Source: https://www.pathmatics.com/blog/how-top-mattress-brands-are-advertising-on-display-and-facebook

Even before the pandemic, online mattress shopping was on the rise. According to the International Sleep Products Association, 45% of the mattresses purchased in 2018 were through online sales. Those numbers will surely be higher once 2020 is tallied.

Online bed-in-a-box startups, of course, have been challenging the sleep status quo for years. Today there are over 200 online mattress retailers, one for every sleeper — no matter your preferred sleep position, size, material, type, and budget. There are even organic and eco-friendly options for a greener sleep.

All of this means that it keeps getting harder for both brick-and-mortar and direct-to-consumer brands to get noticed.

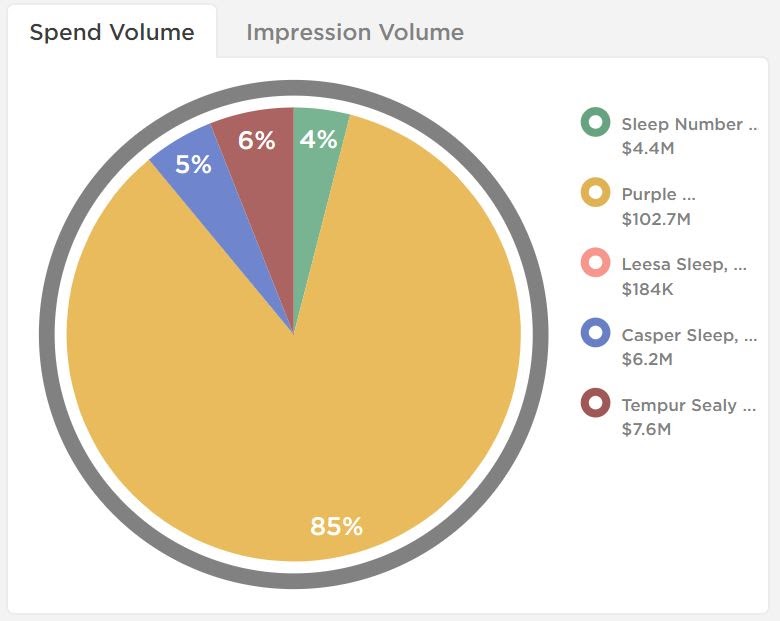

We looked at data in Pathmatics Explorer from five of the top mattress brands — Sleep Number, Tempur, Purple, Casper, and Leesa — to see how they’re using digital advertising to capture sleepy consumers’ attention. Here are some of our top takeaways.

Purple Doubles Down on Digital Ads

First of all, it’s fascinating to note how much Purple is outspending other mattress brands. The comfort tech company has spent $102.7 million on digital ads so far this year — 85% of the total spend for the five brands we looked at. In comparison, its closest competitor in terms of spend was Tempur at $7.6 million.

This aggressive spending strategy worked well for Purple last year. In 2020 Purple spent $224.5 million on digital ads, garnering 37.8 billion impressions. The mattress maker grew its net revenue in 2020 to $648.5 million, a 51.4% year-over-year increase from 2019.

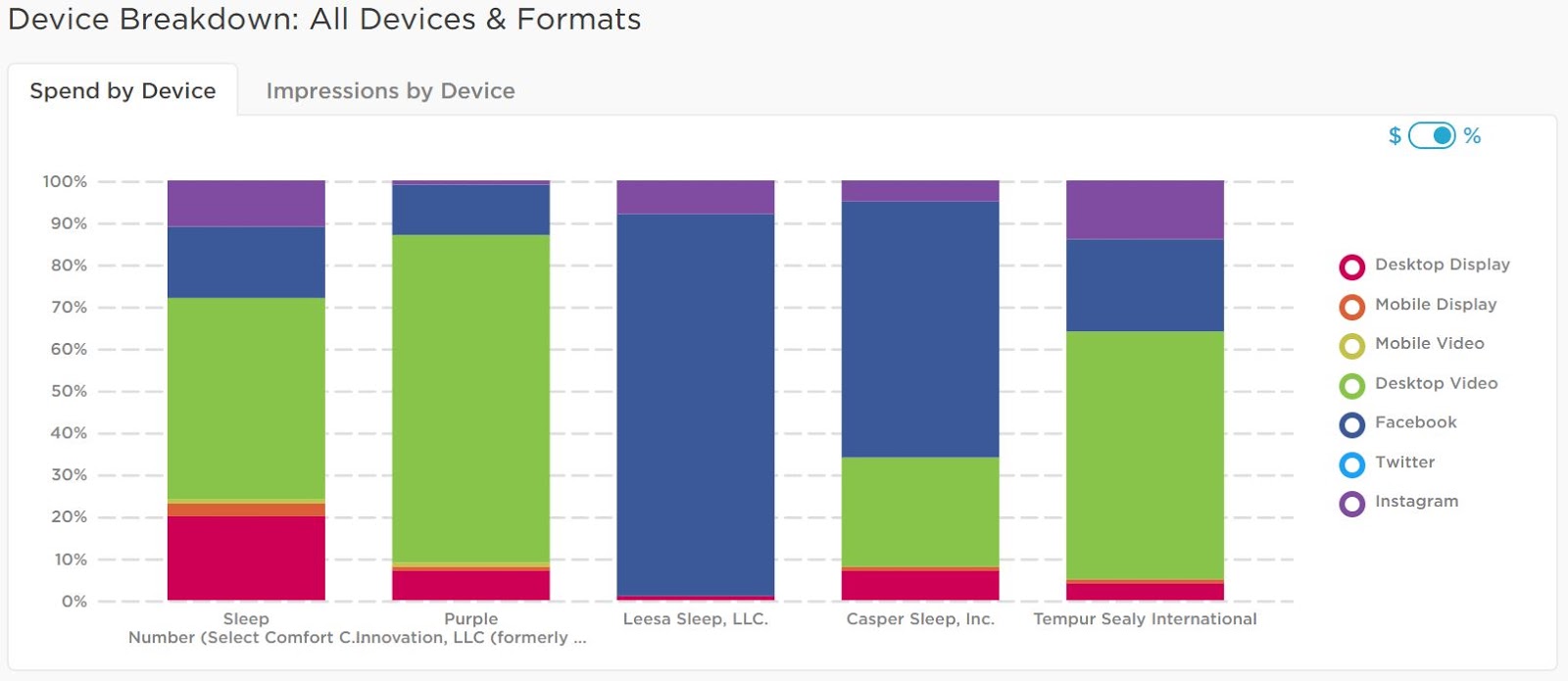

The majority of Purple’s spending (78%) so far this year has been focused on desktop video. Here’s an example of one of its top creatives in terms of spend:

Interestingly, three quarters of Purple’s ads (77%) were ad network purchases. By contrast, the other mattress brands we looked at preferred to buy impressions directly from publishers.

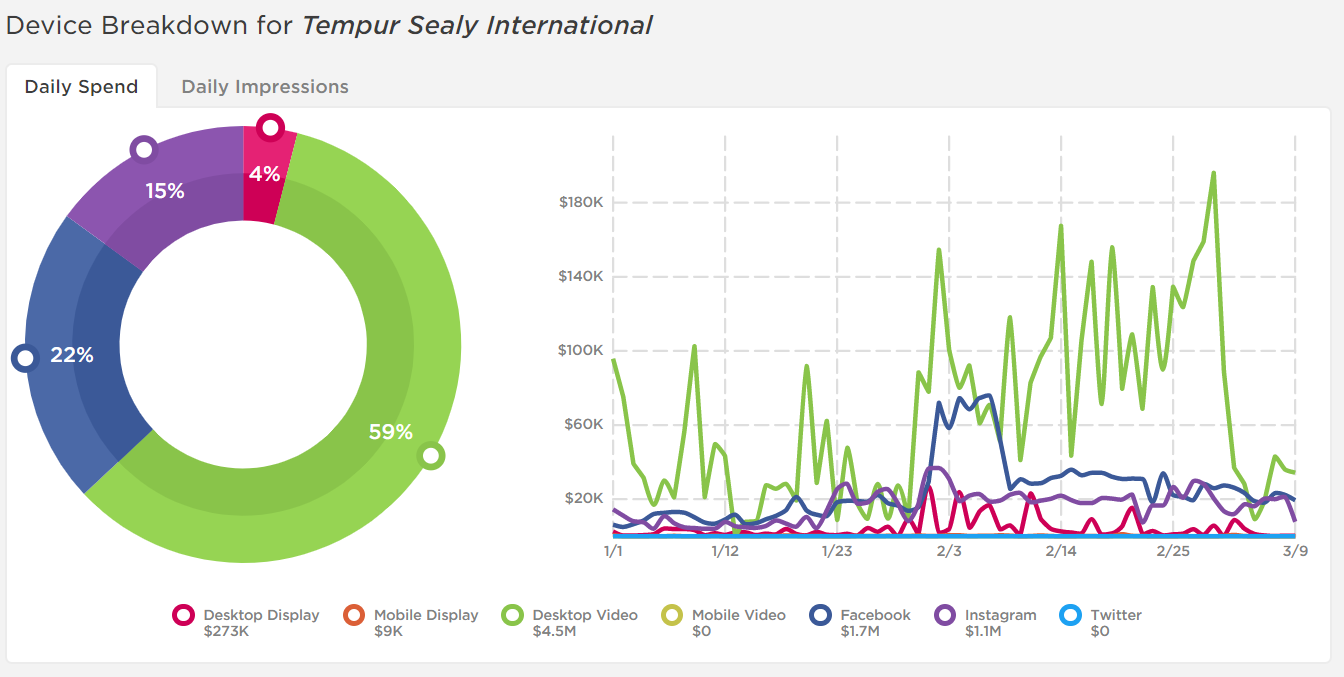

Tempur: The Original Memory Foam Mattress

Tempur-Pedic first offered its memory foam mattress in 1991, so it’s had plenty of time to refine its branding and advertising strategies. Like Purple, Tempur Sealy has focused the majority of its spend on desktop video (59%).

As you can see, Tempur’s spending increased in the weeks leading up to President’s Day (2/15), which is historically a big day for mattress sales.

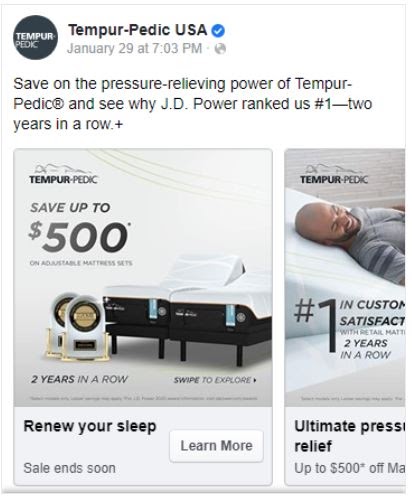

This particular creative, which was first seen on 2/1, leans heavily into the brand’s award-winning reputation.

Perhaps this is Tempur’s way of reminding people that, unlike online startups, their product has been tried and tested.

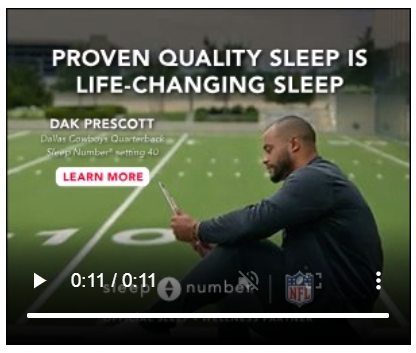

Sleep Number Partners with the NFL

Dallas Cowboys Quarterback Dak Prescott is using his Sleep Number to get a competitive edge on the field.

Sleep Number, too, is hoping their partnership with the NFL will give them leg up on the competition. Although NFL ads didn’t feature in its top creatives for the period, Sleep Number promoted this particular ad heavily leading up to and after the Super Bowl.

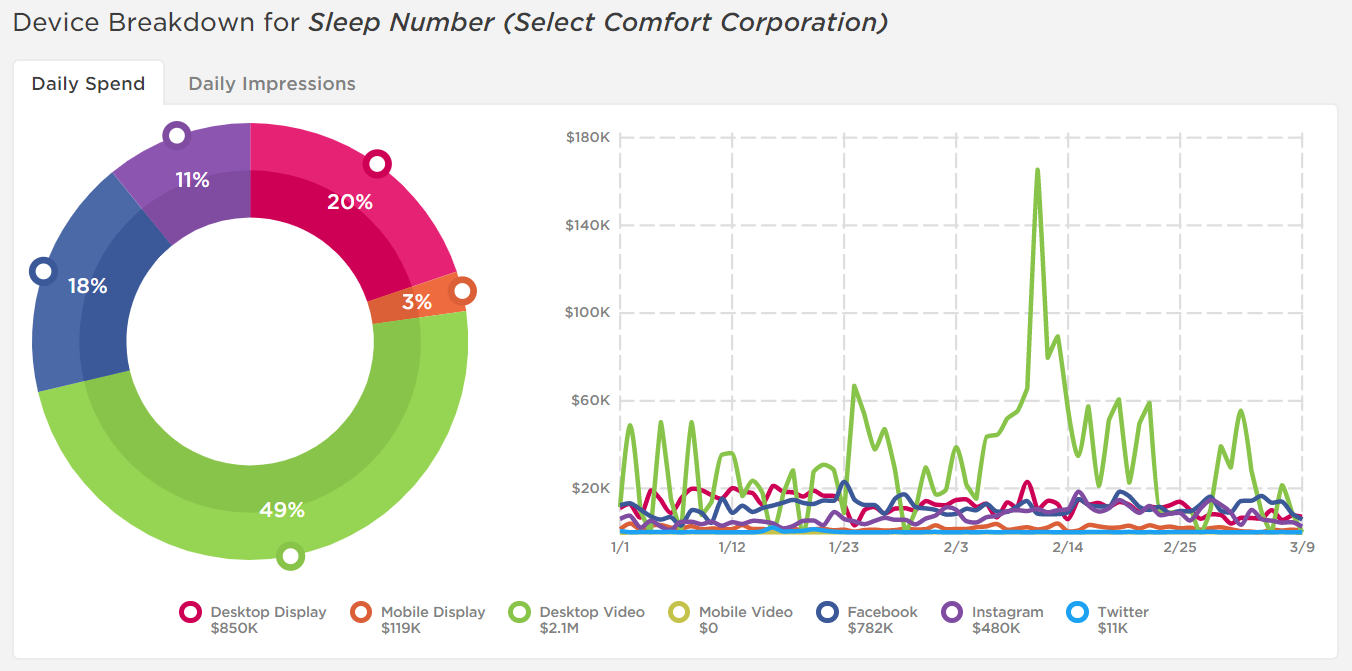

Sleep Number has spent $4.3 million on digital ads this year. The spike in spending in early February coincides with the Super Bowl (2/7) which could indicate a push to capture buzz from the big event.

Leesa and Casper Bet on Facebook

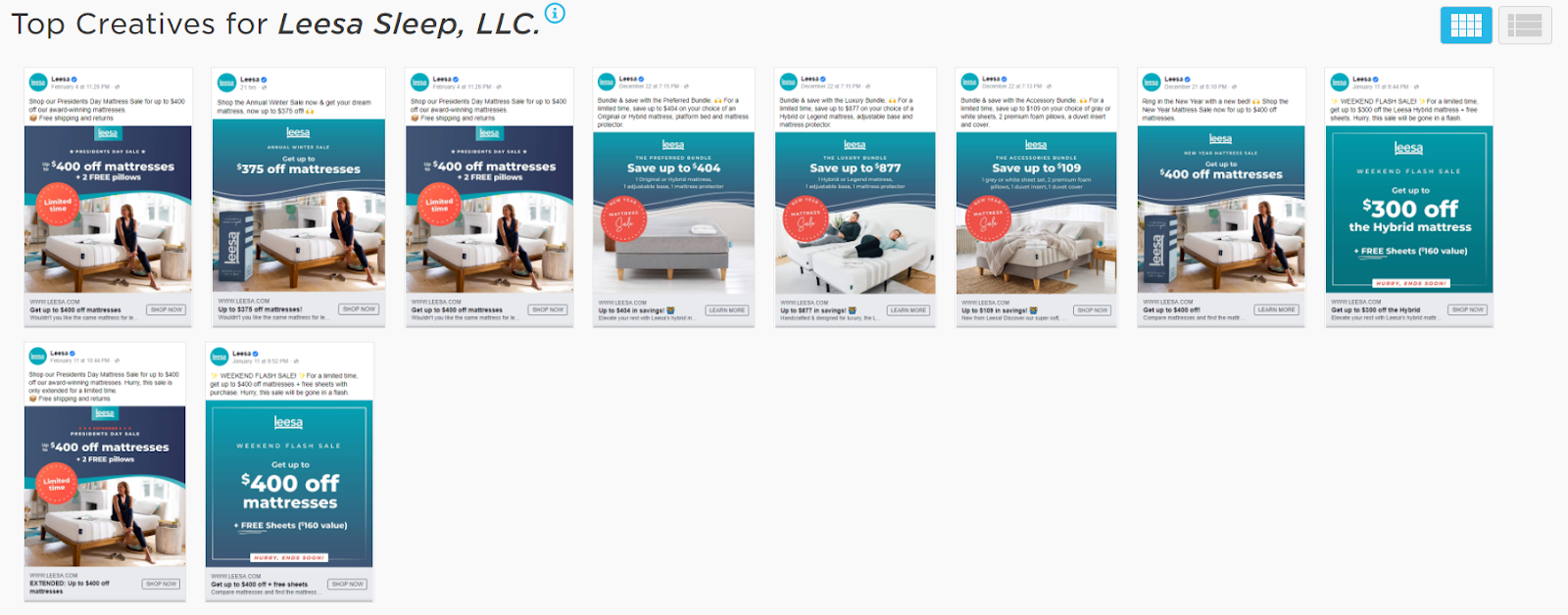

Leesa was voted the best online mattress of 2020 by Wirecutter. Since the start of this year, the brand has devoted nearly all of its $184,000 budget to Facebook ads (91%).

All of its top 10 creatives for this period feature discounts and offers like free pillows and sheets, suggesting that Leesa is trying to target budget-conscious shoppers.

Casper, one of the original online mattress brands, also devoted the majority of its $6.2M budget to Facebook (61%), followed by desktop video (26%). Casper’s ads feature the ubiquitous ‘Millennial pastel’ palette and are overtly designed to appeal to women, with messaging like “Queen size comfort”.

What’s next?

With Memorial Day mattress sales coming up, it’ll be interesting to see how these brands compete for tired Americans’ attention.

It’s unlikely that anyone will catch up with Purple’s spending, so advertisers can’t afford to snooze on their digital strategies. Let’s just hope they got a good night’s sleep.

*Data gathered from Pathmatics Explorer from January 1 to March 9, 2021.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.