Source: https://blog.linkup.com/data-seekers/2021/03/18/renewables-power-top-companies-in-the-energy-sector/

In our recent Energy Sector Jobs Report, we explore an industry in transition. The shift from traditional fossil fuels to renewable energy sources continues to gain momentum on the heels of a record-breaking year for clean energy installations and acquisitions.

The report gives an overview of how job listings in the sector are changing, as well as which companies are growing and which are declining. To expand on this analysis, we decided to take a deep dive into a few standout companies identified in the report to see how their job listings and share prices have changed amid recent growth initiatives.

On the rise:

NextEra Energy (NEE) is the world’s largest utility company, as well as the world’s largest producer of wind and solar energy. The company owns and operates generating plants powered by natural gas, nuclear energy and oil. Common among companies transitioning away from traditional energy sources toward more renewable options, NextEra has a history of failed acquisitions, including an offer from Berkshire Hathaway Energy and Energy Future Holdings.

Share price for NextEra has been steadily increasing over the past three years, though they have made news for recent dips. Job growth has been similarly steady with active job listings up 29% over 2020, and 30% over the last three years.

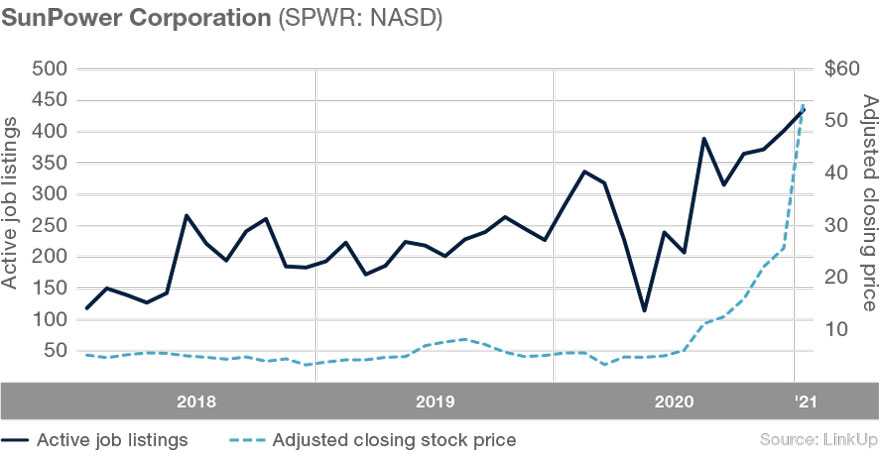

SunPower Corporation (SPWR) is an American energy company that designs and manufactures crystalline silicon photovoltaic cells and solar panels based on an all-back-contact solar cell. They’ve found themselves the subject of recent headlines on the heels of their late February earnings report. Despite 35% growth projections for 2021, SPWR’s share price, which saw substantial growth in 2020, fell double digits.

Even with that drop, the company’s future looks bright with improving margins, growing energy storage, and the potential for Texas’ recent power failures to open up a massive market for solar and energy storage. Job growth for the company looks strong as well, with active job listings up 54% in 2020, and up 269% over the last three years.

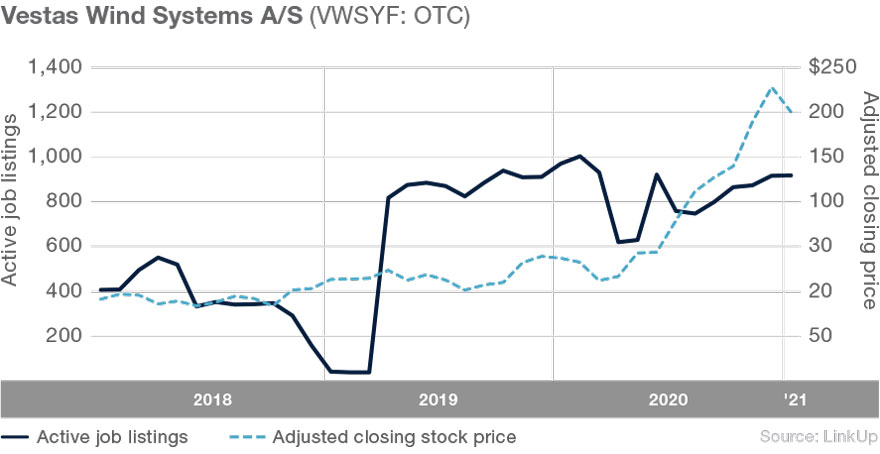

Vestas Wind Systems (VWSYF) is a Danish manufacturer, seller, installer, and servicer of wind turbines across the globe. Vestas is regarded as one of the “big three” turbine makers, along with GE and Siemens Gamesa. Competition among these power-players is fierce in the three channels crucial to revenue growth: onshore, offshore and service. Vestas has led their competitors on the onshore front, but has had challenges remaining competitive in the fast-growing offshore segment. Vestas’ recent launch of what will be the world’s largest wind turbine, the V236-15MW, puts them back on a more even footing with competitors in the offshore segment.

Job listings for the company have grown 125% over the last three years, but were down 5% in 2020. January 2021 found Vestas with 919 active job listings, but February brought bad news with the company laying off 450 workers. Vestas share price rose significantly in 2020.

Lagging behind

Other more traditional energy companies are lagging behind as they cling to old fuel sources instead of prioritizing renewables.

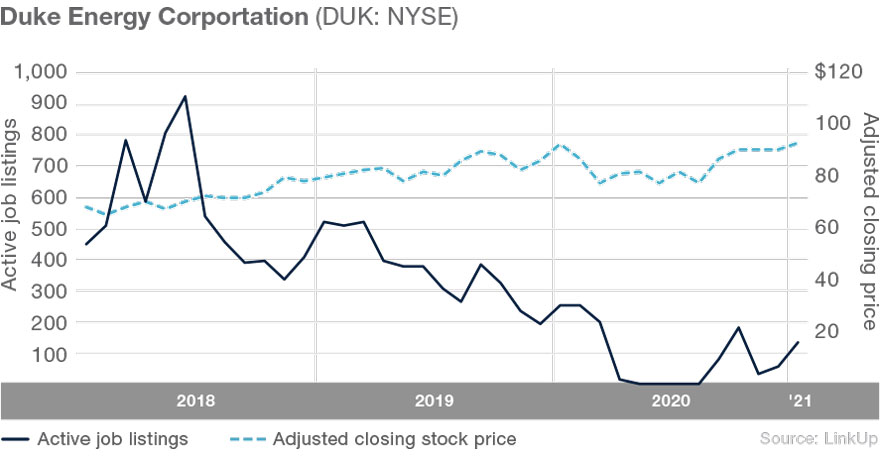

Duke Energy Corporation is an American electric power holding company headquartered in Charlotte, North Carolina. Almost all of the company’s Midwest generation comes from coal, natural gas, or oil, while half of its Carolinas generation comes from its nuclear power plants.

Duke Energy was late to diversify, and was recently eyed for a merger by NextEra Energy, who has long been seeking to acquire a major utility. Currently, they find themselves in the midst of legal challenges by organizations opposed to their plans for additional plants and pipelines.

Duke Energy’s jobs have been on a downslide for some time, down 47% in 2020 and down 70% over the last three years. Share prices have remained relatively steady, with some recent upward movement possibly attributed to the company’s plans to build and sell its first solar plant.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.