In this Placer Bytes, we dive into a critical lesson from Burlington’s recovery, the rebound potential for Nordstrom, and the opportunity for Dollar Tree.

Learning from Burlington

When Burlington removed its eCommerce capabilities the wider retail community was up in arms. This wasn’t helped by the onset of a pandemic that shut down Burlington locations, leading some to assume that it would affect Burlington in the long-run. And while there is still a high likelihood that Burlington will end up with some sort of digital offering, it’s time to give a needed tip of the cap to its powerful offline capabilities.

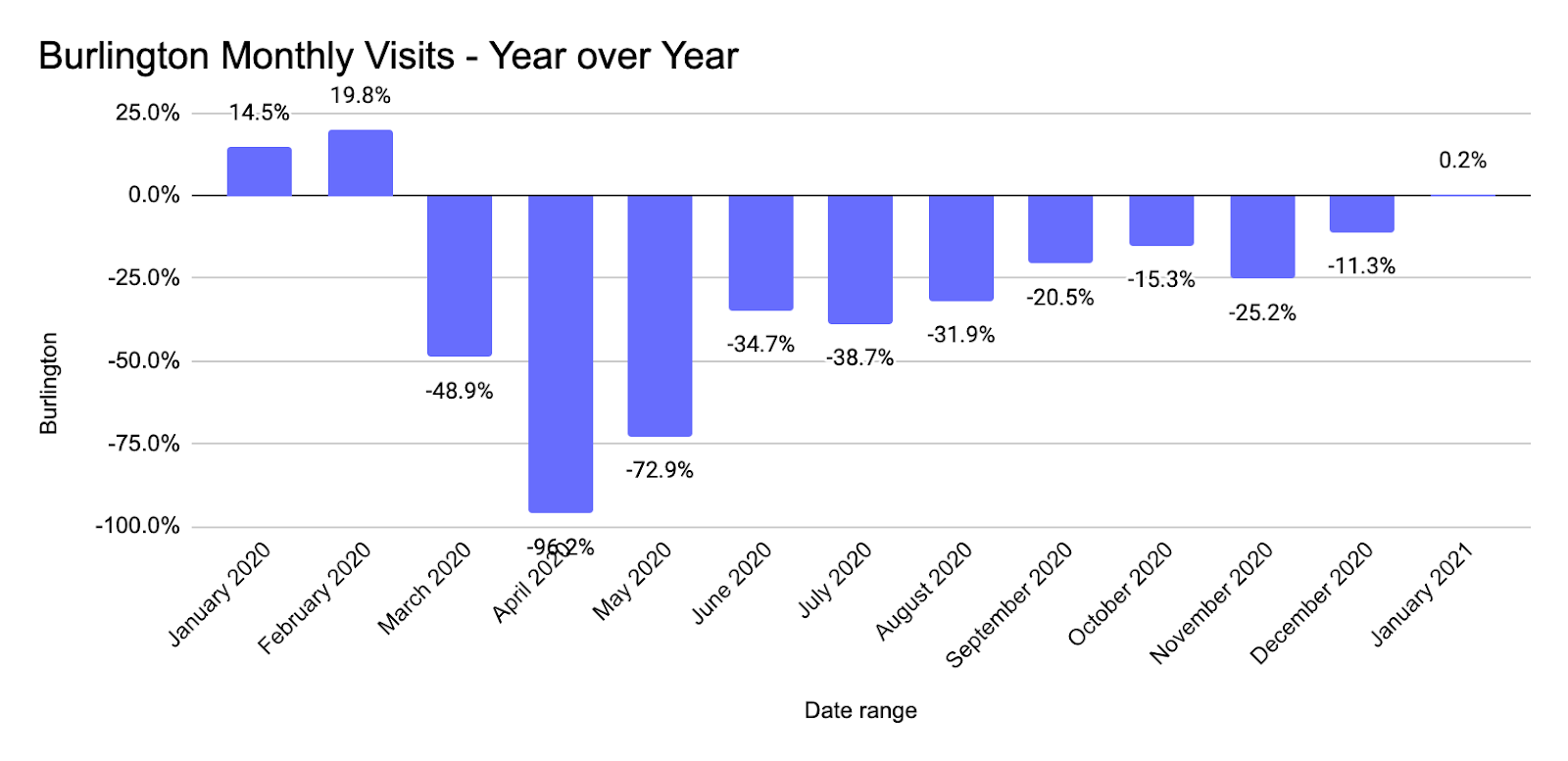

The brand has seen a steady recovery in offline visits since the spring with Q4 showing impressive results. After seeing the year-over-year visit gap increase to 25.2% in November as COVID cases surged, by December the gap had shrunk to just 11.3% – the brand’s best mark since the start of the pandemic. And by January, it had already returned to year-over-year growth with visits up 0.2%.

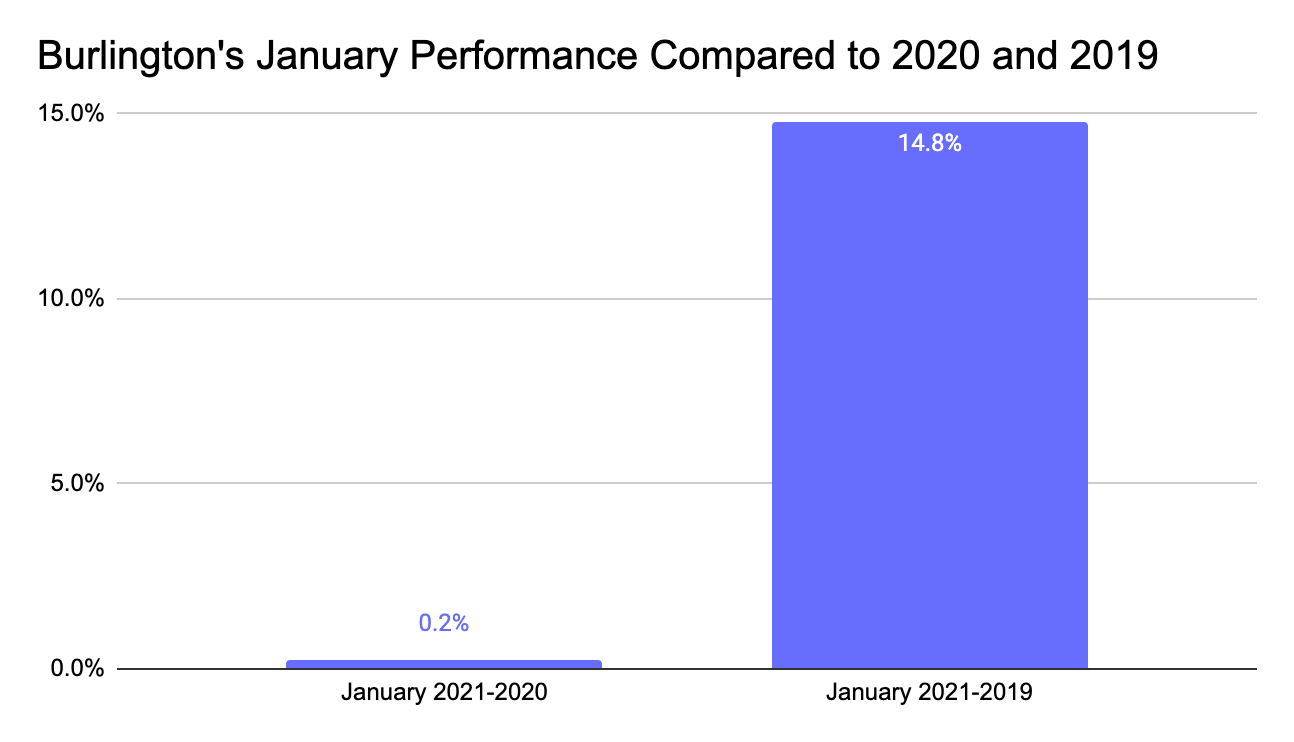

This growth also requires context as the jump comes on top of an especially strong January in 2020. If you compare visits to January 2019, the 2021 mark is actually up 14.8%. And this clears up a few critical elements. First, the brand is clearly recovering, even without a digital complement. Second, Burlington is in the midst of an extended period of sustained growth which further establishes its unique opportunity in 2021. The brand’s value offering should be even better received in the post-COVID economic environment and the shift to the suburbs aligns well with its geographic distribution. Perhaps most impressively, all this is happening while visits in its most important state, California, still lags behind. The result is a very promising picture for the brand in 2021 and the years to come – and all without determining what its online offering looks like yet.

Nordstrom Recovery Prospects

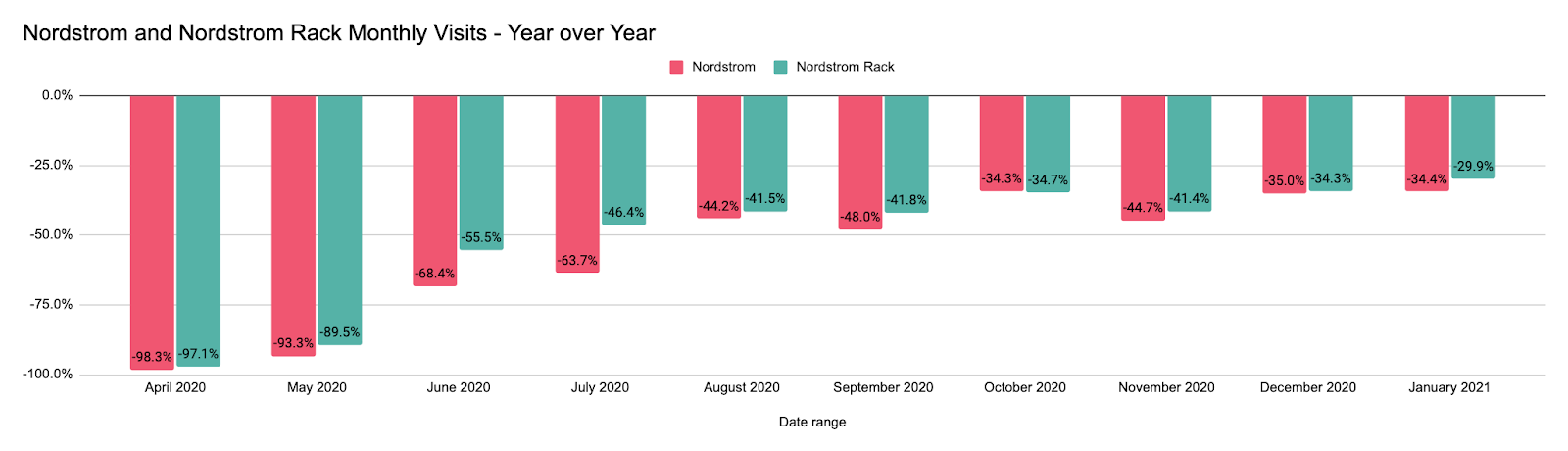

Few brands felt the pain of COVID more than Nordstrom, but both core locations and Nordstrom Rack branches are in the midst of a clear recovery. Nordstrom and Nordstrom Rack locations took a marked step back in November with visits down 44.7% and 41.4% respectively. Yet, the gap was down to 35.0% and 34.4% for Nordstrom in December and January respectively. For Nordstrom Rack, the visit gap shrunk even more with visits down 34.3% in December and just 29.9% in January.

The success of Rack locations could bode well for 2021 when Off Price will clearly have an added value. For Nordstrom, the key may center around the wider recovery of cities and malls enabling the locations largely based there to return to form.

Dollar Tree’s Opportunity

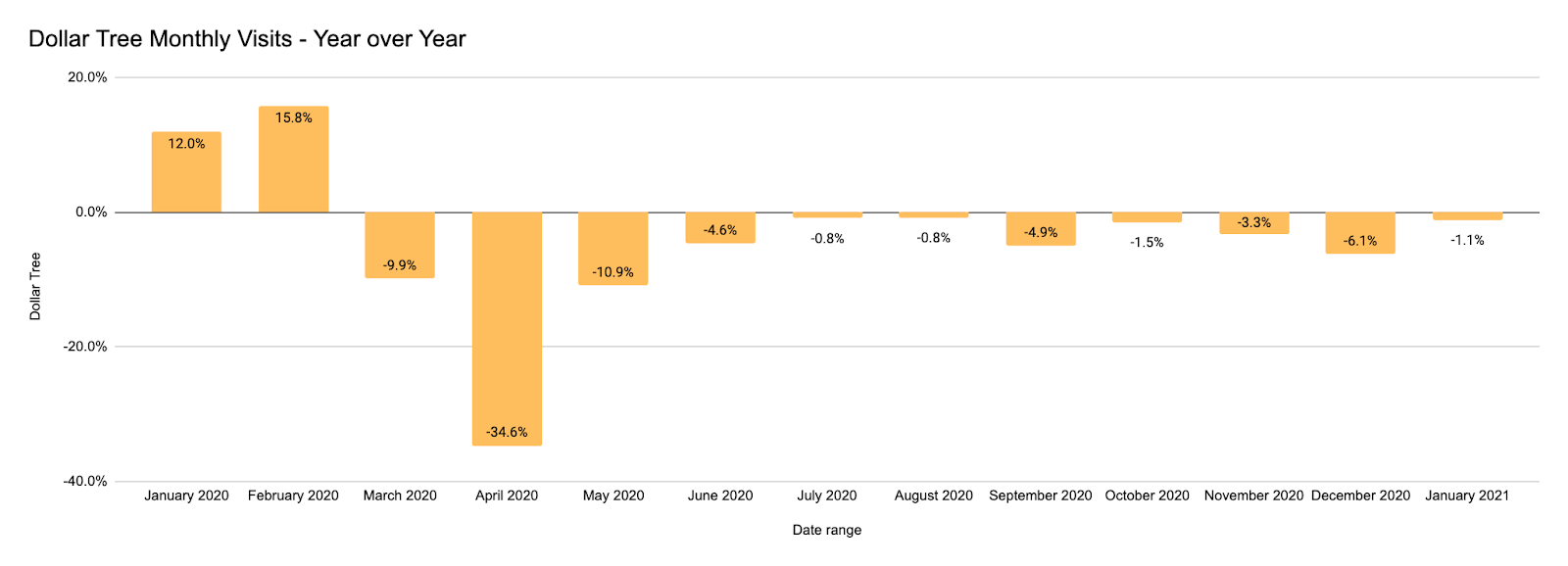

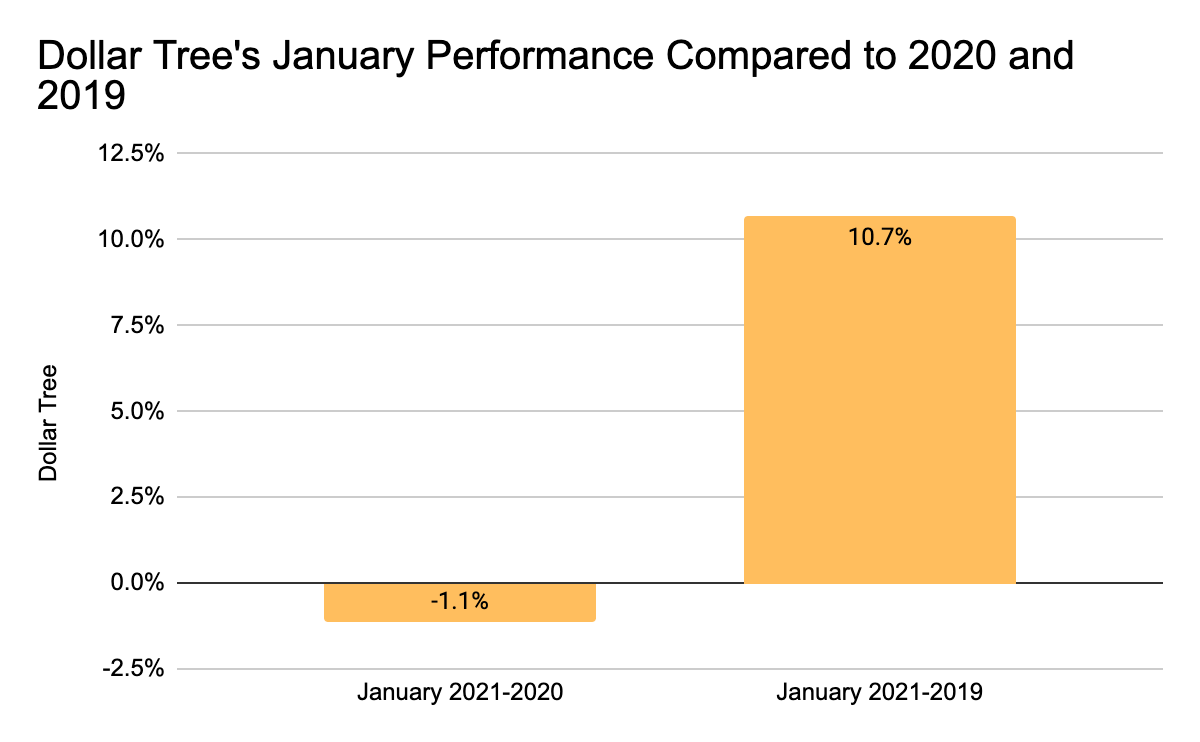

Dollar Tree has seen a solid recovery with visits consistently within striking distance of 2019 levels since June. Yet, unlike some other direct competitors, it has yet to return to year-over-year visit growth. January was close yet again with visits down just 1.1% year over year. This followed a November and December where visits were down just 3.3% and 6.1% respectively.

Clearly these are strong numbers considering the current environment, but should that claim require more substance, a comparison with 2019 should do the job. While visits were down 1.1% year over year in January, when compared with January 2019, the difference was a 10.7% increase. This suggests that while the brand’s pandemic performance has been strong, the dissipation of COVID should help Dollar Tree return to growth.

Will Burlington continue its impressive recovery? Will Nordstrom see the visit gap shrink in the spring? Can Dollar Tree return to year-over-year visit growth?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.