There’s no doubt about it, the computer hardware industry came out on top during COVID-19. While people were stuck at home during the pandemic, there was a higher demand for computer hardware for people working at home. There was also more time for gamers to invest in better, faster gaming equipment.

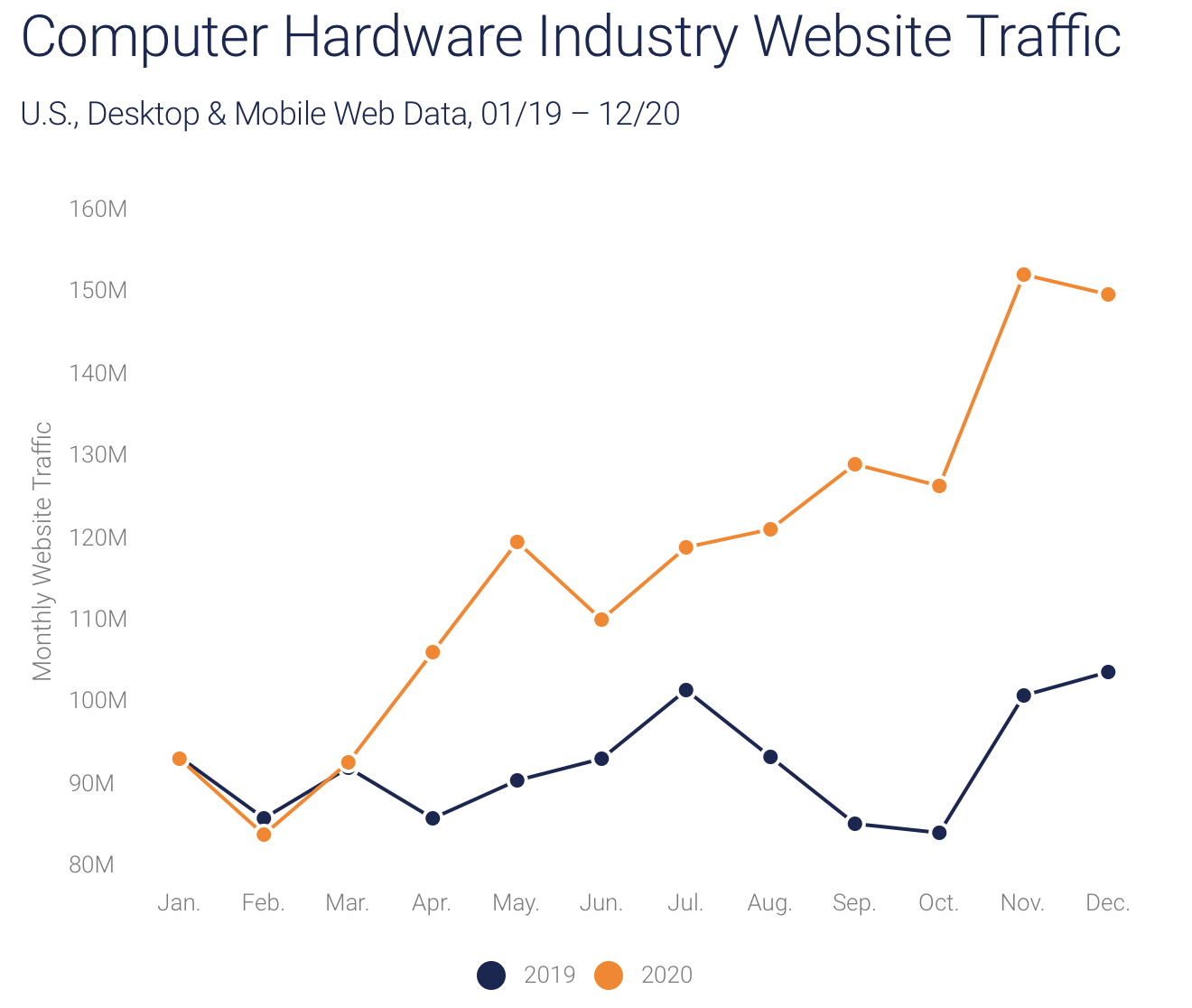

Using SimilarWeb’s alternative datasets, we can see that website traffic to the U.S. computer electronics hardware industry surged 48% year-over-year (YoY) in 4Q20. Indeed on a YoY basis, 1Q20 traffic dropped 4%, before rising 24% in Q2 and 32% in Q3.

The industry experienced peaks in May during the height of the pandemic and Memorial Day sales and experienced an even larger peak in November during Black Friday sales.

Top 10 traffic performers own the industry

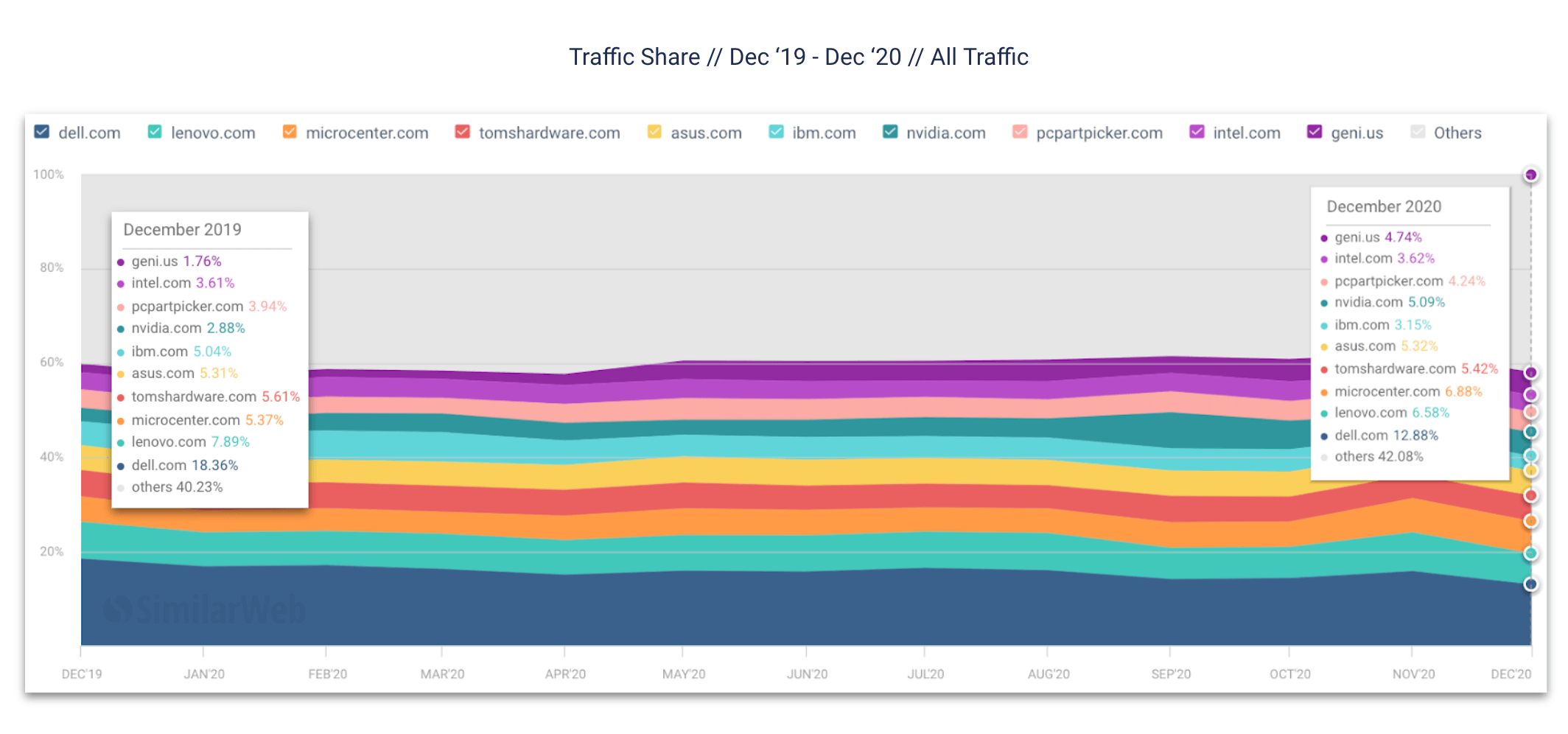

Looking at the top 10 traffic performers, we can see that overall they took just under 60% share of the industry. In particular, Dell received the largest share of traffic throughout the year. However, its share of voice fell from owning nearly 20% of the market to only 13% by the end of 2020.

While most of the top competitors’ share remained the same or shrunk a little, Nvidia’s share nearly doubled from the end of 2019, to just under 6% of the overall computer hardware market.

Video gamers’ darling Nvidia takes the lead

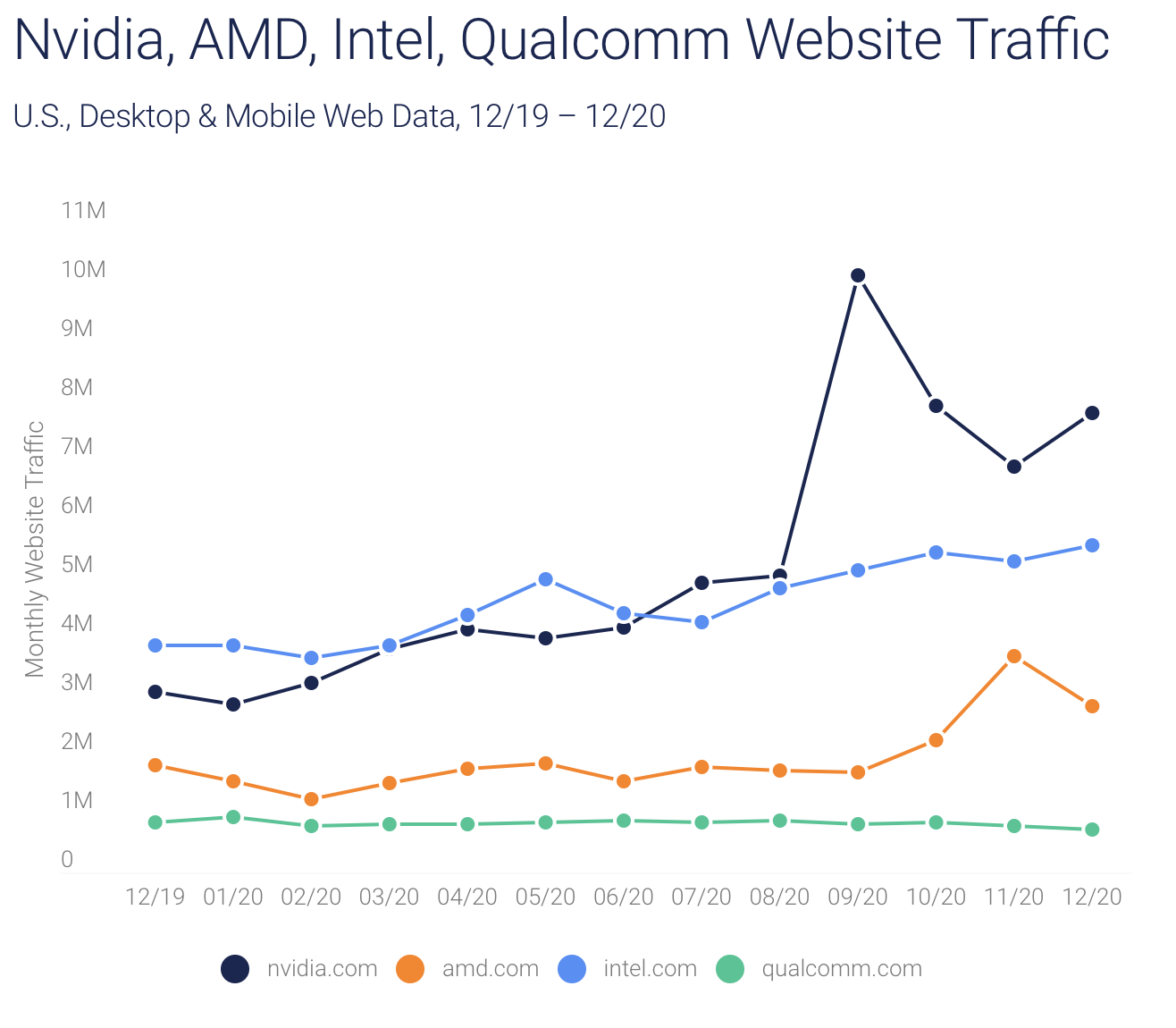

Within the competitive set of top four players (Intel, Nvidia, AMD and Qualcomm), Nvidia experienced the largest growth over the year of 153%, allowing it to cement its position as the top traffic performer by June 2020.

However, Intel also grew by 43% YoY and saw traffic increase consistently on a month-over-month (MoM) basis.

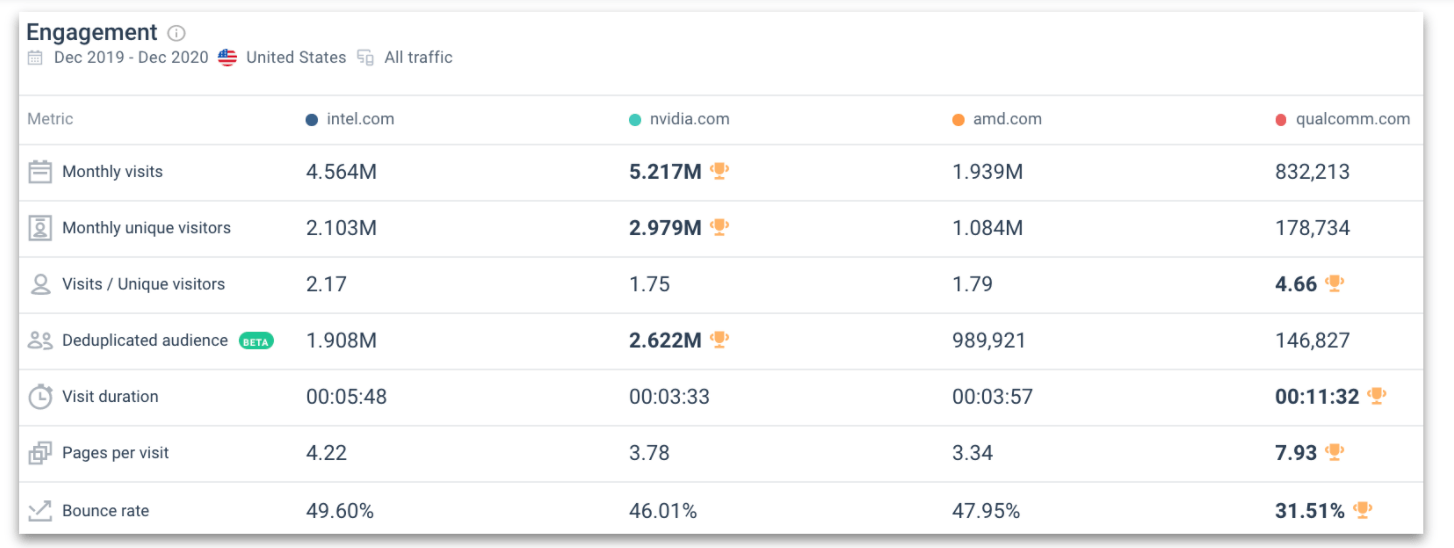

Out of the four companies, Qualcomm boasted the best engagement metrics like visits per unique user, visit duration, pages per visit and also had the lowest bounce rate. Although its traffic declined 12%, our metrics indicate that the traffic it did receive was higher quality.

What’s the secret chip? How did these companies acquire traffic?

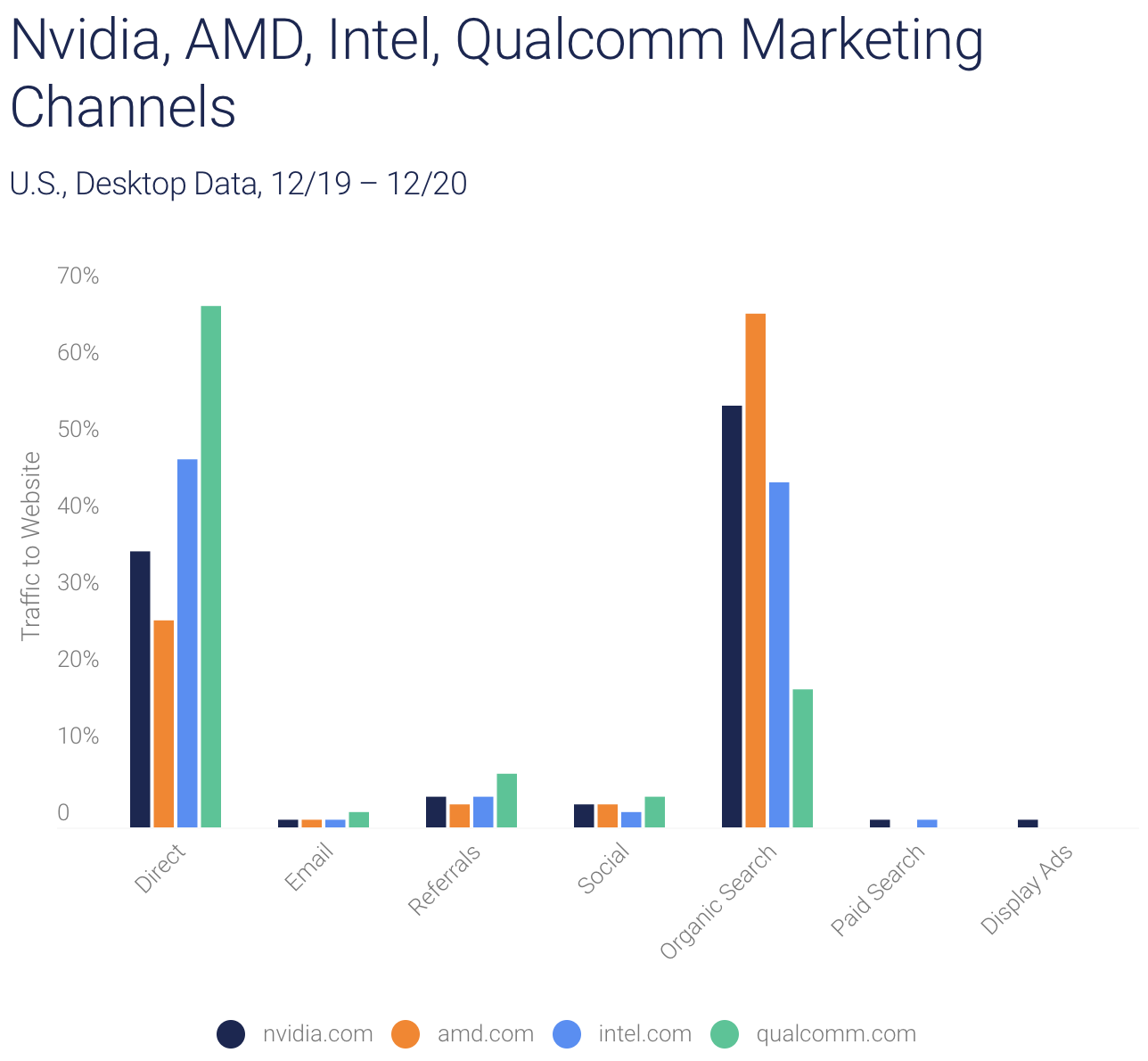

For all four websites (nvidia.com, intel.com, amd.com and qualcomm.com), organic search was the most relied on channel, with an average of just under half of all visits coming through organic search. This suggests content and optimization is very important for these sites.

On average, 44% of all traffic was direct to these websites, suggesting they have less reliance on acquiring consumers through marketing channels.

Specifically, Intel relied just as heavily on direct traffic as organic search, while Nvidia and AMD relied more on organic search.

Other marketing channels, such as referrals, social, paid search and display ads, weren’t as relied on by these sites.

Spotlight on Nvidia

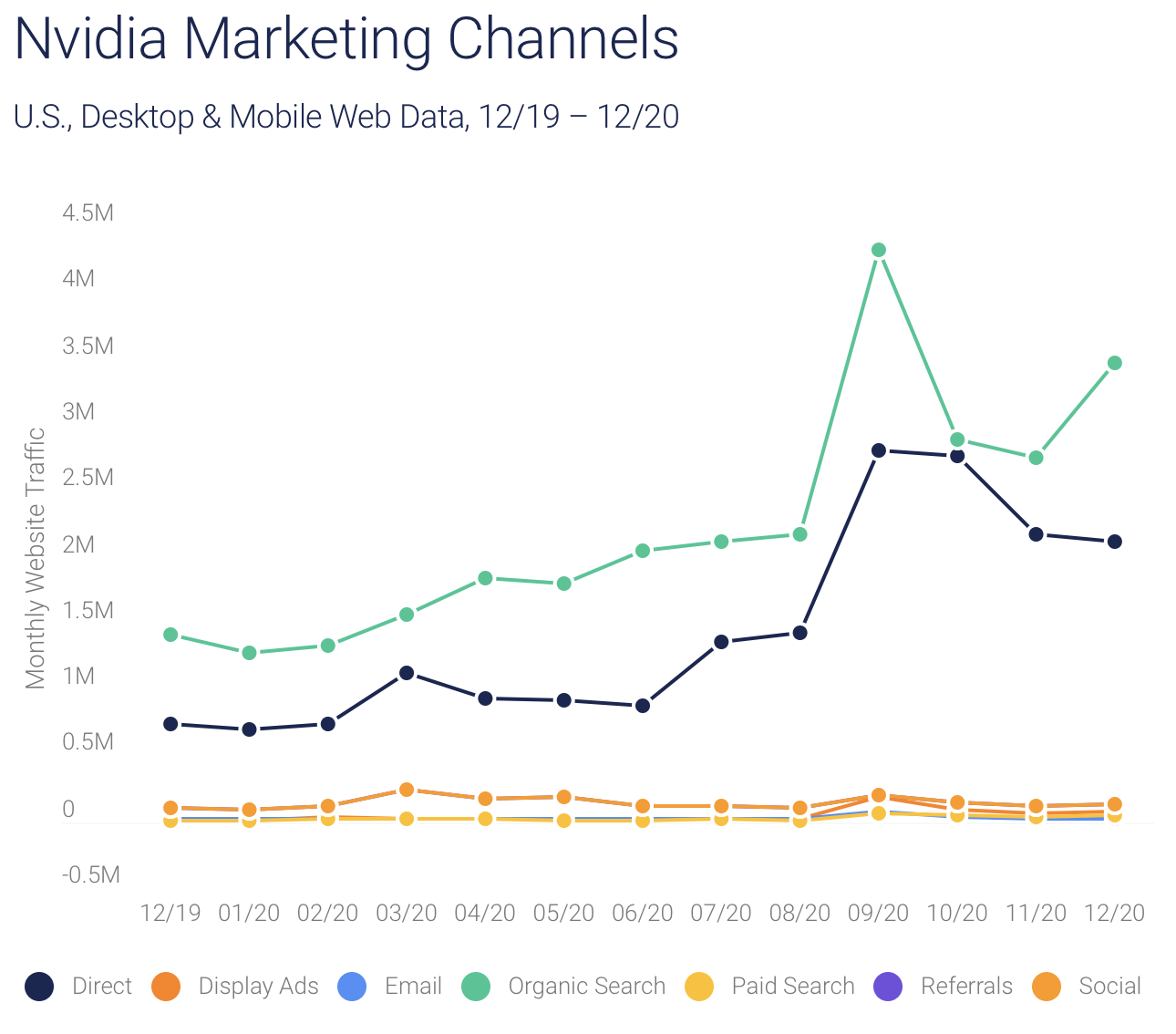

Looking at traffic from marketing channels to Nvidia’s site, we found that it experienced a substantial increase over the year from direct traffic and organic search. This suggests that both brand awareness grew in 2020, and the company focused on optimizing its site and creating more content in order to perform better on SEO.

As for the other channels, traffic remained fairly steady throughout the year, except for September, where traffic through all channels doubled or more. This was the same month Nvidia RTX 3080 was released, suggesting the company used all marketing channels to promote the release.

Here you can see the surge across marketing channels to nvidia.com in September 2020:

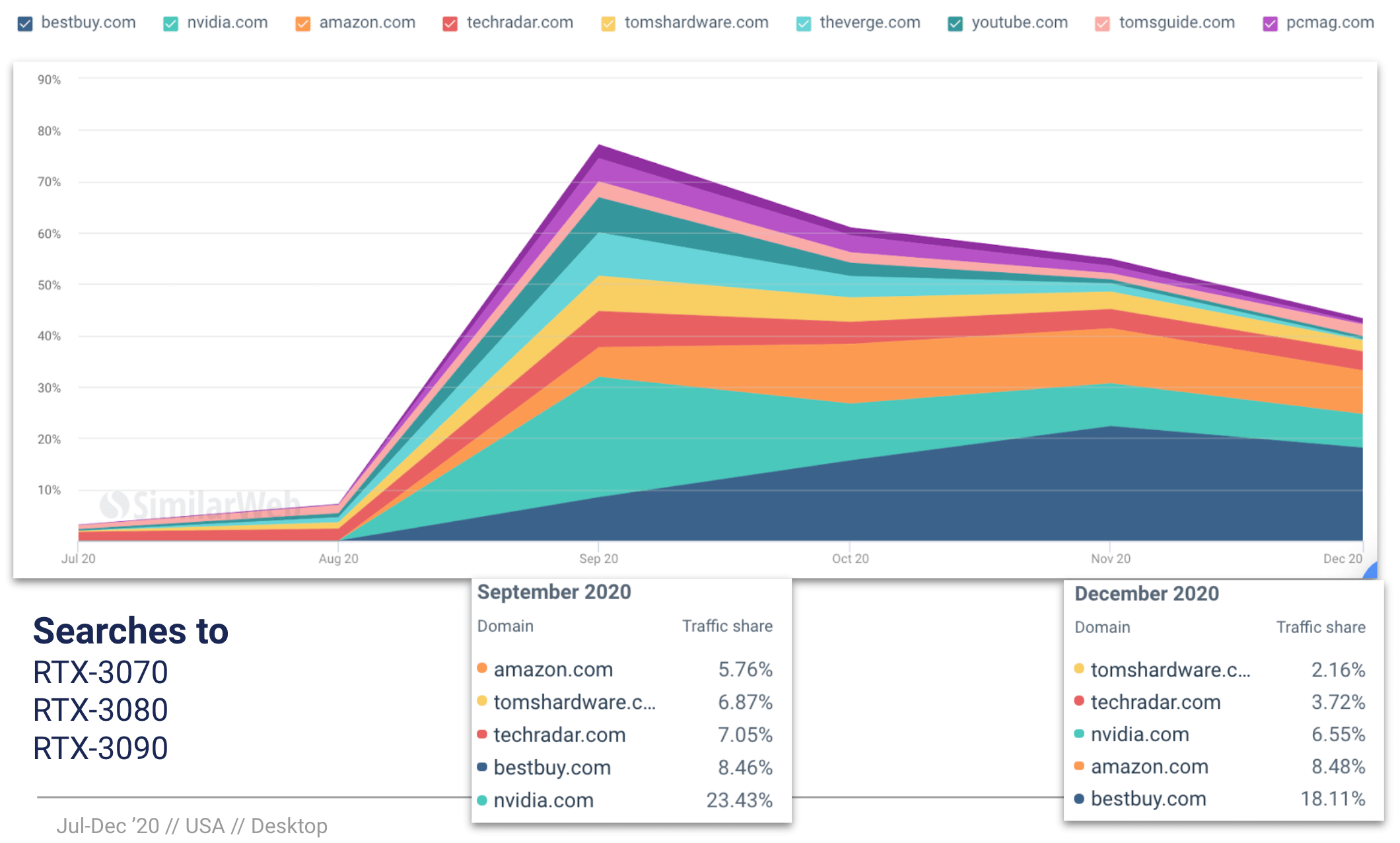

It is clear that the release of Nvidia’s RTX Graphics card drove the increase in traffic to nvidia.com as the demand for RTX-3070, 3080, and 3090 shot up to over 6M searches in September, 2020 (but has since leveled off at 3.5M searches). Three of the top seven SEO landing pages for Nvidia are related to RTX keywords.

RTX keywords drive growth

Taking a closer look at RTX keywords, we can see that Nvidia had 23% share when the RTX product was first released, but that share shrunk to 6.5% in December. Both Best Buy and Amazon have the most search share for RTX keywords.

Top non-branded keywords all go to Nvidia

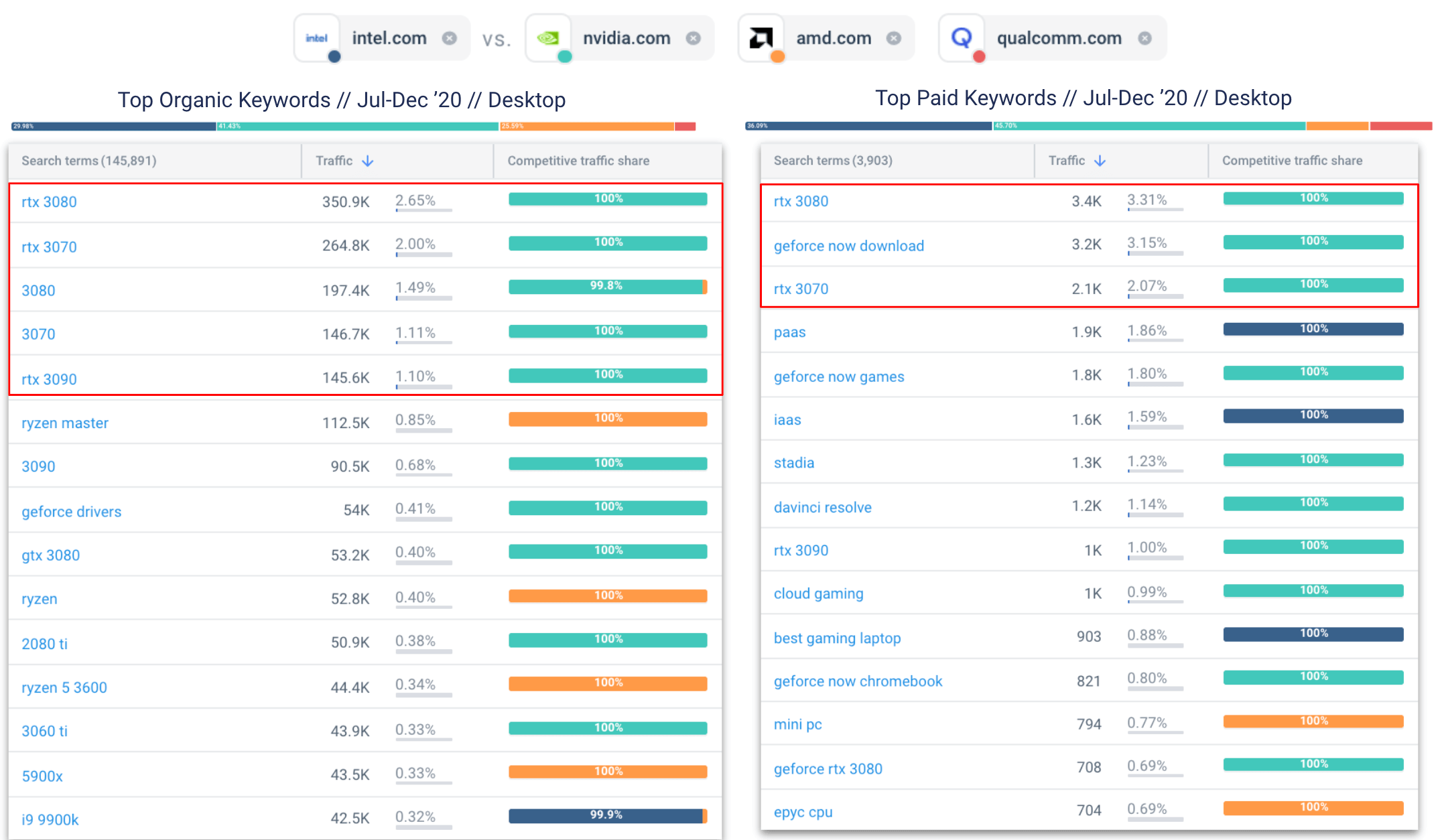

From both an organic and paid search perspective, Nvidia received the largest share of traffic, followed closely by Intel.

Top keywords for both organic and paid were mainly model specific to each brand, suggesting people are searching directly for models rather than generic product keywords or long-tail/question queries around the industry.

Overall, organic search was more important and there were more keywords that generated organic traffic to the industry vs paid keywords (146k vs 4k).

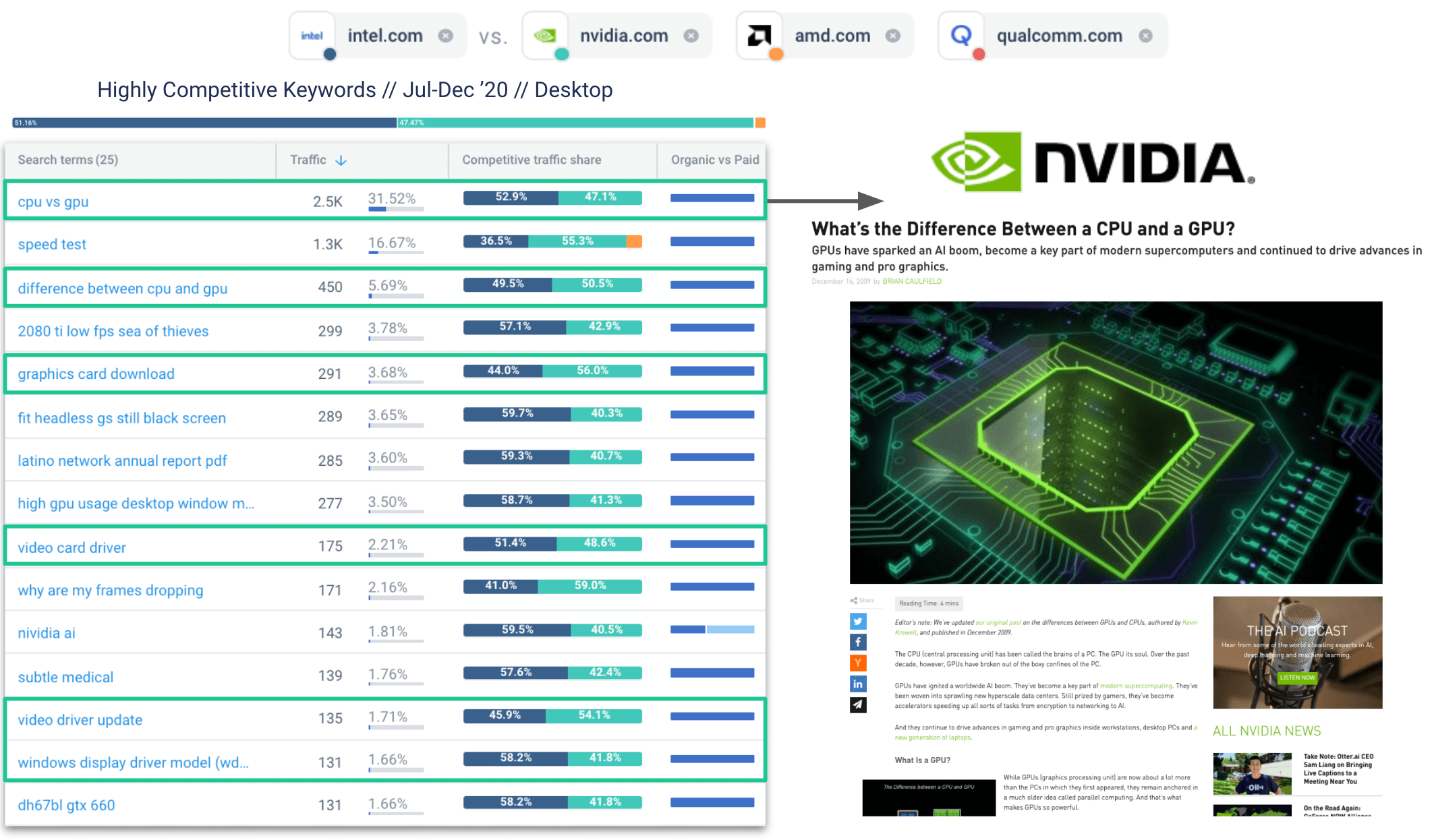

Highly competitive keywords

When looking at the highly competitive keywords that all competitors received a share of voice for, Intel received the largest share, taking more than half of all traffic, followed closely by Nvidia.

Content that all competitors receive a share of traffic from include “cpu vs gpu” as well as graphics cards/video drivers.

Nvidia is the biggest threat

Given the above, it’s not surprising that Nvidia is the biggest threat to all competitors as competitors’ audiences overlap the most with them.

For Nvidia’s competitors, a larger share of their consumers also visit Nvidia’s site, suggesting that Nvidia is the biggest competitive threat to all three sites.

However note that Nvidia’s audience doesn’t overlap with Qualcomm, suggesting that Nvidia is not viewed as a competitor by Qualcomm’s audience.

Newegg retail insights

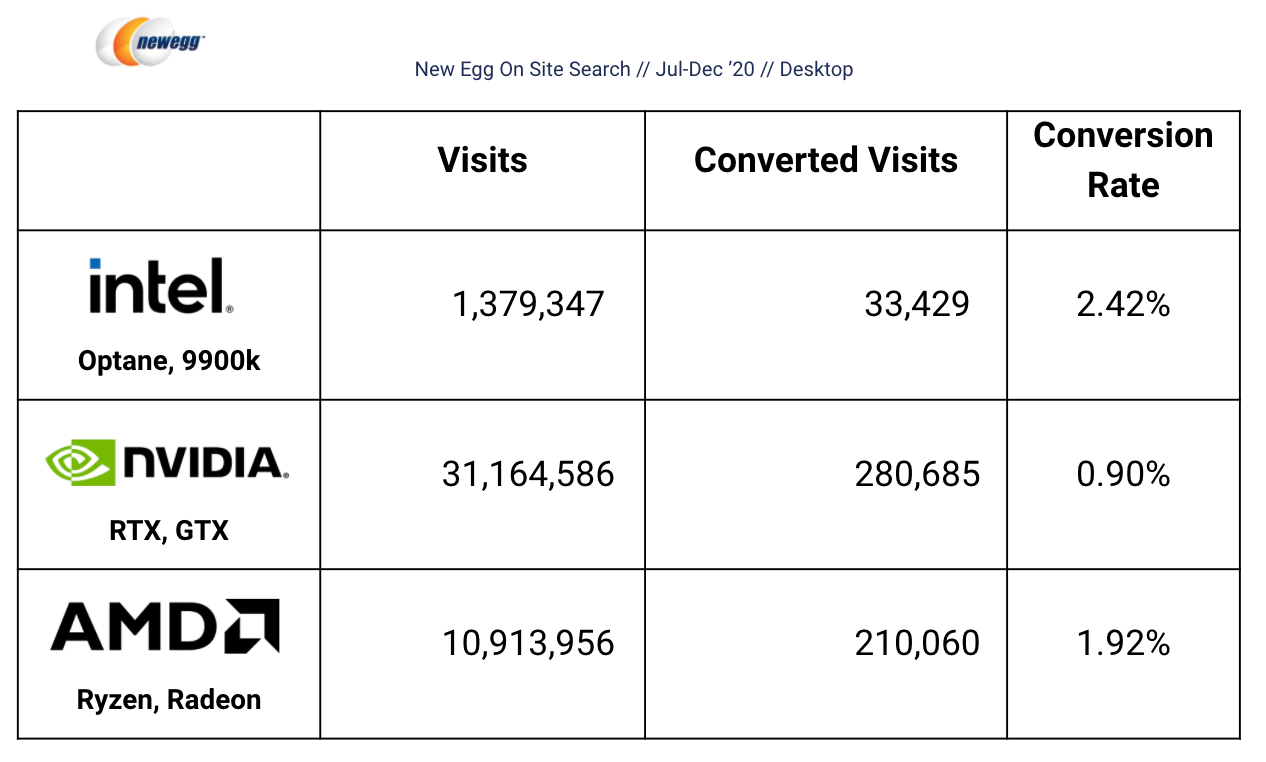

Let’s wrap up with an analysis of the trends on online retail site Newegg, which specializes in computer hardware and consumer electronics.

In 2020, AMD received the largest share of traffic overall on Newegg within the competitive set of Nvidia, AMD and Intel, taking nearly 50% share of all traffic. However, looking on a monthly basis, Nvidia overtook AMD’s traffic in September and October, until it received a huge spike in traffic in November when the AMD Ryzen 5000 Series desktop processors were released.

Although Intel received the second highest share of traffic overall, by the end of 2020 it received the least traffic in the set on Newegg.

In terms of growth, all three companies experienced an increase in YoY traffic on Newegg, but Nvidia grew the most at 440% by the end of 2020. However Intel had by far and away the best conversion rate:

Key takeaways and implications

Overall, the computer hardware industry saw a powerful YoY increase of 43% in 2020. The primary reason: Increased demand for computer hardware with more people stuck at home during the pandemic.

Within the competitive set, Nvidia experienced the largest growth over the year of 153%, outpacing the industry and allowing it to become the top traffic performer by June 2020. Nvidia experienced an increase in both direct traffic and organic search traffic. This indicates that the company put a greater focus on content creation and search optimization and effectively boosted brand awareness and its performance on search engines.

AMD received the largest share of traffic on Newegg within the competitive set, however Nvidia searches generated the most converted visits. Intel boasted the best in class conversion rates.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.