Brick-and-mortar retailers have been suffering during COVID-19, but one category that is expanding is dollar stores. Demand for the inexpensive groceries and household items found in dollar stores skyrocketed in 2020, especially in rural areas with fewer shopping options. An analysis of transaction data found that among dollar stores, Dollar General experienced the highest sales growth in 2020 by capturing spend from customers who previously shopped at competitors.

Dollar General’s sales march ahead of competitors

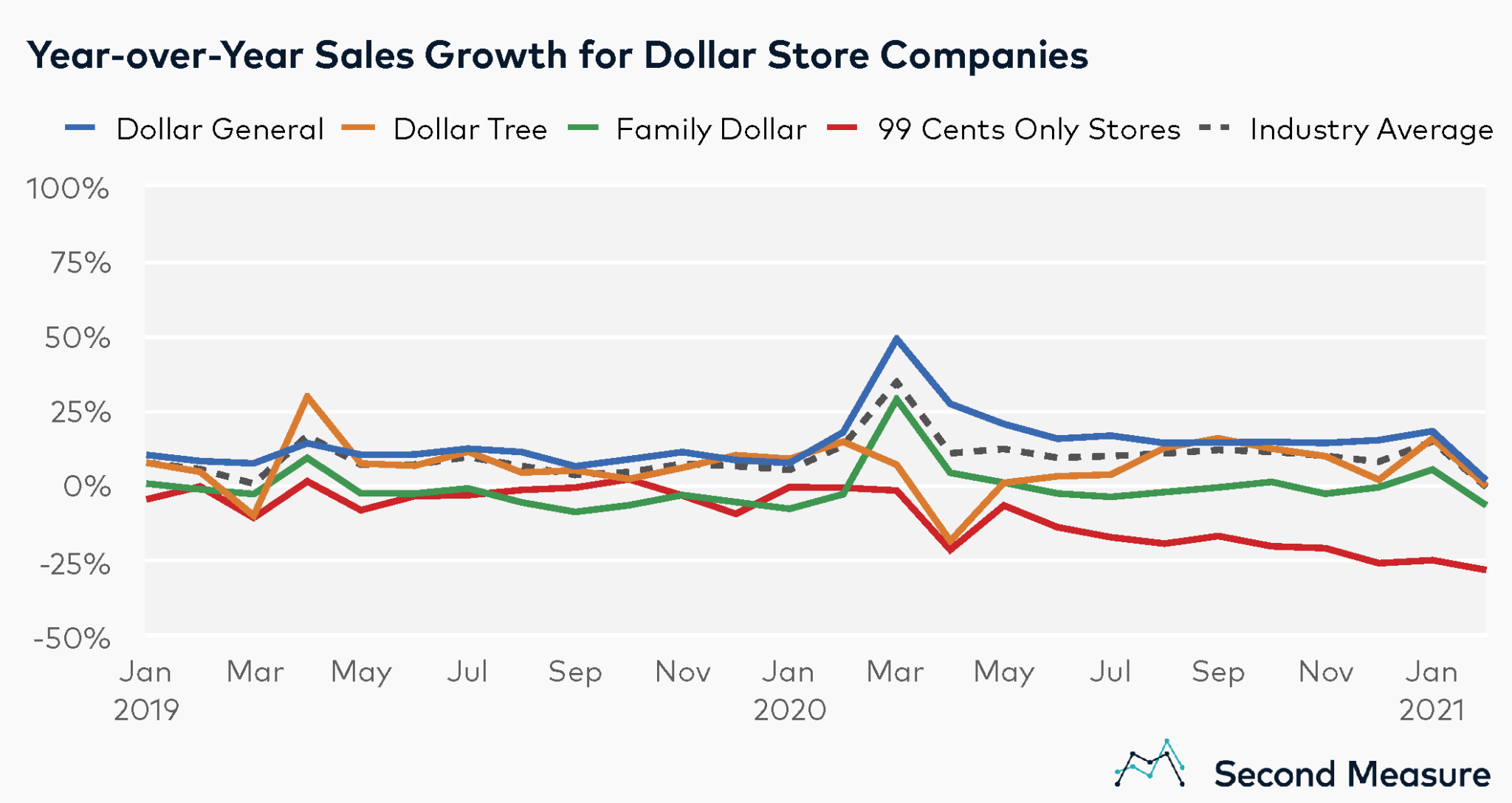

Dollar store sales have been rising over the past few years, with sales growth further accelerating during the pandemic. The biggest players in the industry are Dollar General, Dollar Tree, Family Dollar (which was acquired by Dollar Tree in 2015), and 99 Cents Only Stores. In 2020, the dollar store industry saw average monthly sales growth of 12 percent year-over-year, compared to 7 percent in 2019. It is worth noting that cash transactions are not included in Bloomberg Second Measure data, so some of this growth might be attributed to the migration of in-store cash transactions to online credit card transactions as consumers shifted to online shopping amidst shelter-in-place orders. Additionally, the industry’s year-over-year growth rate in March 2020 was 35 percent, which elevated the yearly average.

Dollar General is the only company in our analysis whose year-over-year sales growth beat the industry average. In 2020, Dollar General’s average monthly year-over-year growth was 19 percent, roughly double what it was in 2019. Dollar Tree and Family Dollar experienced more modest gains, with 6 percent and 1 percent average monthly year-over-year growth, respectively. Interestingly, Dollar Tree had a greater average monthly year-over-growth rate in 2019, with 7 percent, and 99 Cents Only Stores experienced declining year-over-year sales in 2019 and 2020. Last year, 99 Cents Only Stores had an average monthly year-over-year sales decline of 14 percent.

Dollar General’s market share growth came from in-market customers

Dollar General had the highest market share in 2020, earning 61 percent of sales among the competitive set. The company’s share of sales has also been growing over the past few years. More specifically, Dollar General’s relative share growth—or growth rate of market share—doubled from 2019 to 2020.

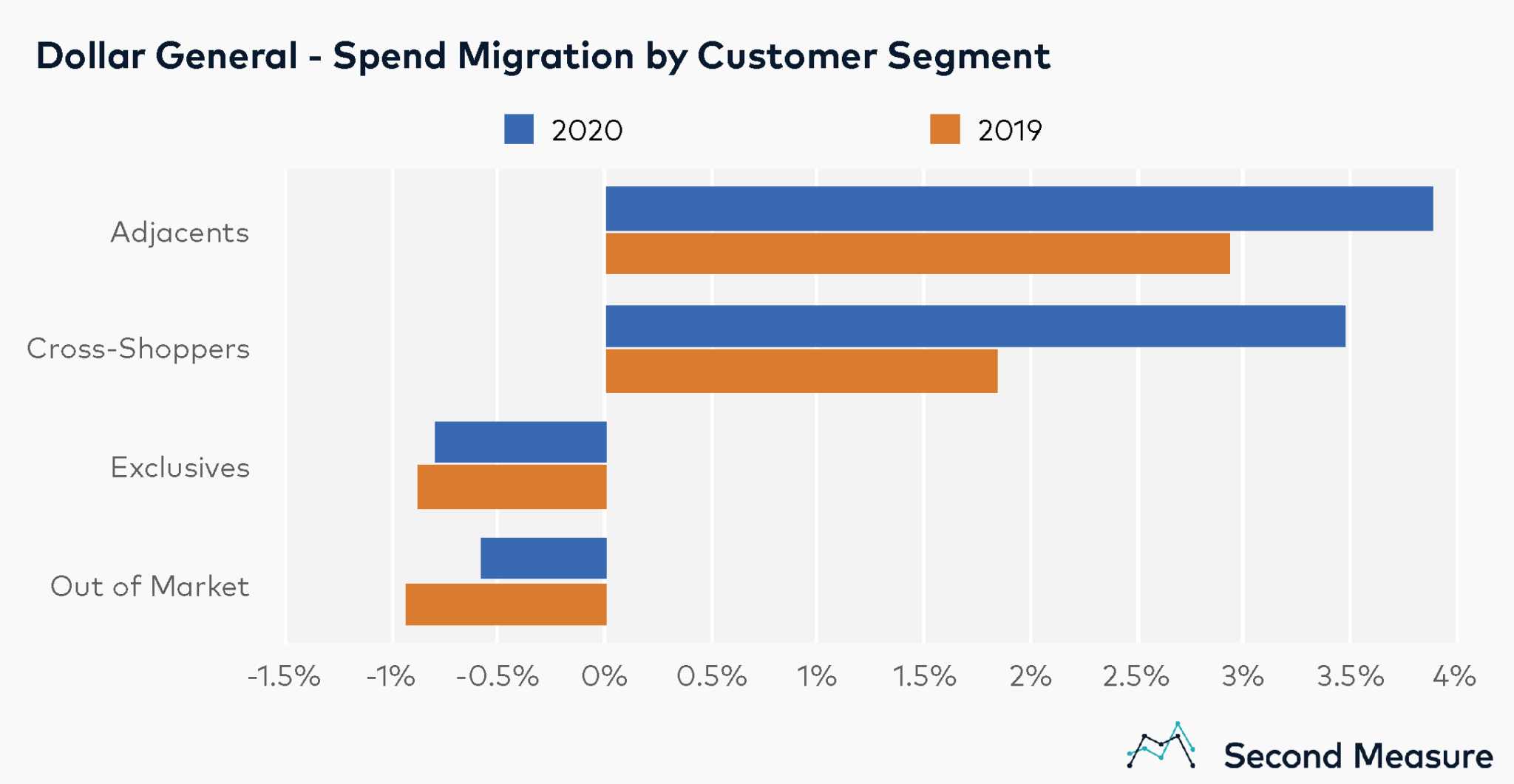

Most of Dollar General’s market share growth in 2019 and 2020 came from capturing more spend from consumers who already shopped at dollar stores. In both years, Dollar General saw positive spend migration from adjacents (consumers who had shopped at a competitor the prior year) and cross-shoppers (consumers who shopped both at Dollar General and a competitor the prior year). These gains were slightly offset by spend lost to out of market customers (defined as customers who had not shopped at any of these dollar stores in the previous year), as well as customers who had exclusively shopped at Dollar General in the previous year.

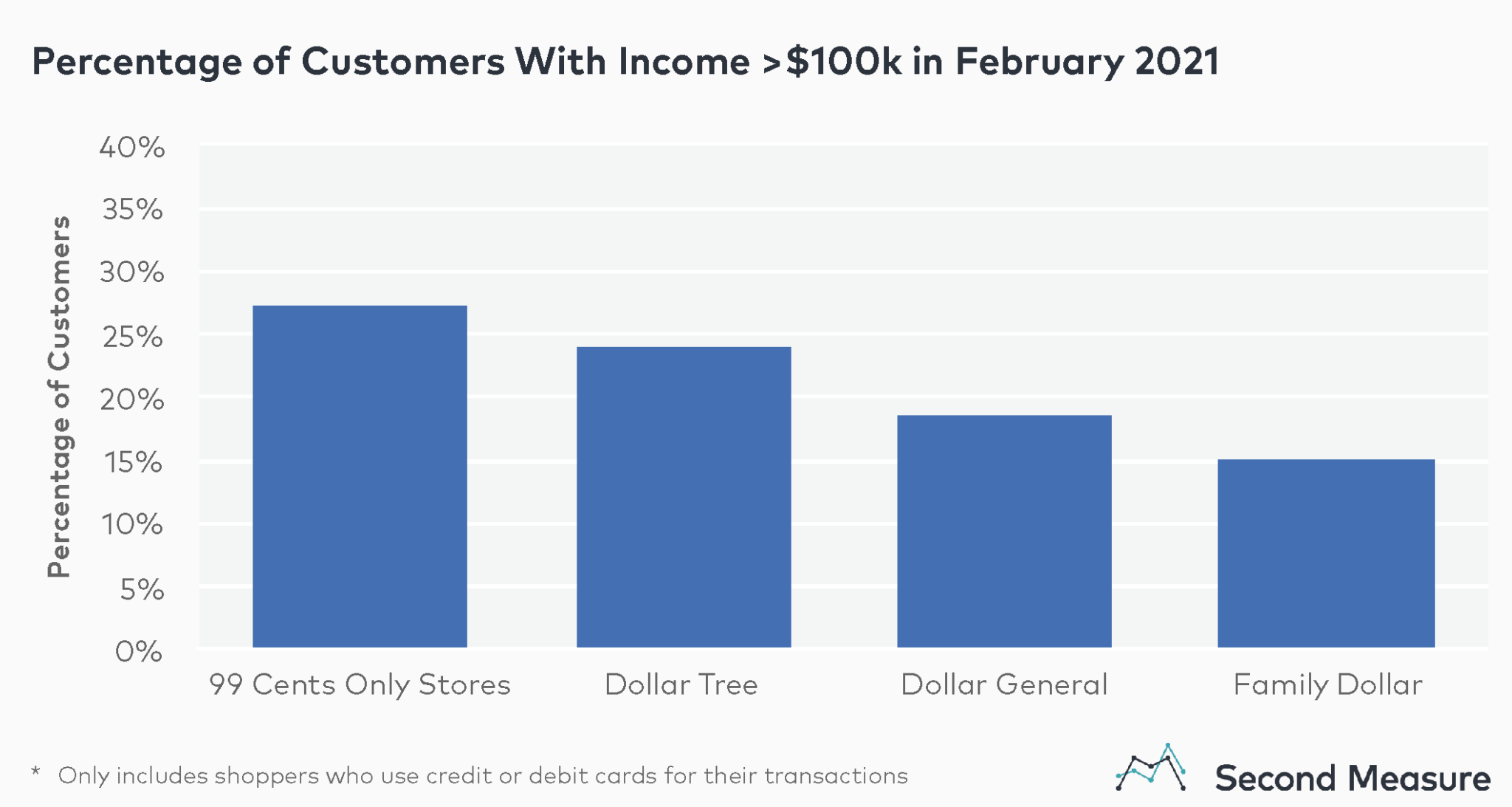

99 Cents Only Stores and Dollar Tree have the most affluent customers

Among dollar store shoppers who use credit or debit cards for their transactions, 99 Cents Only Stores has the highest percentage of customers with incomes over $100,000, with 27 percent in February 2021. Family Dollar has the lowest percentage of high-income shoppers, with only 15 percent making more than $100,000. Since cash transactions are not included in Bloomberg Second Measure data, these income figures may be skewed higher.

Customer income demographics may also be affected by the locations in which these dollar store chains operate. For example, 99 Cents Only Stores is a regional chain with locations in four states (California, Texas, Nevada, and Arizona), while the other three competitors have stores nationwide. In addition, most of Dollar General’s stores are located in rural or suburban areas, while 99 Cents Only Stores are mostly located in cities.

Dollar stores are looking to expand even further in 2021. Dollar General recently announced its plan to open a chain called Popshelf, which would be aimed at more affluent consumers who live in suburban areas. Dollar General is also in talks with the CDC to become a distribution center for the COVID-19 vaccine in rural areas that have less access to big pharmacy chains. Dollar Tree is looking to expand its rural presence by opening Dollar Tree / Family Dollar combination stores that allow customers to more easily purchase food and household supplies from Family Dollar along with $1 or less items from Dollar Tree. Family Dollar has also partnered with Instacart for same-day delivery of its items, drawing upon consumers’ demand not only for inexpensive items, but also the convenience of online shopping.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.