While we’ve had a solid track record over the years with our non-farm payroll forecasts, it’s not often that we’ve actually written in advance the Bloomberg Chyron for jobs Friday, so it’s hard to pass up on the opportunity to start with the images below from last month – starting with our NFP forecast email alert and the Bloomberg screenshot the following day.

And unfortunately, our job market data is giving strong indications that February’s jobs report will be equally as disappointing.

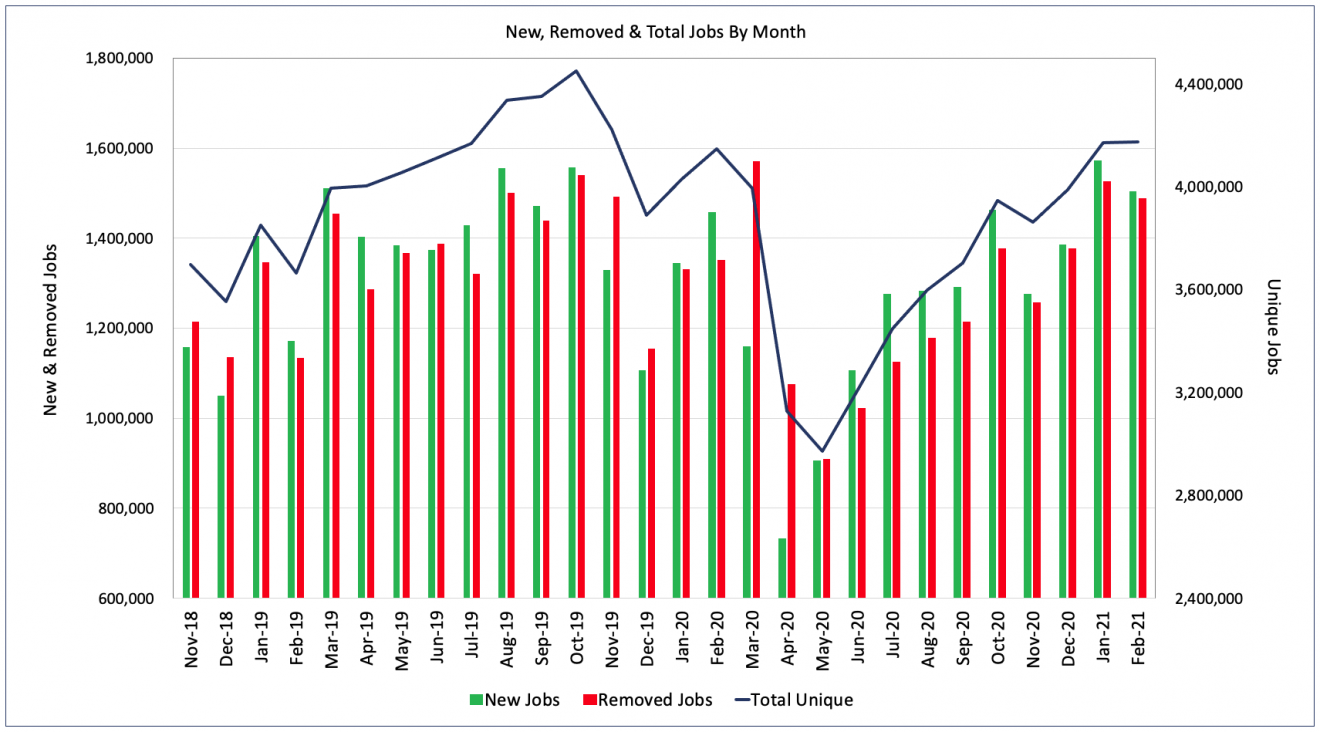

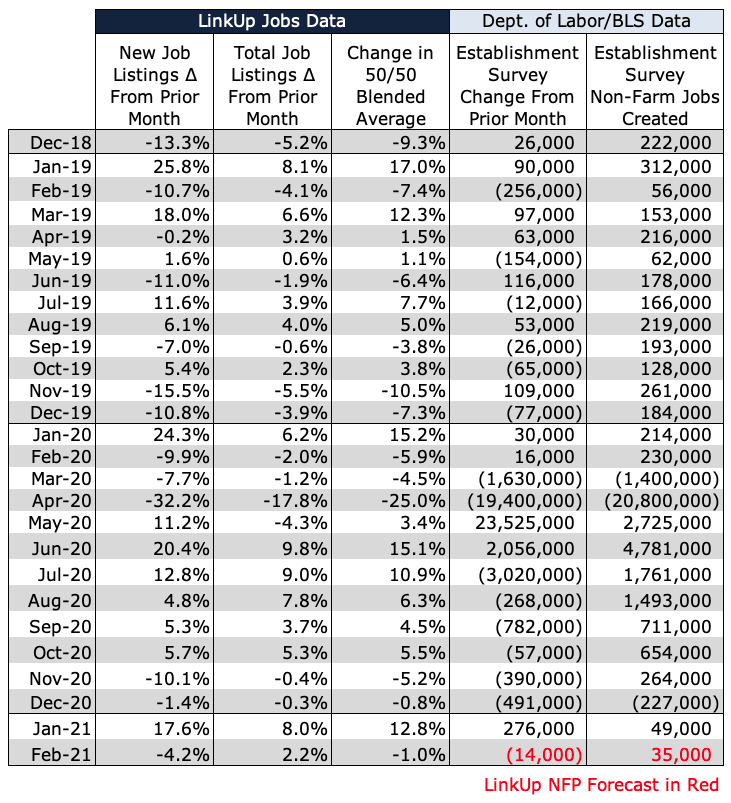

In February, total unique job listings in the U.S. remained perfectly flat from January and new and removed job postings actually declined 4.4% and 2.5% respectively.

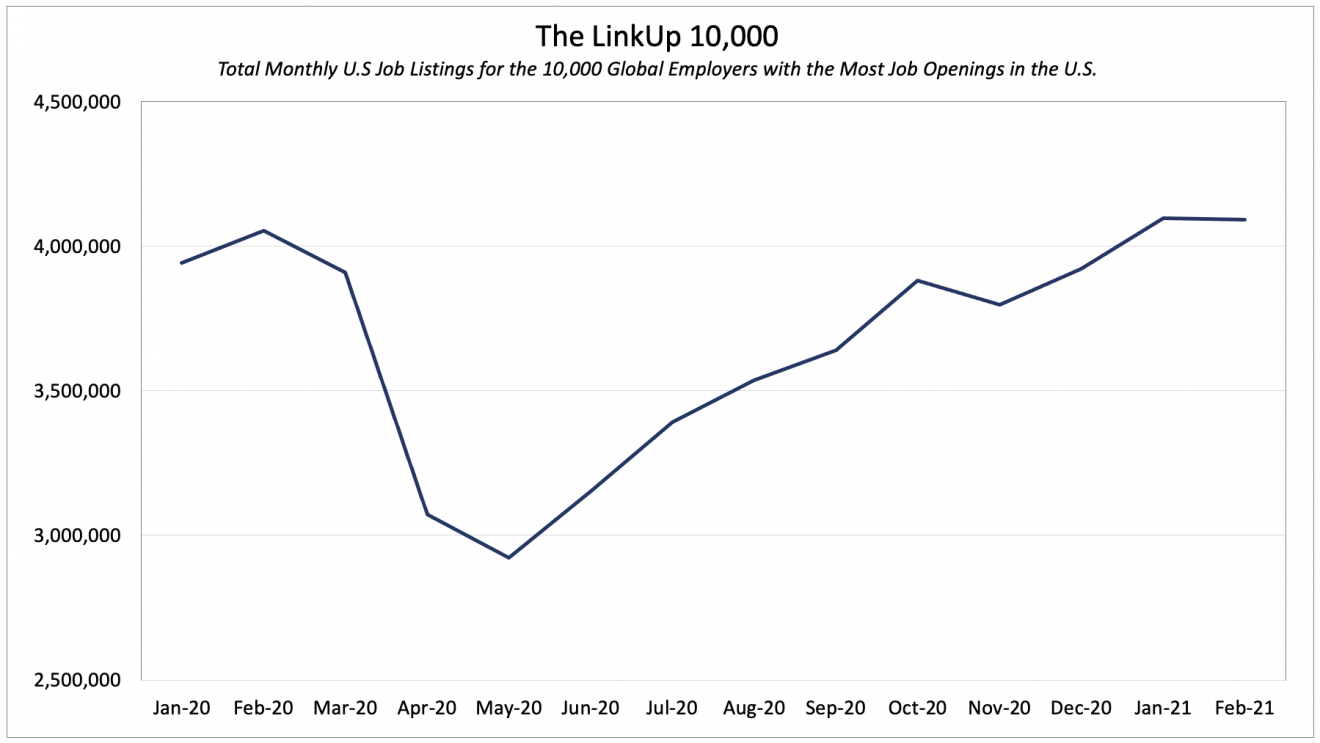

The LinkUp 10,000, which measures U.S. job openings for the 10,000 global employers with the most job openings each month, was also flat from January.

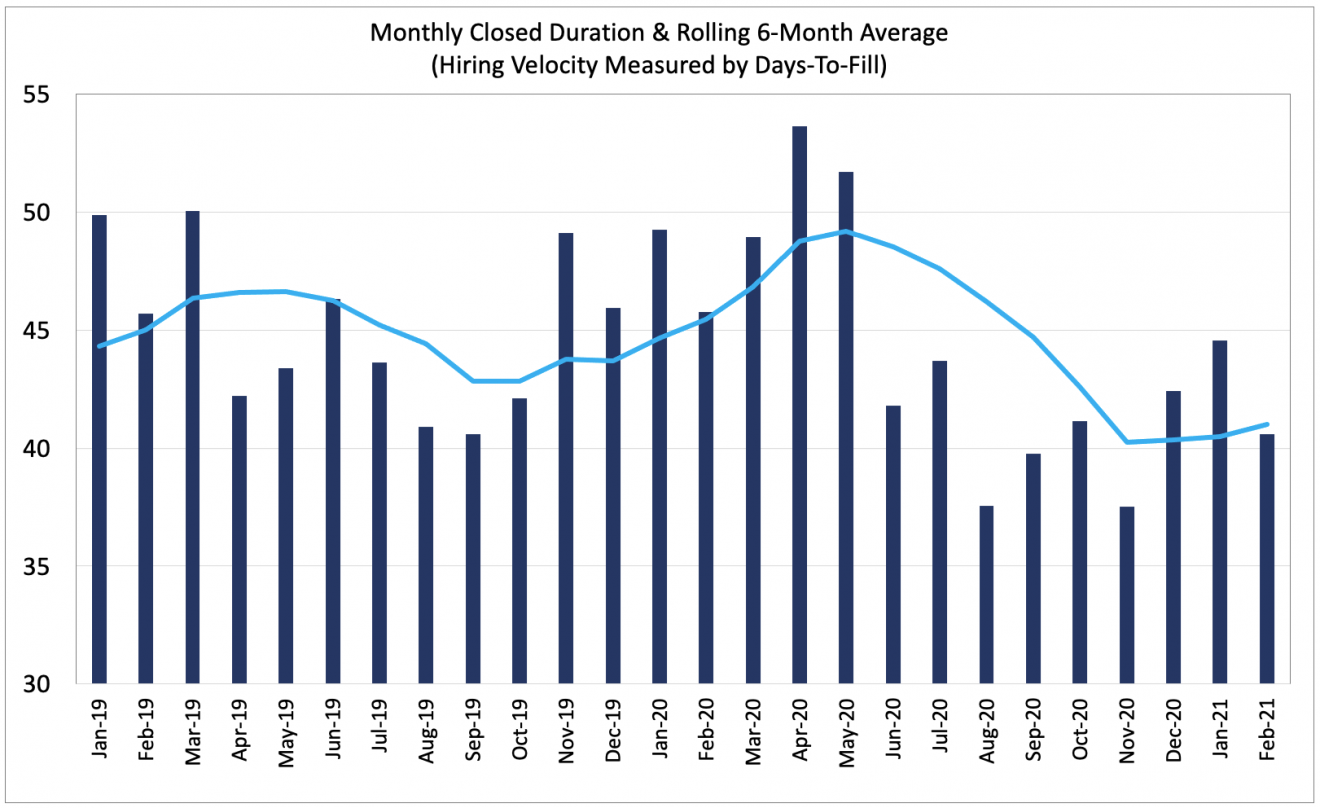

Hiring velocity as measured by LinkUp’s Job Duration metric (a measure of hiring velocity or the number of days that job openings are posted on an employer’s website) increased in February but that is more a function of the seasonal anomalies from January’s duration number that we explained in detail last month.

More relevant than February’s Job Duration number specifically is the fact that the rolling 6-month average has been flat since November and actually rose a bit in February – a strong indication that hiring velocity has been sluggish since late last summer.

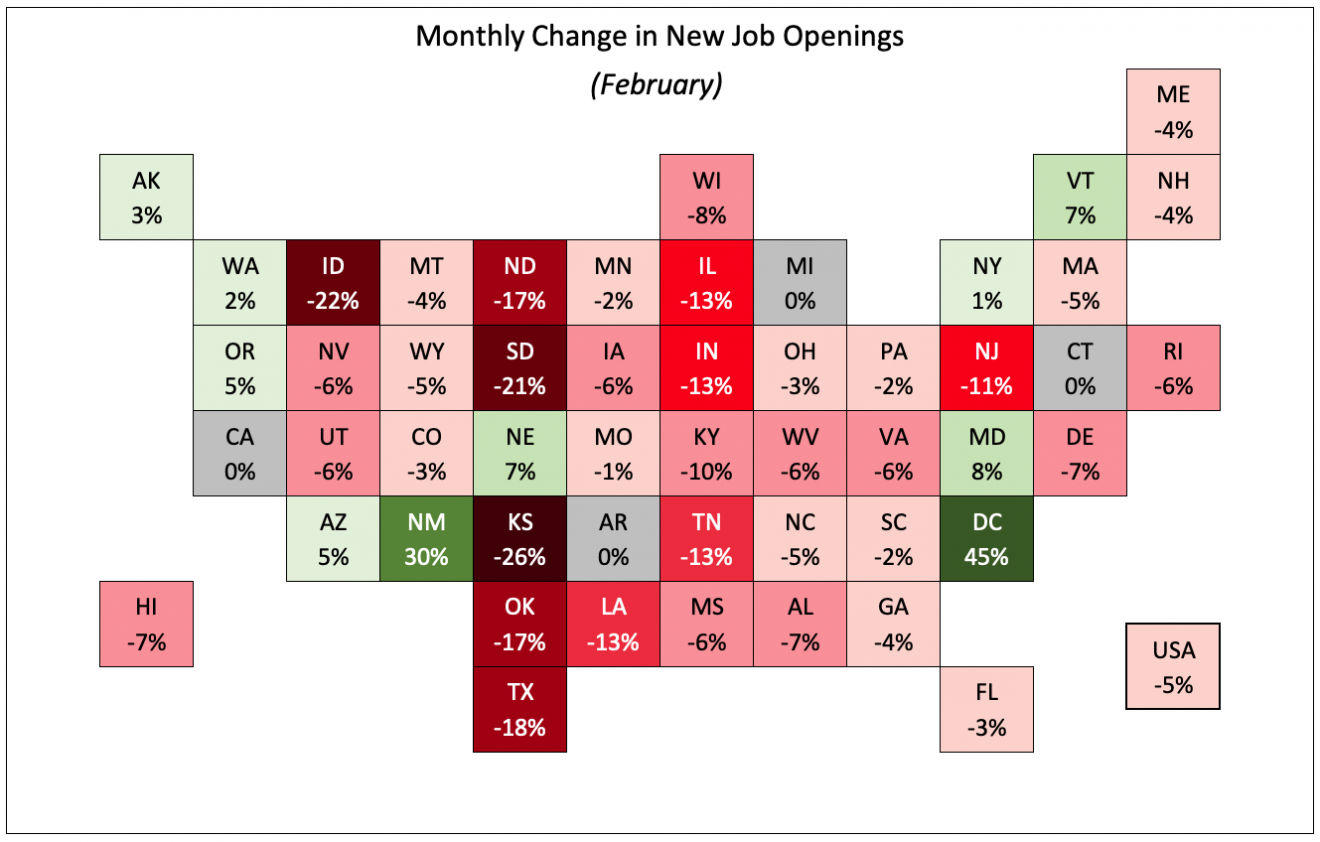

Drilling into the change in new job openings by state provides an equally distressing picture of the labor market these days. Only 10 states showed an increase in new openings and new job openings for the country as a whole dropped 5%. (For those readers paying really close attention, the 4.4% decline in new job openings mentioned above pertained to all job openings and included remote jobs and listings that did not include a specific location).

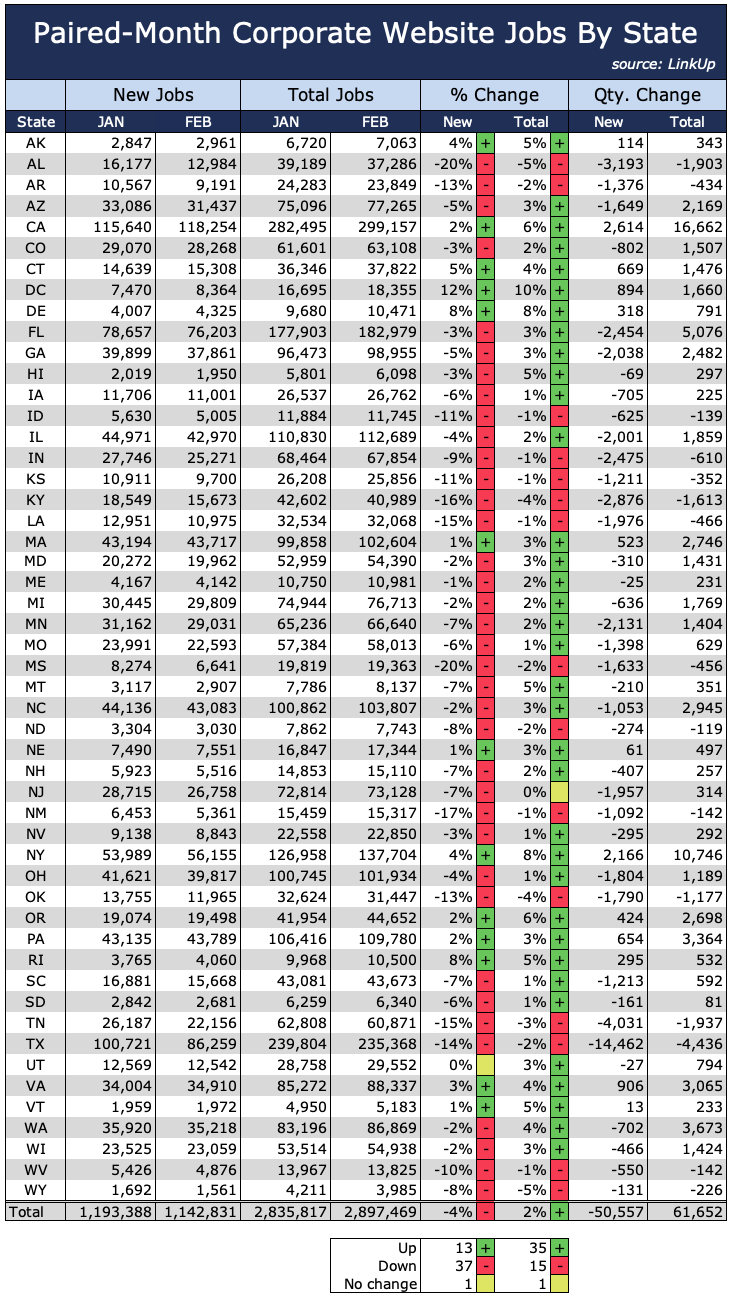

For our non-farm payroll (NFP) forecast, we use paired-month data which looks at new and total job openings for a set of companies that were hiring in consecutive months – in this case January and February.

In February, new job openings fell 4% while total job openings rose 2%.

Based on our data, we are forecasting a net gain of just 35,000 jobs for tomorrow’s jobs report, well below the consensus estimate of 180,000 jobs.

And just as we said last month, while tomorrow’s report will disappoint relative to expectations, it will likely provide yet more evidence (as if we needed any more) of the urgent need for the $1.9T COVID relief package that hopefully gets passed quickly.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.