In this Placer Bytes, we dive into At Home’s continued strength, the recoveries of Lululemon and Nike, and recently announced off-price expansions.

At Home’s Impressive Run

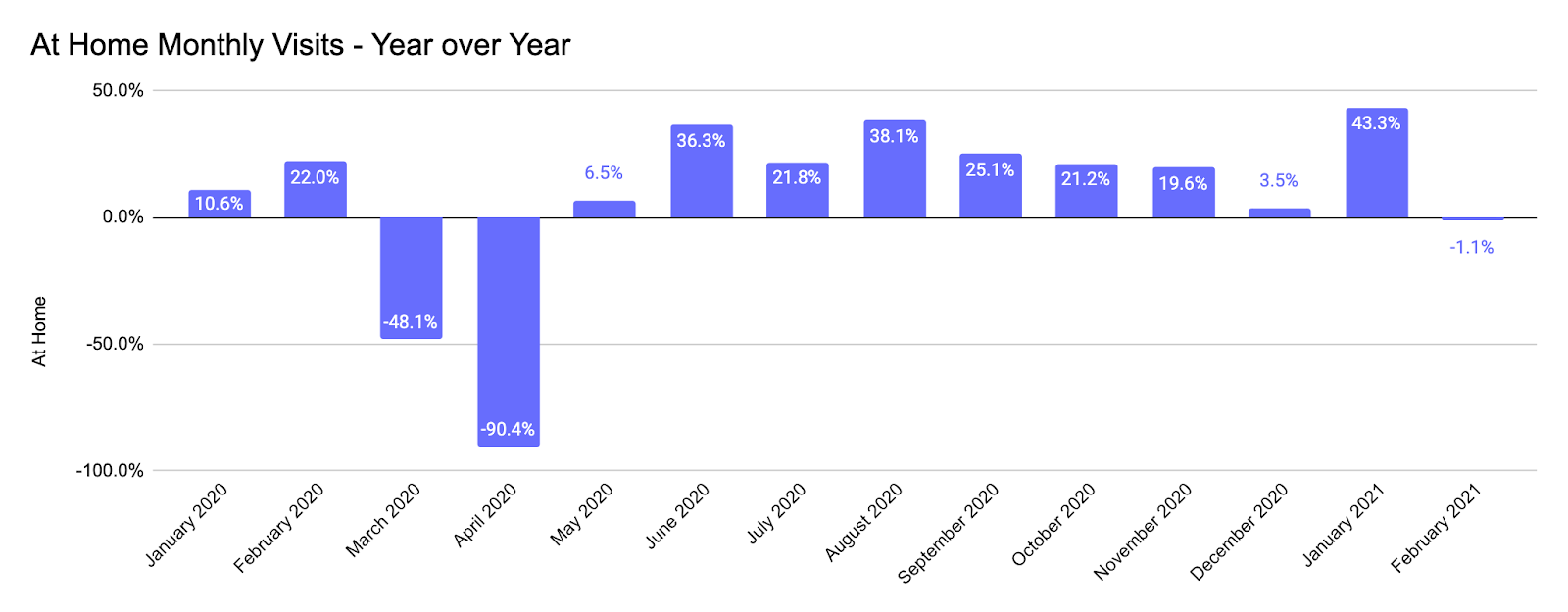

Since early spring, At Home has been one of the most impressive brands in retail cashing in on the home furnishings surge that has lasted into 2021. The brand saw year-over-year growth deep into 2020 with visits in November, December, and January up 19.6%, 3.5%, and a massive 43.3% respectively. And while February did see a 1.1% dip year over year, the situation is hardly ‘bad’ with the month seeing fewer overall days than a year prior.

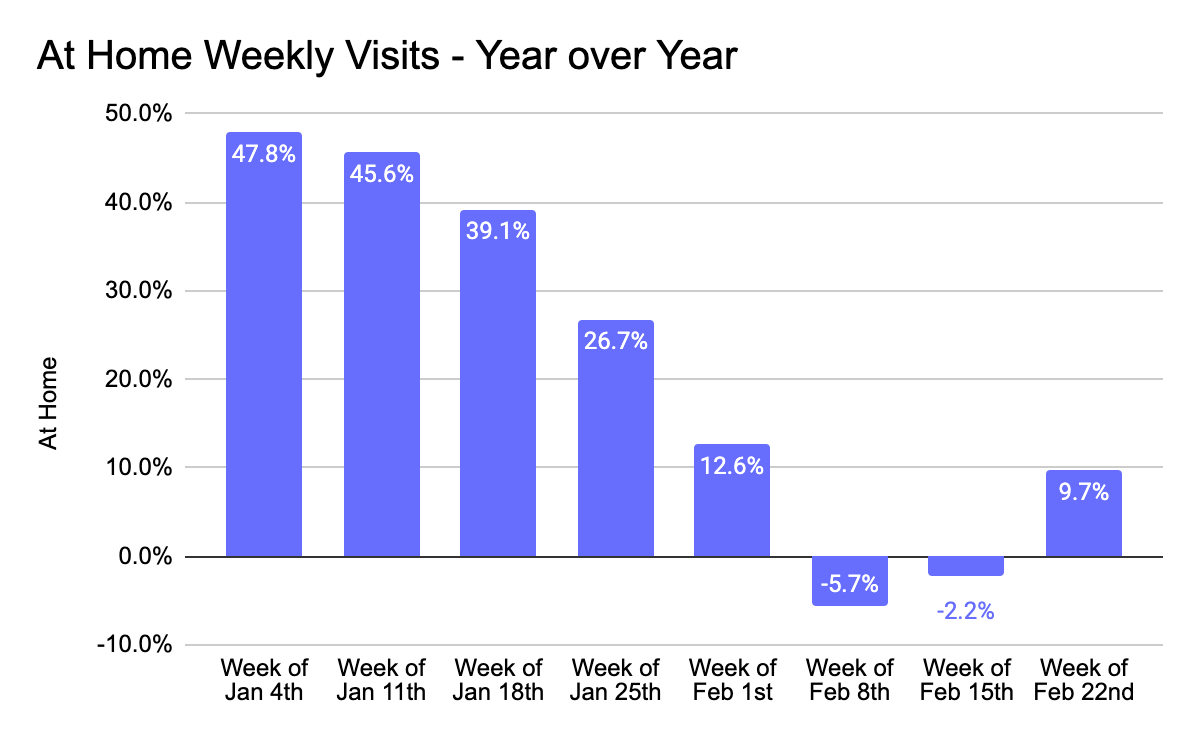

Looking at weekly visits year over year shows that an early January surge gave way to steady declines likely heavily influenced by the severe weather conditions seen throughout the country. But following two weeks where visits were down 5.7% and 2.2% respectively in the middle of February, offline traffic again rebounded the week of February 22nd with visits up 9.7% year over year.

Lululemon and Nike Back on the Rise

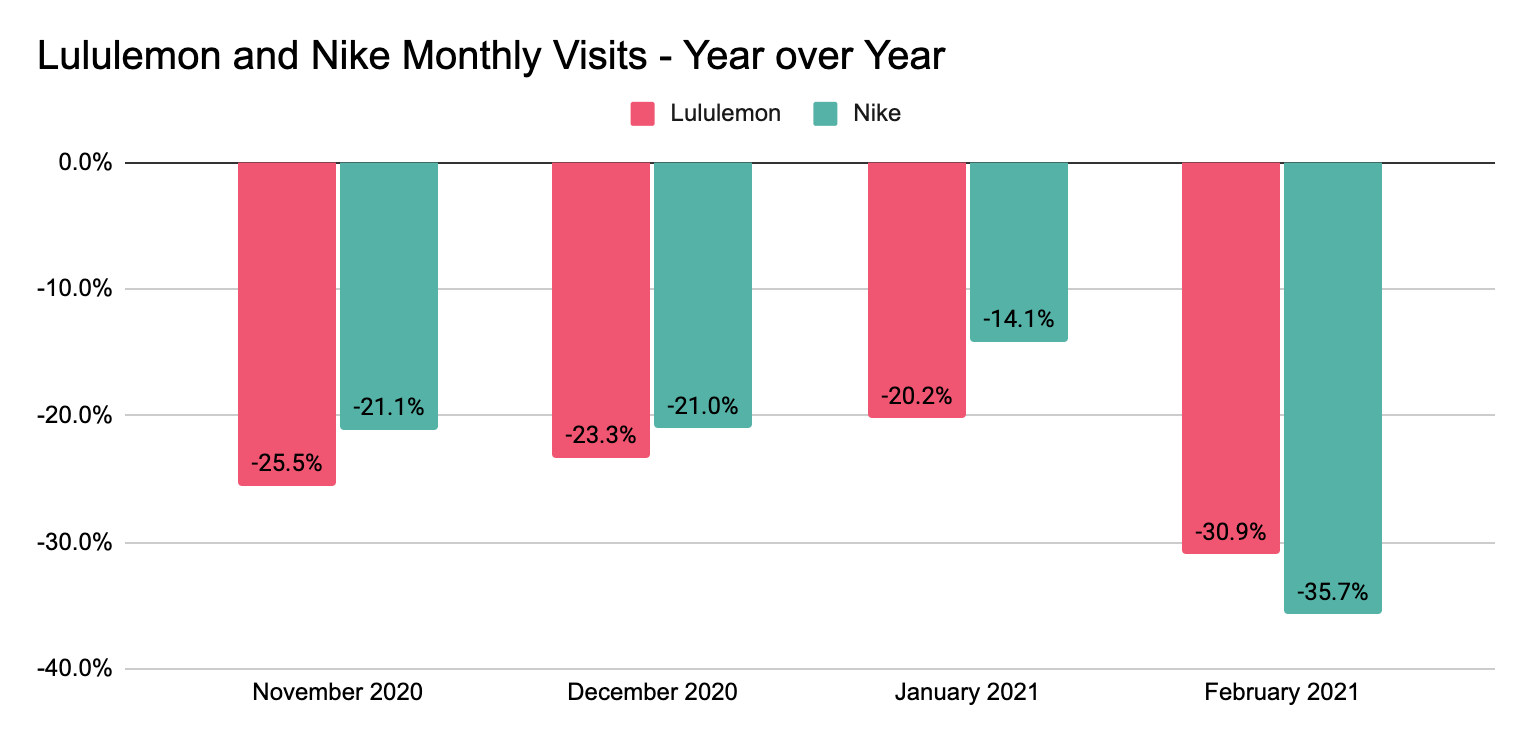

Another high-performing segment has been the wider athleisure and athletic wear space. Brands like Lululemon and Nike, while seeing hits to offline traffic, have been among the stronger performers in all of retail, an especially strong testament to their strength considering the large number of locations in mall and hard-hit urban areas. By January, both brands saw visits in a relatively strong place down just 20.2% and 14.1% for Lululemon and Nike respectively. February hit both brands hard, like most of retail, but still, the signs are stronger than they appear at first glance.

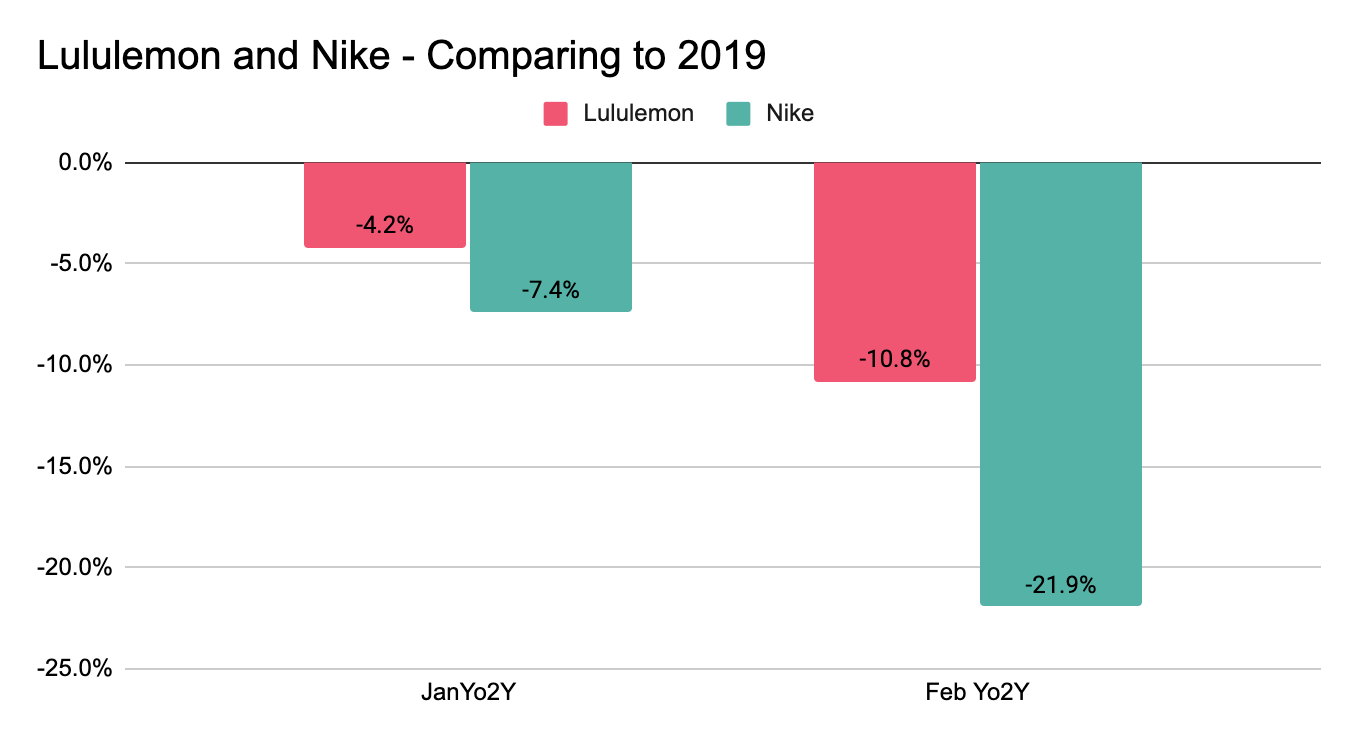

Comparing the visits for both brands to 2019 levels show that Lululemon was down just 4.2% in January and 10.8% in February while Nike was down just 7.4% and 21.9% in January and February. The result is a picture where February’s unique challenges clearly limited recovery progress but were still far less damaging than might have been expected. In fact, the ability to achieve the numbers they did in the face of the wide range of retail obstacles was impressive and indicative of a sharp rebound in March.

Unsurprisingly Expanding

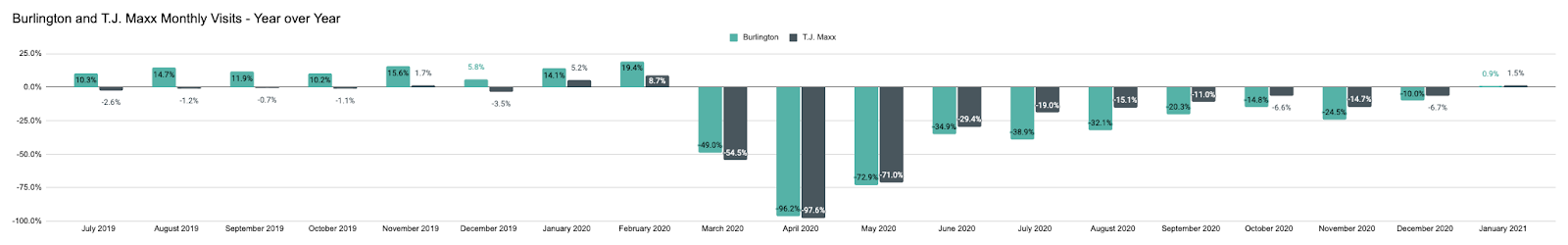

Few sectors in apparel have proven to be as resistant to COVID challenges as off-price retail, and the sector’s strength does not appear to be dwindling. In fact, considering the recent expansion announcements by T.J. Maxx and Burlington, and the wider fit these brands have with key market trends, it’s fair to expect off-price leaders to have an exceptionally strong period to come. Apparel could see a significant bump in ‘first-time demand’ as shoppers increasingly head out to the stores, and the lingering economic uncertainty should make these locations an ideal stop.

Considering this alongside the struggle of key department store brands, there may be a unique and extended ‘moment’ for these brands to show very strong performances. Yet, the most exciting question centers around what ‘tests’ these leaders might try to take advantage of their current advantage. Whether it be a more expansive digital offering, new partnership types or a new format that resides in-mall, there is real reason to expect more exciting announcements.

Will At Home’s reign continue? Can Nike and Lululemon rebound offline in March? Will Off-Price leaders live up to the unique potential they currently possess?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.