Direct-2-consumer (D2C) businesses have grown considerably over the last decade-plus. When companies such as Warby Parker and Allbirds launched, their mission to deliver goods big and small to customers’ front door was a unique option that piqued busy Americans’ interest.

Today, virtually anything you need or crave is now available for delivery online — dish sponges, glasses, socks, cleaning supplies, mattresses, deodorant, luggage, even your groceries for the week.

The business model has proven powerful: Last year, Edgewell attempted to acquire Harry’s just seven years after inception — though the FTC kiboshed that. Bonobos and Dollar Shave Club have both exited the startup realm with billion-dollar acquisitions to Walmart and Unilever respectively.

The proliferation of D2C has even reached marketing agencies. Kristina Monllos at Digiday reported recently that performance marketing agencies will soon look to create their own D2C brands in-house. Agencies such as Boomn, Homestead Studios and Freelance Crew are expected to launch in-house D2C brands sometime this year.

Part of Boomn’s in-house D2C strategy will rely on acquiring brands from fledgling companies that have an opportunity for massive growth. And given most D2C companies either completely sunk or swam in 2020, this will likely prove a successful strategy.

Nationwide stay-at-home orders that were in place for much of last year — and this year, for that matter — created a moment for D2C brands. In fact, eMarketer anticipated a rise to $18 billion in the U.S. D2C e-commerce sales last year and initial global predictions were exceeded by year’s end.

As a result, many D2C companies shifted marketing and ad strategies to entice consumers they are the premium option for at-home buying. Aside from the reports and predictions above, we can see this in the data my own company collects around marketing intelligence. Let’s take a look at a few of the categories some of these D2C companies shifted toward.

Streaming Now — Like, Right Now

Americans love instant gratification, and streaming brands certainly had a moment in 2020 with many at home with not much to do.

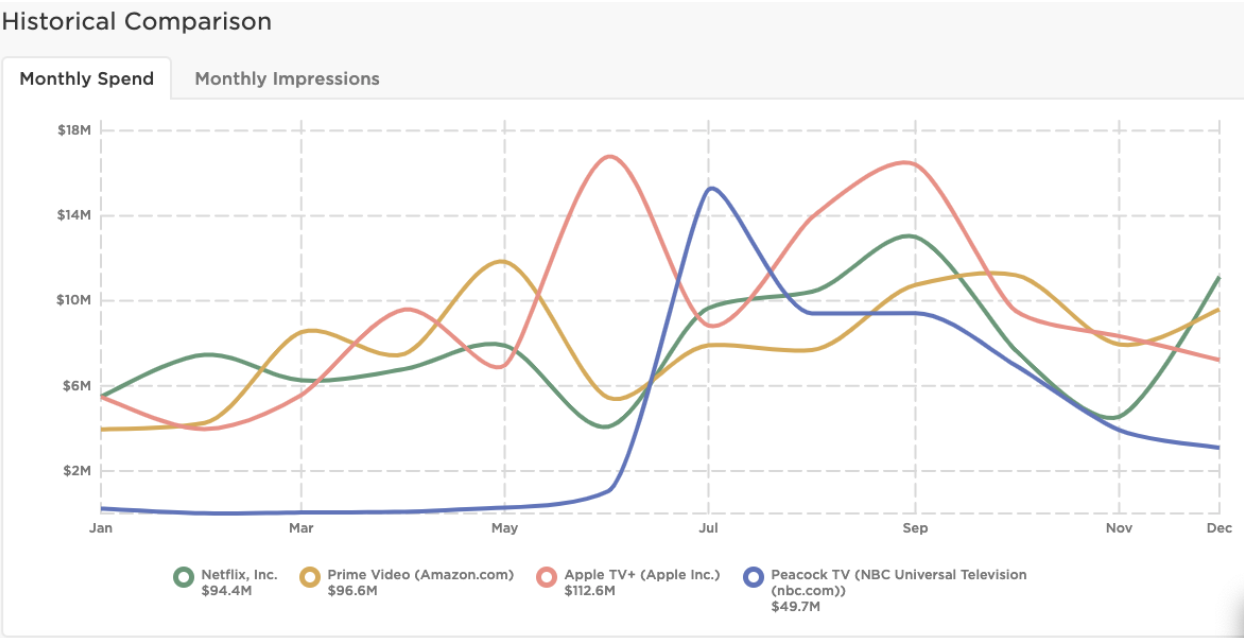

Major streaming services like Netflix and others – along with new competitors Peacock TV – have done whatever they can to entice viewers within digital ads. Pathmatics found that the top streaming brands consistently offered sign-up deals throughout the year, whether that’s Netflix’s typical “try 30 days free” or another leading streaming platform’s new tactic of teaming up with Disney+ and ESPN+ to offer all three services in a bundle worth $12.99.

Further, YouTube has been a prime way for streaming brands to reach their audiences, who are already watching their favorite content creators for hours at a time on the app. In fact, according to syndicated data analyzed at my company, Disney ($168 million) spent more than nearly any other brand on YouTube last year, save for Apple ($245 million). The new streamer heavily promoted new offerings such as The Mandalorian, The Lion King and even their streaming package deal with ESPN and a major streaming platform.

Getting Comfy At Home

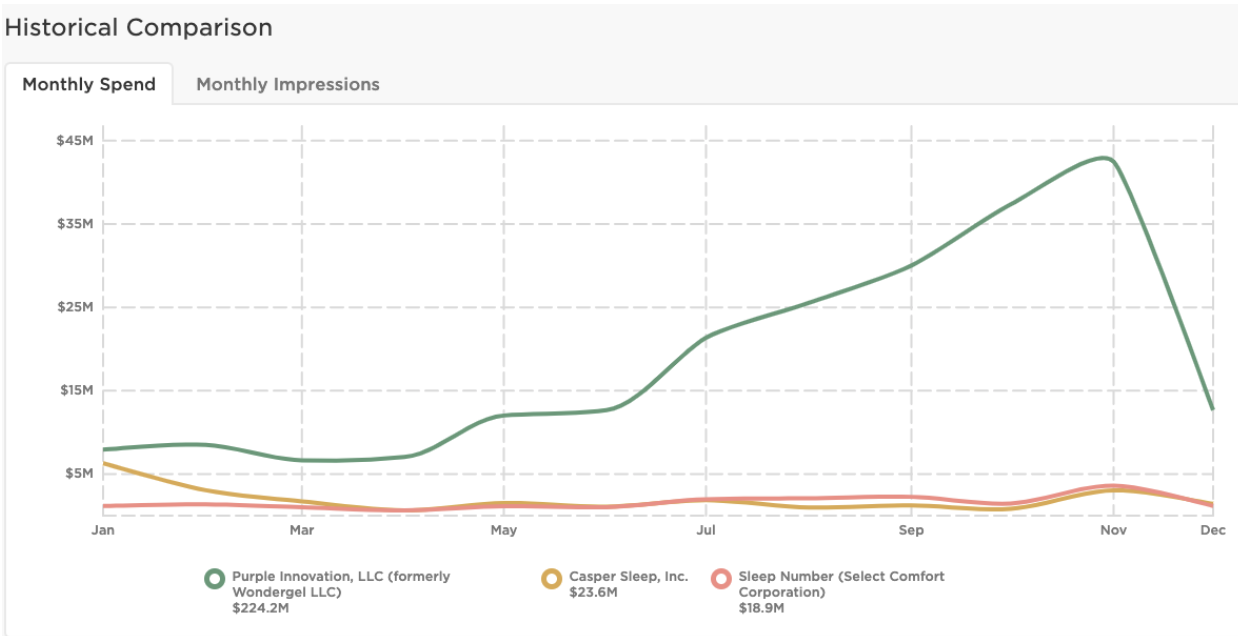

While those at home are getting their Netflix fix, they are sure to want a comfy bed to watch from. CNBC reported in 2019 that there were an estimated 175 online mattress brands, yet the only real differentiation between them comes in their marketing.

According to Pathmatics Explorer, the top three D2C mattress brands’ spending in 2020 ranged from $19 million by Sleep Number up to $224 million from Purple Innovation ($224 million), with another major sleep brand spending in the middle at $24 million. We saw Purple skyrocket to the top of our high spender category last year, investing more in digital ads than Walmart ($210 million), Unilever ($147 million) and one of the world’s largest software brands ($140 million).

Purple drastically increased video ad spend in August, investing $113 million of their total ad spend for the year on a series of 15-second video ads featured across a major web service provider’s sites. Only 20% of Purple’s ad spend last year was spent directly, signifying a broad ad strategy that saw 78% of its ads placed through the a major media brand ad network.

MediaPost has reported that younger, data-driven D2C brands spend aggressively and advertise consistently, which could partially explain Purple’s indirect ad strategy during the pandemic.

The Battle Of Fresh Food

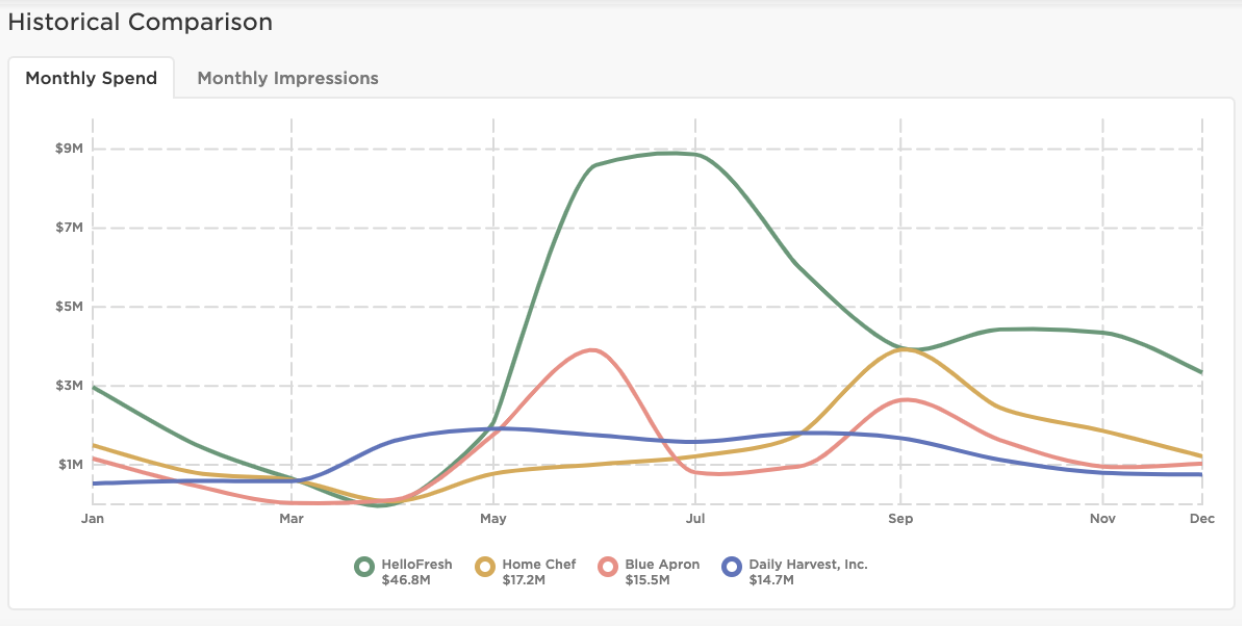

HelloFresh. Home Chef. Blue Apron. Daily Harvest. Before the pandemic began, D2C grocery brands like these were battling for the top spot in America’s refrigerators, with not much differentiation between them. Now, the differentiation doesn’t completely matter, as many Americans look for alternate ways to shop from the comforts of home.

Once considered a fad D2C category, the pandemic has breathed new life into these companies. They offer amateur cooks a way to easily prepare gourmet meals and are massively convenient for those who don’t wish to make extra trips to the grocery store.

These four advertisers were among Pathmatics’ top 40 Food & Drink advertisers in 2020, by spend. Though their ad spend slowed in 2020’s early months, many anticipated this was because of a surge in sign-ups that lead to supply chain issues and ultimately a reduction in ad spend.

Around May, however, ad spend began to increase once again — particularly for HelloFresh, which spent nearly $9 million in July alone. For context, Daily Harvest only spent $1.6 million that month, Home Chef spent $1.2 million and Blue Apron $807,000.

D2C’s Continued Growth

E-commerce sales were expected to surge 18% last year to $710 billion, and the category is set for incredible growth and even with Covid-19, one estimate shows just over 2% year-over-year growth in 2020. This new year will be transformational for D2C leaders as they accelerate their market disruption. There are two strategies all D2C marketing leaders should consider adopting in 2021 based on our findings in 2020.

First, 2021 is shaping up to be the year to invest in streaming and digital television. Expanding your mix beyond social advertising into platforms like Peacock TV will help drive growth and new user acquisition.

Second, D2C brands have likely reached the point of diminishing returns on Facebook and other social outlets. To make up for this diminishment, they should consider investing in video ads on new sites for 2021, such as exploring distribution via direct buys and programming on sites like Yahoo! and ESPN to expand their reach into new audiences.

D2C brands are predicated on a completely digital business model, sometimes with ancillary brick-and-mortar locations that empower and personify the brand’s culture. However, their digital presence and marketing strategies will be the key to success in 2021.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.