Not all British brands can make it in the US. Topshop closed up shop and Primark hasn’t become the dominant force many expected. While Asos and Boohoo have had some success in the market, how does it compare to their performance at home? In today’s Insight Flash, we compare trends for the two brands across the pond, looking at transaction size as well as total spend.

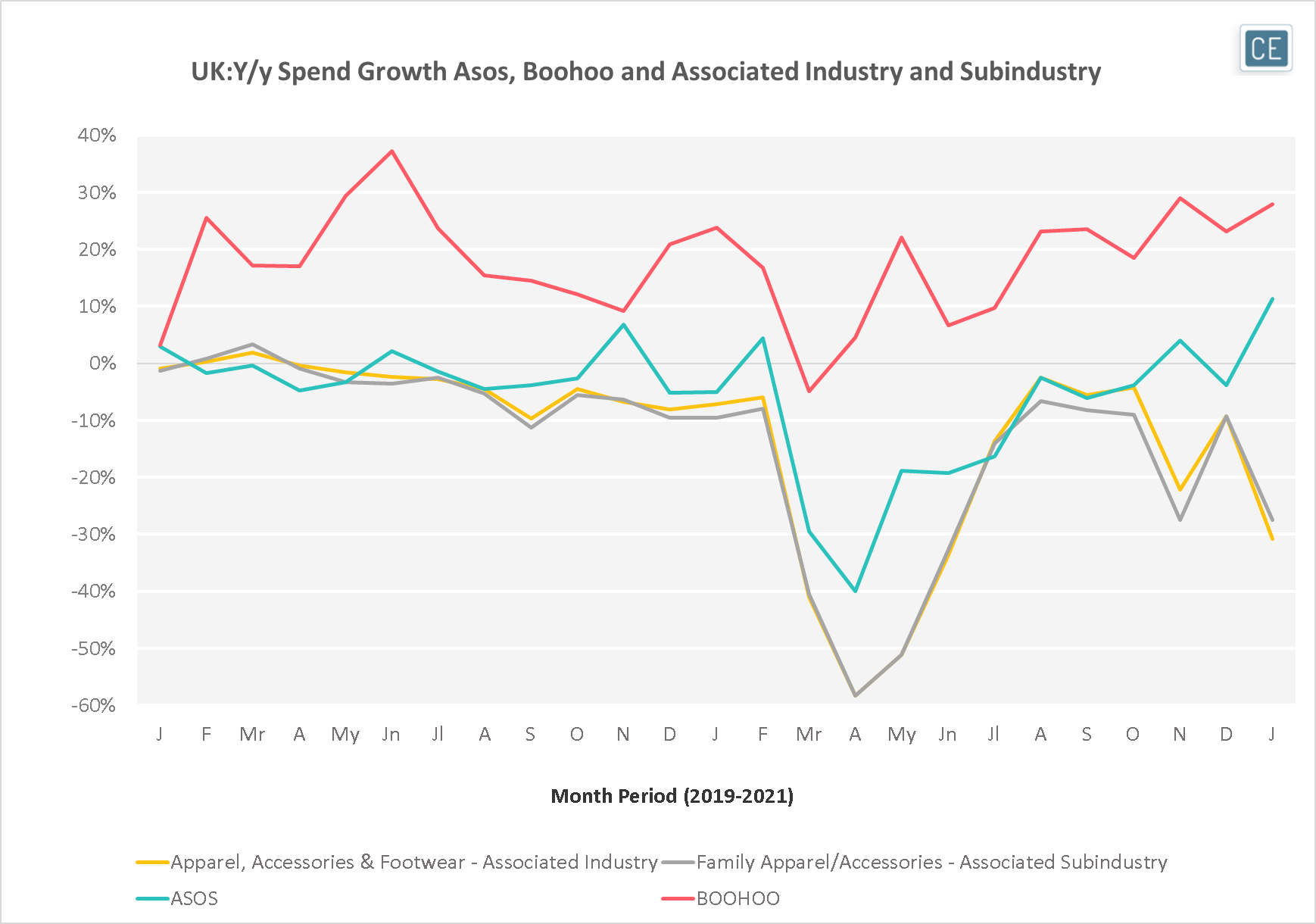

Since the beginning of 2019, Boohoo spend growth has dramatically outperformed overall Family Apparel/Accessories in the UK. Its online model allowed it to grow spend even during the pandemic, with y/y spend growth reaching almost 30% in November 2020 and January 2021. Although Asos growth hasn’t been as impressive, the company still has managed to outperform the subindustry consistently since Fall 2019.

UK Subindustry Trends

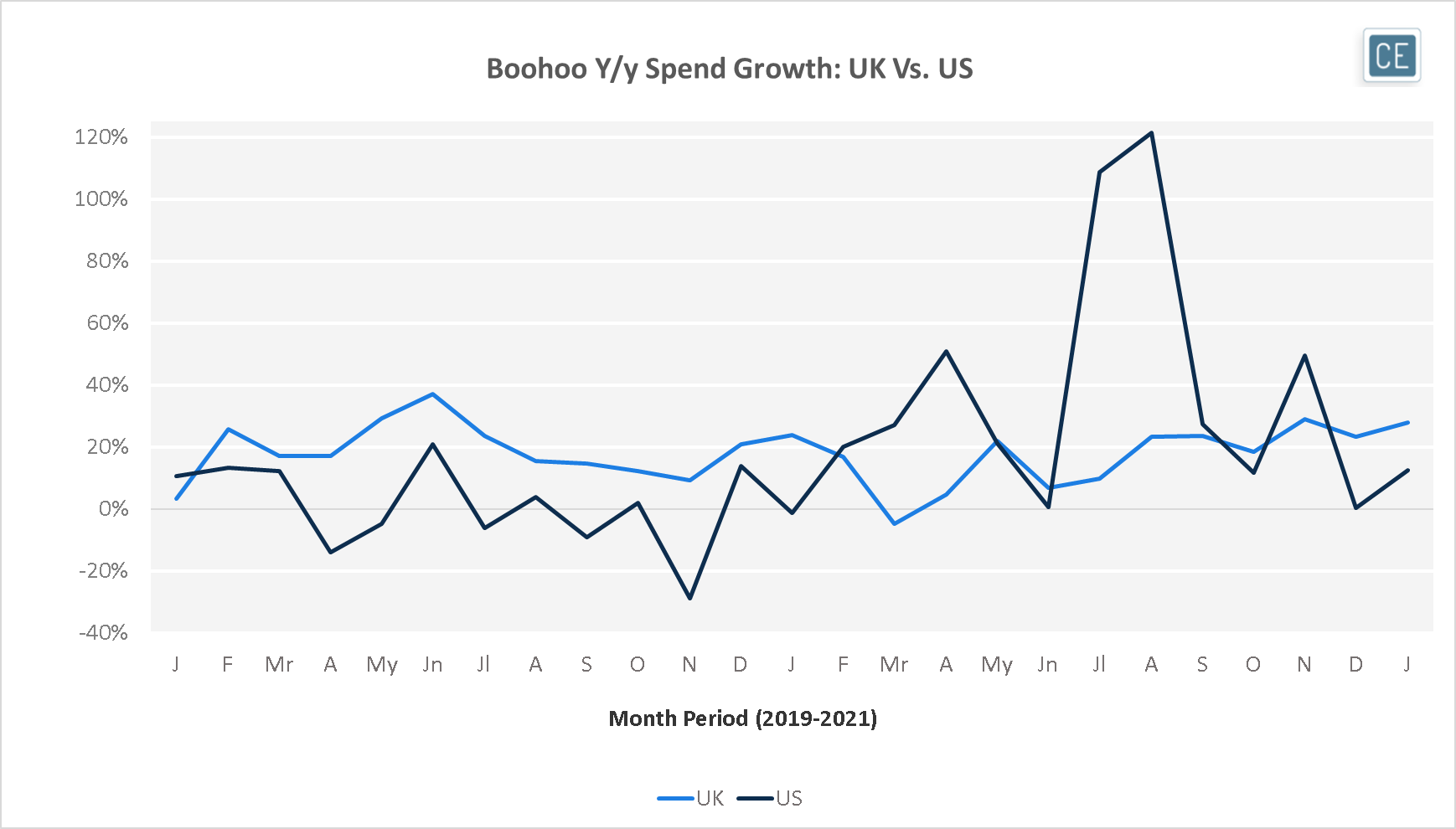

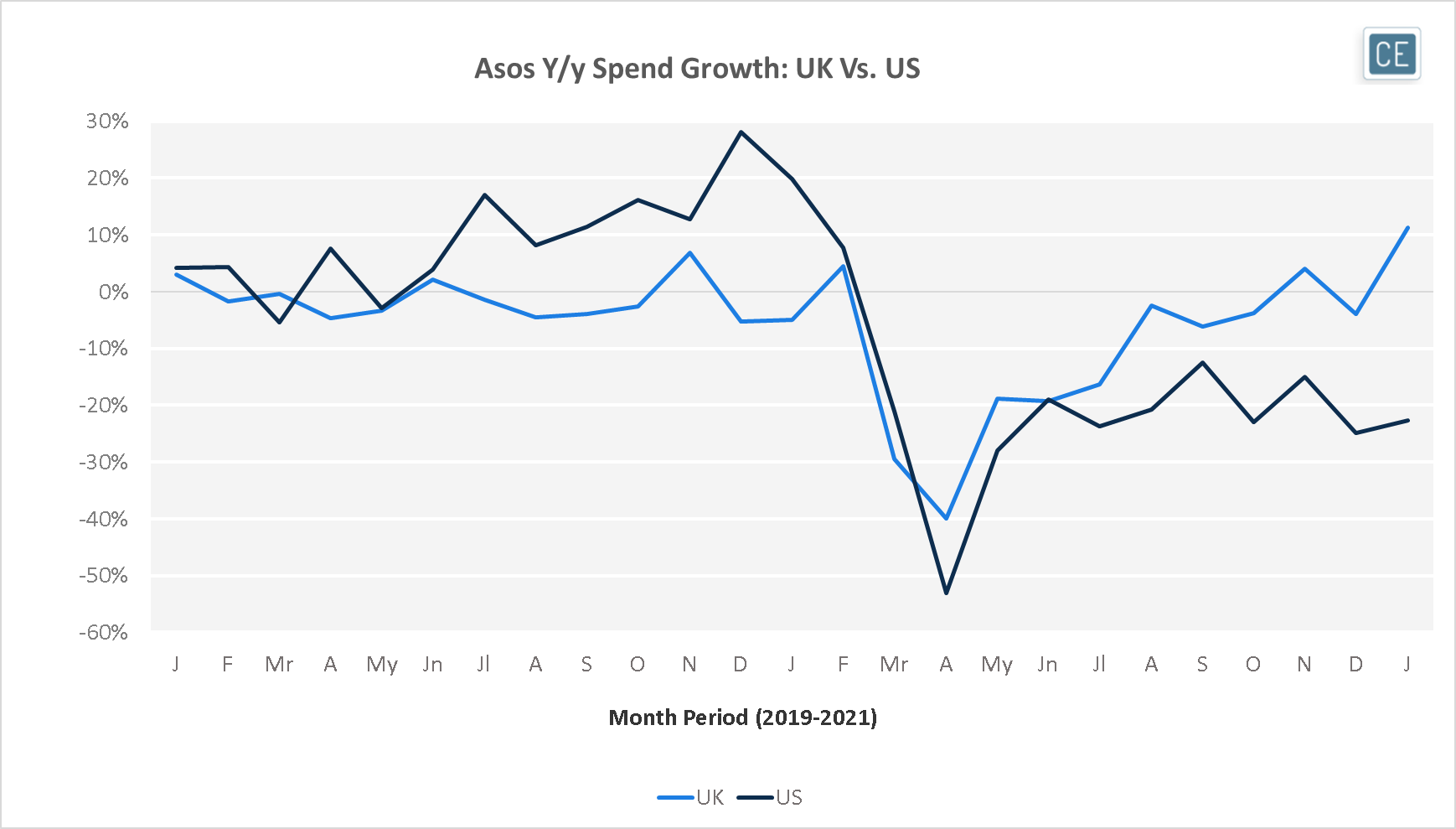

Boohoo spend growth was stronger in the UK than in the US through January of last year. US growth started to outpace UK growth in February though, holding a lead through April and then again in July through September. For Asos, the opposite was true. Growth was stronger in the US for most of 2019 and early 2020. When Asos sales in the US plunged in April, however, sales in its home market didn’t fall as fast.

Spend Growth

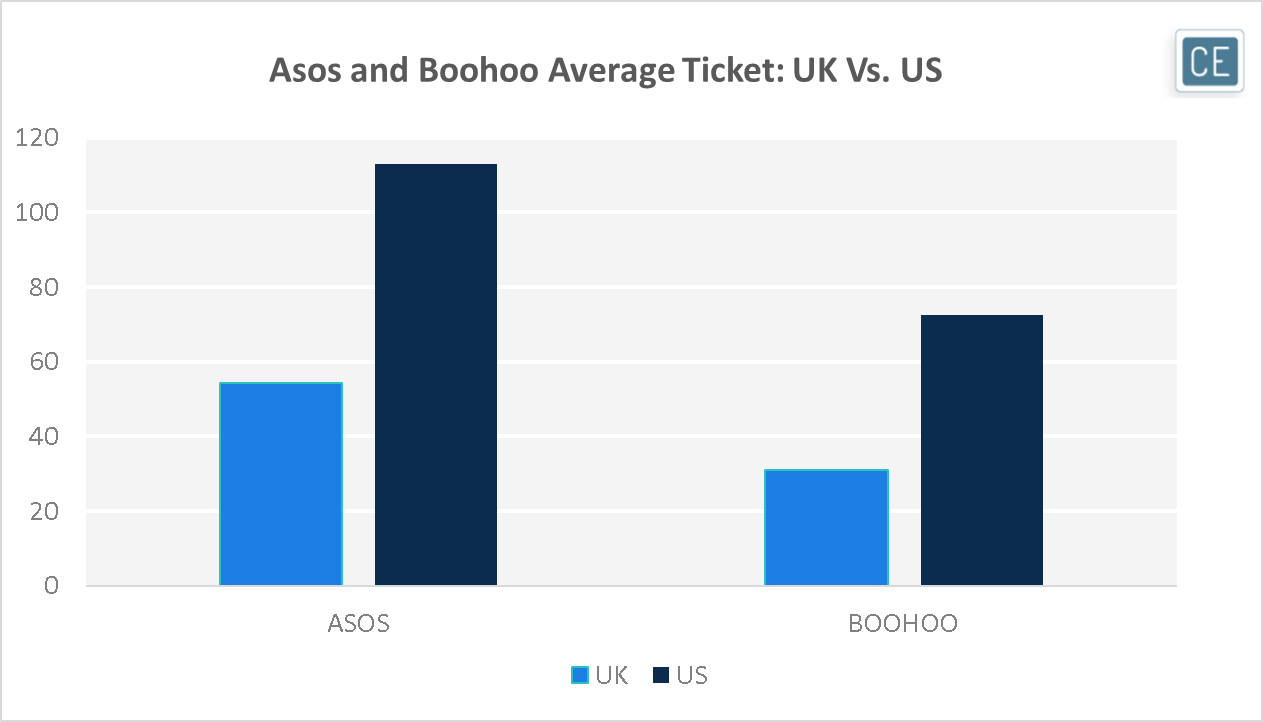

There are differences in spend across the two countries as well. Over the past year, the average ticket for an Asos transaction was 75% higher in UK than for a Boohoo transaction. In the US, it was 56% higher. This implies that Asos US sales may have more growth runway if shoppers match the differential between the two brands seen in the UK.

Average Ticket

Note: UK data for 364 days ending 2/23/2021; US data for 364 days ending 3/5/2021; local currency

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.