Source: https://www.corelogic.com/blog/2021/4/as-home-prices-rise-attention-turns-to-affordability.aspx

Home Price Index Highlights: February 2021

Overall HPI Growth

National home prices increased 10.4% year over year in February 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The February 2021 HPI gain was up from the February 2020 gain of 4.3% and was the highest year-over-year gain since April 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices; however, affordability constraints may work to slow home price growth later this year, especially as mortgage rates increase.

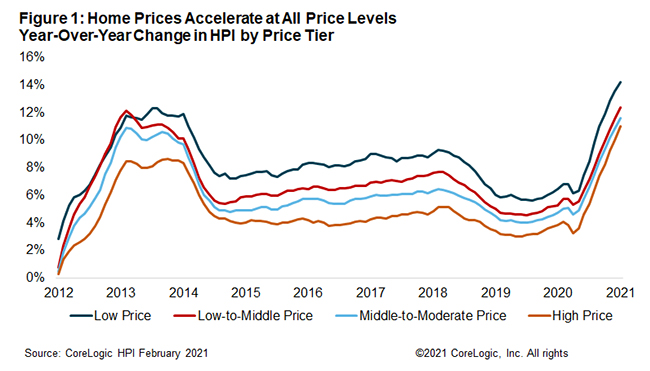

HPI Growth by Price Tier

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price.[1] Home price growth accelerated for all four price tiers to the highest rates since 2005 for the low-price tier and since 2006 for the other three price tiers. The lowest price tier increased 14.2% year over year in February 2021, compared with 12.4% for the low-to-middle price tier, 11.6% for the middle-to-moderate price tier, and 11% for the high price tier.

Entry-level homes in high demand by first-time buyers are in short supply, leading to affordability pressures for these buyers. Lack of affordability is exacerbated by increases in mortgage rates, which further increase monthly mortgage payments. For example, the 30-year fixed-rate mortgage rate has increased about a half a percentage point since hitting a low in January 2021.

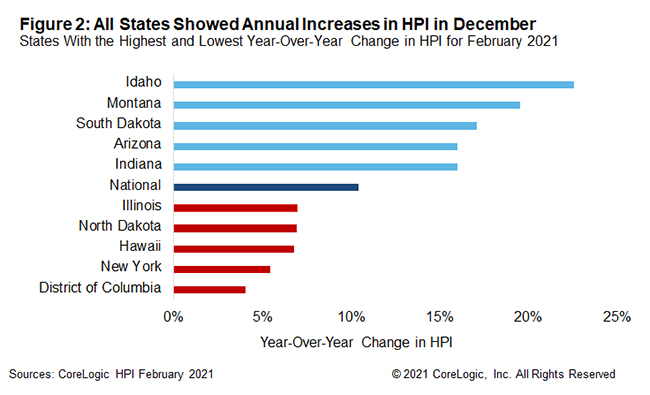

State-Level Results

Figure 2 shows the year-over-year HPI growth in February 2021 for the 5 highest- and lowest-appreciating states. All states showed annual increases in HPI in February, and Idaho led the states with appreciation of 22.6%, nearly double the rate of appreciation from a year earlier. At the low end, Washington, D.C., saw an increase in home prices of 4%.

The surge in home price appreciation was felt across the country, with all states showing higher appreciation in February 2021 than in February 2020. Connecticut and Montana had the biggest acceleration in home price growth from February 2020 to February 2021. Connecticut is notable because prices were falling by 0.6% in this state in February 2020 but increasing by 14.8% in February 2021. This turnaround can be partly attributed to an influx of buyers from metropolitan areas in nearby states.

Home price gains surpassed 10% for the first time since 2013, and strong gains are expected to persist for much of this year. This run-up in prices is sobering for prospective buyers as they will need to save more for a down payment and closing costs. Increases in mortgage rates further add to affordability pressure for buyers.

[1] The four price tiers are based on the median sale price and are as follows: homes priced at 75% or less of the median (low price), homes priced between 75% and 100% of the median (low-to-middle price), homes priced between 100% and 125% of the median (middle-to-moderate price) and homes priced greater than 125% of the median (high price).

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.