and January respectively. Should they prove capable of continuing this pace as malls continue to recover, the rate of return could actually increase in the coming months. Alongside significant rightsizing efforts and tests around newer formats, there could be a much brighter future in store for this segment.

Will TJX companies continue to shine deeper into 2021? Will Macy’s and Dillard’s continue to progress closer to normalcy?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.