As we pass the anniversary of the start of the pandemic (the WHO declared COVID-19 a pandemic on March 11th), and with over 20% of the US population now vaccinated with at least one dose as of March 14th, we examined how consumers have behaved from then to now. We look at consumer spending and foot traffic across the most and least vaccinated states, how new shoppers acquired during COVID are being retained across retailers, and how share of wallet has potentially changed over the past year.

Key Takeaways

Vaccines Not (Yet) Main Economic Driver

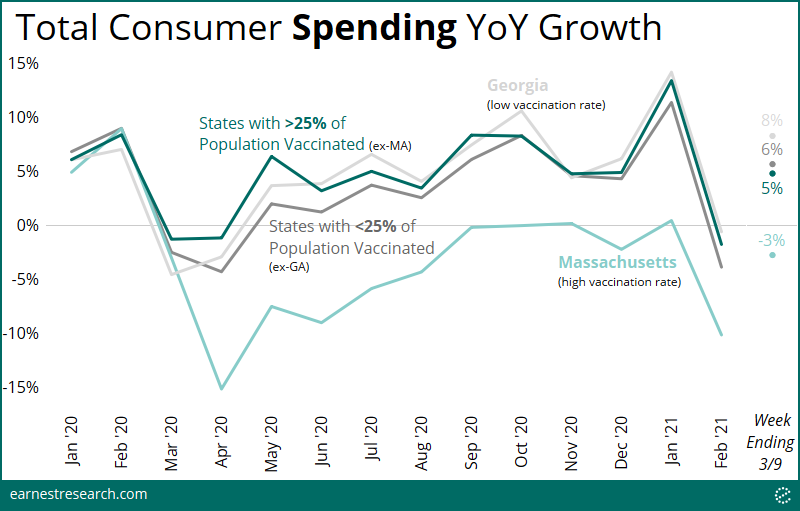

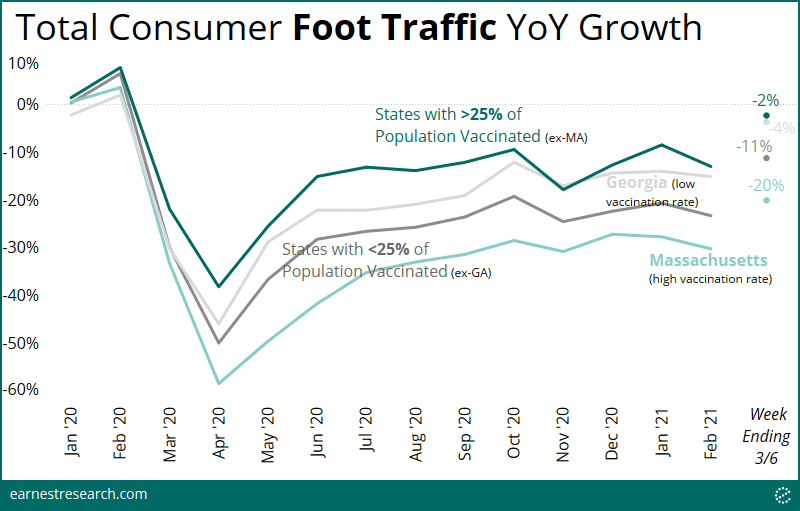

Are vaccines rollouts driving consumer spending? Is consumer foot traffic returning? States currently leading the vaccine rollout__*__ are not (yet) exhibiting signs of spending outperformance, implying that other local variables such as reopening restrictions, risk-averse levels, and public policies are still the primary factors determining the revival of local economies. Foot traffic in these states, although outperforming, remain at the same elevated levels it has enjoyed since the start of the pandemic.

Georgia has had the slowest vaccine rollout to date with just 16% of its population vaccinated, yet it continues to be an outperformer in total__**__ consumer spending and traffic. On the other hand, Massachusetts continues to struggle to revive, despite being among the most vaccinated states, with 25% of its population vaccinated.

Interestingly, the states leading the vaccine rollout exhibited several points of outperformance in the middle of 2020, then narrowed at the end of the year, followed by January’s stimulus-driven aggregate uptick and February’s subsequent drop. Early March saw an acceleration across all states, but without any clear signs of outperformance in the most vaccinated states.

Bellwethers: Travel, Dining, and Gyms

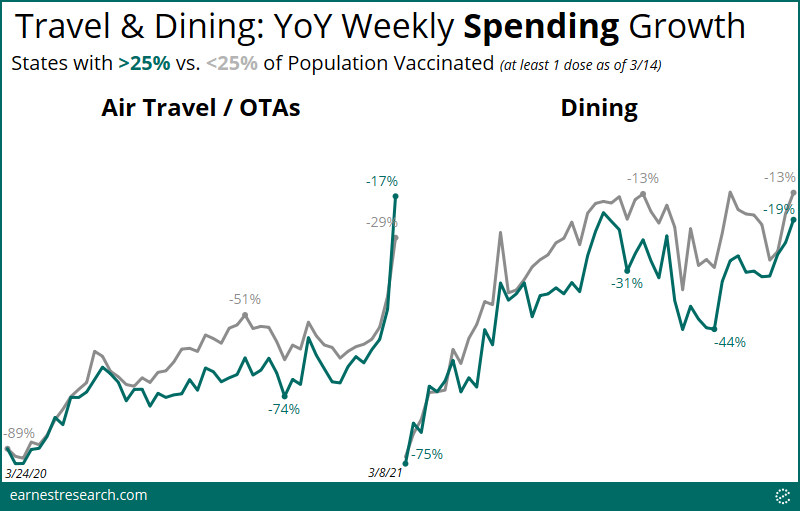

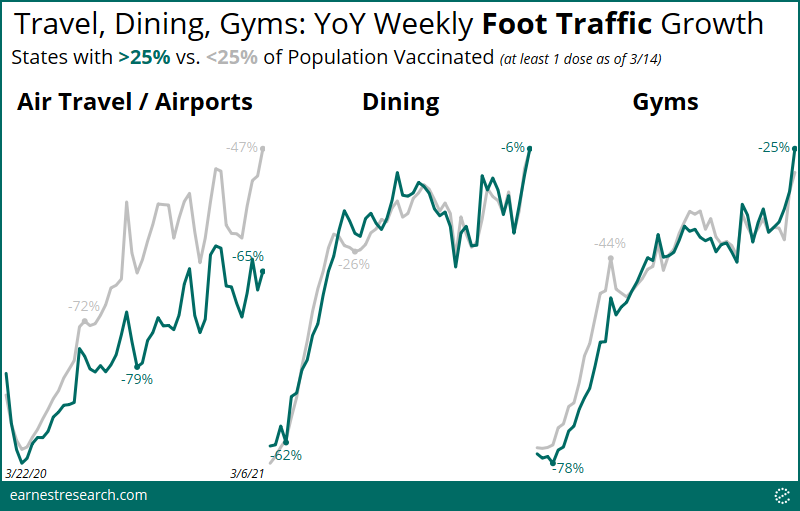

Focusing on sectors that signify the bellwether of a returned-to-normal consumer environment, such as Travel, Dining, and Gym Visits, some interesting trends are beginning to emerge.

In the most recent week of data across the most vaccinated states, Air Travel and Online Travel Agency bookings growth jumped ahead of the rest of the country, after trailing behind over the past year. While still negative year-over-year in the struggle to climb up from the ~90% declines a year ago, the most vaccinated states saw bookings down 17% vs. the 29% declines seen across the rest of the country.

Interestingly, however, when measuring actual foot traffic to airports and their terminals, the most vaccinated states continue to underperform, with traffic declining 65% vs. declines of 47% observed across the rest of the country. This may suggest that while the comfort-to-travel may not have yet arrived, the comfort-to-book may be beginning to materialize in the most vaccinated states.

Similarly, gym visits in the states most vaccinated slightly outpaced the rest of the country in early March. Within Dining, spending underperformance of 15 points late last year in the states most vaccinated narrowed to just 5 points in the most recent week, although actual dining traffic looks equivalent to the rest of the country.

In It For The Long Haul?

Following the one year anniversary of shoppers acquired during the pandemic, a key question remains: will COVID shoppers remain loyal and true, or will this mostly online-driven cohort not make it past the honeymoon period? (See our analysis on COVID-acquired customers from November 2020).

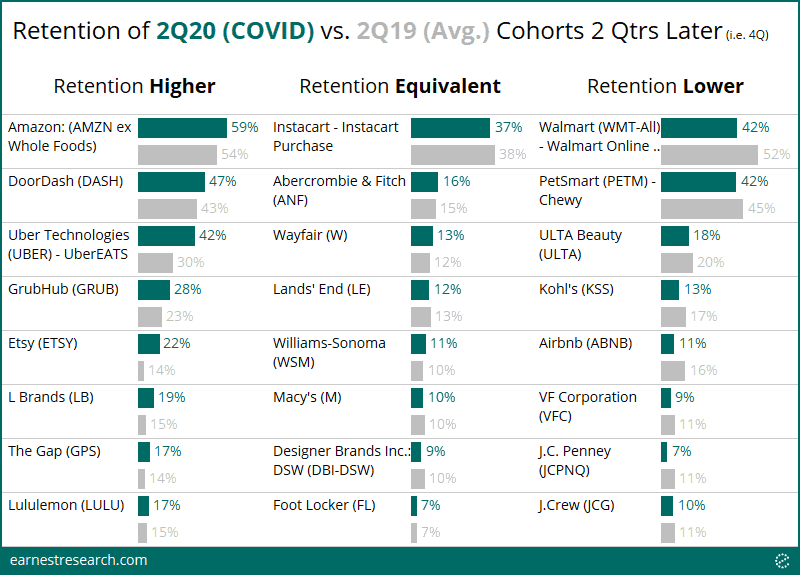

We looked at retention rates in the most recently completed quarter (4Q20), among shoppers acquired—-overwhelmingly online—in 2Q20. We compared their retention rates to the 2Q19 acquired cohort as a benchmark. [As we close 1Q, we will refresh this analysis to see if vaccine rollouts have changed the retention rates of the COVID shopper.]

Across an array of retailers in various sectors, Amazon, DoorDash, Uber Eats, Etsy, among others, saw multiple points of higher retention from the COVID shopper relative to last year’s cohort. Interestingly, Instacart and Wayfair, together with other traditional retail brands, saw equivalent retention rates. On the other hand, Walmart Online Grocery, Chewy, Ulta, Kohl’s, and Airbnb saw several points of lower retention from the COVID cohort.

Amazon Eating Your Wallet

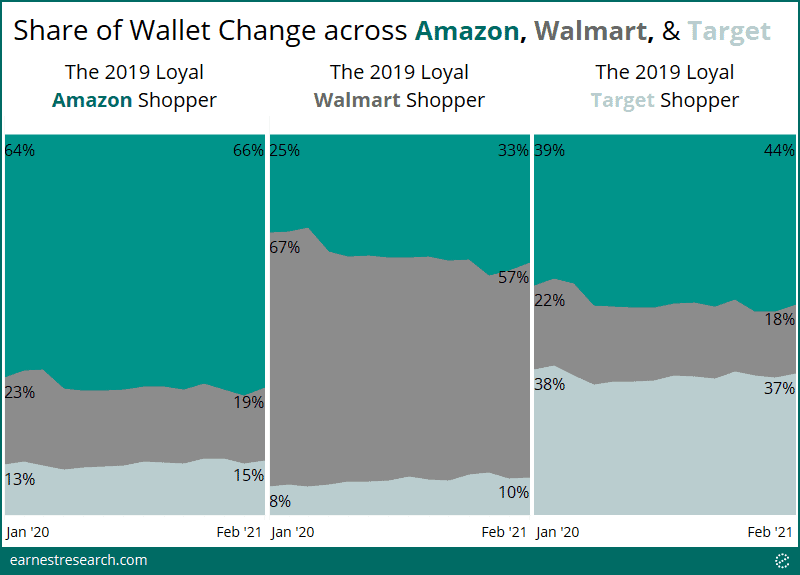

With 20% of customers at Amazon, Walmart and Target representing ~60% of spend at these merchants in 2019, we looked at how the share of wallet changed for this high-value quintile through 2020 and into early 2021.

Amazon’s most loyal customers (i.e. this top quintile) increased their share of spend by 2 points to roughly two-thirds. Their spend at Walmart jumped at the outset of the outbreak when folks were stockpiling groceries, toilet paper, etc. before receding 5 points lower than at the start of last year. Meanwhile, their spend at Target inched up a couple of points.

After peaking in spring last year, Walmart’s most loyal shoppers actually reduced their share of spend at their favorite merchant by 10 points, almost entirely to the benefit of Amazon gaining 8 points, and 2 to Target.

Target’s most loyal cohort remained relatively stable last year, ceding just 1 point by the end of 2020. Interestingly, their share spend at Amazon increased 5 points, while their share at Walmart dropped 4 points.

Notes

__*__Statistics on state vaccination rollouts are sourced from this NY Times analysis, which sources its data from the Centers for Disease Control and Prevention. States with 25% or more of their population vaccinated, with at least one dose as of 3/14, include (in descending order of most to least vaccinated): New Mexico, Alaska, South Dakota, Connecticut, North Dakota, Maine, Rhode Island, Massachusetts, and New Hampshire.

__**__Total Consumer Spending includes our entire consumer universe, excluding the Charitable Giving, Finance, Gig Economy Income, and Telecommunication sectors.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.