According to ATTOM Data Solutions’ newly released Q1 2021 Special Report, spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the virus pandemic, states along the East Coast, as well as Illinois, were most at risk in Q1 2021 – with clusters in the New York City, Chicago and southern Florida areas – while the West continued to face less risk.

ATTOM’s most recent Coronavirus housing impact analysis revealed that first-quarter trends generally continued those found in 2020, but with smaller concentrations around several major metro areas. The reported noted the number of counties among the top 50 most at-risk was down in the New York, NY; Philadelphia, PA and Washington, D.C. metro areas.

The report also noted the only three western counties in the top 50 during Q1 2021 were in northern California, while the only southern state outside of the East Coast with more than two counties in that group was Louisiana.

ATTOM’s Q1 2021 analysis reported that 22 of the 50 counties least vulnerable to pandemic-related problems from among the 552 included in the Q1 report were in Colorado, Minnesota, Wisconsin and Texas. The report noted that ten of them were in the Denver, CO; Dallas, TX, and Minneapolis, MN, metro areas, including Hennepin County (Minneapolis), MN; Dallas County, TX; Tarrant County (Fort Worth), TX; Denver County, CO, and Arapahoe County (Aurora), CO.

Also, according to the most recent Coronavirus housing impact report, other housing markets among the top-50 least at-risk, with a population of 500,000 or more, included Harris County (Houston), TX; King County (Seattle), WA; Mecklenburg County (Charlotte), NC; Wake County (Raleigh), NC and Erie County (Buffalo), NY.

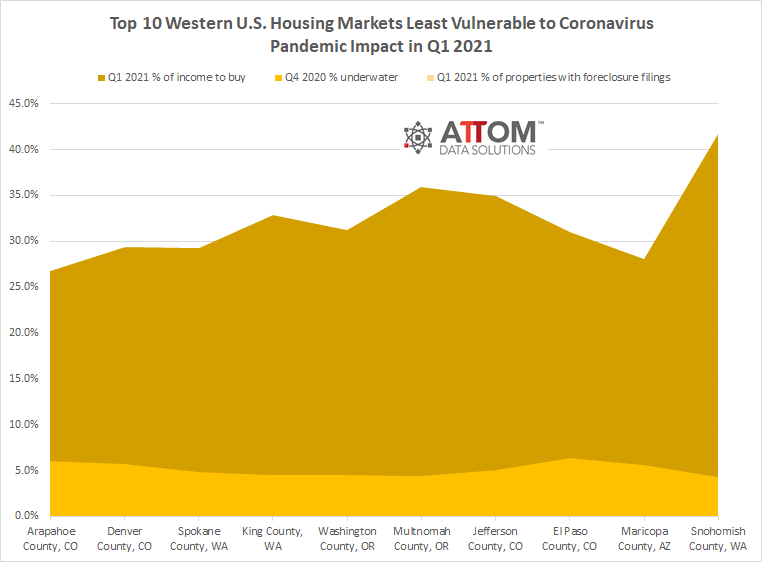

In this post, we take a closer look at those Western housing markets least vulnerable to the impact of the Coronavirus pandemic in Q1 2020, among those counties with a population of 500,000 or more, to reveal the top 10 counties and the various contributing factors.

The top 10 larger housing markets in the West that were least vulnerable to the impact of the Coronavirus pandemic in the first quarter of 2021 included:

Arapahoe County, CO (#535 overall ranking out of 552 counties)

Denver County, CO (#533 overall ranking)

Spokane County, WA (#529 overall ranking)

King County, WA (#519 overall ranking)

Washington County, OR (#518 overall ranking)

Multnomah County, OR (#514 overall ranking)

Jefferson County, CO (#503 overall ranking)

El Paso County, CO (#497 overall ranking)

Maricopa County, AZ (#479 overall ranking)

Snohomish County, WA (#468 overall ranking)

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.