Source: https://insights.consumer-edge.com/2021/04/online-personal-care-at-the-razors-edge-of-innovation/

Historically, success in personal care has meant winning precious shelf space from brick-and-mortar retail giants. This has created a large barrier to entry for new brands and left entrenched standbys with the lion’s share of the market. A recent faction of upstarts, however, has turned this model on its head by offering personal care products directly to consumers through their own websites. In this week’s Insight Flash, we look at some of these brands to see which ones have the highest spend growth, how loyal their customers really are, and whether cross-shopping implies that there may be consolidation in the space.

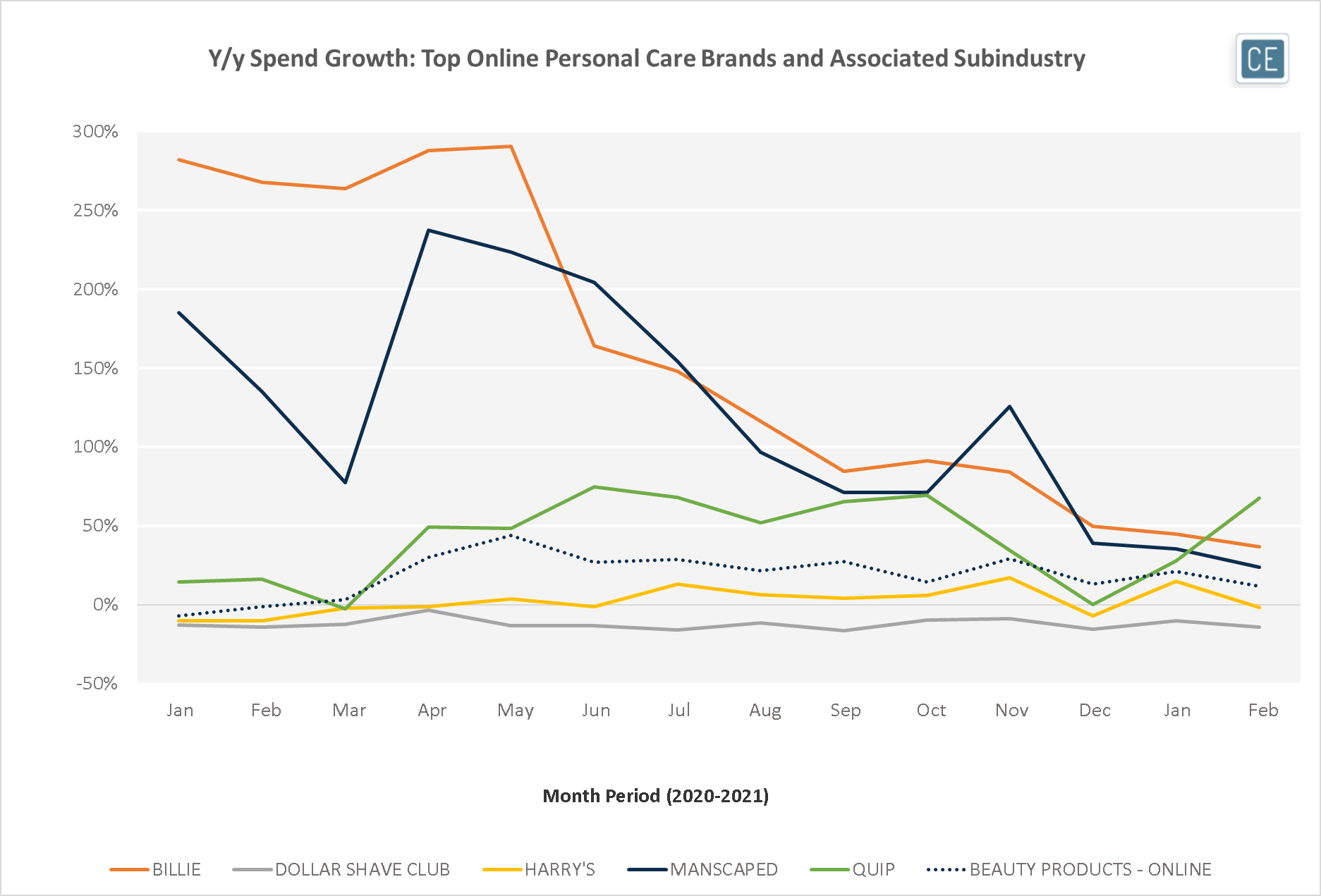

Over the last year, Billie and Manscaped have seen the highest y/y direct-to-consumer spend growth, although it has decelerated from triple-digit levels in early 2020 to 37% for Billie and 24% for Manscaped in February 2021. Although Quip spend growth was more moderate over that time period, a strong start to 2021 made it the leader in spend growth at 67% in February.

Top Brands Growth vs. Subindustry

Note: Direct-to-Consumer only

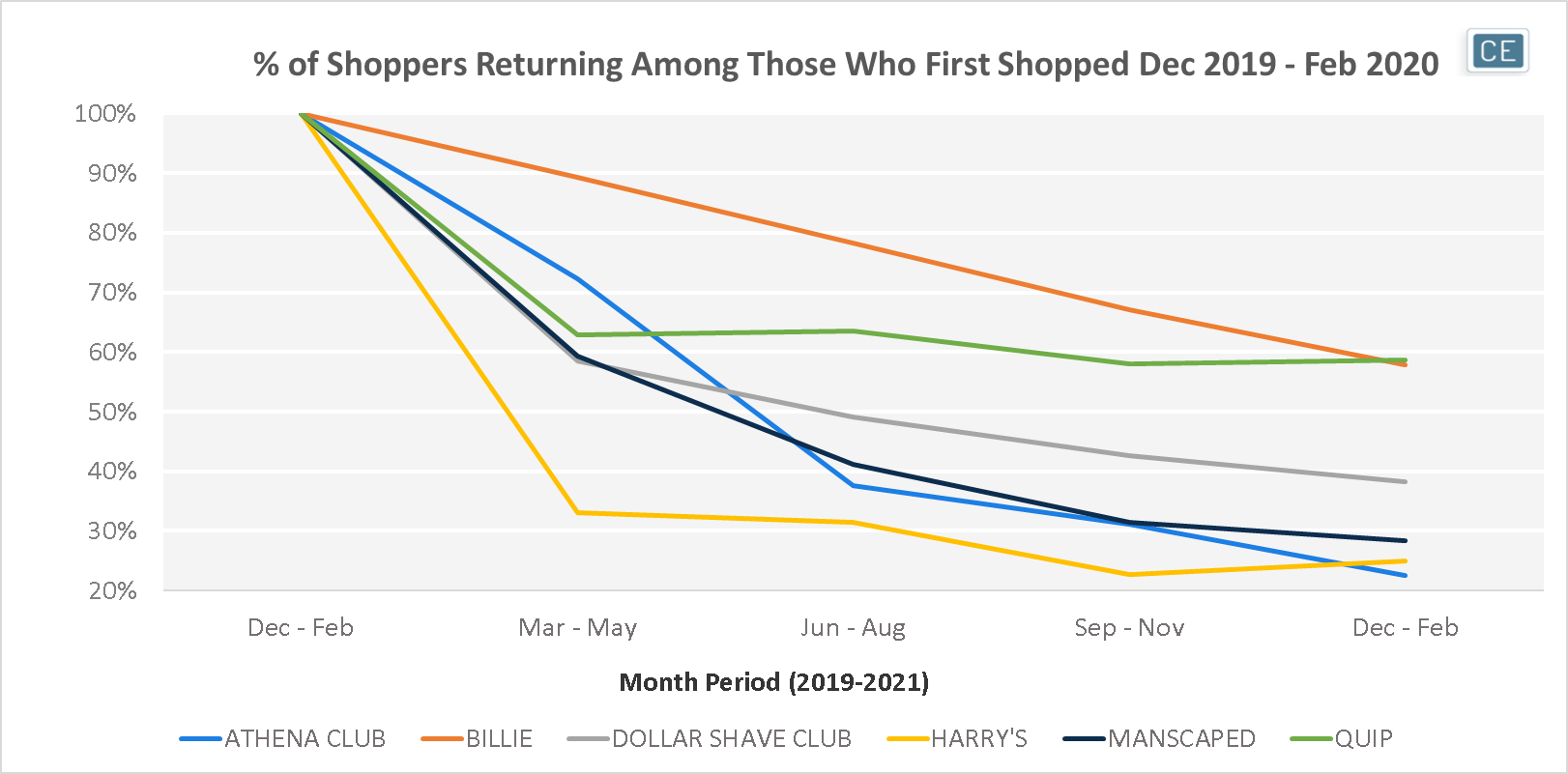

Quip shoppers are also among the most likely to stick with the product. Although one third of shoppers didn’t come back for additional purchases in the three months following their first Quip order, the two-thirds that did stay continued to purchase throughout the year after, giving Quip the highest repeat purchase rate at 59% in December 2020 – February 2021. Billie was right behind at a 58% repeat purchase rate, and had the highest repeat purchase rate in every other period, with an impressive 89% of shoppers returning in the three months after their first purchase, 78% in the three months after that, and 67% in the next three months.

Customer Loyalty

Note: Direct-to-Consumer only

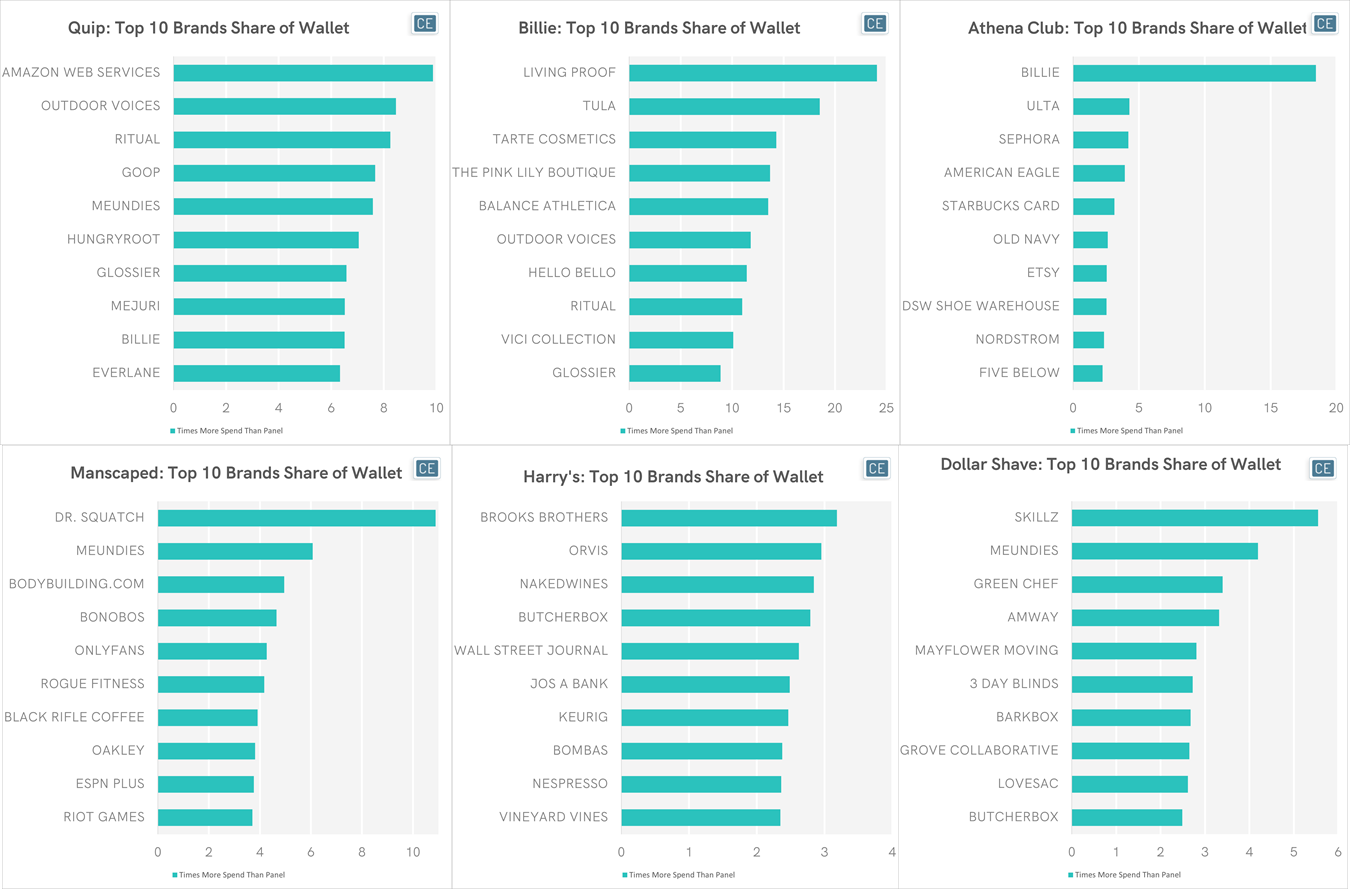

High cross-shop among these single-category direct-to-consumer brands implies that there may be scale advantages to consolidation. Quip shoppers spent over five times as much of their wallet on Ritual, Glossier, and Billie as the overall population. Billie shoppers overindexed to spending on Living Proof over twenty times more than the overall population, and to spending on Ritual over ten times more. Athena Club shoppers spent fifteen times more on Billie. Manscaped customers spent over ten times more than the overall population on Dr. Squatch, while Harry’s customers were more likely to spend on DTC food from vendors like Naked Wines, ButcherBox, Keurig, and Nespresso. Dollar Shave Club members were more likely to spend on whole basket deliveries from purveyors like Green Chef, BarkBox, and Grove Collaborative.

Share of Wallet

Note: Among those who shopped title brand direct-to-consumer, % of wallet at listed brand indexed to % of wallet for overall population 3/1/2020-2/28/2021; limited to brands with at least 100 shoppers

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.