Source: https://insights.consumer-edge.com/2021/03/using-channel-data-to-see-where-kgf-is-fishing-for-sales/

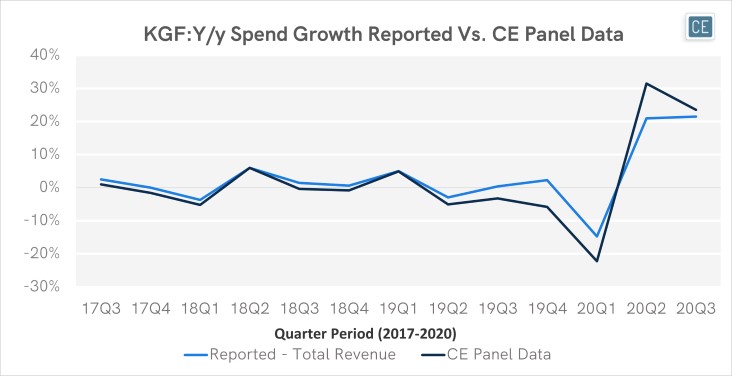

CE Transact data has tracked Kingfisher sales very well in the UK, with high correlations to reported results. Our recent launch of online vs. offline channel breakouts in the UK provides further insight into what has helped the home improvement retailer weather the COVID storm.

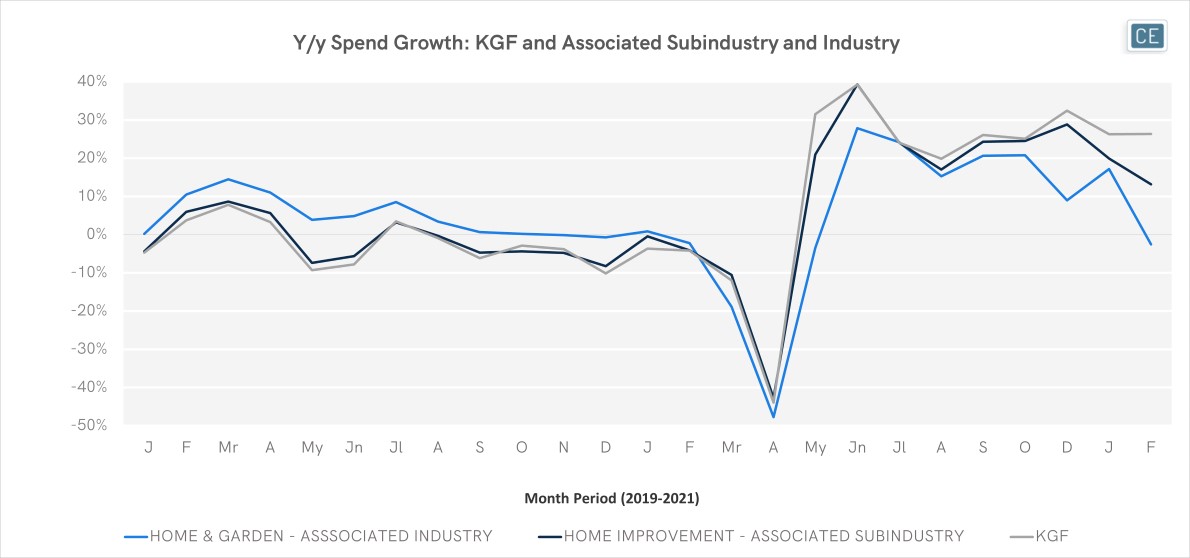

While Kingfisher’s growth lagged overall UK Home & Garden spend throughout 2019, the company got a big boost during the pandemic. KGF sales grew over 30% y/y in May 2020 while overall Home & Garden was still declining, and outpaced industry growth when Home & Garden recovered to 28% growth in June. Since August, KGF y/y growth has been outpacing the industry every month.

Kingfisher vs. Industry Trends

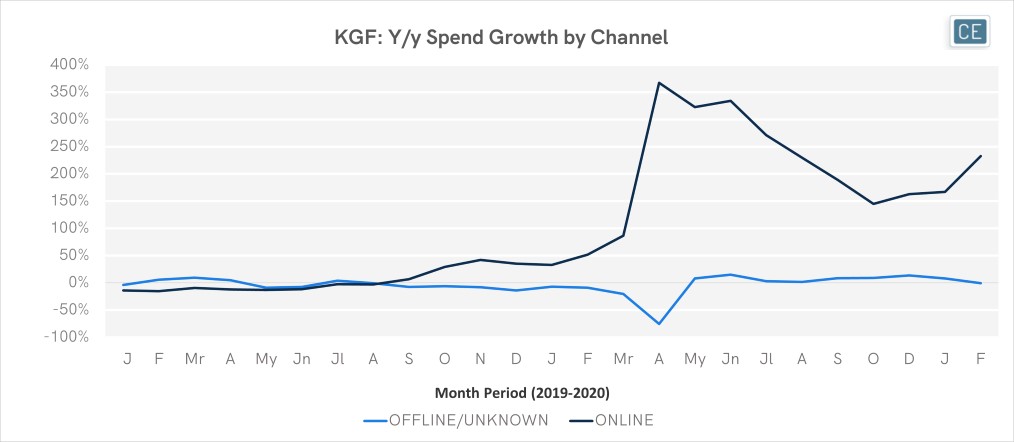

KGF’s e-commerce business strength is a likely driver of its recent success. Already showing substantial growth pre-pandemic, KGF online sales grew over 300% in April, May, and June of 2020. Although offline sales returned to positivity in May, even strong y/y growth of 17.7% in February paled in comparison to online’s almost 200% growth rate.

Channel Spend

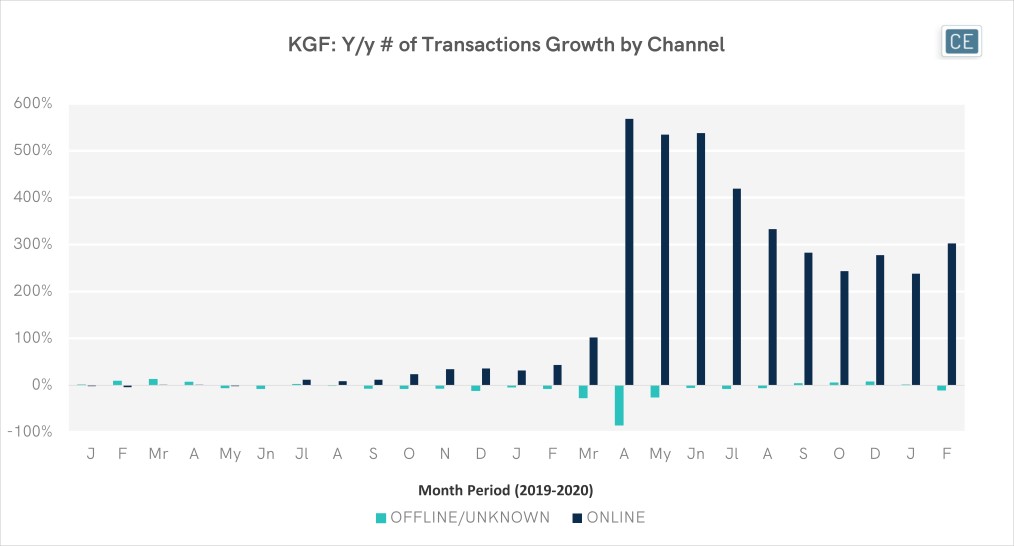

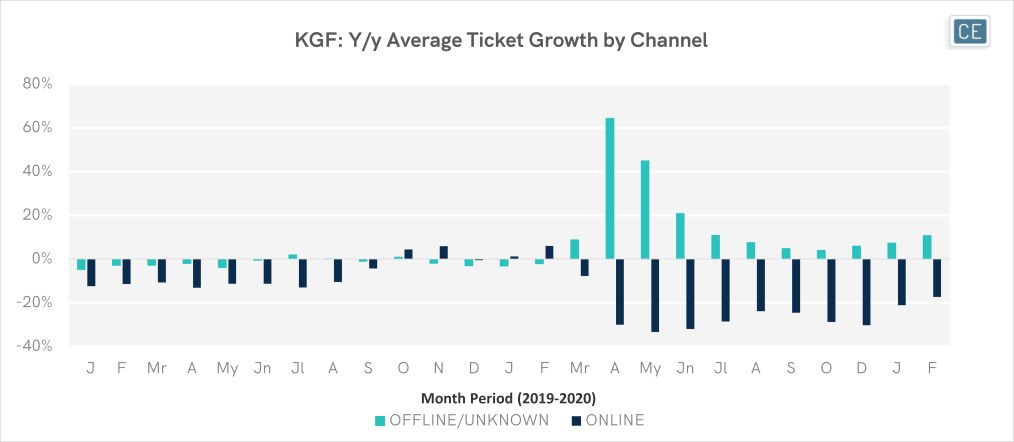

This divergence in online vs. offline trends becomes even more stark when looking at growth in transactions vs. average ticket. Despite overall spend growth beginning in May, offline KGF transaction growth was negative through August of last year. Meanwhile, online transaction growth topped 500% in April through June before “decelerating” to over 400% in July and over 300% in August. In contrast, offline ticket size growth skyrocketed to 64% last April and 45% last May. Meanwhile, online transaction size saw decreases of 15-35% every month since then. It seems like many KGF shoppers are substituting online purchases for what would have been quick trips to get a few things and saving offline visits for stocking up.

Transactions vs. Average Ticket

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.