In a challenging year for apparel companies, many clothing subscription companies doubled down on their e-commerce strategies. In March 2020, Nordstrom closed its brick-and-mortar Trunk Club locations in favor of ramping up its digital channels. Similarly, Rent the Runway announced that it would permanently close its five stores while revamping its membership tiers to eliminate the unlimited rental option. Fashion subscription companies have also needed to evolve to meet consumers’ new demands for clothing, especially in the athleisure and loungewear categories, which have seen a rise in the pandemic.

Sales in the clothing subscription category declined overall in 2020, but consumer transaction data reveals that two companies, Stitch Fix and Wantable, saw year-over-year sales growth and also captured greater market share, particularly in the largest U.S. metro areas.

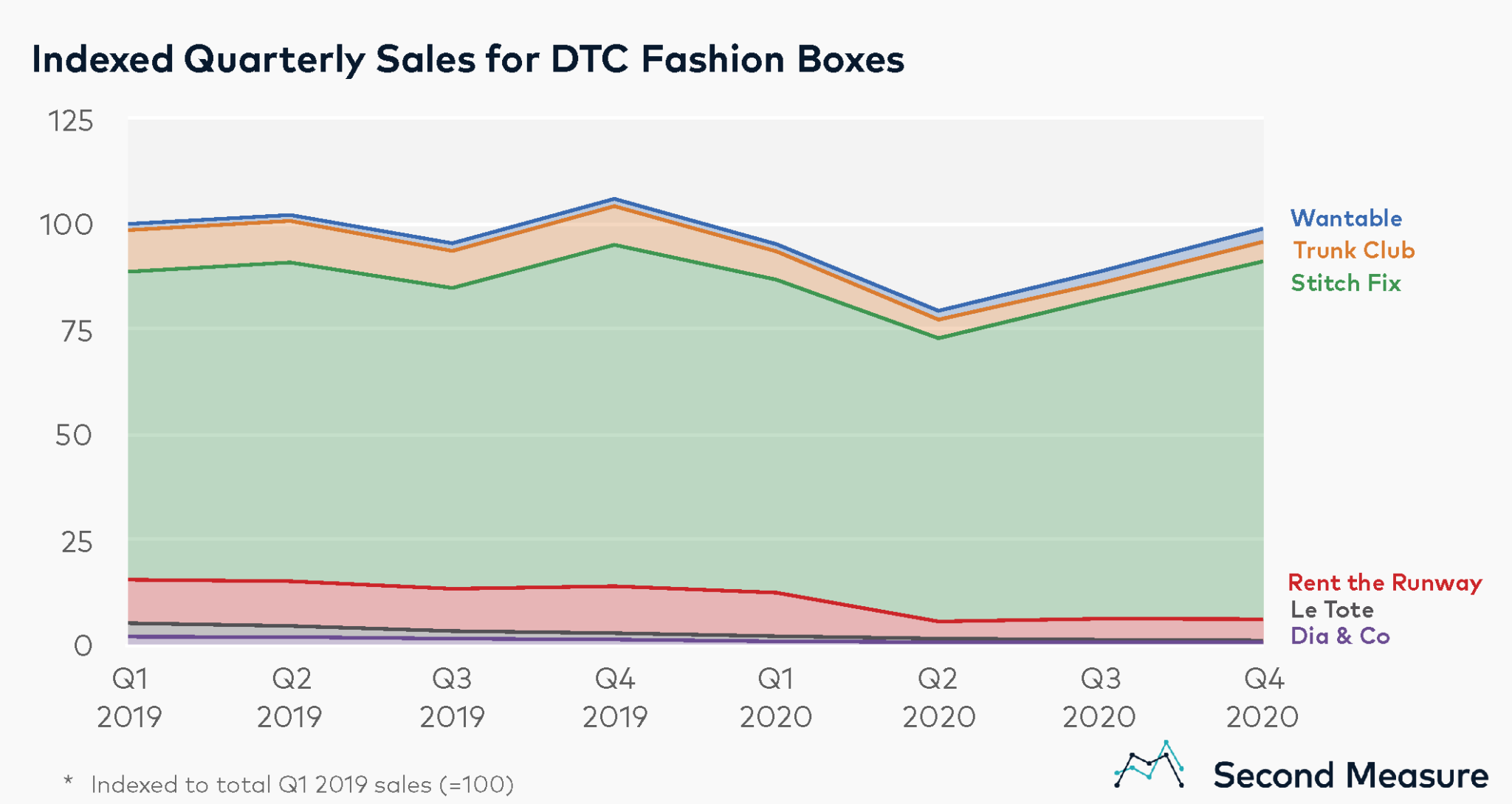

Fashion box category shrank in Q1 and Q2 2020, but largely recovered by year end

The market size for fashion boxes decreased 22 percent year-over-year in Q2 2020. However, in Q4 2020, sales for this category almost recovered to 2019 levels, narrowing the gap to -7 percent year-over-year. When looking at individual companies, Wantable saw the most sales growth with an increase of 51 percent between 2019 and 2020. Stitch Fix’s annual sales remained relatively flat, while sales at Le Tote, Rent the Runway, Dia & Co and Trunk Club decreased significantly by an average of 55 percent.

Notably, DTC fashion styling companies operate on a few different business models. Stitch Fix, Dia & Co, Wantable, and Trunk Club send customized boxes of clothes on demand or at a consumer’s preferred cadence (monthly or quarterly), which the consumer can try on at home and then purchase or return. By contrast, Le Tote and Rent the Runway are clothing rental companies with monthly subscription plans.

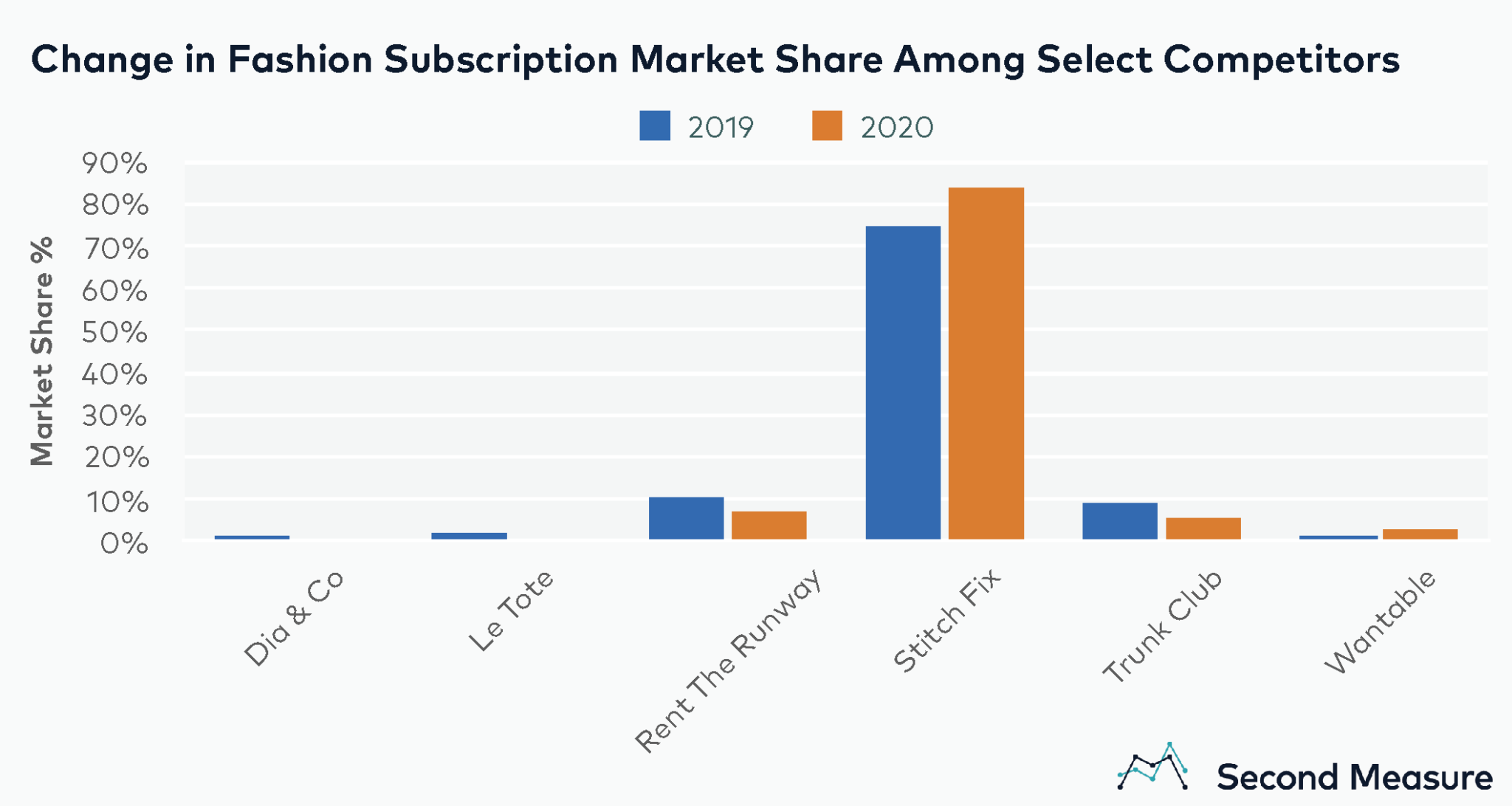

Stitch Fix and Wantable gained market share in 2020

Between 2019 and 2020, Stitch Fix’s market share among the six companies grew by 9 percentage points, leading to 12 percent relative share growth — the growth rate of market share. Wantable’s relative share growth was 68 percent in the same time frame, more than any other company in the competitive set. Interestingly, Wantable is the only company in the competitive set that offers separate “style” and “active” plans, underscoring consumers’ increased demand for athleisure and activewear.

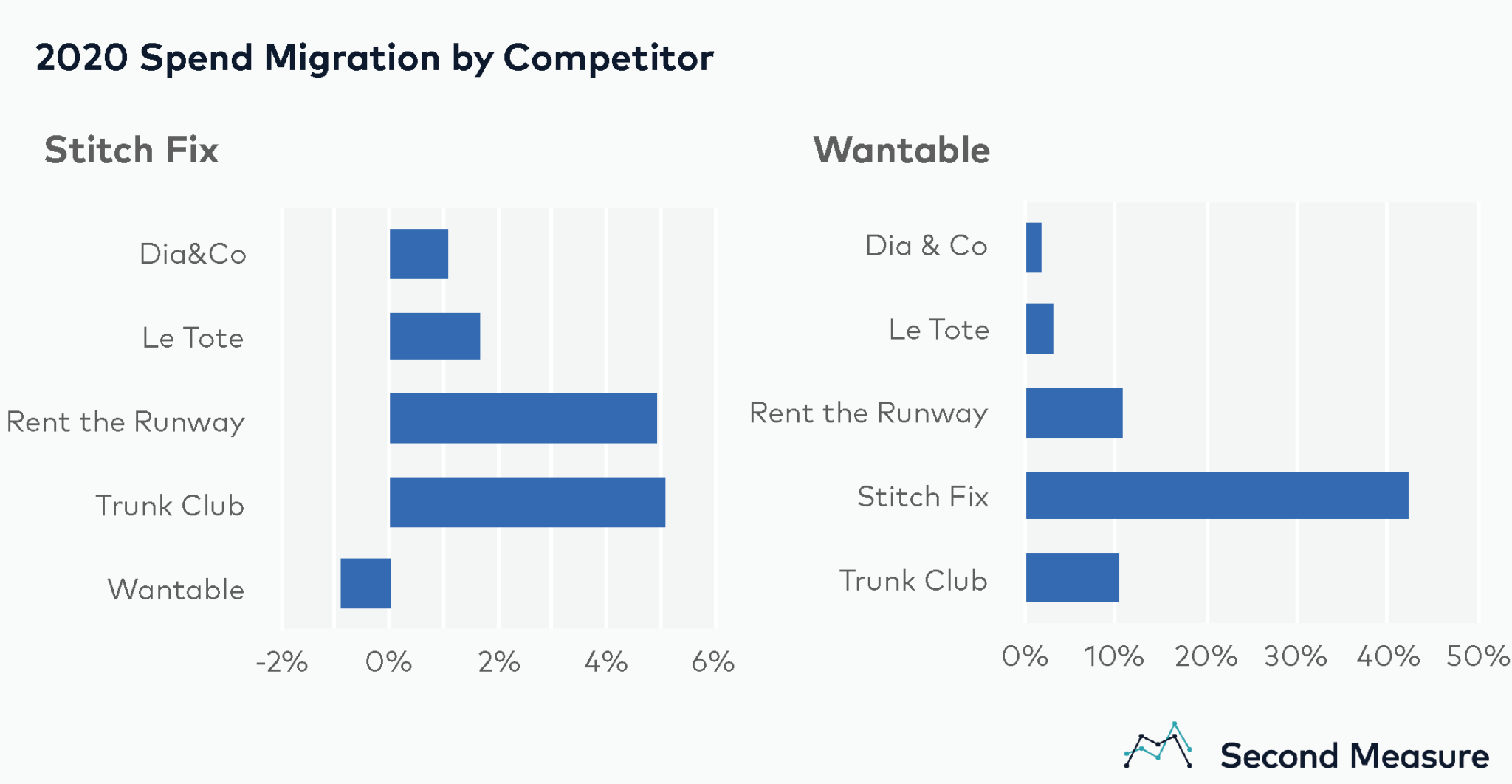

By contrast, Dia & Co’s market share more than halved in 2020, while Rent the Runway’s and Trunk Club’s relative market shares decreased by 35 percent and 42 percent, respectively. Spend migration data further illustrates that Stitch Fix and Wantable captured additional spend from these competitors. Of Stitch Fix’s 12 percent relative share growth, the company captured 5 percentage points each from Trunk Club and Rent the Runway. At the same time, of Wantable’s 68 percent relative share growth, 42 percentage points came from Stitch Fix.

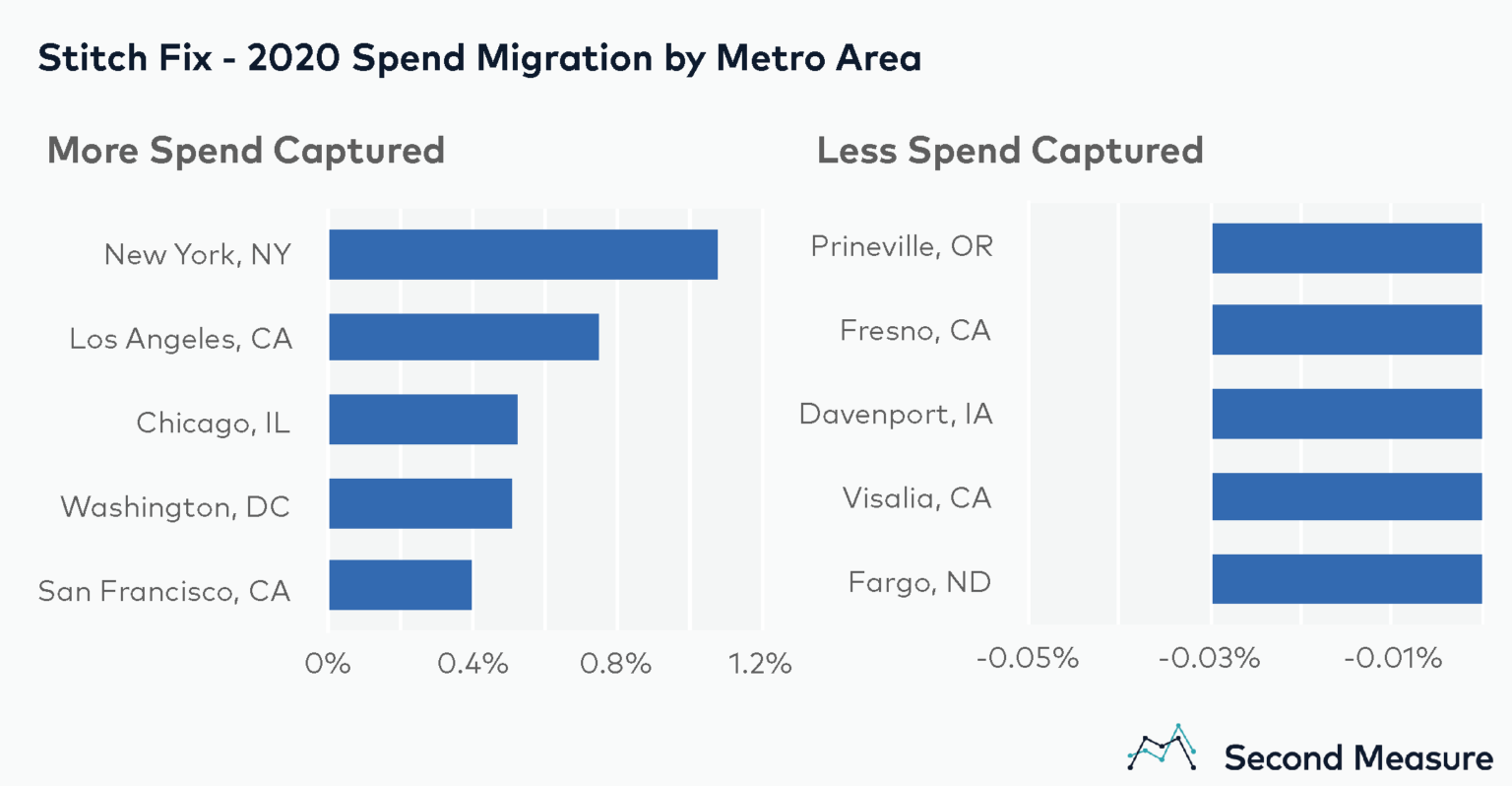

NYC and LA among metro areas where Stitch Fix captured more spend

In 2020, Stitch Fix’s gains in market share were largely attributed to populous coastal cities like New York, Los Angeles, and Washington DC. More specifically, Stitch Fix saw its highest gains in the New York metro area, which accounted for just over 1 percentage point of positive spend migration. On the other hand, the company saw slight market share losses in smaller metro areas in the West and Midwest, such as Fresno, CA and Davenport, IA.

Stitch Fix’s overall market share growth is likely due in part to demand for its kids’ subscription during the back-to-school season, and the addition of more athleisure and activewear inventory to meet the evolving needs of consumers who are working from home. To diversify its offerings, Stitch Fix has also been expanding its direct buy options so consumers can purchase individual clothing items without signing up for a subscription or a full clothing box.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.